HJBC

Investment Thesis

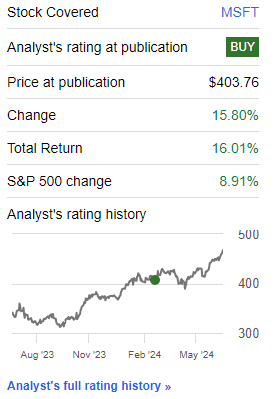

Since my previous bullish thesis dated March 8th, 2024, Microsoft Corporation (NASDAQ:MSFT) (NEOE:MSFT:CA) stock has gained 15.8% with a total return of about 16% almost double the S&P 500 performance.

Seeking Alpha

In the previous article, I reiterated my buy rating whereby upside was backed by the company’s strong financial performance, innovation, and solid brand recognition. Above all, the company was undervalued with an estimated fair value of $510. My estimated fair value was determined by running a dcf model where I assumed a double-digit growth rate of 10.5% and a discount rate of 8.9%.

In this analysis, my previous growth levers remain intact, and I would like to provide an update on the major developments that I believe will catalyze my bullish stance on this stock. MSFT is currently trading at $467.56 which is ~9% below my target price of $510 meaning it is still trading at a discount. Given this cheap entry point and the compelling growth story backed by recent developments that I believe are shaping my long-term growth levers as discussed in my previous article and giving the bullish momentum traction, I believe this stock is a buy.

Technical View

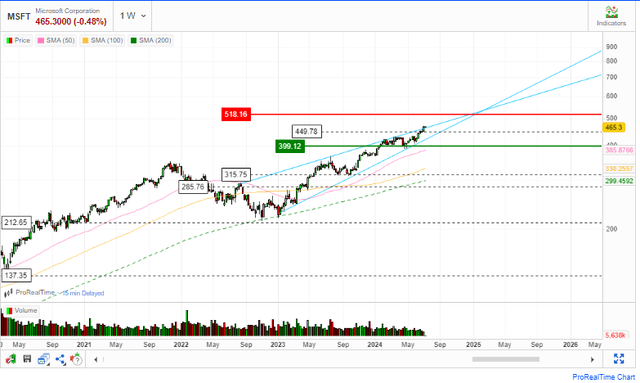

From a technical perspective, MSFT is in a bullish trajectory characterized by a rising wedge pattern, as indicated by the two blue trend lines in the chart below. The stock has a strong resistance around the $518 mark which coincides with the peak of the rising wedge pattern where a potential trend reversal is likely or a breakout to an inverted rising wedge pattern which is a bullish trend.

Market Screener

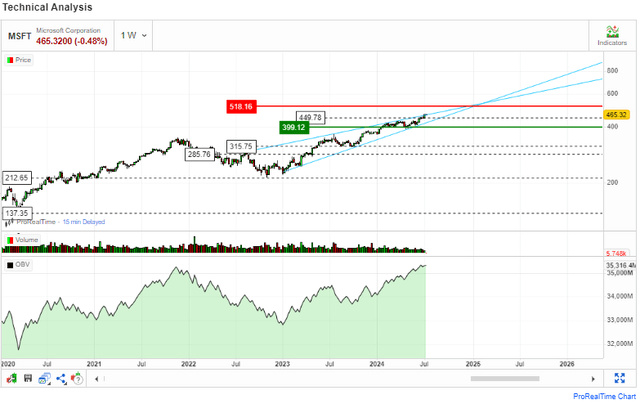

To confirm the sustainability of the upward trajectory, the stock is trading above the 50-day, 100-day, and 200-day moving averages, meaning that it is bullish in the short, middle, and long-term horizons. In addition, its OBV is rising steadily indicating an increasing cumulative trading volume implying that the stock demand is rising which is a recipe for sustainable share price growth.

Market Screener

In summary, MSFT is in a strong bullish momentum currently warranting a buy rating. However, the stock faces a resistance at about $518 which is slightly above my fair value of $510 a point at which I will reassess the fundamentals to determine whether to hold or buy if an updated model leads to a higher price target.

Growth Story since MY Last Coverage: Growth Trajectory Continues

On April 25th, MSFT reported its Q3 2024 earnings, where its strong financial performance continued to impress. The company’s diversity was crucial in its growth narrative, reporting significant growth from different segments. First off, its overall sales jumped 17% YoY to over $62 billion, exceeding analysts’ estimates by $977.92 million. Meanwhile, operating income surged 23% to slightly under $28 billion. Further, its net income rose by approximately 20% YoY to $21.9 billion.

This strong performance was a result of significant growth from its different segments, which, in my view, reflect the benefits of diversified revenue streams. The company saw a double-digit growth in its entire segment, which in my view reflects the robust demand for its products as well as its strong brand recognition.

To put it in perspective, the Microsoft cloud segment reported revenue of $35.1 billion, which was a 23% YoY growth. I think this solid growth has been a result of the company’s continued expansion of Azure capabilities and the growing demand for cloud services. The productivity and business process segment reported a 12% YoY revenue growth to $19.6 billion with Office 365 and commercial revenue growing by 15%. Its Microsoft 365 consumer subscribers grew to 80.8 million, which lends credence to my assertion of growing demand and strong brand recognition. The surge in Office 365’s commercial income demonstrates the potency of several platforms, including Teams, Word, Excel, PowerPoint, and Outlook, among others.

Tremendous growth was also reported in the personal computing section, with a reported revenue growth of 17% YoY to $15.6 billion. Most importantly, the Xbox content and services revenue soared by 62% significantly fueled by the activation of the Blizzard acquisition.

This exemplary performance reflects the company’s strategic focus on cloud services and online gaming, as well as the fruitful integration of acquisitions such as the Blizzard acquisition. Its innovative culture, especially in the AI which I will discuss shortly has given the company’s growth traction and I believe this instills confidence in investors that MSFT is poised for long-term growth. Above all, the results exhibit its strong market position and its ability to deliver consistent growth through diversified revenue streams, which bodes well for its sustainable stock growth.

Innovative MSFT: The Recipe for Sustainable Growth

With its discoveries and investments in the AI field, Microsoft has been a force to be reckoned with in the ongoing growth of the IT industry, which is currently centered on AI. The company has been at the front run of AI innovations, which I believe have been and will keep being a major growth lever. Recently, the company has innovated the latest Copilot+ PCs, which I will discuss in this section.

Its advanced neural processing units are not unique in architecture but also have advanced and improved performance capabilities. The latest Copilot+ PCs from MSFT use the most sophisticated architecture to date, combining a neural processing unit [NPU], a graphics processing unit [GPU], and a central processing unit [CPU]. The NPU is made to do a variety of AI tasks locally without requiring communication with the cloud, thanks to its combination of over 40 on-device AI models.

With their NPUs, which are the most potent in the PC market right now and can execute over 45 trillion operations per second [TOPS], they enable new AI features in their products. According to the company, Copilot PCs deliver industry-leading AI acceleration and are up to 20x more powerful and up to 100x more efficient for running AI workloads. The power efficiency of the NPU guarantees all-day battery life.

It’s worth noting that MSFT was an early investor in the AI space, with a $1 billion investment in the ChatGPT developer OpenAI. It has since increased its investment to about $13 billion giving it access to the most developed AI models in the industry, which in my view, serves as a competitive advantage.

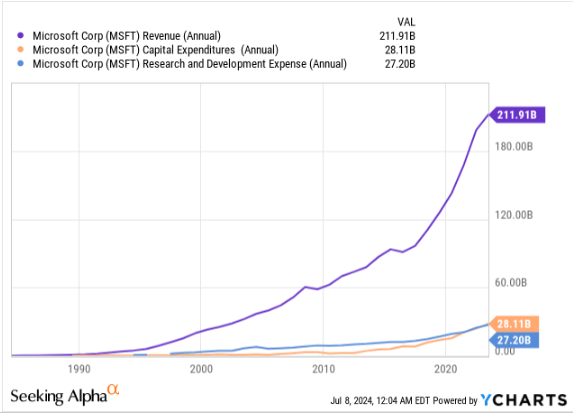

With the company’s growing R&D research expenditure and CapEx which is backed by a strong revenue base, I believe this company can keep innovating and stay ahead of competition in the competitive race as proven by its recent innovation of the NPU.

Seeking Alpha

Although Microsoft seized the chance to capitalize on AI, competition is intensifying. Nevertheless, Microsoft has taken the lead once more with its AI-powered Copilot+ PCs. The corporation isn’t wasting any time: starting on June 18, its largest computer partners are offering the new Copilot+ PCs and select Copilot+ Surface devices.

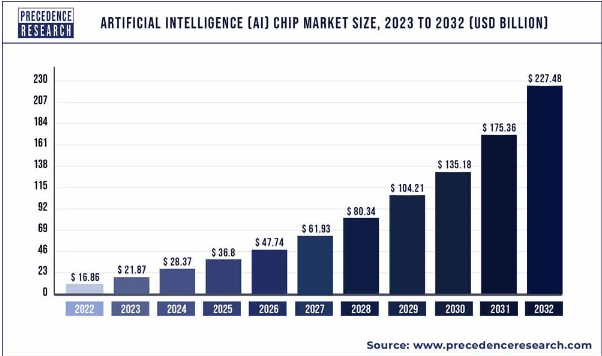

Given the company’s outstanding innovations, I believe it is in a strategic position to leverage favorable industry trends to achieve growth. According to precedence research, the AI chip market is projected to grow by a CAGR of 29.72% between 2023-2032.

Precedence Research

I believe the Copilot+ PCs could potentially set a new standard for what we should expect from the company’s computing devices as well as make MSFT a leader of innovation in the tech industry, which serves as a competitive advantage if not a MOAT.

Q4 2024 Earnings Report: Upcoming Near-term Catalyst

Historically, MSFT has been responsive to its quarterly earnings report, with its stock movement reflecting its financial performance as reported in the earnings report. For instance, in Q3 2024, its shares rose about 5% in extended trading after issuing fiscal Q3 results that exceeded expectations. Its EPS was $2.94 compared to an estimated $2.84 and its revenue of $61.86 billion beat expectations by $977.92 million.

With its quarterly performance being a catalyst to its stock movement, I anticipate that the expected Q4 2024 earnings release date scheduled for July 23rd will be a major near-term volatility catalyst. For this reason, I anticipate a positive response since I expect a strong Q4 quarterly report. My revenue expectation for this quarter is in the region of $61.8 billion compared to $56.19 in the same quarter of 2023 and an EPS of about $2.9 compared to $2.64 last year. This optimism is guided by the company’s solid growth trajectory backed by favorable industry trends and strategic investments, especially in cloud computing and AI discussed in the previous section, which I expect to keep driving growth. As a result, I expect a robust quarterly performance which will lead to bullish sentiments in the market, hence an upward stock movement after the earnings release.

My Final Thoughts

In conclusion, MSFT is still innovating and devoting more resources to R&D as well as CapEx speaking volumes about the company’s deliberate actions to keep innovating and sustain their growth. Its strong performance has been sustained in the MRQ and I expect it to continue in the current and future quarters given the solid growth levers and favorable industry trends.

Although I am bullish on MSFT, investing here has its share of risk. One risk that investors ought to be aware of is the integration and profitability of a large acquisition. For instance, the Activision Blizzard acquisition valued at about $75 billion is a strategic move to improve the gaming segment. However, the integration of such large acquisitions involves complex processes including corporate cultures and systems, which could sometimes hurt a company’s performance and profitability.

Given this background and the fact that the stock is trading below my previously estimated fair value, I rate it a buy.