Anthony Bradshaw

The Western Asset High Income Opportunity Fund (NYSE:HIO) is a closed-end fund that specializes in providing its investors with a very high level of current income. As is the case with most income-focused funds, this one tries to accomplish its goal by investing in a portfolio of domestic junk bonds. These assets have significantly outperformed investment-grade bonds (AGG) over the past decade:

This is entirely due to the yield of these securities being superior to that of investment-grade bonds. The domestic junk bond index (JNK) is actually down 20.92% over the past decade compared to a 7.21% decline of the Bloomberg U.S. Aggregate Bond Index. As current data is pointing towards the United States possibly entering into a recession, it is possible that we may be entering into a similar low-interest rate period depending on how far the Federal Reserve cuts interest rates over its next few meetings. However, unlike during the decade following the 2008 financial crisis, inflationary pressures are very real today and we could very easily end up with a recession along with high inflation. This greatly reduces the appeal of any bonds, even ones with a high yield, as we might wind up in an environment in which the yields of bonds cannot match inflation. Therefore, investors might want to be cautious about buying any bonds and favor equity-income funds instead, as those funds will have a better chance of maintaining the purchasing power of any money invested in them.

With that said the Western Asset High Income Opportunity Fund does offer a much higher yield than the domestic junk bond index. At the current share price, this fund is yielding 10.76%, compared with a 6.52% trailing twelve-month yield of the Bloomberg High Yield Very Liquid Index, which tracks domestic junk bonds. The fund’s yield compares quite well to that of its peers:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

Western Asset High Income Opportunity Fund |

Fixed Income-Taxable-High Yield |

10.76% |

|

Allspring Income Opportunities Fund (EAD) |

Fixed Income-Taxable-High Yield |

8.95% |

|

BNY Mellon High Yield Strategies Fund (DHF) |

Fixed Income-Taxable-High Yield |

8.30% |

|

BlackRock Corporate High Yield Fund (HYT) |

Fixed Income-Taxable-High Yield |

9.37% |

|

KKR Income Opportunities Fund (KIO) |

Fixed Income-Taxable-High Yield |

10.05% |

|

PGIM High Yield Bond Fund (ISD) |

Fixed Income-Taxable-High Yield |

9.07% |

As we can clearly see, the Western Asset High Income Opportunity Fund has a higher yield than any of its peers. This is something that will undoubtedly appeal to any potential investor, particularly those who are seeking to earn a very high level of current income from the assets in their portfolios. However, there are also some reasons why one might want to be cautious here. This is because a fund with an outsized yield might have it because the market’s wisdom is that the fund will need to cut its payout in the near future. Basically, the market has priced the fund at a level that will give it a yield in line with its peers once the cut comes. As such, we want to pay special attention to the fund’s finances in order to determine how well it is actually covering its distribution at the current level.

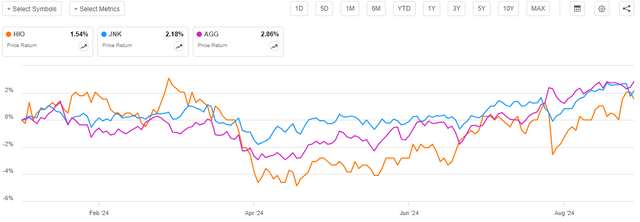

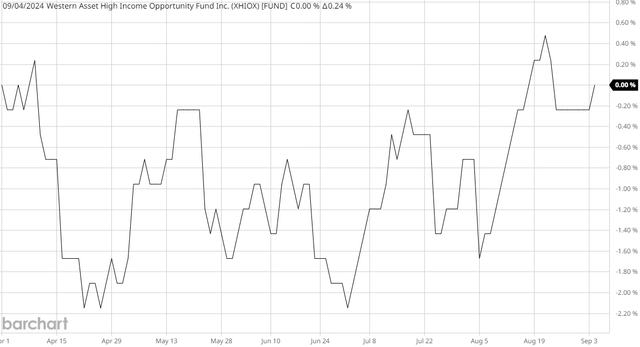

As regular readers might remember, we previously discussed the Western Asset High Income Opportunity Fund in mid-January of this year. The domestic bond market has been mixed since that time. During the first few months of this year, various market participants realized that they were wrong about the speed at which interest rates would come down in 2024. This meant that bonds were overpriced at the start of the year, which caused an adjustment as prices fell and yields rose to match the new reality. However, as the summer set in, the market became very optimistic that the economy was weakening sufficiently to justify a monetary easing policy starting in September. Economic data has continued to show weakness since that time, which reinforced this optimism and drove bond prices up. As such, we might expect that the performance of this fund has also been mixed since the date of our previous discussion.

This assumption proved to be correct, as the shares of the Western Asset High Income Opportunity Fund are up 1.54% since my previous article was published:

As we can see, the fund underperformed both domestic junk bonds and domestic investment-grade bonds. It also exhibited considerably more volatility, with it both gaining more and losing more than the indices whenever the market moved. This fund does not use leverage, so this is somewhat unexpected as its assets would not normally decline more than the market. The takeaway here is that the fund delivered lower capital appreciation on average than the indices over the roughly seven-month period. This is something that could disappoint potential investors.

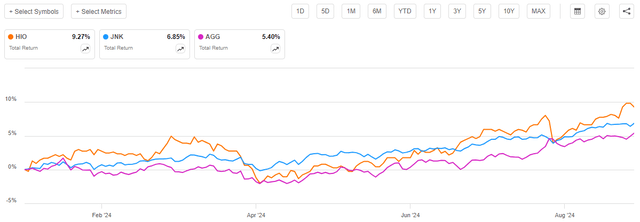

However, investors in this fund actually do a lot better than the share price performance suggests. As I stated in the previous article on the fund:

The distributions paid by a closed-end fund should always be taken into account as part of a performance analysis. This is because these funds tend to distribute both their capital gains and their investment income, which results in the distribution yield being significantly higher than most comparable index funds. These outsized distributions can fully or partially offset share price declines and always result in investors receiving a much higher level of performance than the share price alone would indicate.

When we include the distributions that were paid out by the Western Asset High Income Opportunity Fund and both indices over the approximately seven-month period, we get this alternative performance chart:

As we can clearly see, including the distributions causes the total returns provided by all three assets to increase compared to where they were just by looking at the share price performance. The Western Asset High Income Opportunity Fund receives the greatest boost though, as investors in this fund received a 9.27% total return over a roughly seven-month period. This return comes despite the fact that the share price was pretty much flat. This shows the power of a high yield and will likely increase the appeal of this fund in the eyes of those investors who are considering purchasing shares of this fund. However, we should still ensure that the fund can maintain its distribution since closed-end funds tend to lose a lot of their value if they cut the distribution.

As seven-and-a-half months have passed since our last discussion on the Western Asset High Income Opportunity Fund, there have been a number of changes with both the fund and in the broader macroeconomic environment. One of the most important developments is that the fund released an updated financial report, which will improve our understanding of the fund’s ability to maintain its current very high yield. The remainder of this article will focus on discussing the changes that have occurred as well as providing an updated financial analysis.

About The Fund

According to the fund’s website, the Western Asset High Income Opportunity Fund has the primary objective of providing its investors with a very high level of current income. This makes a great deal of sense for a bond fund because bonds are current income vehicles. However, the fund’s website does not go into a great deal of detail about exactly what its investment strategy is. Rather, all that the website states is this:

The first bullet point shown in the website’s description is that:

[The Fund] provides a portfolio of primarily high-yield corporate debt securities.

This does not exactly provide us with much insight into the fund’s strategy. The word primarily just means that the fund will have more than half of its portfolio invested in high-yield corporate debt securities (junk bonds). The phrasing still allows the fund to invest in a lot of other things.

Fortunately, we can get a better strategy description in the fund’s most recent annual report:

The Fund seeks high current income. Capital appreciation is a secondary objective. In seeking to fulfill its investment objectives, the Fund invests, under normal market conditions, at least 80% of its net assets in high yield securities and up to 20% in common stock equivalents, including options, warrants and rights.

The remainder of the strategy description from the annual report is mostly marketing material intended to improve investor confidence in Western Asset’s competence as a fund manager. As regular readers are already well aware, Western Asset is one of the better bond fund managers around, so I see no reason to copy the marketing paragraph. The quoted paragraph basically tells us everything that we really want to know. The important things that we learn from the description are:

- The Western Asset High Income Opportunity Fund is a hybrid junk bond/common stock fund;

- The fund will have at least 80% of its assets in junk bonds;

- The fund will have common stocks occupying the remainder of its portfolio not occupied by junk bonds.

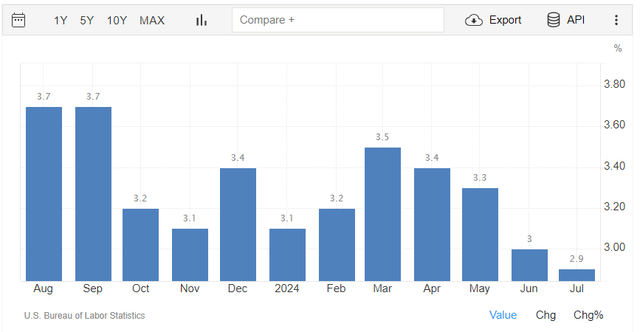

The potential for common stock holdings here improves the fund’s standing in my eyes. As I mentioned in the introduction, there exists the potential for entering into a recession in the near future. However, inflation is still not tamed as the most recent inflation report shows that the consumer price index increased by 2.9% year-over-year in July:

While this was the lowest level reported in the past twelve months, it is still well above the Federal Reserve’s 2% target. The core inflation rate for July was 3.2% year-over-year, and some other measures of inflation show much higher levels. For example, consider the following numbers from the most recent inflation report:

|

Inflation Category |

YoY Change |

|

Rent Inflation |

5.10% |

|

Services Inflation |

4.90% |

These numbers are obviously substantially above the Federal Reserve’s target. We should keep in mind that we are still seeing numbers like this after nearly two years of supposedly tight monetary policy (which really was not very tight, as I have shown in various previous articles). As inflation is still this high, it is not hard to envision a scenario where inflation surges if the Federal Reserve does indeed cut in a few weeks, as the market expects. After all, an interest rate cut would remove one of the impediments to monetary expansion. Neither presidential candidate has offered any plan to reduce government spending and money-printing activities that are the root cause of inflation, which only adds to our concerns that inflation is not beaten.

In an inflationary environment, investors do not want to be holding bonds. This is because the bonds pay back the money borrowed with a currency that has a much lower value at maturity than was originally lent. Common stocks do not have this problem due to the fact that corporate profits usually rise with inflation, which supports higher stock prices. As such, equities do a better job at protecting wealth from losing its purchasing power in an inflationary environment. The fact that the Western Asset High Income Opportunity Fund can invest in common stocks thus enables it to be better at preserving the purchasing power of an investor’s wealth than an ordinary bond fund.

However, the Western Asset High Income Opportunity Fund does not currently have anywhere close to 20% of its assets invested in common stocks. According to the fund’s third-quarter 2024 holdings report, the fund had the following asset allocation on June 30, 2024:

|

Asset Type |

% of Net Assets |

|

Corporate Bonds and Notes |

86.0% |

|

Senior Loans |

7.8% |

|

Sovereign Bonds |

3.4% |

|

Asset-Backed Securities |

1.0% |

|

Convertible Bonds and Notes |

0.7% |

|

Common Stocks |

0.0% |

|

Warrants |

0.0% |

|

U.S. Treasury Bills |

2.4% |

|

Money Market Funds |

0.1% |

As we can see, the fund’s common stock and warrant weighting is very low. In fact, the only common stocks that it is currently holding are Endo International (OTC:ENDPQ), a bankrupt pharmaceutical company, and China Aoyuan Group, a Chinese real estate owner. Obviously, the Endo International shares are not worth much given that the company went into Chapter 11 protection in 2022, and one hundred shares of the company can be purchased on the pink sheets for $0.02 right now. Anyone who is familiar with the Chinese real estate market can likely attest that the shares of China Aoyuan are also basically worthless (the fund values its entire position at $2,155).

As I pointed out in a few previous articles, convertible bonds can offer some of the inflation protection benefits of common stocks due to their ability to be exchanged for common equities. However, with only 0.7% of its net assets invested in these securities, investors cannot really expect those securities to help preserve purchasing power very much. Thus, it appears that this fund is not currently taking advantage of its ability to protect its investors against inflation. It is uncertain how big of a problem this is likely to be, as a very severe recession might reduce consumer spending enough to offset the inflationary pressures from a growing money supply caused by high levels of fiscal spending, but that would only be a temporary respite at best. Overall, I would prefer that this fund have a bit higher level of common equity (or convertible bonds) for wealth protection.

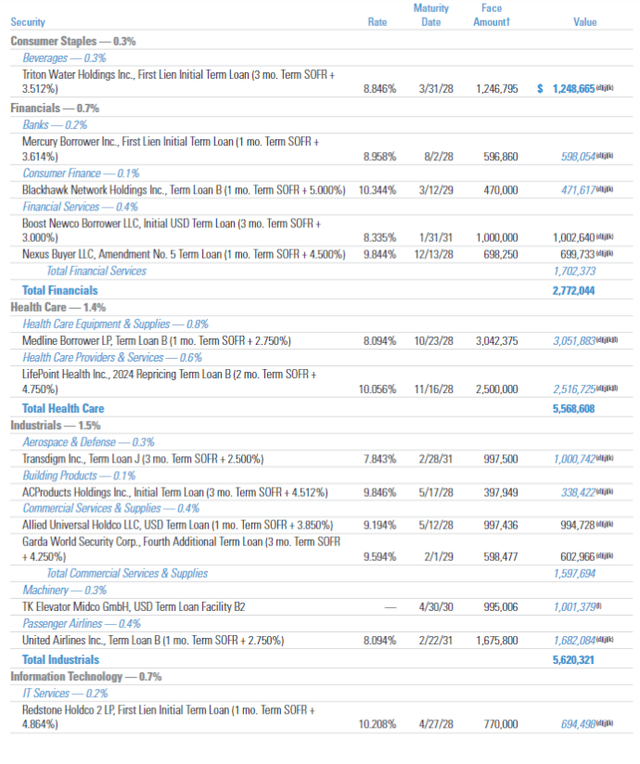

With that said, the senior loans in the fund should be able to provide the fund with a fairly attractive level of income. At least, they should be able to do this until the Federal Reserve reduces interest rates. Here is a sample of the senior loans that this fund is holding:

As we can see, these loans typically have a floating-rate coupon that is equivalent to the secured overnight financing rate + XXXX%, where XXXX is a value from 2.5000% to 5.000%. As of today, the secured overnight financing rate is 5.35%, so these securities are currently paying out a coupon yield of 7.85% to 10.35%. That is certainly a very attractive yield, and in fact it is in line with the average annual return of large-cap common stocks (SP500) going back to the 1920s. For now, that is probably enough to keep up with inflation. However, the secured overnight financing rate usually moves in lockstep with the federal funds rate. Thus, the yields paid by these securities will decline fairly quickly once the Federal Reserve starts cutting. This will reduce the appeal of these securities when compared to common stocks. It will be interesting to see whether or not the fund’s management starts moving money out of senior loans in favor of stocks once this occurs. If it does, that could better position the fund for greater returns (barring a severe recession) but I will admit that I am not getting my hopes up here.

Distribution Analysis

The primary objective of the Western Asset High Income Opportunity Fund is to provide its investors with a high level of current income. To this end, the fund pays a monthly distribution of $0.0355 per share ($0.426 per share annually). This gives the fund a very attractive 10.76% yield at the current price.

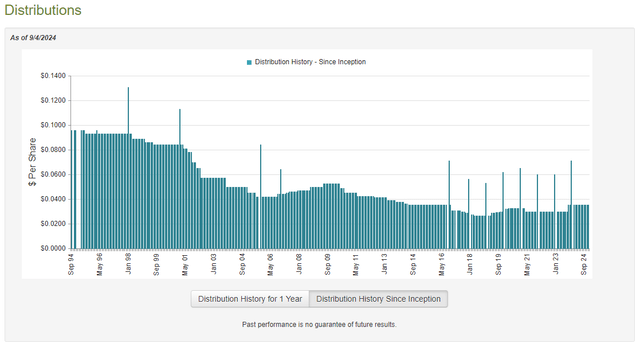

Unfortunately, this fund has not been especially consistent with respect to its distributions over the years:

As I stated in my previous article on this fund:

The fact that this fund’s distribution has varied to such a degree over its lifetime might be something of a turn-off for any investor who is seeking to earn a high level of income from the assets in their portfolios. However, the fund did increase its payout back in October of 2023 so that might improve its perception among some investors. The real concern here though is that today’s inflationary environment has rapidly increased the cost of maintaining a certain lifestyle, so we need more income to cover our bills than we did a few years ago. This fund’s recent distribution hike helps a lot here, but its unreliability over the long term could lead some investors to believe that they cannot depend on it.

As mentioned in the introduction, the most recently released financial report that is currently available for the Western Asset High Income Opportunity Fund is the semi-annual report that corresponds to the six-month period that ended on March 31, 2024. A link to this document was provided earlier in this report. This is obviously a more recent document than what was available the last time that we discussed this fund, so we should have a look at it to see how well the fund is covering its distribution.

For the six-month period that ended on March 31, 2024, the Western Asset High Income Opportunity Fund received $18,428,096 in interest and $131,270 in dividends from the assets in its portfolio. We subtract the amount that the fund paid in foreign withholding taxes to arrive at a total investment income of $18,552,668 for the six-month period. The fund paid its expenses out of this amount, which left it with $16,666,899 available for the shareholders. That was not sufficient to cover the $20,256,133 that the fund paid out in distributions during the period.

Fortunately, the Western Asset High Income Opportunity Fund was able to make up for the difference through capital gains. For the six-month period that ended on March 31, 2024, the Western Asset High Income Opportunity Fund reported net realized losses of $5,937,286, but these were more than offset by $14,944,562 of net unrealized gains. Overall, the fund’s net assets increased by $5,418,042 after accounting for all inflows and outflows during the period.

Thus, we can see that the fund technically managed to fully cover its distribution during the six-month period. However, it had to rely on unrealized gains to accomplish this task and that is not necessarily sustainable due to the fact that unrealized gains can be erased by a market correction. This does not appear to be a problem at the moment. This chart shows the fund’s net asset value since March 31, 2024:

As we can see, the fund’s net asset value has been overall flat since the closing date of its most recent financial report. This means that it has fully covered all of the distributions that it has paid out since that date. Thus, for now, the fund appears to be okay. However, it is important to note that the upside potential of bonds is likely very limited right now because every interest rate cut that is likely to occur is already priced in. As the fund’s income will decline once the Federal Reserve starts reducing interest rates, its ability to sustain the current distribution could be challenged. Investors will want to keep a very close eye on this fund’s net asset value going forward.

Valuation

Shares of the Western Asset High Income Opportunity Fund are currently trading at a 5.25% discount on net asset value. This is reasonably in line with the 5.53% discount that the shares have had on average over the past year. Thus, the current entry price seems reasonably acceptable for anyone who wishes to add this fund to their portfolio.

Conclusion

In conclusion, the Western Asset High Income Opportunity Fund does a reasonably good job with its junk bond portfolio. The fund is managing to sustain a very attractive distribution yield despite not using any leverage, which is quite surprising. The fund also trades at a reasonably attractive price right now.

However, there are two potential issues here. The first is that the fund’s ability to protect its investors against a resurgence in inflation is likely to be limited. As inflation is well above the Federal Reserve’s target, yet it seems likely to cut interest rates anyway, this is a problem that we should not ignore. This fund does have the ability to invest a minority of its portfolio in things that offer better inflation protection than bonds, but it is not currently using this ability, and it might not do so if inflation does pick up. The second problem here is that the fund’s income will likely decline when interest rates decline due to the fact that the secured overnight financing rate will probably fall. Meanwhile, capital gains might be limited, so the fund could struggle to maintain its distribution.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.