RapidEye

NEW YORK (August 28) – Chair Powell was surprisingly blunt in his talk last week at Jackson Hole, announcing that “the time has come for policy to adjust.” But he also said, “The timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” Nevertheless, the markets have responded with an almost unanimous expectation (99.5%) of a rate cut when the Fed meets again in September.

Powell was speaking to the vector of rate policy (i.e., decreasing rates), not the timing or the amount of the rate decreases, which he left open. We’ll be seeing the latest inflation numbers on September 11, before the FOMC meets again September 17th-18th. That meeting will print with the Summary of Economic Projections, and we could well see some surprises in the Fed’s estimates.

We’re currently at 2.89%, headline inflation, YoY, as of August 14th. Core inflation is 3.2%. While the latest August numbers point to disinflation in many categories, most of the categories showing disinflation are periodic expenses that don’t implicate the day-to-day living expenses of most Americans. Those that do, meantime, continue to escalate. Used cars and trucks, for example, are down 10.9%, but motor vehicle insurance is up a humongous 18.6%!!! There’s a whole litany of expenses of daily living that continue well above “headline” inflation: Food away from home is up 4.1%; Shelter, 5.1%; electricity, 4.9%. Those are just the most egregious costs.

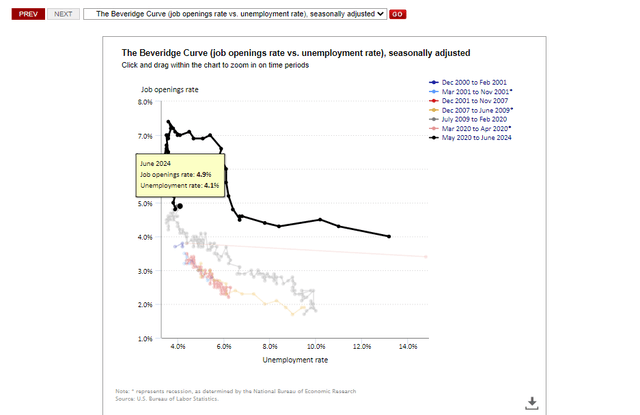

Meanwhile, a glimpse at the latest Beveridge Curve, which compares job openings to the unemployment rate, shows that the Fed may be overemphasizing the increasing unemployment rate at the wrong time, notwithstanding the Sahm Rule we discussed here. The unemployment rate for June, 4.1%, is offset by a job opening rate of 4.9%. We might well be at “full employment”, as the differential is just 80 bps, roughly the same as it was (+/-20 bps) from July 2018 to December 2019). Indeed, the Beveridge Curve, right now, looks incredibly normal. All things considered, notwithstanding its long tail from the pandemic.

Beveridge Curve (Bureau of Labor Statistics)

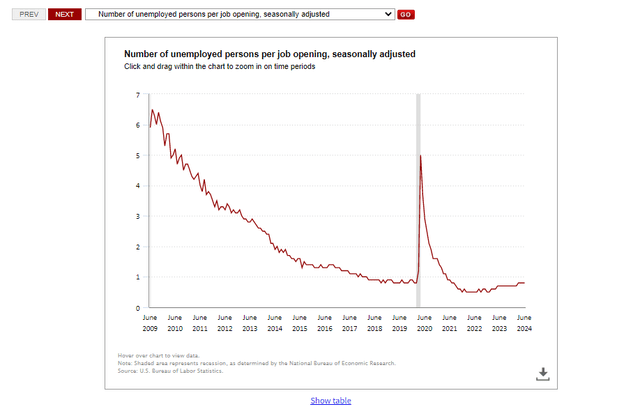

Indeed, there were fewer people unemployed per job opening (0.8 people per job) in June than in comparatively “boom” years, like 2017 (when we had 3%+ average quarterly GDP) when that average number was 1.13, as illustrated below.

Number of people unemployed per job (Bureau of Labor Statistics)

What the Future Holds

I’m reiterating our earlier call to leave rates where they are and to increase QT another 5% to 10% to trim inflation by reducing the level of M2 in the economy. We’re confident that will eventually, but most directly, restore the Fed overnight rate to r*, the neutral rate of interest.

Our biggest fear is that the Fed will concede to critics that believe its 2% target is too harsh and that it is an arbitrary rate. In fact, it is, but that is largely beside the point. A 2% rate of inflation provides a moderate rate of inflation while encouraging people to spend. But the critics have pointed out that getting over the “last mile” of a 2% rate of inflation will require higher unemployment, at least to the extent the Phillips Curve still holds true.

In our view, inflation is a dangerous, insidious, destructive, phenomenon that damages the long-term well-being of the economy. Keeping it at bay or raising the unemployment rate is an easy choice.

Containing inflation should be the Fed’s primary objective, over low unemployment and especially over a “soft landing”.