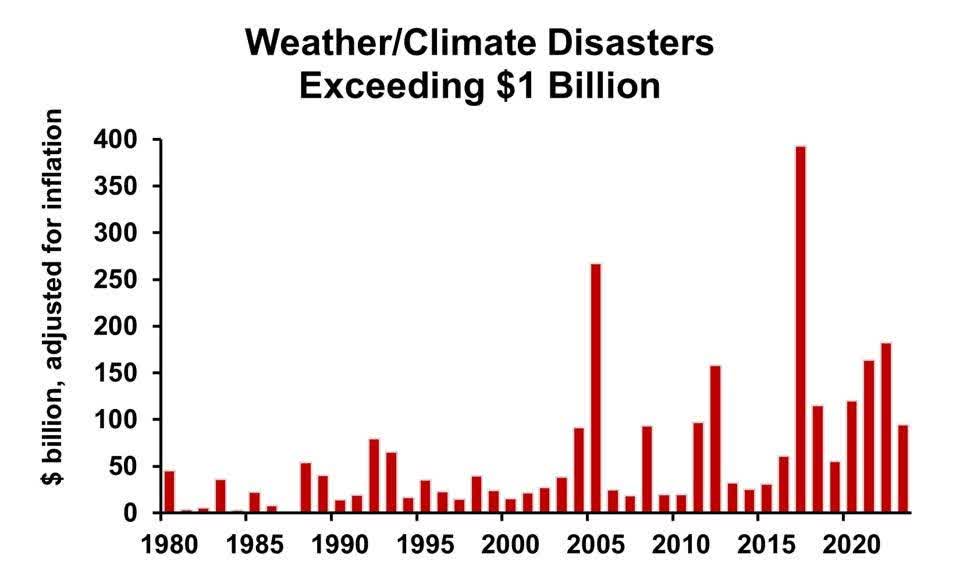

Poca Wander Stock Annual cost of large weather/climate disasters, inflation adjusted. ( DR. BILL CONERLY BASED ON DATA FROM NOAA.)

Homeowners’ insurance costs have risen markedly, with few choices in some markets. Climate change has been proclaimed as the cause, but misguided regulation is part of the problem along with uncertainty about what has really driven claims. Insurance costs will probably decline a small amount in the coming year, but the longer trend depends on uncertain factors.

Insurers must cover their costs to stay in business, as well as earn a return on their capital. Costs, in turn, are driven by the number of claims and the severity of claims. Losses that come from extreme weather, such as hurricanes or tornadoes, may be increasing due to climate change, but some of the recent changes may be temporary.

The cost of claims rises with inflation generally, the cost of building repairs in particular. The dollar cost of claims also depends on the legal system. State law and regulation may encourage more claims or fewer, with resulting high insurance costs or low. Laws that seek to help homeowners but which restrict insurers’ ability to cover their costs will lead companies to exit the business. The final result is insurance being unavailable. When this happens, political forces typically lead to more insurer-friendly regulation.

In recent years, insurance premiums have risen and availability has been strained in some locations. Extreme weather events have increased. The chart above shows the dollar amount (adjusted for inflation) of weather events with losses exceeding one billion dollars per event, based on data from NOAA.

The national sum of insurance claims or damage reflects not only severe weather but the locations in which structures are built. For decades, Americans have been moving to more dangerous locations, at risk of hurricanes and tornadoes. Many northern states have cold winters but few extreme weather events that trigger unusual claims. As people move from the north to the south, total dollars of claims rise.

Homeowners want to know when relief from high insurance costs will come. A little is now on its way, but the longer-run trend is uncertain.

Here’s the problem from the insurance company’s perspective. Some costs are fairly predictable, such as house fires not related to lightning. Fires mostly begin from cooking, heating or electrical systems, and that is fairly regular.

But weather-related claims (wind damage, storm flooding, lightning-caused fires) depend on both routine weather patterns and climate change. We know that tornadoes will hit the South and Midwest every year, but we’re not sure if averages from the last 50 years still apply today. Global warming could be triggering more extreme events, but we don’t know the magnitude very well. A study by the U.S. Environmental Protection Agency found “… moderate climate change will cause average extreme weather damages to increase by tens of billions of dollars per year. However, the confidence intervals surrounding our estimates are very wide, reflecting substantial underlying uncertainties.”

Insurers struggle with this. If recent data have simply been unusual events, part of the random nature of weather, then policies should be priced for average historical losses. But if recent events have been triggered by ongoing climate change, then prices should reflect even greater losses in the future. At the same time, companies don’t want to price themselves out of the market, but neither do they want to take on too much risk.

Most insurance companies buy reinsurance from large global companies with strong financial reserves. The insurance company handles ordinary claims with its own money, then calls on the re-insurer for unusually large claims. The reinsurance companies, then, take on the greatest risk from climate change. And even those who are convinced about human-caused warming are unsure of the magnitude of effects. But magnitude of effects is what re-insurers need in order to price their coverage. And those reinsurance costs must be recovered by the primary insurance company from homeowners’ premiums.

Reinsurance pricing is falling, as of mid-2024. This will tend to lower insurance premiums a small amount in 2025. The decline, though, will shave just a small amount off of last year’s 11 percent increase.

The long-term trend of homeowner insurance costs depends on the extent to which ongoing climate change is increasing actual losses. And that is uncertain, unfortunately. Homeowners who want to protect themselves against future increases might look to move into states with less severe weather. And newer structures will probably fare better in actual claims and in insurance pricing. But for those who want to live in regions prone to hurricanes and tornadoes, only small relief is in sight.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.