WendellandCarolyn

The past couple of days have been quite positive for shareholders of The Kroger Co. (NYSE:KR). On September 12, shares of the massive grocery chain closed up 7.2%. And as of midday on September 13, the stock was up another 1%. This move higher has been driven by financial results covering the second quarter of the 2024 fiscal year that management just reported. Even though earnings per share fell short of expectations, revenue and adjusted earnings per share exceeded the estimates that analysts had put forth. Overall guidance for the year seems to be solid considering what is going on economically. Add on top of this how the stock is currently priced, both on an absolute basis and relative to similar firms, and I do think that rating it a ‘buy’ makes sense.

This is not the first time I have come out with a bullish assessment of the company. Back in May of this year, I reaffirmed my ‘buy’ rating on the stock. Unfortunately, since then, shares are up only 5.1% while the S&P 500 is up 6.8%. However, I have been consistently bullish on the firm since first writing about it in June 2017. Since then, shares are up 177%. That’s comfortably higher than the 130.3% increase seen by the S&P 500 over the same window of time. In the long run, I expect this kind of outperformance to continue.

A solid quarter

Fundamentally speaking, things are going reasonably well for Kroger at this point in time. As an example, let’s start with revenue for the second quarter of the 2024 fiscal year. Sales for the quarter came in at $33.91 billion. That’s an increase of 0.2% compared to the $33.85 billion the company reported for the second quarter of 2023. It also happens to be $207 million above what analysts anticipated for the quarter. The revenue picture for the company would have been even better if we didn’t factor in fuel revenue. Given the extreme volatility of fuel, combined with how low margins associated with it are, it would be appropriate to strip these out. In this case, revenue would have been up 1.3% year over year.

Even though this kind of growth does not seem impressive to many, there were some parts of the company that performed extraordinarily well. According to management, delivery sales jumped 17% year over year, mostly because of the firm’s Customer Fulfillment Centers. The overall e-commerce households that it caters to jumped by 14% during this window of time. Even though I never would have thought several years ago that a shift to digital sales would have been meaningful for the grocery space, we have seen greater adoption on that front. And it’s great to see that Kroger is doing so well in its efforts to play in this space. Although we don’t have any data on this, it is likely that the introduction of 223 new Our Brands products also helped revenue rise during this time.

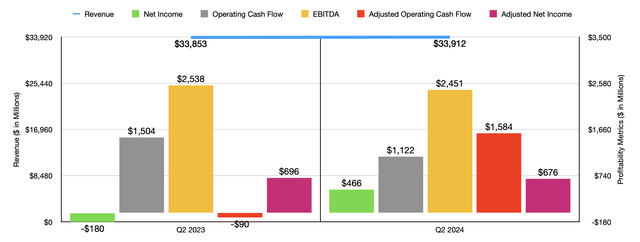

The bottom line for the company is a bit more complicated. In the second quarter of 2023, the company generated a loss per share of $0.25. In the second quarter of this year, the company achieved a profit of $0.64 per share. This translates to an improvement from a loss of $180 million to a gain of $466 million. In a vacuum, this is a fantastic improvement. Unfortunately, though, analysts we’re hoping for something a bit more. They anticipated earnings per share that would have been $0.28 higher than what the company ultimately achieved. The disparity would have been even greater had it not been for a $367 million gain on investments that the company reported in the second quarter of 2023 compared to the $121 million loss achieved this year.

If we make certain adjustments, the picture is radically better. Even though adjusted earnings fell from $0.96 per share last year to $0.93 per share this year, taking adjusted profits down from $696 million to $676 million, the adjusted years reported by management happened to come in $0.02 per share greater than forecasted by analysts. Other profitability metrics for the company were certainly mixed. As an example, operating cash flow dropped from $1.50 billion last year to $1.12 billion this year. If we adjust for changes in working capital, however, we get an improvement from negative $90 million to positive $1.58 billion. While I am happy to see that, I am disappointed to see that EBITDA dipped from $2.54 billion to $2.45 billion.

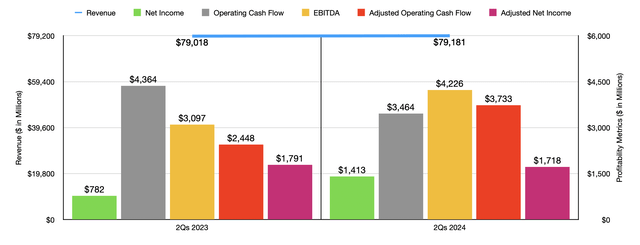

In the chart above, you can see financial results for the first half of 2024 compared to the first half of 2023. The first thing I noticed is that most of these metrics were better year over year. Revenue, profits, adjusted operating cash flow, and EBITDA were all higher year over year. However, operating cash flow took a dive. For the rest of this year, management has provided some guidance that suggests that the picture will be slightly worse than it was last year. Adjusted earnings per share are expected to be between $4.30 and $4.50. If we see the midpoint of this guidance achieved, that would imply an adjusted net income of about $3.20 billion. This would be down from the $3.45 billion reported last year. However, operating cash flow is expected to be between $6.1 billion and $6.5 billion, with a midpoint of $6.3 billion. While this is down from the $6.79 billion reported last year, it would be up from $5.98 billion that was generated on an adjusted basis. Meanwhile, it is looking like EBITDA will come in at around $7.66 billion. This compares to the $7.95 billion generated in 2023.

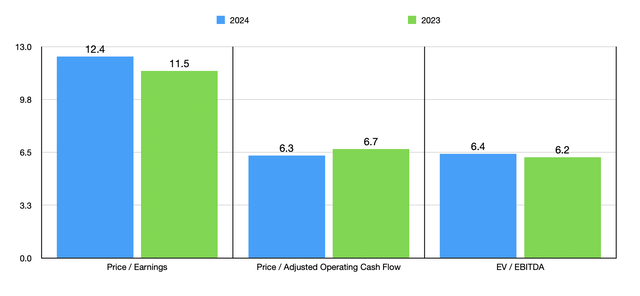

Even though we are looking at a mediocre year relative to what was seen last year, shares of the company are still attractively priced. In the chart above, you can see how the stock stacks up, on a forward basis, compared to what we would get when using data from 2023. I always love seeing a company trade in the mid-to-high single digit range. And it just so happens that Kroger achieves this from a cash flow perspective. In the table below, I also compared the company to five similar firms. On a price-to-earnings basis, only one of the five companies is cheaper than it is. And when using the other two profitability metrics, only two of the five firms are cheaper than our candidate. It’s interesting to note that Albertsons is cheaper in all three instances.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| The Kroger Co. | 12.4 | 6.3 | 6.4 |

| Albertsons Companies, Inc. (ACI) | 9.9 | 4.0 | 4.3 |

| Metro Inc. (OTCPK:MTRAF) | 21.2 | 12.4 | 11.1 |

| Casey’s General Stores, Inc. (CASY) | 28.1 | 15.2 | 14.0 |

| J Sainsbury plc (OTCQX:JSAIY) | 54.0 | 3.7 | 3.6 |

| Sprouts Farmers Market, Inc. (SFM) | 32.3 | 21.3 | 14.2 |

When it comes to Kroger, the big unknown involves its pending merger with Albertsons Companies. In the past, I have written about the transaction, with some of my most recent articles, here and here, pointing out that the merger is looking increasingly unlikely. This is because of a court case currently going on regarding antitrust concerns. It’s likely that this process will still take a couple of more weeks, if not longer. However, in its earnings call transcript, the management team at Kroger stated that, ‘as the preliminary injunction trial with the FTC nears its conclusion, we are confident in the facts and the strengths of our position’. Obviously, even they acknowledge that the deal could very well fail. However, management has been making moves in case it doesn’t. This includes successfully closing a new offering of $10.5 billion worth of senior unsecured notes that closed subsequent to the end of the second quarter. The company has also been working through an exchange offer regarding certain notes of Albertsons, with that exchange offer being contingent upon the transaction closing. But only time will tell what transpires on that front.

Takeaway

All things considered, I would say that Kroger is doing quite well for itself. Yes, 2024 is going to be a mixed bag for shareholders. But the firm is performing well considering the current economic environment. Shares are attractively priced and this revenue and adjusted earnings beat shows the quality of the business and its management team. Add all of this together, and I do think that keeping the company rated a ‘buy’ is logical right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.