da-kuk

Introduction

Illumina (NASDAQ:ILMN) has finally rid itself of GRAIL. My last look at the stock followed its 2023 financial report, wherein revenues and gross margins dropped and SG&A expenses climbed. The company also projected “approximately flat” revenues in 2024. This was in the context of a valuation that was rich. My recommendation was “sell,” noting that the company’s “premium valuation is not justified by its current performance or future prospects.” Illumina stock is -1.68% since this update, while the S&P 500 has returned nearly 10%. So, it has underperformed. The company has since reported two quarters of financial data and has had some important operational developments, meriting another look.

Illumina Post-GRAIL: A Strategic Shift Toward Core Growth

As alluded to in the first sentence, Illumina has finally freed itself of GRAIL. Recall that the company acquired GRAIL (a company focused on early cancer detection through blood tests) in 2021 for approximately $7.1 billion. However, the acquisition faced intense scrutiny, particularly from the European Commission, due to concerns that the merger could limit competition in a burgeoning field of early cancer detection. The EC ordered Illumina to divest GRAIL. The company completed the spin-off of GRAIL (GRAL) in June 2024 via a third-party sale (although Illumina retains a 14.5% stake in GRAIL). Today, GRAL trades at a market capitalization of $500 million.

So, the focus shifts back to Illumina’s core business in DNA sequencing and array-based technologies. Recently, the company outlined their plan (2024 Strategy Update Special Call) to drive revenue growth into the high single digits by 2027, achieve double-digit EPS growth from 2025 to 2027, and expand margins. The company is primarily betting on growth within the “$10 billion” next-generation sequencing [NGS] market.

Illumina’s Q2 earnings highlighted plans for cost reductions and sales growth. Focusing on “Core Illumina,” Q2 revenue was $1.092 billion. Gross margins were 68%, which improved from 65.5% in the same period last year. R&D and SG&A expenses totaled $241 million and $60 million, respectively. Core Illumina’s operating profit was $442 million. Their operating margin was 40.5%. Net income was $66 million. Looking at the overall picture in Q2, due to the divestiture, Illumina recorded $1.886 billion in “goodwill and intangible” impairments. This contributed to an actual net loss of $1.988 billion in Q2.

Illumina is recognized as the leader in NGS and controls the majority of the global market for DNA sequencing instruments and consumables. This is evident in their ability to generate billions of dollars in revenue annually from their NGS segment, outpacing competitors by a significant margin. Their platforms, such as the NovaSeq and MiSeq systems, are widely adopted across research institutions, clinical labs, and biopharma companies. This makes it challenging for these organizations to easily switch. The company invests a lot in R&D to maintain innovation, setting new benchmarks in terms of throughput, accuracy, and cost per genome. Finally, they have entered into strategic collaborations with companies like Roche (OTCQX:RHHBY) and Amazon Web Services (AMZN).

Financial Health

As of June 30, Illumina recorded $920 million in cash and cash equivalents. Total current assets were $2.459 billion, while total current liabilities were $2.208 billion. Subsequently, their current ratio is > 1, which points to their ability to cover short-term obligations. Illumina has $1.49 billion in long-term debt, but this appears manageable given that Illumina’s core business is profitable. Even with the GRAIL challenges, net cash provided by operating activities was $157 million in the first six months of 2024. As such, there is no need to estimate the cash runway.

Peer Comparison

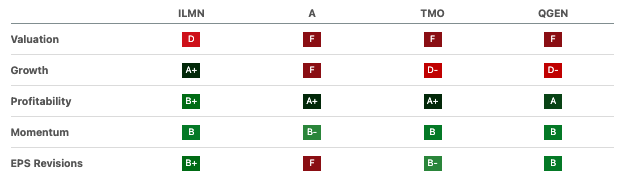

Illumina’s valuation is grading more favorably compared to February (“F”).

Seeking Alpha’s Quant Factor Grades

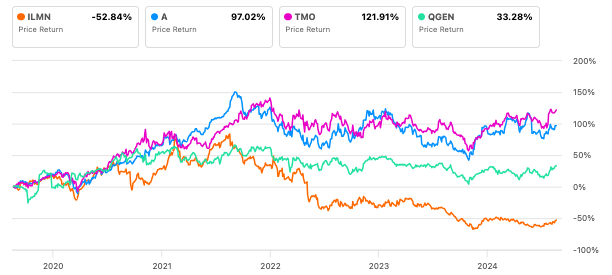

Compared to other companies within the Life Sciences Tools and Services industry, ILMN maintains a very high valuation that demands considerable growth. Its P/E Non-GAAP, for example, of “36” outpaces peers like Agilent (A), Thermo Fisher Scientific (TMO), and Qiagen (QGEN) that trade in the 20s. YoY revenue growth is either flat or down 1-6% for every company, reflecting some macroeconomic challenges. Illumina boosts favorable gross profit margins. Its 66% gross profit margin outpaces Agilent’s 50%. Illumina’s stock returns, however, are considerably lower than those of its peers since 2019.

Seeking Alpha

Risk/Reward Analysis & Investment Recommendation

In conclusion, Illumina has put GRAIL completely behind them and appears to be making progress in operations (e.g., improved margins, cost-cutting plans, etc.). Despite its stock seeing a modest uptick recently, the market remains cautious. After all, Illumina is still troubled by ongoing revenue declines amidst competitive pressures in the genomic sequencing market.

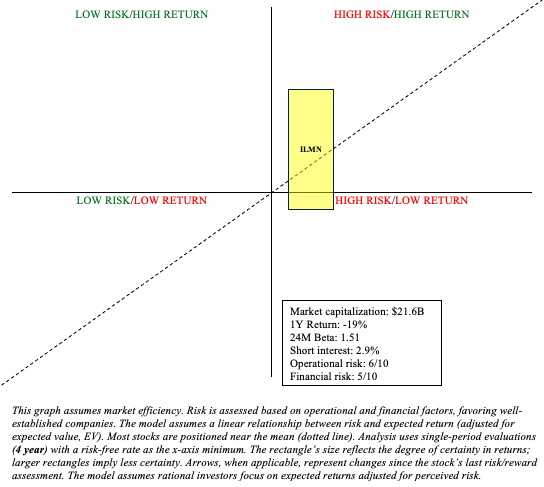

Author

My stock evaluation process has changed slightly since my “sell” recommendation in February. I am currently evaluating stocks for their value within a barbell portfolio, in which the majority of funds are allocated to lower-risk assets such as Treasury securities, with a sliver set aside for speculation. So I am more risk-tolerant than I was a few months ago. ILMN is a Quadrant 1 stock (high risk/high return) with promising growth prospects in an NGS market poised for significant expansion in the coming years. With GRAIL behind them and a solid plan for reasonable growth in place, I am willing to change my recommendation to “buy.”

However, investors should pay close attention to the company’s ability to turn things around. Importantly, Illumina is bound to face greater competition from the likes of Thermo Fisher Scientific and Agilent, who are also heavily investing in NGS. Finally, ILMN, like the majority of their industry, is vulnerable to macroeconomic headwinds. For example, during difficult economic times, healthcare providers and consumers may postpone or reduce spending on non-essential medical procedures, such as NGS. Inflation drives up operational costs such as raw materials and labor. Illumina operates globally and is thus vulnerable to tariffs, trade restrictions, and global supply chain disruptions.