FreshSplash/E+ via Getty Images

Since my last article a few months ago on Kaspi.kz (OTC:KSPI), the stock has performed strongly with a 31.6% total return in a few months. Has there been some radical change at the business that caused this outsized return? No, not really. The business is just continuing to execute. Having only been listed on the NASDAQ a few months, more investors continue to wake up to the growth story, and I believe the returns will continue in the near future.

Kaspi in 2024

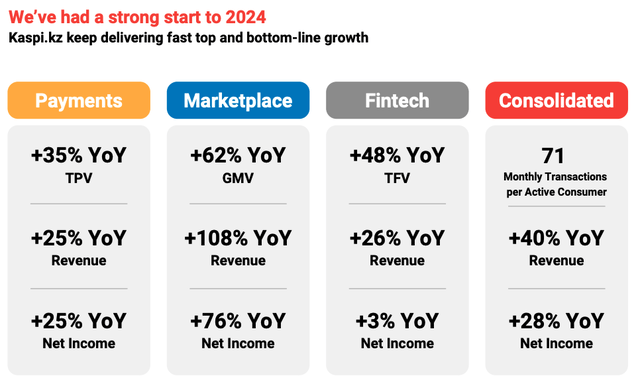

You don’t need to look much further than KSPI’s most recent quarterly report to discern that the growth story is still very much intact.

Q1 Results (Kaspi.kz Investor Relations)

Kaspi is a “Super App” – a collection of popular disparate applications and services bundled all together. I try to explain it to people like this, imagine if your bank, Amazon (AMZN), Expedia (EXPE), PayPal (PYPL), Mastercard (MA) and even the DMV were all in one place. That’s Kaspi. Still, some of these businesses are higher quality than others. Kaspi started out as a bank and has added in additional high value services over time. I’ve consistently warned that the success of this business is dependent on the business becoming less of a bank and more of a technology business. The bank will always play a role in the business and is a critical touch point for consumers, but as an investor it’s critical to see growth in payments and marketplace. As a percentage of net income these two segments grew from 60% in 1Q 2023 to 68% in 1Q 2024.

The e-Car Business

Since acquiring Kolesa.kz, Kaspi has been working to develop a holistic customer experience where Kaspi can serve every need of consumers related to automotive. From purchasing, financing, insuring, registering, to getting any auto parts a consumer might need, Kaspi can help. Year in and year out Kaspi has been able to leverage its existing platform to develop new businesses. Already this year, they are developing a first party e-car business and have already profitably sold 1.2k cars. The consumer auto market in Kazakhstan is large and meaningful – which is why I think it has been highlighted in the most recent quarter. The market is about $3.4 Billion annually which is roughly 1.5% of Kazakhstan’s GDP. Part of the bear thesis for Kaspi is that the country of Kazakhstan is only so large and that the business will hit a ceiling soon. If the business continues to innovate, there is a chance that they will be able to find ways to extend their runway within the country.

Risks from the National Payment System

News broke April about the Kazakh Central Bank creating a new payment system designed to replace the profitable business lines of Kaspi and Halyk bank which control about 80% of the market together. This seems to have led to a nearly 20% draw down in the stock in a number of days. However, management sounded quite blaze about the risk in their Q1 earnings call. They stated that this project is nothing new – it’s been around for 10 years. Further CEO Mikhail Lomtadze added:

first of all, the payment system is not really replacing the successful payment networks which have been developing in the country and is actually planning more of add functionality to allow more transactions between the banks and not planning to interfere in any way.

I think there is still some risk that a government sponsored payment system could create competition with Kaspi, but, unless it is mandated, I don’t think it will be a substantial threat in the short term. Kaspi already has nearly every merchant in the country signed on to use their payment network. Adding a new payment system may be too taxing for all of Kaspi’s merchant partners. Still, this is something that has to be watched closely. In my opinion, it only takes one government mandate to really create issues for Kaspi – though they haven’t shown much ill will towards the business yet.

Lingering Risks from Fintech

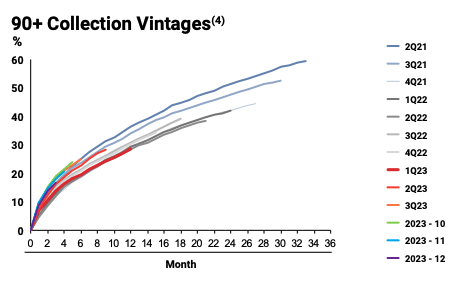

Kaspi was born a bank. They don’t have the income statement of a bank but, they do have the balance sheet of a bank – customer deposits make up 95.4% of the business’s outstanding liabilities and loans to consumers represent 65.4% of the company’s assets. Kaspi has not been leaning into more lending, but the majority of their loans are still buy-now-pay-later style loans to consumers. Their deposits are also substantially coming from consumers. So it should come as no surprise that Kaspi’s fortunes should rise and fall with the consumer in Kazakhstan. NBK data shows that loans to individuals in the country have been on the rise for years and at the country level, non-performing loans are on the rise. Data from Kaspi reflect the explosion in credit, but not necessarily the NPLs. Delinquency rates at Kaspi have been low and stable around 2.2%. This is likely the result of better underwriting on the initial loans. Additionally, Kaspi has been able to collect reasonably well on delinquent payments.

Kaspi 90+ Day Collections (Kaspi Investor Relations)

Due to the asset light nature of the payments and marketplace businesses, the balance sheet won’t look much different anytime soon. However, as those businesses grow, they can help to cushion any downturn in credit quality that the business might see.

There Is A Lot To Like

I remain very bullish on this business. The growth and the valuation, at a P/E of 12.7, are outstanding. They continuously innovate and build new businesses with a resounding focus on profitability much unlike many popular loss making tech businesses. Still, going into the next quarter, I remain laser focused on credit quality. As long as there no hiccups on the lending side of the business and the government remains somewhat business friendly, Kaspi has a very bright future ahead as a business and as a stock.