PM Images

Investment Thesis

In a lower interest rate environment, dividend-paying stocks often perform better as investors seek higher yields than what fixed-income investments offer. With reduced appeal of bonds, these stocks become an attractive alternative, driving their performance upward. Consequently, I believe that lower interest rates will enhance the performance of dividend-paying stocks. This article will explore this dynamic further, focusing on the ETF IGRO and related macroeconomic factors and why I believe this ETF will outperform.

Fund Description and Performance

The fund aims to replicate the performance of the Morningstar Global ex-US Dividend Growth Index with 399 constituents. The ETF invests in securities with a history of uninterrupted dividend growth and sustains that growth (at least five years of consecutive dividend growth). The consensus earnings forecast must be positive, and the forward-looking dividend payout ratio must be less than 75%. The methodology thus ensures future dividend growth.

Below is a summary table including expense ratio and dividend frequency. In addition to this, I have also provided the YTD price performance of 9.5%. This return is good, but still lower than the S&P 500 index price and total return of 13% and 14.89%, respectively. I believe this is attributed to lower technology sector allocation and ex-us country element.

Price Performance (Seeking Alpha)

Holdings and Sector Weights

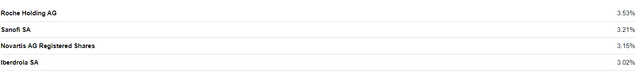

The top three fund holdings of the four, shown below, are healthcare stocks and the second largest sector weight is healthcare at 16.98% with $134m of the $788m AUM invested in this sector.

Top 4 fund holdings (Seeking Alpha) Sector Breakdown (Seeking Alpha)

The healthcare sector is considered a safe and steady investment during bear markets. It’s regarded as a late-cycle defensive play because it can help protect a portfolio when the stock market gets volatile. Here’s why:

Essential Services: No matter how the economy is doing, people still need medical care, medicines, and other health services.

Stable Earnings: These companies often have reliable earnings and cash flow, which is appealing to investors looking for safety during tough market times.

Dividend Payments: Regular dividend payments, make them attractive to investors who want steady income, especially when investments such as bond yields are losing value.

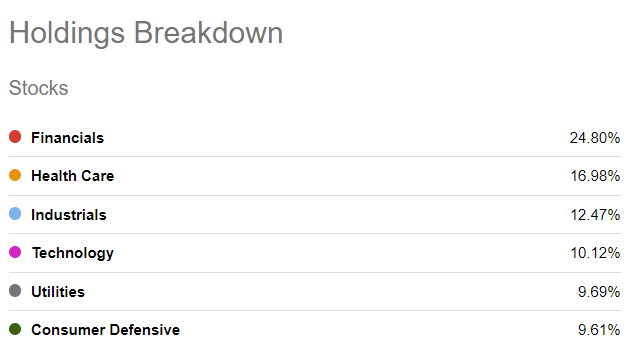

If we compare a healthcare index to a standard vanilla world index, it’s easy to see how defensive healthcare investments are useful. For example, in 2008 and 2022, the MSCI World Healthcare Index fell by half of what the MSCI World Index dropped by. This shows how healthcare keeps up its trend of reducing downside risk. In fact, since 2000, healthcare has outperformed the market every time global equities have gone down.

Healthcare vs World Index (Alliance Bernstein)

Macro Backdrop

Dividend stocks tend to perform well during periods of macroeconomic volatility and government rate cuts, as investors seek alternatives to bonds for yield appreciation. While dividend payments may grow more slowly than a stock’s capital appreciation, investors can rely on increasing dividend yields to enhance returns over time. The power of compounding, especially when reinvesting dividends, can turn this into a highly lucrative strategy.

Historically, when the Federal Reserve starts cutting interest rates, companies that continue to raise their dividends have typically outperformed other stocks. In contrast, during periods of high interest rates, investors often favor other short-term income-generating assets with minimal risk. For instance, following the inflation surge largely triggered by the invasion of Ukraine, which led to significant price increases in everyday consumer goods, Chair Powell was compelled to implement a series of consecutive rate hikes to counteract the inflation impact (basic economics which I will not discuss in this article). This resulted in the yield on the 10-year Treasury climbed from 1.72% to 5%. During this time, money market funds saw a 21% increase in AUM as investors gravitated toward high-yielding cash equivalents with little to no risk, often at the expense of dividend stocks, which faced pressure on their valuations.

Given that dividends contribute significantly to total returns, investors might consider focusing on stocks that increase their dividends when the Fed lowers rates, especially if income is a priority. Additionally, dividend-paying companies have historically acted as a hedge against market uncertainty, as management is generally cautious about altering payout ratios. This stability becomes even more appealing during times of heightened economic and political uncertainty.

Such companies are often known as “dividend aristocrats” as the methodology for such indices only includes firms that have increased their dividends for 25 consecutive years or more. A recent study by Ed Clissold and Thanh Nguyen of Ned Davis Research offers empirical evidence supporting this. They discovered that, on average, dividend-paying stocks tend to outperform non-payers starting several months before the first rate cut in a Fed easing cycle and continuing for six to nine months after the cut.

I consider this a key reason for my BUY rating on this ETF. Macroeconomic factors significantly influence dividend growth strategies, as lower interest rates allow companies to borrow more cheaply, reducing the likelihood of dividend cuts. Additionally, with an inverted yield curve, the likelihood of a recession increases, which in turn raises the probability of further rate cuts.

Why International Dividends

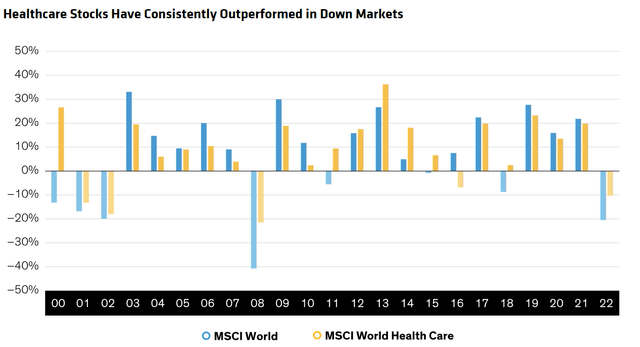

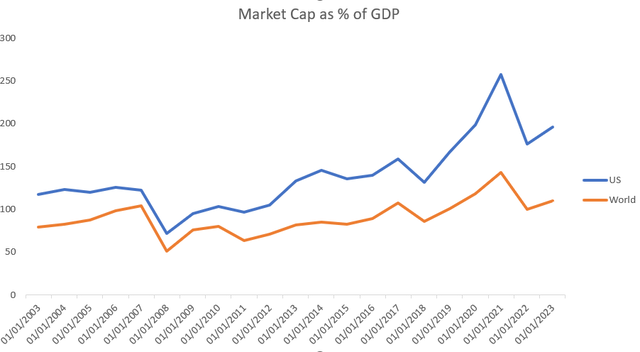

As illustrated in the graph below, the US stock market has expanded significantly compared to other equity markets since the 2008 financial crisis.

US Equity Market Size (Goldman Sachs)

Although the US has long had the largest stock market and economy, the gap between it and other markets has widened since the financial crisis. This disparity is due to the US experiencing a more robust recovery compared to the rest of the world. Additionally, the total market capitalization in the US has grown relative to GDP, indicating that the stock market’s value has increased compared to the country’s economic growth. In contrast, this ratio has remained relatively stable in the rest of the world. The US market cap increased by 70% while the world market cap only increased by 39% since 2003

Market Cap % of GDP (Bloomberg)

This trend is not surprising, as US companies, particularly in the technology sector, have experienced much greater profit growth compared to their global counterparts. However, this has also led to inflated market valuations relative to companies outside the US. Therefore, I believe this underscores the importance of geographical diversification as an investment strategy.

I’ve always been a strong advocate of receiving dividends from companies outside the U.S., as some of the longest-running dividend payers are based outside of the U.S. This, along with the fact that European markets have lagged behind U.S. performance, reinforces my belief in seeking returns beyond the U.S. market.

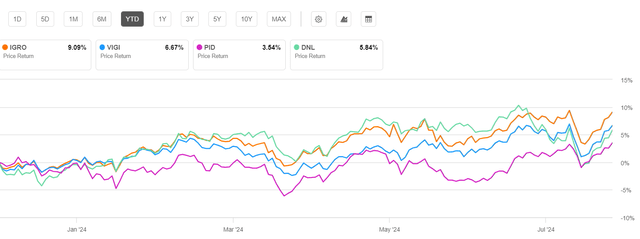

Peer Comparisons

I have compared several ETFs similar to IGRO, and IGRO consistently outperforms the others while maintaining the lowest fees. IGRO’s year-to-date performance is 9%, notably higher than its peers, whose returns range from 3% to 6%. Over the past year, IGRO has also led the group with a performance of 15.74%, with the next closest being VIGI at 14%.

Peer Comparison (Seeking Alpha)

In addition, IGRO turnover (a measure of how much the ETF trades) is at the low end relative to its peers at 38%. Less trading means lower transaction costs, which contribute to performance over a long period. Furthermore, IGRO’s 3- and 5-year beta values are 0.92 and 0.98, respectively, closely aligning with the category average of 1, indicating minimal market volatility. This is crucial for investors seeking a stable dividend yield with minimal risk.

Risks

As with any investment, there is always a risk of being wrong. A significant concern here is that the portfolio is somewhat concentrated. With only 399 constituents, it’s relatively small and therefore exposed to single-stock risk. This means that disappointing earnings from just a few companies could negatively impact the ETF’s price. Additionally, because this ETF excludes U.S. stocks, particularly U.S. tech, it may miss out on short-term sector gains. While I’ve noted that this sector and the broader U.S. market may be overvalued, there’s always a chance that the markets could continue to rise in the short to mid-term.

Conclusion

Overall, this article explains why investing in a diversified international dividend growth ETF is a smart strategy, especially when considering the macroeconomic environment, interest rate cuts, and peer comparisons.