DNY59/E+ via Getty Images

Let me begin this article by saying that I’m the sucker.

That’s right.

I got “suckered” into buying a modest quantity of Medical Properties Trust (NYSE:MPW) shares.

I’m sure others also got mesmerized by the once double-digit yield of this “mission-critical” healthcare REIT.

In my REITs for Dummies book, I explain the term “sucker yield”.

REITs for Dummies (by Brad Thomas)

These days, MPW is no longer yielding double digits (as I will explain below) and is better defined as a value trap (as I explain in REITs for Dummies):

REITs for Dummies (by Brad Thomas)

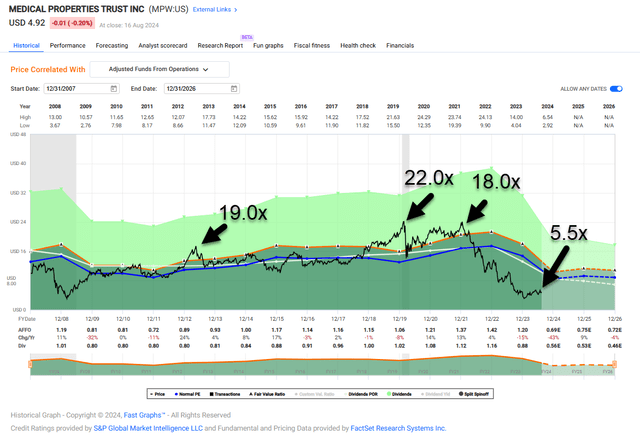

Time will tell whether or not this REIT will ever be able to recover to its normal valuation range of 12.0x P/AFFO. As you can see, the company has previously traded as high as 22x.

As promised, I wanted to provide readers with an update on MPW post Q2 earnings.

The Basic Business Model

MPW is an internally managed real estate investment trust (“REIT”) that was established in 2003 to develop, acquire, and invest in net lease healthcare facilities.

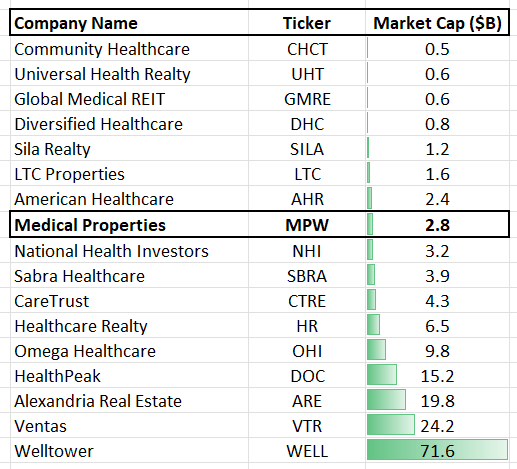

The company has a market cap of approximately $2.96 billion and a portfolio made up of 435 properties containing roughly 42,000 licensed beds.

The healthcare REIT has 53 operators that deliver healthcare services across 9 countries, including the United States, the United Kingdom, Germany, Switzerland, Spain, Italy, Portugal, Colombia, and Finland.

MPW’s tenants are subject to long-term, net lease agreements which require the tenant to pay most property-level expenses such as insurance, taxes, and maintenance.

Medical Properties’ primary business is to develop or acquire real estate, which is then leased to a healthcare operator on a net lease basis.

In addition to owning and leasing real estate, the company provides capital to healthcare operators through mortgage loans which are secured by real estate.

MPW invests in a variety of healthcare properties, including general acute care hospitals, behavioral health clinics, inpatient rehab facilities, long-term care hospitals, and urgent care facilities.

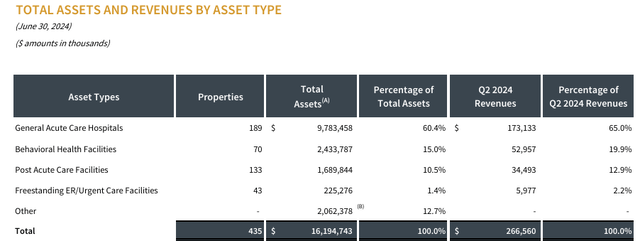

General acute care hospitals is its largest property type and accounts for 60.4% of the company’s assets and 65.0% of its Q2-24 revenues.

A Quick Recap

Medical Properties has faced a litany of challenges over the past several years, including deferred rent, tenant bankruptcies, too much debt, and extremely high cost of equity.

The relationship between the healthcare operators, insurance companies, and the government has created inefficiencies for years.

Hospitals are probably the most “mission-critical” real estate out there.

However, that is a double-edged sword because the government will always be involved in the affairs of the private sector for something as critical as healthcare.

Healthcare operators’ reliance on insurance companies creates other issues and inefficiencies including in-network price controls, rejected claims, delayed payments, etc. Because hospitals play such a critical role, influences other than the free market will always be in play.

Many of the issues were exacerbated by the pandemic, which created labor shortages in the healthcare industry and drove up the cost of labor for nurses and other healthcare workers.

On top of that, government mandates prohibit elective surgeries in order to maximize resources available for patients with covid.

While this served the interest of the public health, it hurt hospital profitability as elective surgeries have some of the highest margins, much more than treating someone with covid that may or may not have insurance.

MPW’s tenants have had a very tough operating environment to navigate over the last several years, and the company’s tenant concentration and high levels of debt have put the hospital REIT in a very precarious position.

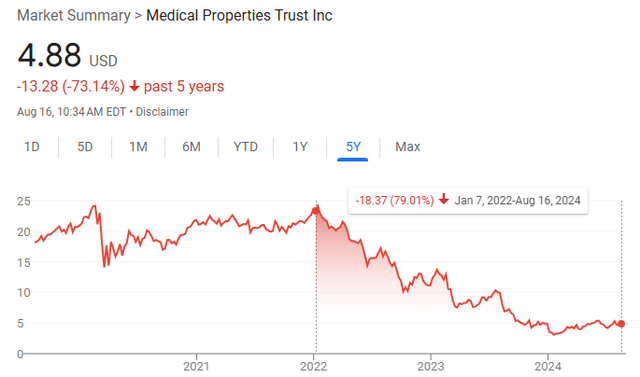

Since the beginning of 2022 the stock has fallen nearly 80%.

In addition to the macroeconomic issues impacting all REITs, mainly inflation and rising interest rates, the main concerns that have surrounded MPW over the last several years include its outstanding debt, the financial health of its tenants, and the stability of its dividend. 2023 was a pretty rough year for MPW as all of these factors came into play.

MPW’s tenant concentration combined with its leverage, high cost of capital, and tenant struggles led to reduced operating cash flow and ultimately an asset divestiture program.

Beginning in 2022, the company began selling properties in order to reduce debt and increase its liquidity.

Some transactions include the sale of a portion of its interest in 8 Massachusetts hospitals to Macquarie Asset Management, the sale of 5 Utah hospitals leased to CommonSpirit, and the sale of its Australian portfolio to HMC Capital for AUD$1.2 billion.

By late 2023, the company disclosed that its leased assets had been reduced by approximately $2.5 billion. While this has helped the company’s liquidity, it has also impacted its cash flow and ultimately led to a dividend cut.

In the third quarter of 2023 the company cut its dividend by nearly 50%, from a quarterly dividend of $0.29 per share to a quarterly dividend of $0.15 per share.

MPW issued a press release on August 21, 2023, stating that it was adjusting the quarterly dividend to better align with its cash flow following the company’s asset divestitures.

In the release, Edward K. Aldag, MPW’s CEO, stated:

“As we made clear during our recent quarterly earnings update, our focus is squarely on reducing leverage and improving our long-term cost of debt and equity capital. Our Board is confident these decisive steps will facilitate achievement of our target leverage ratios and create significant strategic and financial flexibility.”

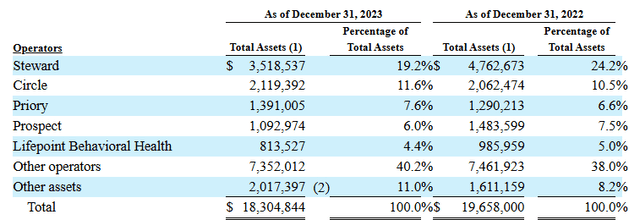

While Medical Properties tenant concentration had improved, it was still highly concentrated, especially in its top tenant Steward, which made up 19.2% of MPW’s assets at the end of 2023.

In May 2024, Steward Health Care filed for Chapter 11 Bankruptcy protection. In the first quarter earnings release, Mr. Aldag addressed the issue, saying:

“Regarding Steward’s recent filing for Chapter 11 bankruptcy, we expect this process may facilitate an orderly transition of Steward’s operations to new operators. As Steward continues these efforts, MPT has agreed to provide $75 million in DIP funding to ensure continued operations and continuity of patient care.”

MPW’s Current Position

In its latest earnings release filed on August 8, 2024, MPW disclosed that Steward made rent payments of approximately $19.0 million for May and June 2024.

It’s unclear what the outcome of Steward’s bankruptcy will be, but it is likely that the properties will ultimately be leased to new tenants or sold.

In the 2Q 2024 conference call, Mr. Aldag said the following regarding the status of Steward:

“We currently have approximately $440 million of secured non-real estate investments in Steward and $2.3 billion in real estate that is expected to be re-leased or sold as part of the ongoing bankruptcy process. We believe these investments are fully recoverable at this time. However, no assurances can be given that we will not have any additional impairments in future periods.”

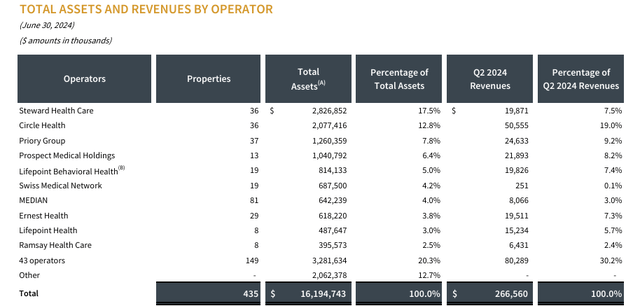

In the company’s 2Q-24 supplemental, it shows that Steward now makes up 17.5% of its assets and only 7.5% of its 2Q-24 revenues. As a point of comparison, at the end of 2023 Steward made up 20.3% of MPW’s revenues.

For the second quarter, MPW reported total revenue of $266.6 million, compared to revenue of $337.4 million in the second quarter of 2023. Keep in mind that it was expected that revenue would fall sharply due to asset sales.

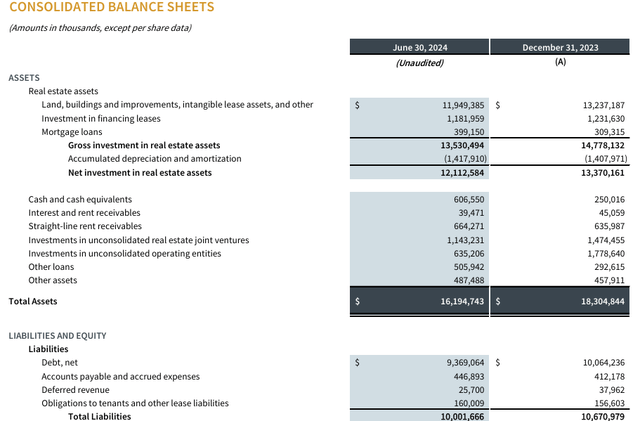

The company reported total assets of $16.2 billion at the end of 2Q-24. This compares with total assets of $18.3 billion at the end of 2023 and total assets of $19.7 billion at the end of 2022.

Normalized FFO (“NFFO”) for the quarter was reported at $139.4 million, or $0.23 per share, compared to NFFO of $285.3 million, or $0.48 per share in the second quarter of 2023.

Year-over-year comparisons are tricky here due to the asset sales. On a per share basis, NFFO fell approximately -52% year-over-year. However, total assets were reduced from $19.2 billion in the second quarter of 2023 to $16.2 billion at the end of 2Q-24, which marks a nearly -16% reduction in the company’s asset base.

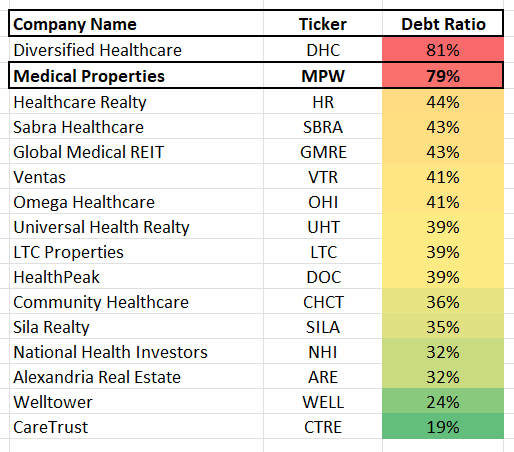

Similarly, the company’s debt was reduced from $10.2 billion in the second quarter of 2023 to $9.4 billion in the latest quarter, representing a -8.48% year-over-year reduction of debt.

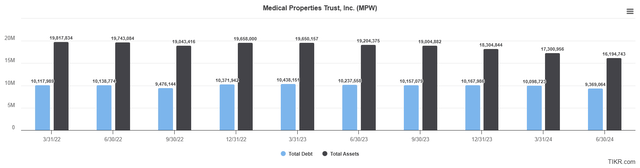

From another perspective, the chart below shows the change in MPW’s total assets and debt since March 2022. It’s clear that the company has prioritized reducing its debt, but at what cost?

From the first quarter of 2022 to the most recent quarter, MPW’s assets have been reduced from $19.8 billion to $16.2 billion, representing an 18.28% reduction in its asset base.

Over the same period, however, the company’s debt has been reduced from $10.1 billion in 1Q-22, to $9.4 billion in 2Q-24, which represents a 7.4% reduction.

Using the debt-to-asset ratio for comparison gives us a ratio of 51.05% in 1Q 2022 versus 57.85% as of the most recent quarter. While the company has reduced its debt, it has reduced a higher percentage of its asset base to do so, leaving the company more leveraged now as it relates to debt as a percentage of assets.

In terms of debt as it relates to the company’s cash flow, MPW reported a pro forma net debt to adjusted EBITDA of 6.5x in the first quarter of 2022.

This compares with the company’s current leverage ratio of 8.1x, so from a cash flow perspective, the company is more highly leveraged now than it was in 1Q-22.

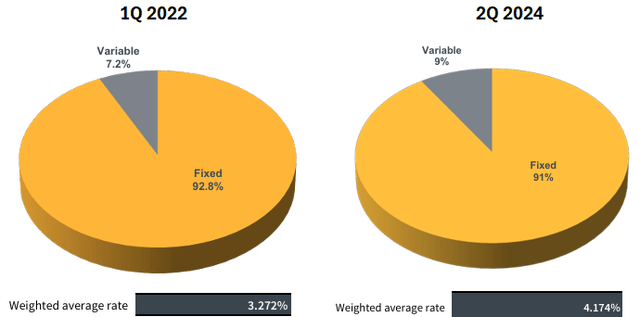

The company began liquidating assets in 2022 in order to shore up its financial position, yet each debt metric now reads worse than it did in 1Q 2022. The graph below shows a comparison between MPW’s weighted average interest rate as well as its debt composition from 1Q 2022 to the most recent quarter.

MPW’s fixed rate debt fell from 92.8% to 91.0% and its average cost of debt increased from 3.272% in 1Q 2022 to 4.174% in 2Q 2024.

Another critical change to mention is that S&P Global downgraded MPW’s credit rating in May of this year due to the health of its tenants and refinancing concerns. Currently, the company has a B- credit rating, which is well below investment grade status.

In my opinion, MPW has a higher risk profile now than it did when it began selling assets in 2022. It has a lower credit rating, a higher leverage ratio, a lower coverage ratio, and a higher debt to asset ratio.

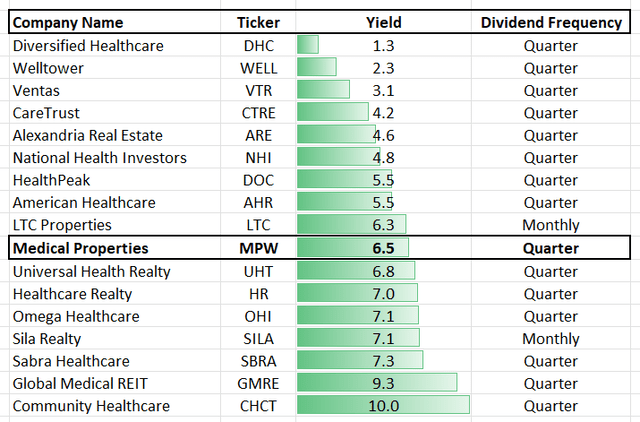

Additionally, the company cut its dividend by nearly 50% in 2023 and in its 2Q 2024 conference call, the company discussed its current dividend strategy and is now limiting the dividend to just $0.08 per share.

In the 2Q 2024 conference call, MPW’s CFO, Steven Hamner, made the following comments regarding the dividend:

“Finally, we agreed also that unless we elect to terminate the amendment provisions ahead of next September 30, we will limit to $0.08 per share per quarter, the amount of cash included in our quarterly dividend payments.

Based on this morning’s reported quarterly results and recent market share prices, this would represent a normalized FFO payout ratio of about 35% and a dividend yield of about 7%.”

MPW final thoughts

Assuming MPW pays a dividend of $0.32 annually ($0.08 x 4), at its current price the stock would have a dividend yield of roughly 6.5%.

The stock is selling for one of the lowest AFFO multiple we’ve seen, currently trading at a blended P/AFFO of 5.59x.

There is no doubt that the stock is cheap on a relative basis.

Whether comparing its current AFFO multiple to its average historical multiple or comparing it to the industry average multiple, the stock is on sale relative to its peers and to where it normally trades.

However, while the stock is trading at a historically low valuation, we do not advise investors to initiate a position unless they have a high-risk tolerance (very high).

There is still a lot of uncertainty, and the stock is extremely volatile. Most investors would probably be best suited to wait and watch and see where it goes from here.

At the same time, there is value in MPW’s real estate, very likely more than MPW’s current multiple would suggest, it’s just a matter of how bad things get before its properties value can be realized with cash flowing to the bottom line.

We rate Medical Properties Trust a Hold.

Data Duel

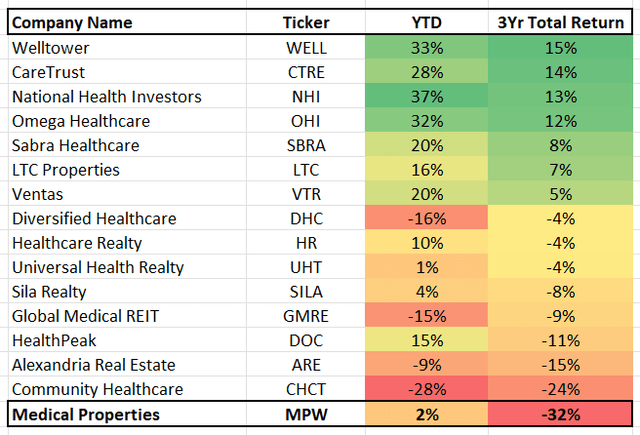

iREIT®+HOYA Capital iREIT®+HOYA Capital iREIT®+HOYA Capital iREIT®+HOYA Capital