imantsu/E+ via Getty Images

I highlighted my ‘Buy’ thesis on IDEX’s (NYSE:IEX) in my previous article published in June 2024, arguing the moderation of order growth. IDEX released its Q2 result on July 31, reporting a 4% decline in organic revenue and lowering the full-year growth guidance due to project delays and overall softness in the industrial market. Despite these near-term headwinds, I favor IDEX’s efforts in portfolio management and capital allocation. I reiterate ‘Buy’ rating with a fair price target of $220 per share.

Acquiring Mott Corporation

On July 23, 2024, IDEX announced to acquire Mott Corporation for $1 billion, anticipating to close the deal by Q3 FY24. Mott is a leading player in the design and manufacturing of sintered porous material structures and flow control solutions. I favor the deal for several reasons:

- Mott’s solutions have the potential to expand IDEX’s applied material science technology. IDEX has been developing their applied material business over the past few years, and these configurable mission-critical components can contribute higher gross margin for IDEX over time.

- The purchase price represents around a mid-teens multiple based on 2025’s forecasted EBITDA, making it a reasonably priced deal for IDEX, in my view. Additionally, with Mott’s EBITDA margin in the low 20s, the acquisition could potentially improve IDEX’s overall margin profile.

- Lastly, both companies serve similar customers; as such, IDEX can leverage existing sales force to distribute more essential products and solutions. I anticipate synergies from both revenue and cost sides.

In addition, IDEX divested Alfa Valvole for $45.5 million in cash. Considering IDEX acquired the company for €102 million in 2015, it was not a successful acquisition for IDEX. However, I think it makes sense to divest a low-growth company to optimize IDEX’s overall portfolio.

Project Delay and Weakness in Industrial and Life Science Market

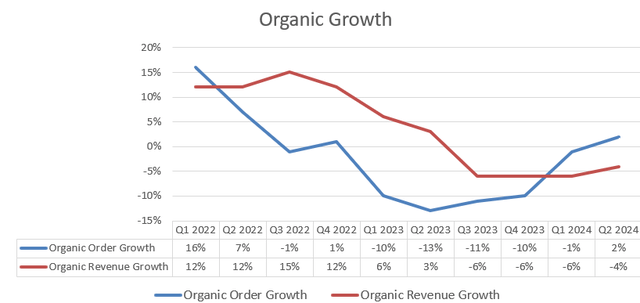

Over the earnings call, the management indicated some project delays due to the upcoming U.S. election, as well as some softness in the overall industrial market. Consequently, the company’s revenue declined by 4% organically in Q2, with orders growing by 2%.

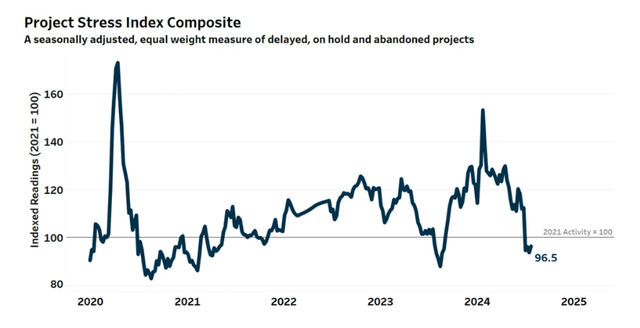

As indicated in my initiation report, IDEX has a broad range of end-market exposures, and their growth is closely tied to the overall industrial activities. ConstructConnect publishes Project Stress Index on a monthly basis, and according to the latest report in August, the overall non-residential construction project delays were relatively high in the first half of 2024, but the stress index fell below the historical average in July. As such, I believe project delays may be temporary issue for IDEX, and the business will be likely to recover in the second half of the year.

Other than project delays in the industrial market, IDEX faces growth challenges in the life science and analytical instrumentation markets. As indicate over the earnings call, the weakness was caused by inventory destocking activities in distribution channels. The management doesn’t anticipate a substantial recovery in this fiscal year. I think the underlying reason for the weakness in the life science and analytical instrumentation markets is the high interest rate and tight capital funding environment. As communicated by Danaher (DHR) and Thermo Fisher (TMO) during the most recent earnings, the overall life science market was weak in the first half of the year, and both companies anticipate the market will gradually recover in 2025.

Outlook and DCF

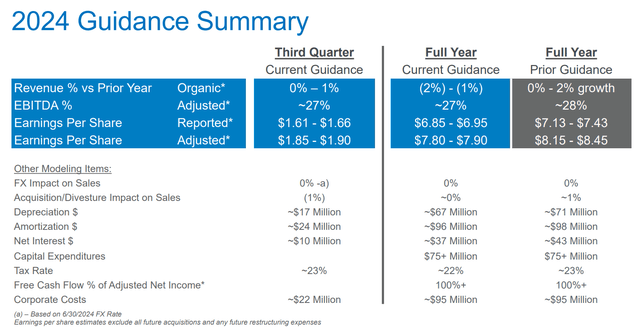

Due to the softness in industrial market, the company lowered the full-year guidance for both revenue and EPS, as detailed in the slide below.

I estimate the growths for the three major segments as follows:

- Fluid & Metering Technologies: IDEX distributes pumps and water solutions, and I anticipate a weakness in the agricultural market, partially offset by some stability in municipal water market. As discussed earlier, the project delays have led to weak order growth in their Fluid & Metering Technologies. As such, I forecast a 2% revenue decline for FY24.

- Health & Science Technologies: Due to the tight capital funding in life science market, I forecast Life Science & Analytical Instrumentation will maintain weak in FY24. Overall, the segment is likely to have a sluggish volume growth in FY24, and I forecast the total revenue will decline by 5% in FY24.

- Fire & Safety/Diversified Products: I anticipate stable LSD growth in the second half of FY24, and IDEX will deliver 3% organic revenue growth for FY24.

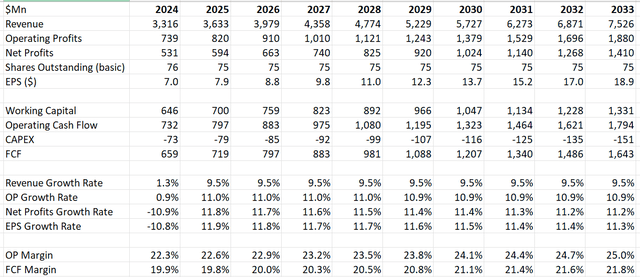

Therefore, I calculate IDEX’s organic revenue will decline by 2% in FY24. Additionally, I estimate IDEX’s organic revenue will grow by 6.2% from FY25 onwards, assuming: Fluid & Metering Technologies will grow by 5%; Health & Science Technologies by 8%; and Fire & Safety/Diversified Products by 5%, all in line with historical average.

As discussed in my previous coverage, IDEX has been actively pursuing acquisitions to broaden their portfolios. I estimate the company will allocate 10% of revenue towards acquisitions, resulting in 330bps growth to the topline.

I calculate IDEX will generate 30bps margin expansion driven by:

- 15bps gross margin expansion due to new products offerings with higher ASPs

- 8bps operating leverage from SG&A, driven by economic of scales and leverage from sales team

- 5bps from R&D optimization

The DCF summary is as follows:

The WACC is estimated to be 8% assuming: risk-free rate 3.8%; beta 0.84; equity risk premium 7%; cost of debt 7%; equity balance $3.5 billion; debt $1.3 billion; tax rate 23%. The fair value of IDEX’s stock price is calculated to be $220 per share.

Key Risks

IDEX aims to deliver 80-100bps price-cost spread over the economic cycle, and delivered 100bps in the second quarter. However, with the inflation rate returning to historical norms, I think IDEX is unlikely to achieve the high-end of price cost spread in 2025. The lower price growth will potentially impact the gross margin for IDEX.

Closing Thoughts

Despite the near-term challenges from project delays and weakness in life science end market, I am confident with IDEX’s long-term growth opportunities. Their active portfolio management allows the company to optimize their product and solutions, while better leveraging sales team. I reiterate a ‘Buy’ rating with a fair price target of $220 per share.