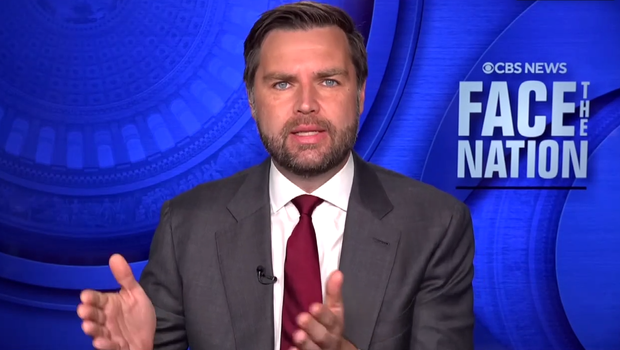

Washington — Sen. JD Vance, the Republican nominee for vice president, said Sunday that former President Donald Trump’s plan to eliminate taxes on overtime pay is reflective of the GOP belief that “American workers should keep more of their own money.”

“When you work over time in this country, beyond 40 hours, you get time-and-a-half,” Vance said on “Face the Nation with Margaret Brennan.” “And the President’s saying, ‘if you’re one of those select hard workers that’s really busting your rear end to try to make good in Kamala Harris’ economy, then you should get a tax cut.'”

The former president pledged during remarks in Arizona this week to eliminate income taxes on overtime pay to give people “more of an incentive to work,” after previously announcing a string of tax proposals geared toward hourly workers — including cutting taxes on tips and on social security benefits.

Still, any change to the tax code would require Congress’ approval, and there could be an opportunity in 2025, when Trump’s 2017 tax cuts are set to sunset. But this proposals would raise concerns about significantly adding to the deficit, which conservative in Congress vehemently oppose.

Vance, an Ohio Republican, argued that the tax plans are in line with the GOP ideals, adding that if a future Trump administration can penalize companies for manufacturing goods overseas, the tax breaks can occur in a way that doesn’t blow “a hole in the deficit.”

CBS News

Vance said the overtime tax idea “fits fully” with Trump’s entire tax agenda, noting that “we want American workers to get tax cuts” and “we want to actually penalize companies that are shipping jobs overseas through tariffs.” He added that with the tariffs, the administration would charge a penalty to bring manufactured goods back into the country in an attempt to “induce more people to make more things in the United States of America.”

Vance sought to tie the movement of manufracturing jobs oveerseas to the Biden-Harris administration, calling it not just “40 years of American failure,” but also “one of the great tragedies of Kamala Harris’ leadership.”

“We started to undo that for four years under Donald Trump’s leadership, but we’ve got to do it for much longer and in a much more intense way, because, as we’ve learned just in the last few days, the world has gotten more dangerous,” Vance said. “We can’t rely on other people to make the stuff we need.”

Gary Cohn, former director of the U.S. National Economic Council who served as Trump’s top economic adviser and also appeared on “Face the Nation” Sunday, said the tariff dynamic is more complicated than candidates may make it appear on the campaign trail. Cohn said that when it comes to products that other countries are able to produce for cheaper due to lower regulatory standards, the U.S. should “not allow them to use their unfair advantage to disadvantage American workers.” But for importanted products the U.S. doesn’t produce, tariffs on those would lead to inflation, Cohn said.

And when it comes to cutting taxes for workers, Cohn urged that the biggest revenue creator in the government is taxes.

“I think every elected politician would like to say no one has to pay taxes on anything, and I think every American citizen would like not to pay taxes,” Cohn said. “That would be a perfect utopian world where we didn’t have to pay taxes. I don’t think there’s a reality in that.”