Marc Dufresne/iStock Unreleased via Getty Images

A Well Diversified Exchange and Data Provider; Multiple Likely to Expand as Mortgage Market Improves

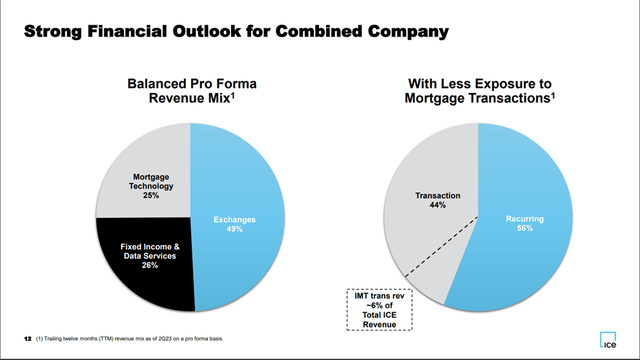

Intercontinental Exchange (NYSE:ICE) is an extremely well diversified global exchange group with ~50% of revenue coming from Exchanges, ~25% of revenue derived from Fixed Income & Data Services and ~25% of revenue derived from Mortgage Technology. Following the announcement of the acquisition of Black Knight, ICE’s multiple has come under a bit of pressure given the slowdown in the mortgage market. However, due to the diverse revenue mix and potential for a rebound in mortgage activity with the forward path of interest rates likely downward, I see a path towards multiple expansion for ICE. As such, I am initiating coverage on ICE with a Buy rating as I see a likely fair multiple for the exchange on 2025 EPS as ~23x vs. the current multiple of 21x.

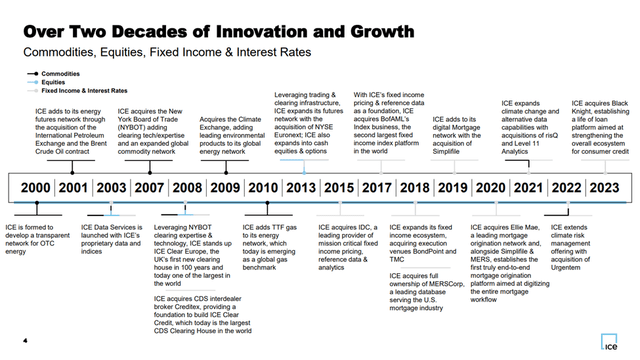

Intercontinental Exchange: Track Record of Diversification and Growth Impressive

Intercontinental Exchange is a global exchange and data company that offers exchange-traded futures, equities and options across a wide variety of asset classes. In addition to exchange trading, the company provides clearing houses, data services, and analytics to customers across the capital markets. More recently, the company has expanded its mortgage technology offering (via its acquisitions of Ellie Mae and Black Knight) to include loan origination and closing technology, as well as servicing capabilities and data and analytics.

ICE Black Knight Closing Call Presentation

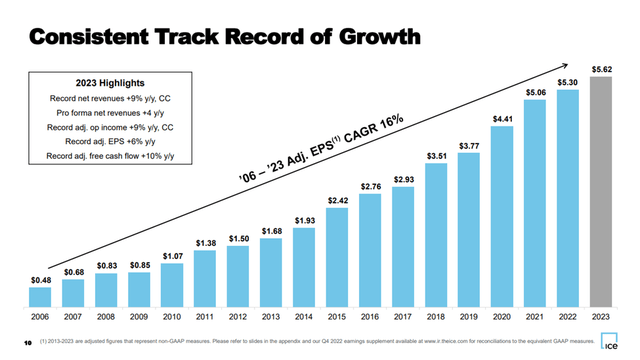

The company was founded in 2000 to develop a network for OTC energy trading and through several acquisitions over the years, expanded into commodities and metals, interest rates, U.S. equities and U.S. multi-listed options (via its acquisition of NYSE Euronext), and fixed income trading and clearing. In 2015, ICE acquired IDC, which is a leading provider of fixed income pricing and reference data and analytics, which was followed by its acquisitions of BofAML’s Index business and BondPoint and TMC. In 2018 ICE began to expand its mortgage offering through full ownership of MERSCorp which was followed by its acquisitions of Simplifile and Ellie Mae and most recently its acquisition of Black Knight in 2023. Along the way, ICE’s playbook has been to convert primarily analog-based methods of transacting and reporting into digital methods, a playbook which has served the company well as evidenced by its consistent EPS Growth over the years – 16% CAGR since its first full year after going public.

ICE 4Q23 Earnings Call Presentation

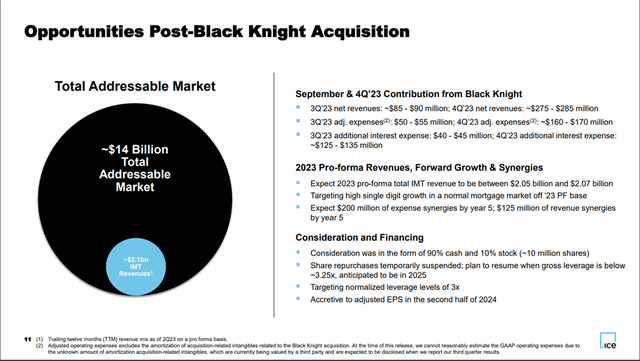

Following the acquisition of Black Knight, ICE’s pro forma revenue mix has become much more diversified. For the TTM ended 2Q23, ICE’s Exchange business comprised 49% of pro forma revenue, Fixed Income & Data Services made up 26% of the mix and Mortgage Technology made up 25% of the mix. Additionally, the acquisition pushed recurring revenue to 56% of total revenues, while transaction-based revenues made up 44%. Further, the acquisition diversified Intercontinental Exchange away from mortgage transaction revenues, with that component now down to 6% of total ICE revenue.

ICE Black Knight Closing Call Presentation

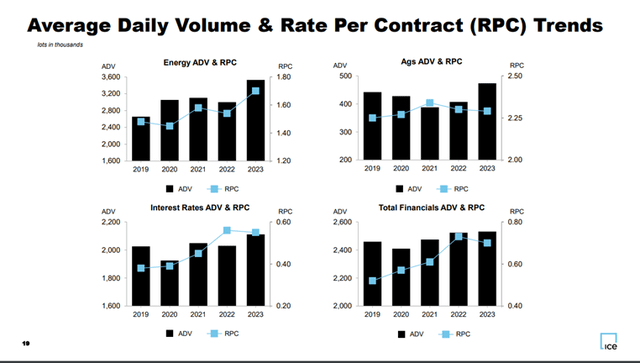

Exchange Business Overview: Strong Competitor with Generally Growing Revenue Led by Futures & Options Trading

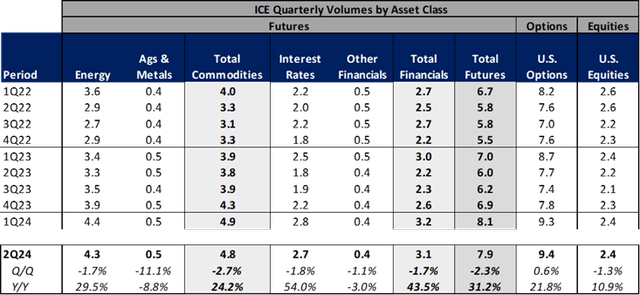

Intercontinental Exchange’s Exchanges business comprises futures & options trading across Energy, Agricultural Commodities, Interest Rates and Other Financials. ICE primarily competes against the other large U.S. listed futures and options exchange, CME Group (CME) within this space but also competes against other European-based exchanges within this business (primarily as it relates to ICE’s interest rate complex). Futures and options trading make up ~75% of transaction related revenue within the Exchanges business and average daily volumes and revenues have grown at a 4% and 9% CAGR within the futures and options complex over the past 3 years as ICE has managed to grow both ADV and RPC (revenue per contract).

ICE 4Q23 Earnings Call Presentation

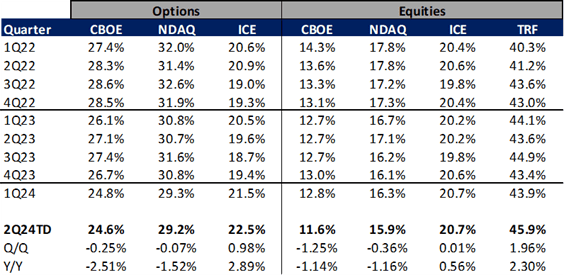

In the U.S. cash equities and U.S. multi-listed options business, ICE primarily competes against Nasdaq, Inc. (NDAQ) and Cboe Global Markets (CBOE). ICE market share in U.S. cash equities is currently around 20% of the total market and average daily volume and revenue have declined at a 3% and 1% CAGR over the past three years, respectively. ICE’s market share in U.S. multi-listed options is currently slightly above 20% and average daily volume and revenue have grown at a 16% and 4% CAGR over the past three years, respectively (as RPCs have declined).

OCC and Cboe Global Markets

Additionally, within ICE’s exchange business, the company offers data & connectivity services and listings services for both corporations and ETF providers. The data and connectivity business allows financial institutions and corporates to access the robust amount of data coming out of ICE’s trading businesses to better help them manage trades and hedge risk while the listings business provides corporates (and ETF providers a venue on which to list shares of their companies’ stock. These businesses have grown at a 6% and 4% CAGR over the past three years, respectively.

Fixed Income & Data Business: A Massive Data Provider With a Largely Recurring Revenue Stream

In 2015 through 2018 ICE built out a massive fixed income business via its acquisitions of IDC, BAML’s Index Business, BondPoint and TMC (as noted above). Following these acquisitions ICE became one of the leading providers of fixed income pricing, reference data and analytics as well as an execution venue (via the acquisitions of BondPoint and TMC) for market participants. Today, ICE’s fixed income business generates $2.3 billion of annual revenue, nearly 80% of which is recurring revenue related to its data and analytics and network services solutions. This business has been a very strong performer for ICE with revenue growing at a 7% CAGR from 2020 through 2023. ICE continues to expect the business to perform well, as it anticipates recurring revenue for 2024 to grow in the mid-single digits and recently noted that Annual Subscription Value (ASV) has returned to the 4% range from the 2% range experienced in 2023.

Mortgage Technology Overview & Black Knight Acquisition; Creating a Mortgage Behemoth

Over the past several years ICE has built out its mortgage business into a massive technology provider across the origination, closing and servicing space. Also, in typical ICE fashion, ICE also provides data and analytics to participants within the mortgage ecosystem. ICE’s push into the mortgage space began in 2018 with its full acquisition of MERS (a company it owned a minority stake in prior to 2018), a data provider to the U.S. mortgage industry. The company then acquired Simplifile, a company that electronically connects lenders, agents and county recording offices in the residential mortgage space, in 2019. Then in 2020 ICE acquired Ellie Mae which, when coupled with MERS and Simplifile, established ICE as an end-to-end mortgage origination provider and allowed ICE to follow its longtime playbook of digitizing largely analog processes. Finally, in late 2023 ICE completed its acquisition of Black Knight which established the company as a full life of loan platform.

Following the Black Knight acquisition, ICE’s pro forma revenues for 2Q23 TTM (the last full quarter prior to the Black Knight closing on September 28, 2023) increased to $8.5B from ICE standalone revenues of $7.4B. The acquisition significantly increased ICE’s exposure to the mortgage market as pro forma operating income related to mortgage activities increased to ~16% from ~8% prior to the transaction. ICE anticipates that the acquisition will be accretive to EPS in the second half of 2024. Priorities for ICE following the acquisition are to integrate the Black Knight businesses, execute on synergies and pay down debt (targeting a normalized leverage ratio of 3.0x, down from 4.3x at the end of 3Q23). ICE anticipates that during a normalized mortgage market its entire mortgage complex should grow in the high single digit range (as pro forma revenues of $2.1B leave plenty of room for growth within the $14B TAM post-close) and that it will benefit from revenue synergies amounting to $125 million by year 5 post-close. Further, ICE anticipates realizing $200 million in expense synergies from the transaction by year 5, $135 million of which should be realized by the end of 2024. Additionally, ICE expects to resume its share repurchase program when gross leverage falls below 3.25x, which is likely to occur in 2025 (my estimates forecast gross leverage falling below 3.25x in 2Q25).

ICE Black Knight Closing Call Presentation

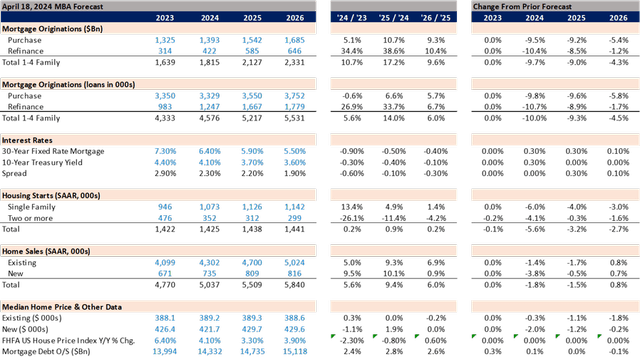

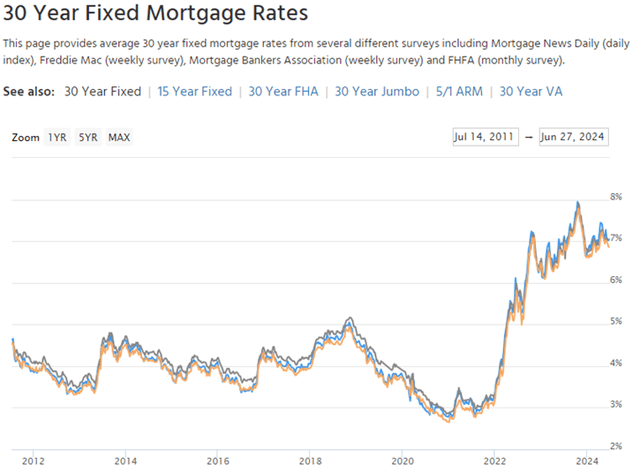

Mortgage Market Overview: Post-Covid Spike, Slowdown Continues Due to Low Supply/High Rates

Despite all of the benefits ICE foresees with the combined mortgage business the mortgage market has been challenged in recent years following the spike in activity immediately following covid. ICE’s pro forma Mortgage Technology Revenues in 1Q24 declined 3% Y/Y, marking the 9th consecutive quarter of Y/Y declines for the business. Additionally, ICE anticipates full year 2024 Mortgage Technology Revenues will be flat to down in the low-single digit range relative to pro forma 2023 results, guidance which ICE recently lowered on its 1Q24 earnings call. ICE noted that its lowered guidance for the business primarily stemmed from the Mortgage Bankers Association’s updated outlook on the overall mortgage market for the remainder of the year, which significantly lowered the outlook for mortgage originations and home sales for 2024, 2025 and 2026 in April relative to its prior estimates. Due to these adjustments, the outlook for ICE’s mortgage business remains challenged in the near term. However, should interest rates decline from current levels there is certainly the possibility that the business could see tailwinds in the future, even if home sales remain challenged due to high home prices, as ICE should benefit from a wave of refinancings from recent home sales carrying high mortgage rates (30-year mortgage rates have remained well above 6% since 3Q22) and ICE will continue to benefit from the $125 million in revenue synergies it expects over the next 5 years. As such, I am forecasting the Mortgage Technology Revenues to increase ~9% in 2025 driven by a rebound in baseline Mortgage Technology Revenues (mid-to-high single digits – driven by anticipations of Fed rate cuts which are expected to begin in 3Q or 4Q 2024) and the benefit of revenue synergies from the transaction (ICE has noted that it has already achieved $30 million in synergies from the transaction).

Mortgage Bankers Association Mortgage News Daily

Recent Volumes and 2Q24 EPS Expectations; Seeing Upside to Street Estimates for the Quarter

Through the end of 2Q24, ICE’s volumes have performed very strongly with total Futures volumes up 31% Y/Y (seasonally down 2% Q/Q) driven by a 44% Y/Y increase in Financials volumes (-2% Q/Q) and a 24% Y/Y increase in Commodities volumes (-3% Q/Q). U.S. Options volumes are up 22% Y/Y (+1% Q/Q) and U.S. Equities volumes are up 11% Y/Y (down 1% Q/Q). Based on the performance of these asset classes and after scrubbing my model for the quarter, I estimate 2Q24 EPS will come in at $1.48, about $0.01 above current Street estimates, so I would anticipate the Street could move higher for the quarter in the coming days as earnings previews begin to roll out.

Intercontinental Exchange, OCC and Cboe Global Markets

TXSE Group Plans to Launch Texas Stock Exchange – Likely Not A Huge Impact To ICE

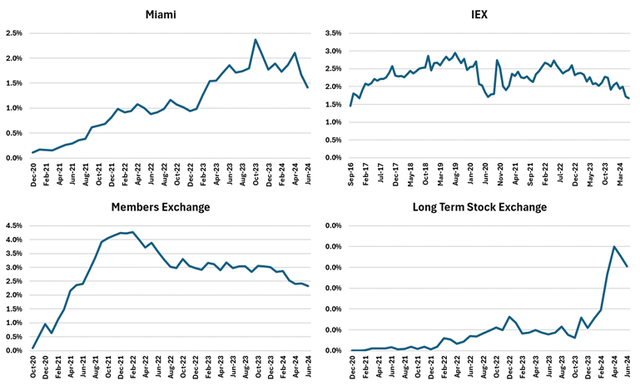

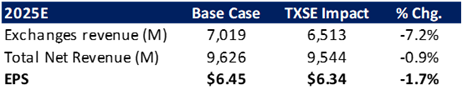

On June 5, 2024, TXSE Group announced that it had raised $120 million in capital with expectations of filing an exchange registration with the U.S. SEC. The company plans to launch the Texas Stock Exchange later this year as a fully electronic venue to trade and list public companies and ETPs as a challenger to established exchanges such as Nasdaq, Intercontinental Exchange and Cboe. Backers of the upstart exchange include financial institutions such as BlackRock and Citadel Securities. Given the news and the prominent financial backers of the company, the announcement has generated a significant number of headlines in recent weeks, however I view the announcement as having minimal impact on ICE given the uphill battle ahead for TXSE to garner significant market share in U.S. equity trading.

Over the past 8 years there have been 4 upstart exchanges launch U.S. equity trading venues. The oldest of these newer exchanges, IEX, began trading in 2016 and has only managed to garner market share of around 2% of U.S. equity share volume today. Combined, these four venues only account for around 6% of U.S. equity share volume today. If I assume that TXSE can generate as much market share as the other 4 recent upstart exchanges combined (~6%) and that 100% of that market share gained comes at the expense of Intercontinental Exchange’s current share, this translates into a ~30% reduction in U.S. equity trading volumes on ICE’s exchanges. Based on my 2025 revenue and earnings estimates, the impact of this hit to ICE’s trading volume would translate into an 7% reduction in estimated Exchanges Net Revenue, a 1% reduction in ICE’s estimated Total Net Revenue and a 2% reduction in ICE’s estimated 2025 EPS (assuming no expense offsets). The one wild card as it relates to ICE’s revenue outlook is the impact TXSE could have on Listings and Data revenues as TXSE has announced that it plans to launch a listings business, which would ultimately have knock on effects on the Data business. However, the other upstart exchanges have only managed to garner a handful of listings over the past few years, so this also seems like an uphill battle for TXSE.

Market Share of New Exchange Entrants

Cboe Global Markets Author Estimates

Valuation and Rating; SOTP Suggests ~11% Multiple Expansion as Warranted

Given the business mix with 65% of operating income coming from the Exchanges business, 20% of operating income coming from Fixed Income & Data Services and 15% of operating income coming from Mortgage Technology, I’ve chosen to value ICE on a sum-of-the-parts basis. If I apply a ~21x multiple to the Exchanges business (which is due to a historical ~25x multiple on pure futures exchanges and a ~14x multiple on equities/options exchanges, given ICE’s ~70%/30% split on futures/equities and options), a 25x multiple to the Fixed Income & Data Services business (a 10% discount relative to where peers SPGI and MSCI are currently trading) and a 28x multiple to the Mortgage Technology business (a 35% discount relative to where ICE purchased its two mortgage assets – given ICE was the acquirer I figured a steeper discount was warranted) I come up with a blended multiple for ICE of 23x. Relative to ICE’s current multiple of 21x, this amounts to ~11% multiple expansion warranted. As such, I assign a Buy rating to ICE.

Author Estimates

Risks to the Thesis

There are a few risks to my thesis explained above, primarily as it relates to the Mortgage Technology business. If there is a prolonged slump in mortgage activity and/or a potential increase in interest rates due to a resurgence in inflation, this could continue to weigh on estimates for Mortgage Technology revenues. However, I view the likely path of rates as headed downward given the recent trajectory of inflation. Additionally, as it relates to the mortgage business, there is execution risk on ICE’s front. I view this risk as minimal, however, given ICE’s very long history of successful acquisition integrations and quick wins ICE has had with the Black Knight acquisitions ($30 million of revenue synergies already achieved and expense synergies being realized sooner than anticipated).

Summary

In summary, I view Intercontinental Exchange as an extremely strong operator with a very diverse operating model that has potentially embedded tailwinds as the mortgage business recovers and the company benefits from the integration of Black Knight all of which should set the company up for continued success and should yield multiple expansion from here. As such, I view Intercontinental Exchange as a Buy.