NUMAX3D/iStock via Getty Images

I recently came across Matthews International (NASDAQ:MATW) as I was investigating the funeral services business. I was refamiliarizing myself with Service Corporation International (SCI) as a potential defensive play. SCI is, in my understanding, not just the largest funeral home company in the United States, but the world. Service Corp was one of the 3 defensive plays I covered in this recent article.

With death rates forecast to continue growing, and the presumed pricing power in this industry even in inflationary times, the funeral services industry is one which interests me as an investor, but not so much as a client, of course.

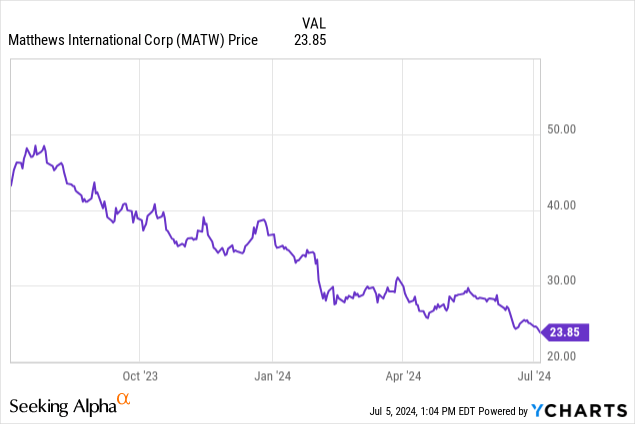

Matthews International is another firm that surfaced during my research. This company is an unusual mix of seemingly completely unrelated businesses. I’ve always found conglomerates intriguing, so I researched further. MATW shares are trading near a multi-year low at this juncture.

Business Segments

Memorialization

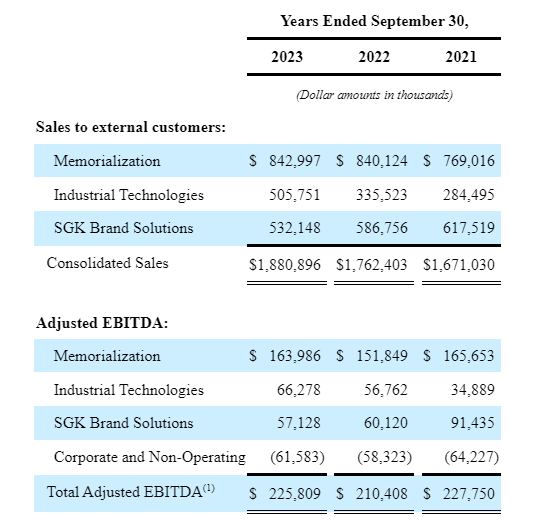

As mentioned, I initially came to discover Matthews Intl in investigating the funeral services industry. What the company bills as their “Memorialization” business is the largest segment of the company by both revenues (~45%) and EBITDA (~57%). It is clearly the dominant part of the company, delivering also the highest EBITDA margin at around 20%.

This segment delivers a variety of products from caskets, to memorial stones, to equipment for crematoriums. One thing that MATW’s memorialization segment doesn’t do is host or facilitate funerals and memorial services. This is mostly a funeral products company, as opposed to Service Corp which through the Dignity Memorial brand owns cemetery properties and provides funeral services.

One of the advantages a company like Service Corp offers is in serving the “pre need” business. That company can collect cash up front from clients who purchase cemetery plots (a booming business, I am told) – possibly many years before the plot is used. Investors will see a sizable deferred revenue account on Service Corp’s balance sheet but not for Matthews Intl. Few things are more attractive in the business world than receiving cash way before rendering service, and investing it in the meantime. That’s obviously a relative negative for Matthews International here, which hasn’t the best balance sheet.

Nonetheless, I’m drawn also to Matthews Intl’s exposure related to the death sector. Increasing death rates will lead to an increase in memorial products. Revenue growth in the Memorial segment was negligible in 2023, but I expect that to be an anomaly. I’m comforted that margins (EBITDA) increased from 2022 to 2023, a time during which inflation pressures were hot.

Matthews Intl

Brand Solutions

Matthews’ second largest segment by revenue is SGK Brand Solutions. It’s a mix of packaging design and printing businesses.

Creative minds may consider printing and packaging as somewhat related to the design of funeral products. I guess the difference, ultimately, is what gets placed inside!

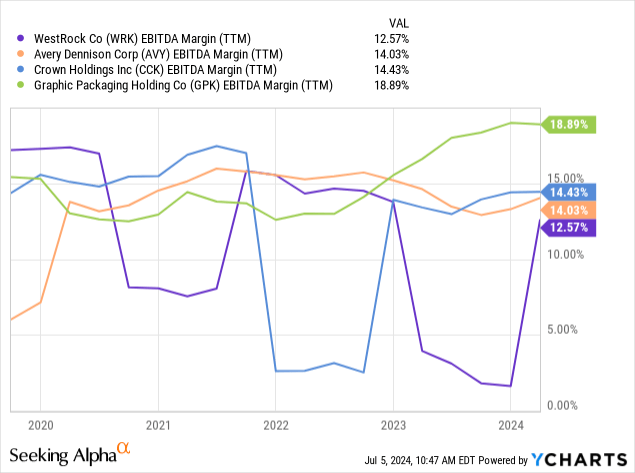

The SGK Brand Solutions segment includes assets in North America and Europe. The company is investing further in digitalization and from the management commentary I’ve read on pricing and cost efficiencies there’s a hint of increased margin expectations. That would be a good thing, with EBITDA margins currently sitting around the 10% level. This appears to be trailing competitors in this industry.

Management spoke highly of the SGK team in the Q2 2024 call, so the hope for investors here is a combination of new account growth and improved profitability.

Industrial Technologies

Matthews Intl’s final segment is related to industrial automation and energy solutions. This includes material handling solutions, tagging and tracing from the production line.

While revenues for this segment rose from $335 million to $505 million for 2023, this is largely due to a couple of acquisitions the company closed for OLBRICH GmbH and R+S Automotice GmbH. These 2 companies were acquired in mid-2022 for a price of less than 0.5x revenues.

EBITDA for the Industrial Technologies segment rose by about $10 million in 2023, likely attributable directly to the acquired assets or operating efficiencies. With that said, the margin for this business area fell by more than 4 percentage points in 2023. Management hints that the industrial segment is underperforming, pointing to customer delays.

Profitability Metrics

Matthews Intl sees its fiscal year end in September. For the 12-months ending September 30, 2024, the company reported GAAP earnings of $1.26 per share. For the Q2 2024 results released in early May, the company saw EPS of $0.29.

There doesn’t appear to be much seasonality to these businesses, which makes sense to me, although profitability has fluctuated. Q1 2024 was quite weak, with the company posting a net loss for the first time in 2 years (EPS of -$0.07). However, in presenting the Q1, management still expected fiscal 2024 results to exceed those of 2023, albeit with a tone of uncertainty. It’s comforting for shareholders to have seen a return to average profitability in Q2 (EPS of $0.29), although the earlier full-year guidance was rescinded.

It’s worth noting that higher interest expenses have been eating into profitability, reaching $12.5 million for the most recent quarter. The company’s interest costs also seem destined to rise.

On a TTM basis, MATW has posted EPS of $1.07, resulting in a current TTM P/E of 22.3x. Based on my calculations, I see EV/EBITDA at 8.7x.

Balance Sheet

After being burned in the past, I’m much more cautious on companies carrying substantial debt. At last report, Matthews was carrying $825 million of debt, and it has been increasing.

The company has refinanced maturities several times in recent years, and has about $300 million maturing at the end of 2025. The leverage ratio is about 4.25x here, which is a little on the high side and possibly a cause for concern.

In their Q2 2024 commentary, management suggested debt repayments and reduced leverage was in the cards. Those serve as comforting words to concerned shareholders, and suggest that Matthews may be finished with acquisitions (at least cash acquisitions) in the near term. It could also suggest, however, that management is feeling the pinch of the company’s debt level.

MATW did increase their quarterly dividend from $0.23 to $0.24 per share late last year, but it certainly hasn’t done anything for the share price. It’s not surprising to see management refocusing on the debt load now.

Looking Forward

As mentioned, interest expenses have been eating into profitability, reaching $12.5 million for the most recent quarter. That remains quite low for a company with more than $800m of debt (interest run rate of 6.25%). Matthews has $300 million of 5.25% senior unsecured notes expiring late next year (2025). Most investors are counting on the Federal Reserve Rate cutting rates by more than 100 bps by then, but regardless it seems almost certain that Matthews will soon be paying higher rent on its maturing debt.

Fitch recently rated Mathews Intl at BB-, below investment grade. Let’s assume that the $300 million is refinanced at 7.25%, resulting in additional interest costs of $6 million as the company’s fiscal 2026 gets underway. With interest expense already running at about 50% of operating income, you can start to understand why investors have soured on shares of MATW which are trading near a 4-year low. There’s certainly an element of risk to investment capital here.

MATW is a stock that might see a boost from any progress in Fed rate cuts, as highly leveraged companies often do.

While company management was optimistic about 2024 results exceeding those of 2023 after Q1, they distanced themselves from that forecast in Q2, guiding to (adj) EBITDA of $220 million for the year, a decline of about $5 million. In adjusting their expectations, the company cited customer delays once again.

Relative to the other firms mentioned in this article, MATW already trades at an EV/EBITDA discount. Being a conglomerate of sorts likely contributes to part of this discount.

I really can’t see investors bidding shares of MATW higher than 9x EV/EBITDA in the current landscape. I also wouldn’t be surprised if the company misses guidance for 2024 or reduces it further given the cautious business commentary. At a conservative EBITDA estimate of $205, the maximum upside I see at this point is an EV of $1.845 billion, which brings me to a share price of about $32.50. That would represent a 35% upside from the recent share price of $24, but it’s difficult to accept the risks at this point. Furthermore, aside from a potential Fed Funds rate decline, it’s hard to see a near-term catalyst.

Additional Risks

Tesla (TSLA) which has employed Matthews Intl as a supplier of Electric Vehicle batteries, recently filed a lawsuit against the company. For several years now, the EV behemoth sought Matthews’ partnership with regards to its engineering solutions as part of its Industrial Technologies segment. The allegation is that Matthews subsequently filed for patents that used Tesla’s proprietary and confidential information.

This is no small suit either, with Tesla seeking $1 billion is damages. Obviously, any financial ruling approaching that amount would drown a small company like Matthews Intl with a market cap of ~$750 million and less than $50 million in cash (C&E) holdings.

Matthews International has resolutely refuted the allegations, contending that Tesla is trying to bully its partner and gain access to its intellectual property. Tesla hasn’t had the best record of success in litigation cases, and so I believe the most likely impact here is simply an additional layer of negative sentiment on shares of MATW. Nonetheless, the status of the lawsuit is something for MATW shareholders (and prospective ones) to keep an eye on.

Quant & Sentiment Ratings

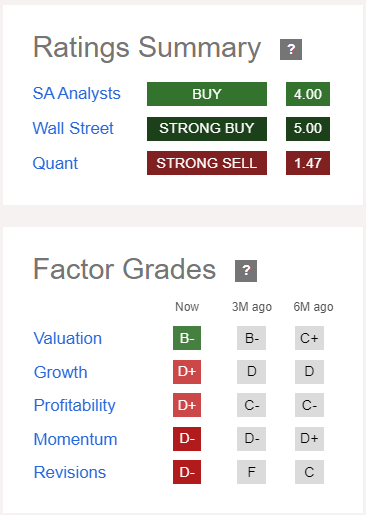

Seeking Alpha analysts have a consensus Buy rating on MATW, but with that said only a single analyst Valkyrie Trading Society has posted on this company over the past 9 months.

Seeking Alpha

The Seeking Alpha Quant Team’s factor grades look terrible on MATW. This really isn’t of any surprise given the stalled growth, recent quarterly loss, and management’s reduction of FY 2024 guidance.

Bottom Line

Matthews International is a collection of 3 fairly distinct business lines, has seen a slowdown in growth, and carries a debt level that is starting to become worrisome. While I like the long-term potential for the Memorialization business, especially for its defensive nature and demographic exposure, there are 2 accompanying businesses (Industrial Technologies, and Brand Solutions) that are subject to recent customer delays and a potential slowdown if the economy waivers, respectively.

An FOMC rate cut could boost shares of MATW, but beyond that there are few evident near-term catalysts.

I’d consider MATW a Speculative Contrarian Buy should the stock price break below $20. Otherwise, I’m waiting for signs of business improvement before seriously considering an investment in this conglomerate.