blackred

Investment Thesis

KBR, Inc. (NYSE:KBR) has good growth prospects ahead. The company is experiencing secular demand drivers within both of its segments. The Sustainable Technology Solution segment is seeing secular trends from ammonia, decarbonization, energy security, and energy transition. The Government Solution segment is seeing secular trends from favorable national security, space, and Cybersecurity end markets. These secular demand tailwinds should support the company’s revenue growth moving forward. In addition, the company should also benefit from a significant ramp-up in HomeSafe Alliance work in the coming years, supported by a multiyear TRANSCOM contract.

On the margin front, the company should benefit from favorable pricing, volume leverage, improving margin mix, and acquisition cost synergies. So, the company has good long-term revenue and margin growth prospects. According to consensus estimates, the company is expected to deliver double-digit EPS growth in the coming years and is trading below historical averages on a forward basis. Hence, I believe the stock offers a good buying opportunity.

KBR’s Revenue Analysis and Outlook

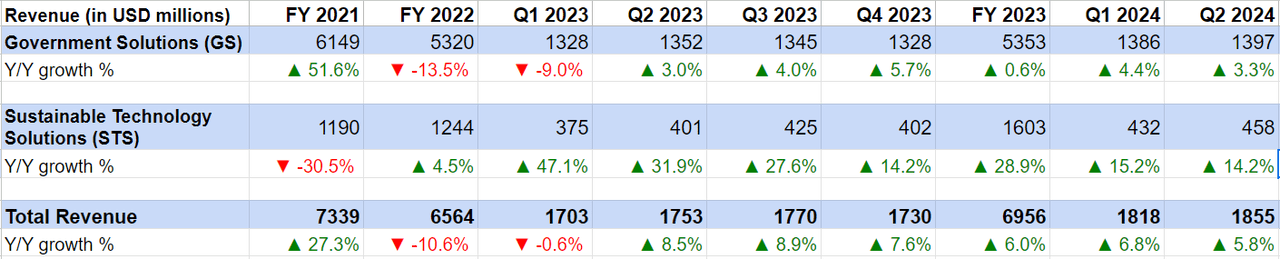

In my previous article in May 2024, I discussed KBR’s good growth prospects benefiting from a healthy backlog and secular growth drivers in its Government Solutions (GS) and Sustainable Technology Solutions (STS) segments, further supported by government investment initiatives. The company has recently reported its Q2 2024 earnings results and similar dynamics were seen there.

In the second quarter of 2024, the company’s revenue grew by 5.8% Y/Y to $1.855 billion. In the Government Solutions segment, revenues increased by 3.3% Y/Y driven by revenue growth of 11% in International, 5% in Defense & Intelligence, and 1% in Science & Space businesses. This growth was partially offset by a revenue decline in the Readiness & Sustainment business as a result of lower EUCOM activity due to funding delays to support Ukraine.

In the Sustainable Technology Solutions (STS) segment, revenues increased by 14.2% Y/Y driven by growing demand for sustainable services and increased technology sales.

KBR’s Historical Revenue Growth (Company Data, GS Analytics Research)

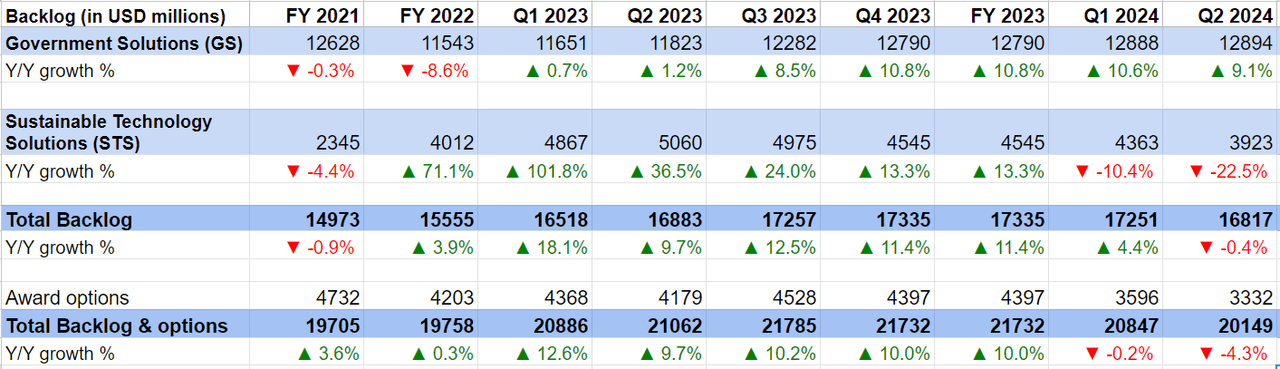

In Q2 2024, the company’s backlog and options totaled $20.15 billion, down 4.3% Y/Y, and it reported a book-to-bill (TTM) of 1.0x.

Segment-wise, the GS segment’s backlog grew by 9.1% Y/Y and delivered a book-to-bill (TTM) of 1.2x. This includes an $82 million cost-plus-fixed-fee task order under an IAC MAC contract by the U.S. Air Force for the Air Force Life Cycle Management Center.

In the STS segment, the backlog declined by 22.5% Y/Y and the TTM book-to-bill was 0.8x. This decline was mainly due to large burn on the Plaquemines LNG project and excluding this project, the TTM book-to-bill was 1.2x. This includes a green ammonia project in India and a 5-year contract to assist the Iraqi government across infrastructure, energy, and sustainable development.

KBR’s Historical Backlog Growth (Company Data, GS Analytics Research)

Looking forward, I am optimistic about the company’s growth prospects. KBR is seeing strong demand drivers in both of its segments.

In the Sustainable Technology Solutions (STS) segment, the company should benefit from secular trends in ammonia production, decarbonization, energy security, and energy transition globally. KBR’s leadership in green and blue ammonia technology positions it to benefit from this trend. The company sees a good opportunity in the Blue ammonia market due to its affordability and, on its recent earning call, management noted that there are only two blue ammonia projects in the world that have received final investment decisions – OCI plant in Beaumont, Texas, and Fertiglobe in the UAE – and both are using KBR Technology. This early lead positions KBR well to benefit from this secular growth market.

While the STS segment backlog was down sequentially and Y/Y, it was mainly due to a large burn on the company’s Plaquemines LNG project. Excluding this project, book-to-bill (TTM) for the segment was 1.2x, which indicates strong demand trends in the market. On the Q2 earning call, management noted strong trends globally, especially in the Middle East, where the company is seeing increasing activity.

In the Government Solutions (GS) segment, KBR is seeing solid organic growth driven by positive trends in national security, space, and cybersecurity end markets. The GS segment reported a trailing twelve-month book-to-bill ratio of 1.2x, reflecting a robust demand environment. The company continues to see solid award wins under its IDIQ (Indefinite Delivery, Indefinite Quantity) contract vehicle. The company is expecting a further ramp-up in award volume in Q3, with over $2 bn worth of bids submitted and awaiting award under the IAC MAC IDIQ program alone. According to management, the company’s volume bids for the total government business across its portfolio has increased significantly in 2024 and currently sit at over $8 bn. As these projects are awarded, I expect a significant ramp-up in revenues in the second half of this year and beyond.

The Government Services segment is also poised to see a significant ramp-up in Home Safe alliance work. As explained in a previous article, HomeSafe Alliance is a JV led by KBR (~72% stake) which won a TRANSCOM contract related to transporting household goods for the US Armed Forces, DoD civilians, and their families in 2021. This contract has a ceiling value of $20 bn over the nine years and is expected to ramp up meaningfully over the next few years. In May, TRANSCOM came out with a press release that they intend to achieve full domestic implementation of this contract by Spring 2025 which bodes well for KBR’s revenue growth in the medium term.

So, I remain optimistic about the company’s growth prospects.

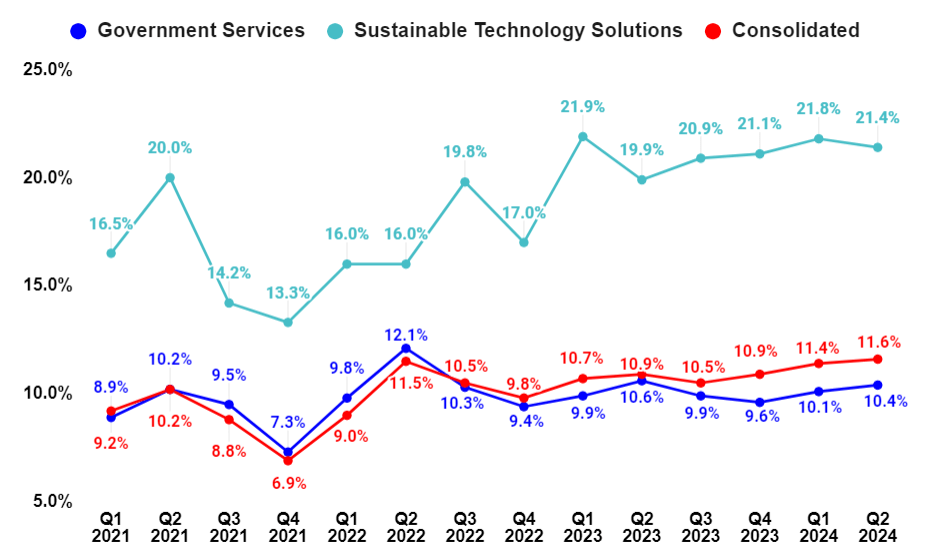

KBR’s Margin Analysis and Outlook

In Q2 2024, the company’s margins benefitted from the international mix, high award fees, and strong project execution in the GS segment and intellectual property licensing mix and strong joint venture performance in the STS segment. This resulted in a total adjusted EBITDA margin expansion of 70 bps Y/Y to 11.6%.

On a segment basis, the STS segment’s adjusted EBITDA margin increased by 150 bps Y/Y while the GS segment’s adjusted EBITDA margin decreased by 20 bps Y/Y in the quarter.

KBR’s Segment-Wise and Total Company Adjusted EBITDA margin (Company Data, GS Analytics Research)

Looking forward, I am optimistic about the company’s margin growth prospects. Given the good demand environment, I expect pricing on projects to remain strong. The company should also see benefits from operating leverage as the revenue outlook remains solid.

Further, as green and blue ammonia gains more traction, the licensing business of the STS segment, which carries high margins, should also become a larger part of the overall business mix. The company has a leading position in ammonia technology and as it gets more opportunities to license this technology, its margin mix should improve.

In Government business, the company’s margins should benefit from synergies from the integration of LinQuest. On its last earnings call, management noted that the margins in LinQuest business are already in double digits. This should help margin mix, with additional potential benefits as cost synergies are realized.

Valuation and Conclusion

KBR is currently trading at 20.50x FY24 consensus EPS estimates of $3.25 and 17.08 FY25 consensus EPS estimates of $3.90. Over the last five years, the company has traded at a forward P/E multiple of 17.91x. While the company’s P/E multiple on FY24 consensus EPS estimates is a premium to its historical levels, its P/E multiple on FY25 consensus EPS is at a discount.

KBR Consensus EPS Estimates and Forward P/E (Seeking Alpha)

The company is expected to post 20% plus EPS growth for the next few years as it benefits from secular demand trends in both the segment as well as ramping up of Home Alliance JV revenues. So, the company’s valuation on a forward basis looks attractive. I continue to see a good upside for the stock, driven by its strong earnings growth prospects and reasonable valuations. Hence, I continue to have a buy rating on the stock.

Risks

-

Any delay in the implementation of the TRANSCOM contract in the coming year, as well as in the realization of benefits from the TRANSCOM contract, can impact the ramp-up of HomeSafe Alliance work, which in turn can impact revenue growth.

-

Any delay or missteps in project execution can offset benefits from good end market demand and impact revenue/margin performance.

-

If the company fails to realize synergies from the LinQuest acquisition, its performance may lag.