wildpixel/iStock via Getty Images

JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) is a relatively new options-based income fund. Incepted in May 2022, it doesn’t have an extensive history, but the recent plunge in the stock market is one such opportunity to see just how a fund like this fares. Ultimately, I think income investors will find it to be an acceptable Buy, even if not the most exciting.

Concept of the Fund

JEPQ is an actively managed ETF. It invests most of its assets in the NASDAQ 100 Index (NDX), its benchmark, but it does not aim for an identical allocation of it. In their Prospectus, the managers note that they may adjust depending on equities they believe to be more undervalued or that will allow for less volatility than the benchmark.

June 2024 Fund Sheet

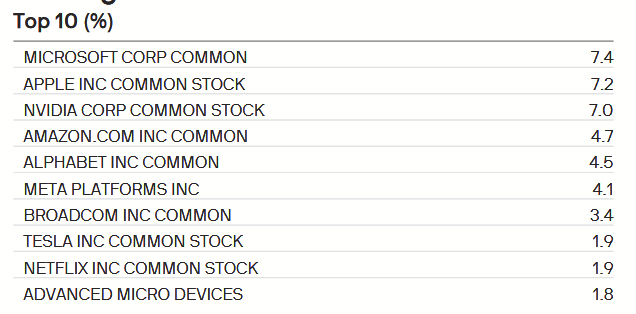

Consequently, their Top 10 Holdings consist of well-known tech giants, representing over 40% of the portfolio.

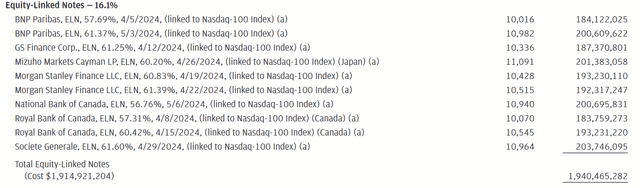

Usually around 15% of the fund, however, is invested in Equity-Linked Notes. The ELNs themselves sell call options and distribute them to JEPQ, which are then available for distribution to shareholders.

With this benchmark-ELN strategy, JEPQ hopes to provide a source of recurring income, limited volatility, and the possibility of capital appreciation over time.

The Recent Market Slump

Without any major declines in the market since inception, the movements of the last month provide an interesting test into the strength of JEPQ’s strategy.

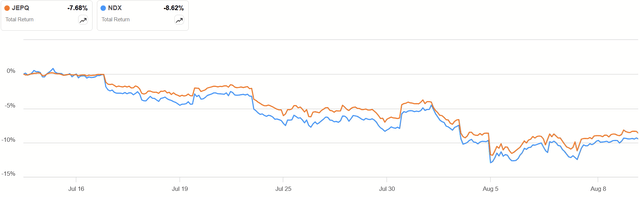

JEPQ vs. NDX 1M Total Returns (Seeking Alpha)

In the past month, JEPQ has narrowly enjoyed better total returns than its benchmark. Both of these, however, account for declines.

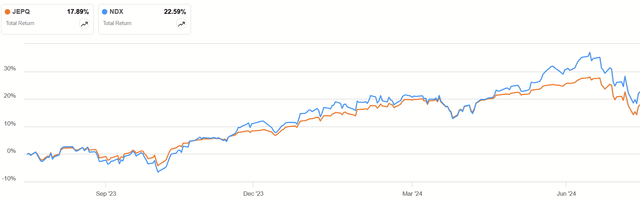

1Y Total Returns (Seeking Alpha)

Still, this advantage in a dip has been offset by NDX’s higher growth over the past year. While folks still get their income, this is the trade-off to bear in mind.

Dividend Situation

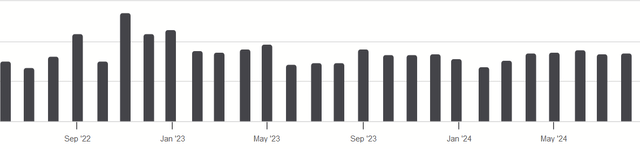

JEPQ has managed to pay a dividend every month since inception. The amount of the dividend has varied quite a bit.

Full Dividend History (Seeking Alpha)

Monthly distributions have been as high as $0.68 and as low as $0.34, and they are usually closer to that lower figure. This is somewhat explained by how ELNs work, functioning like a variable-interest bond. Their distributions depend on market performance, and so it’s unlikely that identical distributions would occur for several consecutive months.

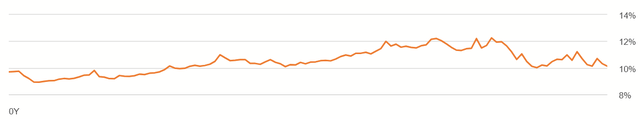

Yield on Cost Full History (Seeking Alpha)

As NDX has grown, while JPQ’s dividends have not, its yield on cost is also lower, once reliably above 10% but no longer. It is not a huge difference yet, but its ability to maintain a yield in this range is something that should be watched closely.

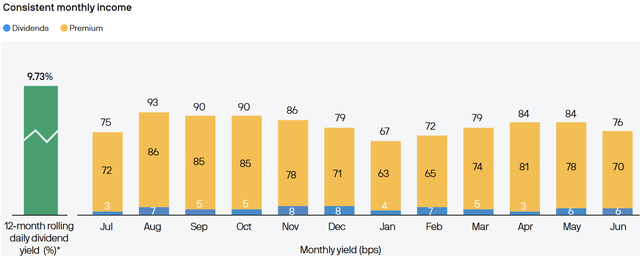

Dividend Sources (June 2024 Fund Fact Sheet)

As seen from the fund’s latest fact sheet, most of these distributions derive from the option premiums in their portfolio. Dividends earned from their equity positions account for a minor piece of this cash flow.

Being actively managed, however, we have to remember that the fund may choose to withhold dividends. I previously covered XYLD (XYLD), another options income fund, and one thing I liked about it is that its dividend generally increased over time and preserved purchasing power. In 2020, however, the fund elected to cease dividends until the disruptions created in the market by COVID abated.

JEPQ managers are different from XYLD’s in that they don’t write the calls themselves; they choose ELNs that do that for them. Spread across multiple issuers and subject to change as these ELNs mature, there are two layers to this: what the ELN issuers will do and then what JEPQ will do. As the ELNs are from major institutions, I don’t suspect there is significant risk here (and if there were, there are probably bigger problems in the world than a JEPQ dividend cut).

The real question is if JEPQ will choose to preserve liquidity in the event of a market crash before distributing again, and the recent dip, while it did shock some folks, isn’t something as major as the COVID crash, which was accompanied by very real dangers posed from the pandemic.

Conclusion

There are some positives and negatives to this fund. While it resists dips better than its benchmark, that doesn’t mean it doesn’t dip. The monthly income is also somewhat variable but averages to about a 10% yield, with it being a bit lower now than before.

If folks can commit to the income-focused aspect of this investment and not be distracted by market fluctuations, the JEPQ does an acceptable job of providing them income for now, but it should continue to be monitored for how well its strategy does over longer stretches of time.