AndreyPopov

This is my sixth article on royalty aggregator Ligand Pharmaceuticals (NASDAQ:LGND). My most recent previous Ligand article was 06/2023’s “Ligand Pharmaceuticals: The New Ligand (“New Ligand“). In it I rated Ligand as a “Buy”. At the time it was selling for $76.42.

As I write on 04/21/2024 Ligand currently trades at ~$70.00, down ~8%. I continue to rate Ligand at a “Buy” because of its recent streamlining moves as discussed in this article. I view it as a better investment now because of these recent moves and because of its ~8% lower price.

In this article I reference the following

- 02/27/2024 — earnings call (the “Call“);

- 02/27/2024 — press release (the “Release“);

- 02/27/2027 10-K (the “10-K“);

- I also refer to its Fourth Quarter and Full Year 2023 Financial Results website presentation accessed 04/21/2024 (the “Presentation“).

Ligand continues to wheel and deal.

General

Ligand is all about doing deals. Its royalty aggregation business strategy differentiates it from a typical biotech. The 10-K describes its operating techniques as follows under its “Strategy and Execution” heading; its strategy uses four key approaches:

…royalty monetization, M&A, project finance, and platform investments. With royalty monetization, we purchase rights on existing royalty contracts that are owned by inventors, academic institutions or companies. There are advantages of royalty investing as a model since royalties 1) have minimal infrastructure, 2) are non-dilutive and 3) their cash flows are often protected in bankruptcy. …

Ligand has not rested on its laurels since 06/2023’s New Ligand. Subsequent to its publication it has done the following deals:

- 04/03/2024 — launches Pelthos Therapeutics;

- 09/18/2023 — spins out and merges Pelican subsidiary with Primordial Genetics to form Primrose Bio;

- 07/17/2023 — acquires Novan, Inc.

Novan acquisition

In acquiring the assets of bankrupt clinical stage biotech Novan, Ligand was taking a shot at grave dancing (biotech style). For a modest outlay of $12.2 million it got:

…berdazimer gel and all the assets related to the NITRICIL™ technology platform, and the rights to the Bayer-partnered Sitavig program.

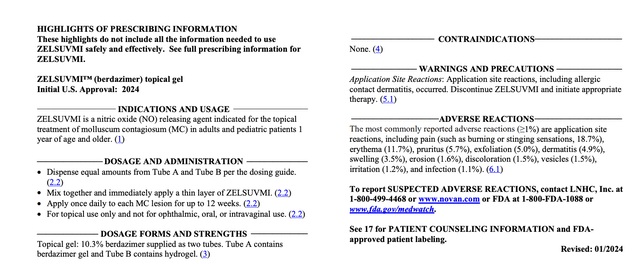

The FDA approved berdazimer gel, renamed ZELSUVMI, for treatment of molluscum contagiosum (MC) in 01/2024. The lead panel on its FDA Label provides:

accessdata.fda.gov

Pelican subsidiary spin out.

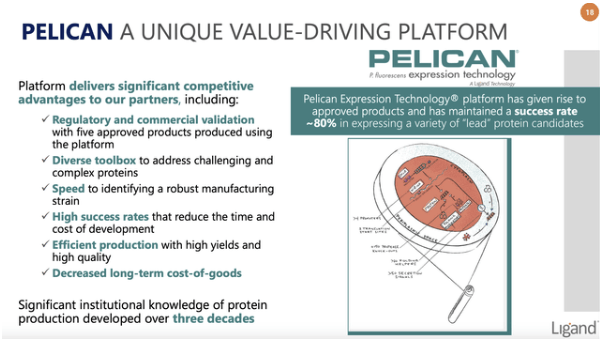

New Ligand includes the following graphic explaining the important role Pelican plays in Ligand’s ongoing success:

seekingalpha.com

Its referenced 09/18/2023 spin out and merger reflects its latest deal leveraging the Pelican platform. Item 8:00 of Ligand’s 09/23/2023 8-K describes the deal. A Pelican subsidiary became a subsidiary of Primrose Bio, a privately held company. Further:

Ligand retains the existing commercial royalties related to the Pelican Expression Technology and will own 49.9% of Primrose Bio. Simultaneous with the merger, Ligand entered into a Purchase and Sale Agreement with Primrose Bio and contributed $15 million in exchange for 50% of potential development milestones and certain commercial milestones from two contracts previously entered into by Primordial Genetics.

Pelthos Therapeutics

Pelthos was launched on 04/03/2024; it is a wholly owned subsidiary of Ligand. As noted in a footnote to Presentation slide 5. It is being formed by Ligand to hold assets it acquired from Novan, most notably ZELSUVMI. The only indication we have as to Pelthos’ ZELSUVMI commercialization plans is that it is “expected to be commercially available during the second half of 2024″.

MC is a viral disease. An 08/2023 article in the Journal of Clinical and Aesthetic Dermatology [JAMA] provides an interesting and comprehensive overview of the MC landscape. It only mentions berdazimer gel in passing as a “a first-in-class nitric oxide (NO)-releasing topical treatment’ that was under evaluation by the FDA at the time.

The following extracts are paraphrased quotes from the JAMA article describing key aspects of MC and its treatment when the article was published:

- MC is an unclassified member of the Poxviridae family…it causes a benign, cutaneous-manifested infection that occurs only in humans;

- the prevalence of MC in the United States (US) general population is approximately five percent; pediatric patients are disproportionately affected by MC compared to adults, with the highest incidence of MC occurring among children under the age of 14 years;

- in real-world clinical practice, MC most commonly presents in patients 1 to 4 years of age, but older children can develop more extensive infection and require more frequent treatments;

- main populations affected by MC are pediatric patients with intact immune systems; young, immunocompetent, sexually active adult patients; and patients who are immunocompromised of all ages;

- lacking a cure or a first line treatment the article notes that clinicians often opt for a policy of benign neglect when a patient presents with MC.

ZELSUVMI will dramatically alter the MC treatment landscape. Pelthos will face a daunting challenge as it navigates the physician/patient/payer triad. It makes sense for it to delay its rollout giving it time to do it right. Unfortunately, investors will have no true read on how it is progressing until later in 2025.

Ligand presents interesting and attractive financial metrics.

General

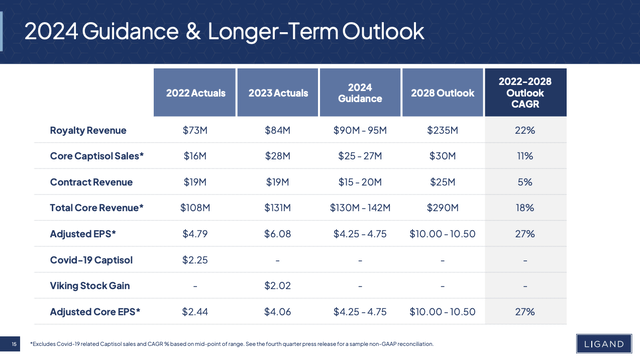

Presentation slide 15 provides an intriguing view of Ligand’s financials. It not only includes figures for 2022, 2023 and a guidance for 2024. It also manifests sufficient confidence in its business model and its ability to operate within that model to publish its longer term outlook out to 2028:

investor.ligand.com

During the Call CEO Davis discussed this outlook as reflective of the breadth of Ligand’s portfolio which provides:

…lower volatility and much greater predictability than is typical in biotech businesses, which in turn provides …[it with the] confidence to share these longer term projections.

Captisol

The graphic above includes two rows for Captisol. The first is “Core Captisol Sales and the second “Covid-19 Captisol, which only has an entry for 2022 Actuals. The 10-K describes Ligand’s captisol business as:

…a patent-protected, chemically modified cyclodextrin with a structure designed to optimize the solubility and stability of drugs. This unique technology has enabled several FDA-approved products, including Gilead’s Veklury, Amgen’s Kyprolis, Baxter International’s Nexterone, Acrotech Biopharma’s and CASI Pharmaceuticals’ Evomela, Melinta Therapeutics’ Baxdela and Sage Therapeutics’ Zulresso. There are many Captisol-enabled products currently in various stages of development. We maintain a broad global patent portfolio for Captisol with the latest expiration date in 2035. Other patent applications covering methods of making Captisol, if issued, extend to 2041.

For those who do not follow Ligand, “Covid-19 Captisol” in its “2022 Actual” column refers to its amazing deal with Gilead (GILD). Under the deal, Ligand provided bulk Captisol for Gilead’s VEKLURY (remdesiver) which was FDA approved to treat COVID-19.

As discussed in 10/2021’s “Ligand’s Ailing Remdesivir Cash Cow” this deal distorted Ligand’s revenues for 2021 and 2022 with major revenue generation. Now that the pandemic is in our rear view mirror, Captisol’s VEKLURY revenues have dropped to nil. Ligand expects this to remain at nil through 2028.

Viking Stock Gain

Ligand’s Viking Therapeutics (VKTX) deal takes us way back and highlights both the delights and frustrations of Ligand’s ongoing deal making prowess. It took a leading role back in 2015 when Viking Therapeutics was launching its IPO. Under the deal, Ligand acquired 49.9% of Viking stock at a cost of ~$12.3 million. In the intervening years, Viking stock has skyrocketed.

During the Call CEO Davis noted that Ligand has:

…generated approximately $80 million in proceeds from the sale of Viking shares and still hold[s] approximately 1.7 million shares.

Great news no doubt, however when one thinks of what might have been, one can’t help but fret. As I write on 04/28/2024 Viking has a market cap of $8.19 billion. Ligand has done crazy well with its initial $12.3 million investment, but nowhere close to the >$4 billion gain it would have realized if it had stood pat with its 49.9% ownership.

Conclusion

Ligand is a different breed of cat compared to other smaller biotechs. I consider the difference as a strongly positive one for by reason of its lower volatility and higher predictability as cited by CEO Davis above.

It is important to distinguish between Ligand’s business and its stock when discussing volatility and predictability. Just take a quick glance at Ligand’s longer term stock chart.

It is totally unpredictable and highly volatile. I will acknowledge this as I must. However, I would contend that if the business keeps growing in accordance with management’s outlook, in time the stock will reflect it. That is the reason I rate this as a buy.