uchar

Context

In this article I will share my dividend investing strategy, which I aim to devise over next 10 year period in order to achieve a portfolio that generates $50,000 of annual dividend income.

Next week I turn 30, and the overall objective is to have a stable, predictable and tangible source of income by the time when I become a 40 year old.

I have not yet decided whether I will retire from being a full time employee by then, but one thing is clear – I want to have the optionality there in case I decide to do so.

Plus, considering my appetite for risk and the fact that having periodic income streams is critical for me to stay consistent on both reinvestments and additional contributions, the portfolio is (will be) tilted towards defensive yield-bearing assets, which offer enticing dividend yields already from the start. Namely, it is a more value / dividend focused strategy than growth oriented approach.

Assumption base for meeting the objective

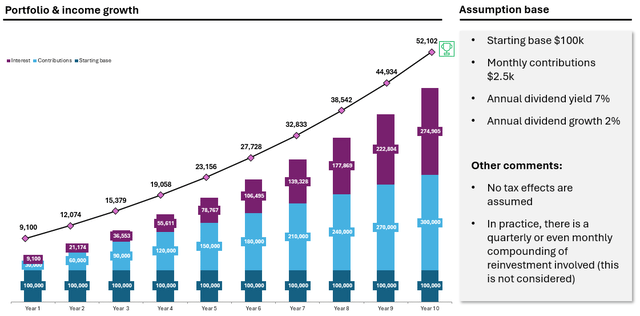

Below I have tried to plot a rather self-explanatory chart, which captures the key assumption base as well as the expected outcomes on a yearly basis until the ~ $50,000 portfolio income target is met.

Not surprisingly, we can see that over time, the interest component is projected to explain larger and larger chunk of the total additions to the portfolio.

While this chart does not focus on a year-over-year statistics (only the line graph shows annual portfolio income streams), by implementing the reflected approach, already in year 7 the annual income reinvestments become larger than the annual contributions of $30,000.

One of the most critical factors that drive these results is the starting dividend yield and the dividend growth aspect. In first year by investing in 7% yielding asset, assuming an annual 2% dividend growth, the yield on cost by year 10 lands at 8.4%, which adds a nice benefit to the overall income production. Yet, the 7% yield factor plays obviously much greater role.

The potential issue here is that usually when we speak about so high dividends, there are elevated financial risks that come into play. Experiencing a dividend cut is one of the worst things that can happen in the context of the aforementioned approach.

However, given the current interest rate environment, by conducting a proper due diligence, investors can find specific securities, which offer 7% or even higher yields at very limited risk, while still offering at least 2% growth element.

Since the objective of this article is not to recommend securities, but rather outline one of the ways on how to achieve $50,000 of annual portfolio income, I will only present three selected examples, which, in my opinion, meet these criteria:

- Main Street Capital (NYSE:MAIN) – see my recent article here.

- Enterprise Products Partners (NYSE:EPD) – see my recent article here.

- Cohen & Steers Infrastructure Fund (NYSE:UTF) – see my recent article here.

Other than that, there are obviously some aspects that could lead to a faster success or instead have an opposite effect, which would force to extend the time period to capture $50,000 target income value (or require larger monthly contributions).

The potential enhancers could stem from, say, 3.5% of annual dividend growth, which seems not that impossible (or aggressive). In the process, there could be also special distributions, which would accommodate stronger reinvestment benefits.

On the other side of equation, the key risks could come from, for example, a sudden dividend cut or the general yield compression, which would be driven by the convergence back to materially lower interest rate environment. While there are some clear mitigants to the former risk (tackled below in the article), the latter aspect is something, which is way more difficult to manage. Granted, having a multiple-driven yield compression would bring decent price appreciation returns, which could then be at least partially harvested and redirected into other yield bearing assets. However, the net effect would still be negative for this dividend investment strategy. In such case, extension of time horizon or larger contributions will have to be considered.

Key cornerstones of the portfolio

As I indicated early in the article, income sustainability is critical for me in order to sleep well at night without having to worry about permanent loss of capital or unexpected and steep decline in the recurring income streams.

For this reason, the following three cornerstones are vital:

- Diversification – this is the only free lunch we can get in the market. Since the dividend investing strategy already per definition implies an assumption of some concentrated allocations (i.e., investments are made in meaningful yield-producing assets, which exclude commodities, macro strategies, growth and non-dividend paying names etc.), having a well thought out diversification is of utmost importance. In my case, I have decided to allocate the capital across multiple sectors in a somewhat balanced fashion. The most common dividend investing sectors are related to real estate, infrastructure, energy, financials and some other smaller areas such as timber, transportation etc. On top of this, one has to pay a careful attention on avoiding single security risk.

- Secular tailwinds – as the holding period is rather long and the idea is to implement a buy and hold approach, having exposure to sectors and / or companies, which are subject to structural tailwinds is very important. In most situations, the presence of tailwinds do not only allow to facilitate a sustainable and tangible growth, but also they introduce an important layer of defence, which reduces the probabilities of loss of capital or dividend reduction.

- Defensive fundamentals – this specific aspect is something on which most of my efforts are spent. When the diversification setting is there and the right niches of market are identified in terms of the structural tailwind perspective, the next step is to cherry pick individuals securities that embody the characteristics to deliver on the necessary objectives (e.g., 7% dividend yield, 2% annual growth, limited risk of a dividend cut). Apart from the obvious statistics such as the yield and the long-term prospects of registering ~2% growth per year, capital structure and cash flow generation profiles are the areas to focus on. Most of my investments consist (and will consist) of companies carrying investment grade balance sheets, which are underpinned by well-laddered debt maturity profiles, thereby minimizing not only the financial, but also the refinancing risk. When it comes to the cash generation, I tend to focus on companies, which have stipulated long-term and bankable agreements that warrant predictability and already an embedded periodic growth factor (usually in infrastructure and real estate assets – attached to CPI). Finally, as the yield component is so important here, companies that have too tight dividend distribution levels are scoped out in order to secure a higher margin of safety.

Final remarks

In this article I have outlined my objective and the portfolio strategy that I will be devising to achieve $50,000 annual portfolio income level target 10 years from now.

Theoretically, one could make an argument that since I am so young, it would make more sense to shift the focus from value and income to growth and higher risk. If I had no emotional biases, I would probably agree with that.

However, given that having recurring income is critical for me to feel some tangible effects from foregoing consumption, focusing on dividend paying stocks will just increase the chances of me keeping the monthly contributions in place for 10 years in a row. Plus, what is perhaps even more important, I just enjoy the process of collecting current income streams.