BCFC/iStock Editorial via Getty Images

Contextualization and new developments arising from Fast Act

First of all, I would like to say that this analysis aims to unpack the developments of Jack in the Box (NASDAQ:JACK) in the last quarter. For a more in-depth analysis of its equity structure, debt ratios, profitability ratios and the like, I would highly recommend reading my first article on the company. Of course, I will certainly revisit some concepts explored before, but I will not delve deeply into those that I have already discussed in the aforementioned analysis.

That said, I’d like to preface this analysis by presenting a bit of the California landscape for QSRs. In our last article, we opened our discussion by presenting some data from Placer.AI regarding traffic within the state. Fast-food chains within the state of California had weaker traffic than the national average in 10 of the 12 weeks after the law was enacted. I also presented three key reasons for this.

The first and second have more to do with the state of the industry as a whole than with the California environment. Basically, it’s the pressure from substitute products (bakeries, convenience stores, etc.) and the consecutive increase in menu prices since guests started to have emptier wallets.

The third reason is more a result of individual preferences regarding the benefits offered by each concept. In the specific case of California, we also saw through Placer.AI’s research that full-service restaurants were attracting substantially more traffic than the average QSR. This differed from the national average, where full-service restaurants were experiencing much slower traffic. This has a lot to do with consumer decisions and the marginal utility provided by each guest visit, driven by perceptions of the intrinsic superior quality of full-service restaurants.

As we know, Jack’s has a high concentration of locations within California, with approximately 949 locations (or 43% in terms of total locations). Therefore, the company, which was already participating in menu price increases to compensate for the lack of traffic with a more robust average check per guest, had to increase prices even further to mitigate the impacts of the FAST Act.

I believe that this quarter we had some idea of how this law impacted the scenario in California, since for Jack this was the first quarter in which the company had to deal entirely with the increase in operating costs resulting from this front.

Incredibly, Jack had its second-best performance within the states in which it operates, precisely in California. It may seem counterintuitive, but in fact, recent data from Black Box shows us exactly how QSRs in general have managed to maintain a high SSS.

Plain and simple, QSRs are raising prices again in California. But impressively, this is offsetting the decline in traffic (which, yes, is having a big impact on QSRs). At least so far. Note in the chart below how QSRs are succeeding in increasing the average check much more than the national average (obviously excluding California):

Even comparable sales within California are outpacing the national average, precisely because of this increase in prices. You can see how the speed of the increase in the average check is outpacing the national average in this other chart:

Jack did not disclose the state composition of the SSS, much less the traffic and growth of the average check per guest. However, we have an idea of how the company conducted these price increases without compromising its mix of promotions and the proposition of delivering the daily value (we will discuss this specifically in a later section).

From the CFO’s statements in the latest transcript, I believe that the price increases within California were not across the board, but rather focused on certain individual items. This price relief plan, more than ever, needed to be implemented in full collaboration with franchisees so that this surgical increase is applied consistently given the reality of the company’s recent refranchises.

In addition to this primary reason, the price advantage of full-service restaurants has been eroding over the quarter. Many have had to raise wages to curb turnover. Denny’s (DENN) is a case in point. With 389 locations in California, the restaurant had to raise its menu prices by approximately 5% to curb turnover. Cracker Barrel (CBRL) even closed two locations in California (Sacramento and Santa Maria), showing that projected traffic was not blindly driven, but rather driven by perceived value.

But even with this scenario that also plagues full-service restaurants, we also have successful examples of how to maintain positive comparable sales momentum amid traffic pressures. The Cheesecake Factory (CAKE) has approximately 18% (38 units) of all its locations in California and, even though it is not benefiting from the traffic transfer from QSRs, it maintains positive comparable sales.

Ultimately, it all comes down to perceived value. With its rotating menu and customizable options, Cheesecake continues to increase menu prices at a faster rate than other brands, keeping them 4% higher through the end of the year. This meant that, even with a strong comparable base, traffic decreased by only 0.2%.

The industry landscape in California is extremely complex. My question is whether QSRs will be able to maintain comparable sales at the same level with just the contribution of the increase in the average check.

We know that this has been going on for about two years nationally, with increases in the average check in the double digits. Until guests simply reduced their visits to restaurants and started eating at home or in other types of establishments.

The increase implemented by Jack, focused on certain items, segmented by their profit margin, gross cash inflow and contribution margin, will mitigate the negative effects from the elasticity of demand, that is, not putting too much pressure on traffic as the benefits of higher checks are obtained.

This should ensure healthy adaptability, both for the company’s own units and for the franchisees. Therefore, I don’t see any problems here. Even though it impacted margins, it was not disastrous, as this last quarter proved to us.

Sales, Traffic, and Average Check: Adjusting the Promotional Mix to Achieve Strategy-Purpose Alignment

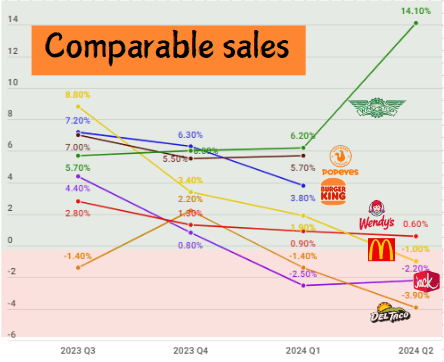

Let’s start with comparable sales. Jack’s reported a 2.2% decline in comparable sales this quarter, while Del Taco saw an even steeper 3.9% decline. These are the metrics when we consider all locations.

Now, when we consider just Jack’s-operated restaurants, we see that comparable sales increased by about 0.1% compared to the same period last year. This SSS was driven by a mix of a 4% increase in average check per guest and offset by a 3.9% decrease in traffic. Company-operated stores under the Del Taco brand saw an 8.8% decrease in traffic that was offset by a 5.3% increase in average check per guest, resulting in a -3.5% SSS. At the franchise level, we saw Jack’s SSS drop 2.4% and Del Taco’s drop 4.1%.

We know that since last year, the company has been selling its own restaurants to franchisees as a way to control operating costs and maintain more profitable assets to maximize both gross revenue from company-operated locations and restaurant-level margins. That said, refranchising efforts have converted 66 Del Taco locations and 5 Jack’s locations to select operators.

I say this to show the importance of separating comparable sales. As of last year, Jack’s had approximately 142 locations, while 2,044 were franchised. Del Taco, on the other hand, operated 146 locations, while 2,035 were franchised.

The chart below shows which direction the QSR and fast-casual segment is moving based on comparable sales:

Author

It wasn’t just Jack’s that showed positive comps within the QSR segment in the latest report. Who remembers McDonald’s (MCD) recently reporting a 1% drop in systemwide comparable sales? Or Portillo’s (PTLO) dropping 0.9%. It turns out that we didn’t see the full potential of value meals impacting traffic. Let’s remember that most of the initiatives of this type began in late June.

Some restaurants, such as Wendy’s (WEN), have maintained this value proposition for the guest since the beginning, which helped maintain positive comps. Take the role of the ‘Biggie Bag‘ in this same example. This is a long-standing value meal, already known to both customers and franchisors.

Wendy’s showed a 2% decline in traffic, which is small when you consider other quick-service restaurants. In the end, it had an SSS of 0.6%, which is not bad at all given the context.

It turns out that in Jack’s case, ‘Munchies Under $4‘ didn’t have the desired effect of increasing traffic, and this ended up weighing a bit on comparable sales. For those who don’t remember, the promotion announced in June consists of options such as: Jr. Jumbo Jack; Tiny tacos; Chicken nuggets; Jr. Chicken Sandwich; Jr. Cheeseburger and others at a popular price.

It turned out that instead of increasing traffic, Munchies ended up increasing the average check per customer. Let’s just say that individual items, without a cohesiveness like a combo or something similar, didn’t attract guests, but instead increased the check of guests who purchased additional items.

It’s as if through a ‘Halo Effect’ Jack was also successful in justifying the purchase of a premium item once a guest purchased a Munchies item. This caused the average check per guest to grow to almost $15. And that helps barbell pricing at the end of the day. It’s menu engineering done ‘by accident’.

So there was a perception by the occasional guest of added value in taking multiple items instead of just one. This is a great cross-selling strategy, but as I said, that wasn’t the goal.

And the sense for both me and management was that as June progressed, traffic that was craving value promotions turned to options like the ‘$5 Meal Deal’, ‘Your Way Meal’, ‘3 For Me’ that offer a complete, cohesive meal, which really seems to be attracting the lower-income guest. I wrote about how value promotions are bringing back (at least temporarily) traffic starting in June in this analysis. I recommend reading it.

It seems that after reading the earnings call I conceived of this paradigm shift of leaning on Munchies to bring the low-income guest to a combination of value meals, barbell pricing (which let’s face it, was already being used in some form with Smashed Jack, but has now been expanded) and hook and build strategy. Don’t worry. I’ll explain how it’s working.

Step 1: Revamped Value Meals

As a cornerstone of its attempt to deliver a cohesive, industry-standard value meal, Jack will return with its ‘Jack’s Big Deal Meal‘, a $5 meal. This meal consists of a curly fries combo, a choice of taco, a drink and a choice of burger from a Jr. Chicken Sandwich, Jr. Jumbo Jack Cheeseburger.

The company hopes that this promotion will generate some traffic from lower-income guests and also bring in a few additional dollars per transaction from the cross-selling leverage mentioned earlier. This, coupled with the fact that next quarter will be a lighter comp, could result in Jack’s comparable sales being neutral or slightly negative. That would certainly be a good thing given the current environment.

Additionally, we saw some promotional activity during the late night period. I had already warned that this would be a very competitive battleground between the likes of Wendy’s, Taco Bell (YUM), White Castle, Denny’s and many others. However, it seems that Jack’s is showing strength with the exclusive Ice Cube’s ‘$12 Cube’s Munchie Meal‘ from June 3 to July 14. In fact, the company reported that this LTO surpassed the previous year’s with Snoop Dogg. Transactions increased by about 14% during the validity of the promotion.

Step 2: Barbell Pricing

For those unfamiliar with industry jargon, barbell pricing is a pricing model that seeks to aggregate both low-priced items and premium-priced items.

In this sense, while in times of slow traffic, restaurants that adopt this model can retain some traffic from lower-income guests who feel compelled to purchase value meals (at this end we have the items from ‘Munchies Under $4’ and ‘Jack’s Big Deal Meal’) and also enjoy products with a gross cash inflow that can be purchased by guests who are not as constrained in their spending.

At the beginning of the year, we saw Jack launch its ‘Smashed Jack‘, a burger that was an absolute success upon its launch, selling out in several units, as well as the ‘Double Smashed Jack’. Adding this to some specific innovations such as the Classic and Bacon Swiss Buttery now updated to the Smash Patty may justify some higher pricing. Management also inferred that it will continue to innovate on the Smashed line in the future.

Step 3: Hook and Build Strategy

This is a marketing approach that aims to attract guests through an LTO or value promotion (Hook) and retain them through building a lasting relationship (Build).

We are seeing the mix of promotions from some restaurants like Dine Brands (DIN). A short example of this strategy in practice at Applebee’s:

- In the first quarter of 2024 around 28% of Applebee’s orders were linked to some kind of LTO, representing an increase of almost 10% on the previous quarter. Management therefore expects the company to use cross-selling and up-selling mechanisms to increase the average check per guest. LTOs are used as decoys, while it is up to marketing to define and implement value creation to increase the average check. In May, for example, the company was offering for a limited time a Dollarita for $1. Around 93% of transactions involving this LTO also had another item indexed.

At Jack, both the Munchie Meal Under $4 and the more recent Jack’s Big Deal Meal serve this purpose for low-income guests. Now, LTOs like the partnership with the hit movie ‘Deadpool & Wolverine’ also serve the purpose of attracting guests in general. Now, the ‘Build’ role is the newly redesigned loyalty app, menu innovations such as the various items expected to be launched from the Smashed line and the growth of promotions for direct channels.

In the end, what did I think of the strategic change?

Jack’s realized a mistake and fixed it halfway through. But it wasn’t a complete mistake. Munchies Under $4 ended up being an interesting cross-selling option that could serve more as a support, increasing dollars per transaction, than as a lure for lower-income guests.

Of course, the launch of Jack’s Big Deal Meal is more of a go-to meal than a new one. It’s a meal that’s similar to almost all the value-oriented meals we’ve seen.

The most important thing for me will be how long Jack’s keeps this value-oriented promotion on the menu.

Some competitors, like McDonald’s, won’t keep their value meals on the menu forever. After September, the company will likely stop serving its value meal. Like Jack’s, the company is also working on barbell pricing (with its new beef burgers and the possible “Big Arch” which would be the first permanent menu item since 1983).

Others will continue indefinitely, such as Wendy’s and its ‘Biggie Bag’. Wendy’s seems to me to be the big winner in the morning shift with its breakfast options for up to $3.

Others will continue their promotions until the end of the year. This is the case with Burger King’s ‘Your Meal Deal’.

Since, in my opinion, this pressure on traffic will not end overnight (in fact, restaurants are working on ways to increase their ROI as they anticipate lean times), maintaining a mix of promotions focused on value will be very well accepted in the long term. In the short term, Jack may even be pressured, since it does not have much ‘ammunition to fire’ in the advertising field.

These strategic changes, combined with a softer composition in the fourth quarter of Jack’s fiscal year, lead me to believe that comparable sales will remain at more accommodative levels than they are now.

What about Del Taco?

As I mentioned earlier, Del Taco has been reporting weaker-than-expected results. But before I fill you with quantitative data, let’s take a look at the company’s promotional mix.

In July, Del Taco launched a value meal promotion called ‘Del’s Real Deal$’, which is similar to the ‘Munchies Under $4’ promotion. This promotion gives guests the option to choose from a range of menu items for as little as $2. These items include tacos, burritos, nachos, and other options. The company has had a history of offering value meals for some time now.

Last year, in the first full year after the acquisition by Jack, Del Taco had added the temporary ‘Del’s Deal Value Meals’ for $5 to its menu, in a move very similar to what we’re seeing today. But most of the time, the company has promoted LTOs to drive traffic. This year, the company brought back the Shredded Beef Birria, while last year, the company resurrected the Funnel Cake Fries. So, it looks like this is a Hook and Build strategy as well.

Other efforts, now operational, aim to increase Del Taco’s restaurant-level margins, which have been falling due to the impacts of the FAST Act. In fact, they have been falling for some time. This has a lot to do with operational leverage and the impact that the decrease in transactions has on profits.

The kiosk integrations provided by the new POS called Qu will also permeate Jack’s operations and positively affect Del Taco. In my last analysis of Jack, I dedicated an entire chapter to this POS and how it can control operational costs and boost sales.

To give you an idea, in the last quarter, Del Taco’s store-level margins (13.14%) were the lowest I’ve seen in the QSR and fast-casual segment (excluding small and/or rapidly deteriorating brands).

This doesn’t mean that the company is at any structural risk at the moment, but rather that Jack will need to pay more attention to operational improvements at Del Taco than at Jack’s locations.

Note the difference in the restaurant-level margin for the two brands:

Restaurant-level margin (Author)

That said, management said that in addition to the improvements provided by the new Qu POS across the franchisee and company-owned restaurant system, they are working to implement tools that will help grow margins at the restaurant level. These include: energy and work tool rentals, adoption of a new oil management process and continuation of new training focused on food management for franchisees.

In fact, during the last quarter, Jack had to perform a goodwill impairment because the fair value of Del Taco did not match the book value recorded on the balance sheet. This indicates that the expected economic benefits from the acquisition of the company are not materializing in reality.

This impairment caused Jack to report a net loss in the quarter. However, as you may already know, this expense does not have a direct impact on cash flow. But its realization already indicates that the cash flow generated by Del Taco was not what was expected on the date of its acquisition.

We have already mentioned the reasons for this impairment: negative trend in comparable sales, low margins, continued unfavorable economic conditions and share prices below expectations.

Note that unlike Jack, Del Taco has labor costs that when compared as a percentage of revenue differ greatly from what we would consider healthy labor costs. In this last quarter, Del Taco used 38.6% of its revenue as labor costs. This is approximately 6.2% higher than what Jack reported spending in this last quarter.

I see it as essential that Del Taco starts pulling its levers to increase these restaurant-level margins. This is even more important than the review of its promotional mix, which is an earlier stage than what we are seeing at Jack.

I do not believe that this situation will get any worse in terms of margins, unless we see a new accelerated inflation of food, which I do not see as possible in the short term. If everything goes as expected, this will be the ‘bottom’ of the restaurant level margins, which should start to increase as the new operational improvement procedures are implemented.

Otherwise, I am still skeptical about Del Taco’s performance in the short and even medium term. Everything indicates that comparable sales will continue to decline as traffic remains slow.

Chicagoland, Florida and Georgia

As I mentioned in my previous analysis of the company, lean unit models allow the units to operate with greater capillarity, especially in markets where the company does not have as much brand appeal.

And Jack has already developed its prototype called ‘CRAVED’, which is already being used in test markets such as Mexico, Salt Lake City and Louisville. These units have a faster payback period of about two years, totaling approximately five years or less.

Some of these restaurants are already estimating that AUVs will reach more than $5 million by the end of the calendar year.

Neither Jack nor Del Taco has as much presence in the eastern half of the country as they do in the western half, especially in the southwest. That said, the company intends to enter the Florida, Chicago and Georgia markets by 2025 through a mix of company-owned and franchised units.

In Chicagoland, Jack plans to open approximately 10 locations by 2025, primarily under company-owned units. However, the company has already identified more than 100 opportunities that could be pursued by select operators. In Florida, the company has signed five development agreements in Tallahassee and an additional agreement for 10 locations in Orlando. In Georgia, the company has signed 15 additional development agreements focusing on the Macon, Augusta and Savannah markets.

In total, including commitments in markets where Jack already has a presence, there are more than 150 development agreements open to date.

Regarding the restaurant count, the company remained stationary. There were three openings and three closures during the quarter. Year-to-date, there were approximately 14 Jack In The Box restaurants opened (2 owned and 12 franchised) and 4 restaurants closed (all of them franchised). In other words, there was a net growth of 10 units, the same as last year.

At Del Taco, there were 12 restaurants opened and 7 closed, a net growth of 5 units. Although low, this growth at Del Taco surpassed the same period in 2023, when the brand showed a net growth of 3 units.

My PT remains the same

As explained in my other analysis, my target price remains the same for Jack. It is around$59 and $61. This would be an upside of approximately 13%. Although the company has an interesting yield, the dividend growth is still quite limited to justify holding the stock after reaching the target price.

In the Gordon Model, for the company to be traded at its fair value, the dividends would need to grow perpetually by approximately 3.7%, which is quite unlikely given the dividend growth. Furthermore, the company is quite discounted in relation to its peers and presents a safe option to buy given the risk/return evidenced by the valuation in the previous analysis.

On the operational side, I expect comparable sales for Jack to remain close to -0.5% to 0% as the company works on its promotional mix and works on a softer comp. For Del Taco, I am a bit more pessimistic, with comparable sales of -3.5% and -3%.

I also expect margins to improve as the company works on its new POS to streamline processes and manage peak times. I expect this to also push digital sales to 20% of total sales, which would have a positive effect on revenue.

That said, I reaffirm my ‘Buy’ rating for the company. However, since the company is not a cash cow (with a payout of approximately 30%) I still do not see a reason to hold it indefinitely like a Wendy’s. However, I do see substantial potential to hold it as long as the stock remains undervalued relative to its fair value. Once the market recognizes this perceived undervaluation through its performance (as we have seen since the last quarter), I consider selling as an appropriate strategy to maximize capital gains.