Gilnature

Although the S&P 500 index is exposed to hundreds of stocks, seven account for nearly a third of its total exposure. These include Apple (AAPL) (7%), Microsoft (MSFT) (6.5%), NVIDIA (NVDA) (6.2%), Alphabet (or Google) (GOOGL) (3.7%), Amazon (AMZN) (3.5%), Meta (or Facebook) (META) (2.4%), and Tesla (TSLA) (1.3%). Tesla is not in the top seven; it is the 11th largest in the index, but it is trendy amongst retail investors, making it a part of the “Magnificent 7” index of the top seven.

Realistically, these seven stocks drive most of the gains and losses in both the S&P 500 and Nasdaq 100, with Apple, Microsoft, Nvidia, and Alphabet as significant components. Thus, investors may find interest in funds only exposed to these stocks, such as the Roundhill Magnificent Seven ETF (NASDAQ:MAGS) which owns each in equal weighting.

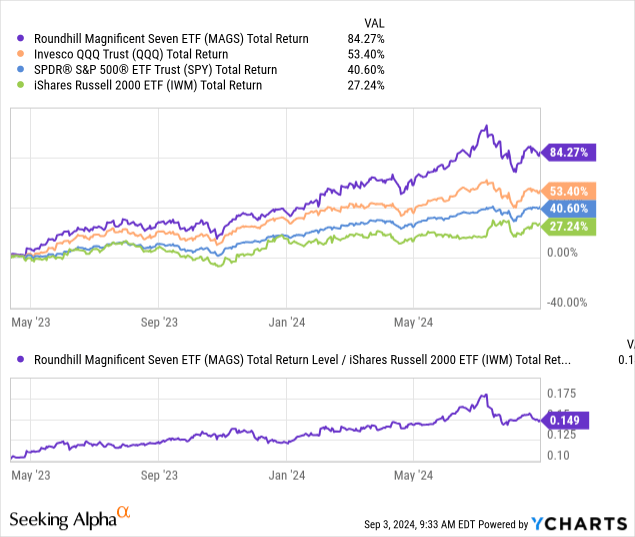

Since these stocks have gained so much momentum over the past year, MAGS has outperformed the larger indices by a wide margin, rising 84% since its inception and over 33% this year. See below:

The more interesting comparison is MAGS vs. the Russell 2000 ETF (IWM) because that index has no exposure to these mega-cap tech giants. This year, the magnificent seven is responsible for most of the returns in the S&P 500, with most of the “smaller” large caps not performing nearly as well. Of course, when market breadth is low when only a few stocks drive the market, it is often a sign that a bull market does not have a steady footing. I believe that is the case today.

As seen in the lower chart above, MAGS’s relative performance to the Russell 2000 ETF has waned since the August correction, potentially indicating this key trend has reached its natural end. Of course, that may depend largely on changes to fundamental economic trends.

A Magnificent Mega-Cap Bubble

Those who have read my work likely know I avoid the mega-cap technology giants. This is not because they aren’t good companies, but because their valuations generally do not align with their future growth potential. Most of these companies, but not all, have traded at much lower valuations in the past while having more growth potential. Further, I feel that these stocks garner significant attention from retail investors. That indicates these companies have strong consumer brand power, but investors may overlook their valuations and risk factors. On that note, these companies may have greater economic risk than in the past due to their immense size and scale.

Tesla is the top holding among those with Robinhood (HOOD) brokerage accounts. Apple, Amazon, Nvidia, and Microsoft are the next four largest holdings, while Meta and Alphabet are thirteen and fourteen, respectively. I am a retail investor, and many readers are, too. Therefore, I do not necessarily want to invest “with the pack.” A herd mentality can drive stocks much higher, far beyond reasonable expectations, but it can also turn into excess fear and panic in the other direction.

I have no issue with missing out on the gains these seven have delivered over recent years because I do not expect those gains to last. Whether their bull market ends soon or in a year or two remains unclear. However, I believe there are more signs today that they’ve collectively reached a negative tipping point than ever before.

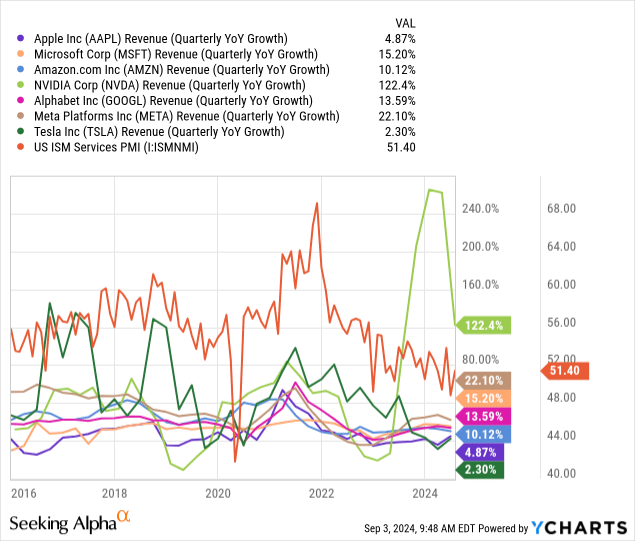

Six of these stocks, all but Nvidia, have revenue growth that generally tracks the services PMI index. Of course, one or two may deviate dramatically in any given quarter due to unique business factors; however, collectively, we can see clear economic exposure in their top-line growth. See below:

The services PMI index is probably the most telling economic growth indicator in the modern US economy. It is an index of survey measures of various business growth factors (output, orders, employment, costs, prices, etc.) for services businesses, including technology, finance, communications, and others. When it is below 50, that indicates services businesses are seeing a net decline in activity. Although the manufacturing PMI has been below 50 for around two years, it is less relevant to the service-driven US economy.

The services PMI is also less directly exposed to commodity price and inflationary factors and does not face negative deviation from inflation, unlike the manufacturing PMI. Instead, the services PMI has slowly but steadily declined from the late-lockdown era growth heyday for technology stocks and is now pointing toward stagnation.

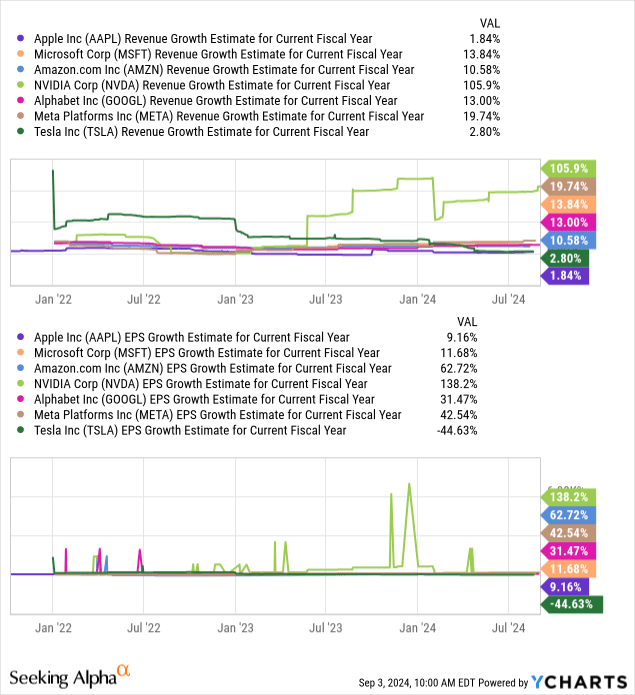

The services PMI was around 54 a year ago, and the six (ex. Nvidia) have had median annual sales growth of around 12%. Now that the PMI is closer to 50, it may be that economic factors will push these companies’ growth toward zero over the coming year. This is not reflected in analyst expectations. The median sales growth estimate (based on analyst consensus) in the current year is 13% for these seven, with a heavy skew on Nvidia. The median EPS growth estimate is 31%. See below:

These charts are not pretty, primarily because Nvidia’s ascension to market dominance has come with highly volatile income growth over recent years and a more accelerated rally with the AI boom since 2023. Tesla, likely the most exposed to consumer economic changes, is expected to see a sharp decline in income this year, followed by sustained growth after 2025.

Some may mistake high-growth expectations for high stock performance potential. I believe the opposite is more likely, as excessive expectations can often lead to disappointment. That was recently seen in Nvidia, which posted outstanding growth figures but caused a sharp correction as they were not as strong as many expected. Today, I’d argue most analysts are looking too much at the historical growth rates of these firms and not enough and the macroeconomic implications of their future growth potential.

Fundamentally, all of these stocks are tied to the US consumer. Tesla, Amazon, and Apple have straightforward ties to consumer spending power. Alphabet and Meta have strong and indirect relations due to their advertising focus. Microsoft is similar to Apple, but has more B2B exposure, while Nvidia likely is the most “pure” technology growth stock today.

I’d argue that all besides Nvidia are hardly technology companies today but are consumer staples firms that leverage technology. All have solid competitive moats (besides Tesla, in my view) and can expect continued sales from consumer demand or other businesses catering to consumers (advertising). They have limited competitive risk but still have notable economic risk that may be underappreciated because they did not have as noteworthy exposure to consumer trends in the past.

Further, I’d argue their organic growth potential is limited because they’re so large. They (besides Tesla) cannot grow much more by expanding their core businesses but by acquiring smaller firms that may provide strategic value. While that gives them growth potential, it also means a large portion of their cash flows are going to investments that may not pay off.

Monopoly Power Creates Regulatory Risks

This makes most of the magnificent seven similar to the industrial trusts of the late 19th century. Back then, a few companies with tremendous growth rose to power until they absorbed their competitors. Then, oil and railways were essentially “technology,” given they were new markets. However, as they matured and monopolies formed, the government broke them up. Today, most of these firms (excluding Nvidia and Tesla) have crossed a threshold where they’re acting as monopolies in now mature (stagnating) industries.

The US government has an antitrust investigation or action against Apple, Google, Amazon, Meta, and Microsoft. Some of those cases are recent and could have significant direct negative impacts on the core operations of these companies by forcing sales of acquired businesses. While the outcomes are unclear, it is clear that the growth potential of these firms is likely limited by antitrust law.

The Biden FTC has opposed mergers with an increasing antitrust focus. However, that is unlikely to change regardless of who wins in November. One of the few things most Americans agree on today, regardless of party, is antitrust sentiment. Of course, Trump has been in feuds with a few of these firms, and his VP pick is openly scrutinous of Big Tech monopoly power.

MAGS’ Valued For 2010s Goldilocks Forever

The 2010s were terrific for most of these companies. Extremely low-interest rates, decent economic growth, rapid technological innovation, and renewed consumer strength fueled tremendous growth for these firms. In my view, MAGS is valued as that period will continue forever. We saw a temporary return to that environment in the 2021 recovery, but I believe it firmly ended with the rise in interest rates and inflation.

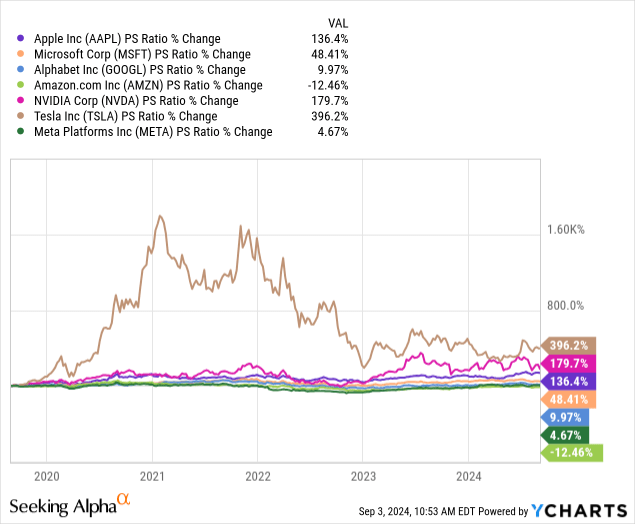

Over the past five years, the price-to-sales ratio of six out of seven of these companies has increased. The median change is 48%, with a heavy skew toward Tesla and Nvidia. See below:

The past five years have been great for these companies despite all that has occurred. TTM sales have increased by 48% (Apple) to 861% (Nvidia) over the past five years, at a median level of 125%. Since the 2020 lockdowns caused more consumer and business reliance on technology and immense government stimulus benefited consumer spending, they did not see sales slow materially in 2020.

The services PMI likely indicates these companies should see their sales growth slow over the coming two years. I believe monopoly action may dramatically lower the long-term sales growth potential of all besides Nvidia and Tesla, which still face competition. Organically, I think most of these companies have obtained total dominance in their respective markets that they cannot grow without acquisitions, and they are facing increasing FTC backlash.

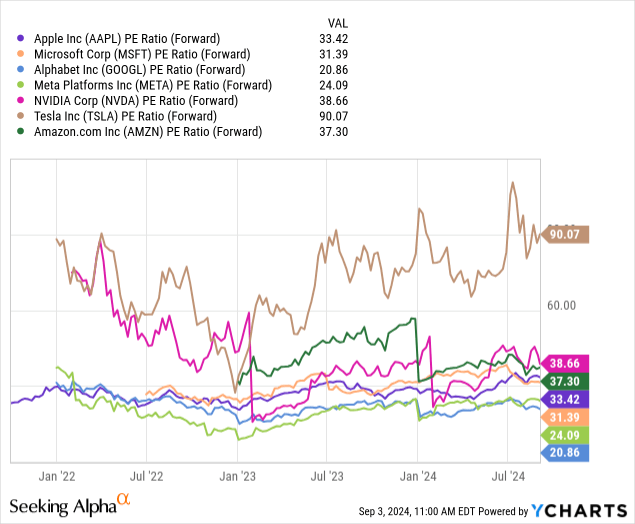

Thus, we’re seeing much higher price-to-sales valuations and, to me, much lower sales growth potential. Then, it follows this collective is likely very overvalued, on the widespread assumption that previous growth trends can continue indefinitely. All these companies’ forward “P/E” is over 20X, with a median of 33X. See below:

Meta and Alphabet may be the least overvalued of the bunch, having “P/E” ratios below 25X. For me, 15X is the target if we assume growth in line with the economy, given that’s the median “P/E” for the S&P 500 over the long run (past 150 years). Figures between 15-30X depend on abnormal growth expectations, which may be reasonable. These companies also generally have low balance sheet risks with strong cash positions, improving their fair value. For example, Apple has $62B in cash, which is high but low compared to its $3T+ market capitalization, so we need not discount its liquidity balance significantly.

Tesla’s 90X valuation would be reasonable if the company were in its infancy stages of earning an income. However, it is an automobile company facing much higher cyclical risks than most. My views on Tesla are further detailed in “TSLY: Strategic Guide To Selling Tesla Call Options.” To summarize, I think the company should not be worth more than the next seven largest carmakers combined when it does not necessarily have a permanent competitive edge in the EV space and has inferior sales growth to Toyota.

Although Meta and Alphabet have more reasonable valuations, they face both regulatory risks and may face declines from slowing advertising spending, Amazon too. Advertising is discretionary spending for companies and will likely be the first to decline during a recession. Consumer durable sales, such as electric vehicles, computers, and smartphones, should decline faster if the economy slows. Thus, I’d argue that all besides Nvidia face immediate risk from a slowing economy, with that risk seemingly widely underappreciated by investors.

The Bottom Line

I am very bearish on MAGS today and am short-selling Nvidia and Tesla. Each of the seven firms in the ETF is unique enough that investors should analyze it specifically, regardless of its long or short outlook. They’re all united by the fact that retail investors are attracted to them due to their immense media attention and size. However, excluding Nvidia, I’d argue most are hardly technology firms they used to be but are instead consumer-focused conglomerates that utilize technology and some B2B segments.

Nvidia is not so different but should have more sales growth potential associated with AI innovations. Still, I short-sold NVDA before its recent report (and remain short) because I expect competitive pressures from AMD (AMD) will cause it to fail to live up to currently excessive investor growth expectations. I also feel the current generation of AI may not live up to current expectations, and NVDA is exposed to falling Bitcoin prices.

Finally, I expect many readers will correctly comment regarding “why now?” Indeed, these companies have been arguably overvalued for years, and although their economic and regulatory risks may not have been as significant, they are not entirely new risks. For me, it boils down to the stock market being primarily driven by investor liquidity and not fundamentals.

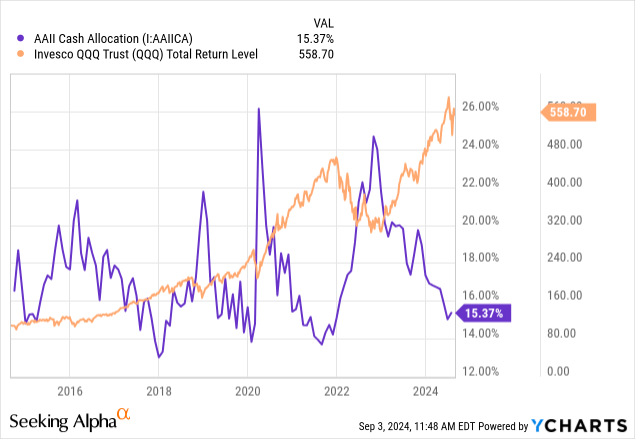

MAGS has not traded long enough to illustrate, so I’ll use the relevant Nasdaq 100 ETF (QQQ). In general, the Nasdaq 100 rises when individual investor cash allocations are high and falls when cash allocations are low. See below:

Today, individual investors have relatively low cash waiting to be deployed into stocks. Bond allocations are also low, meaning individual investors are likely at maximal stock exposure today. In my view, if individual investors do not have liquid assets to deploy into stocks, we should not expect their favorite stocks to rise. The end of 2021, 2019, and the beginning of 2018 saw similar cash allocations and proceeded corrections. The recent minor correction saw a slight rise in cash allocations, but not enough to expect stocks to rise for over a month or two.

Everything considered, I would avoid MAGS today and have a particularly bearish outlook on a few of its components. The critical risk to my thesis is that the services economy improves with more consumer spending and improved sentiment. AI innovations may also fuel growth for these companies; however, I believe that retail investors’ speculative exuberance regarding AI may fuel a rally even if AI does not immediately improve profits. Rising unemployment may also temporarily improve the income of some of these companies, allowing them to lay off redundant workers. While all of those are risks to my bearish thesis, I believe those trends have already played out, leaving these companies valued on irrational expectations.