JHVEPhoto

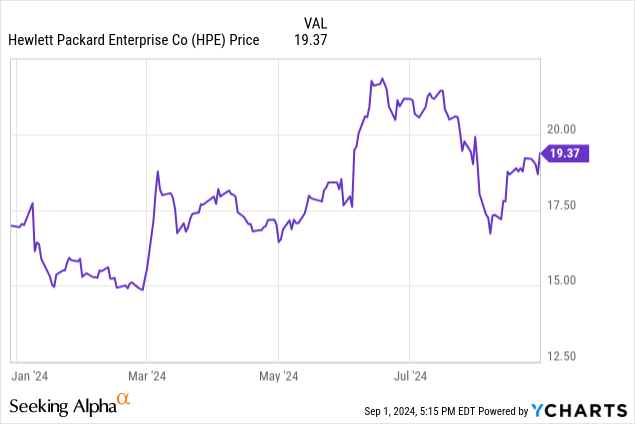

In January, I wrote an article about Hewlett Packard Enterprise Company (NYSE:HPE), in which I rated the company a strong buy, praising them for investing in the right parts of the growth industries of cloud computing and artificial intelligence.

As you can see, the company’s stock has done pretty well from then until now, and I thought that now, with the company’s earnings release expected later this week, it was worth examining them again, to see how the process was going, and whether the company, even after the price increase, is still something to consider investing in.

Balance Sheet

|

Then |

Now |

|

|

Cash and Equivalent |

$4.3 billion |

$2.7 billion |

|

Inventory |

$4.6 billion |

$7.3 billion |

|

Total Current Assets |

$18.9 billion |

$21.4 billion |

|

Property |

$6 billion |

$5.8 billion |

|

Total Assets |

$57.1 billion |

$59.7 billion |

|

Total Current Liabilities |

$21.9 billion |

$23.7 billion |

|

Long-Term Debt |

$7.5 billion |

$7.5 billion |

|

Total Shareholder Equity |

$21.2 billion |

$21.7 billion |

|

price/book ratio |

1.04 |

1.16 |

(Source: most recent 10-Q from SEC).

HPE has continued to keep its balance sheet quite stable for a company having to make investments in the challenging AI industry. The company continues to have a nice cash position and a very modest amount of long-term debt to contend with.

After an increase in prices, the company’s price/book ratio has gone up a bit, unsurprisingly. That said, they are still far below the industry average, suggesting that the company may still be relatively cheap for an enterprise computing giant.

Cash on hand may not be that stable going forward, as the company is planning to acquire Juniper Networks, Inc. (JNPR) for $14 billion in cash. That’s a worthwhile investment that will keep the company powerful for years to come, if approved, but the result is probably going to be a near-term weakening of the cash position and the company taking on more debt.

The Risks

A well-established company of considerable size, HPE continues to face risks in its continuing operations.

Enterprise computing is a growing industry across the globe, and HPE is well-positioned to play a role in that growth. Despite that, there are a lot of companies vying for those exact same positions, and there is no guarantee that the company will continue to invest well and remain high on the lists of enterprises looking for products and services. Even if they do, competition could threaten the company’s historically strong gross margins.

HPE has done well in investing in the right industries to continue growing at a healthy rate. There is, however, no guarantee that they will continue to be able to pick winners in the industry. A wrong investment could cost much, and weaken the solid balance sheet.

Statement of Operations

|

2022 |

2023 |

2024 (1H) |

|

|

Net Revenue |

$28.5 billion |

$29.1 billion |

$13.9 billion |

|

Gross Profit |

$9.5 billion |

$10.2 billion |

$4.8 billion |

|

Gross Margin |

33.4% |

35.1% |

34.6% |

|

Operating Earnings |

$782 million |

$2.1 billion |

$950 million |

|

Operating Margin |

2.7% |

7.2% |

6.8% |

|

Net Earnings |

$868 million |

$2.0 billion |

$701 million |

|

Diluted EPS |

66¢ |

$1.54 |

53¢ |

(Source: most recent 10-Q and 10-K from SEC).

Back in January, one of the points I praised HPE for was the company’s strong margins. As you can see, the margins have continued to be quite strong in the recent earnings, allow the company to not only meet expectations but to slightly beat earnings in recent quarters.

Estimates are that the company will come in at $29.67 billion for this fiscal year with an earnings per share of $1.92, that gives us a P/E ratio of about 10. Next year, the growth continues apace, with revenue of $31.25, and earnings of $2.11 per share. That would be a forward P/E ratio of 9.18, a nice value for a company with a strong track record of HPE. It is also worth mentioning that this is again less than half the P/E ratio that is the sector median, suggesting a potential undervaluation.

What to Expect from Q3 Earnings

This week, HPE will release its third quarter earnings. The estimates are that the company will come in with revenue of $7.64 billion and earnings per share of 47¢. The company has met or slightly exceeded estimates in recent quarters, and I would expect a similar result in this week’s release.

I would keep a close eye on the release especially for the cash and equivalents position, in light of the planned acquisition of Juniper Networks, as this could have a deleterious effect on their strong amount of cash on hand going forward.

Returns for Investors

Last year, HPE raised its dividend from 12¢ to 13¢ per quarter. The company current yields 2.68%, more than reasonable for the industry. With a planned acquisition, the company may not be able to raise the payout very much in the near-term, and probably isn’t going to be looking at major share repurchases, but the dividend is nice to get for a value play.

Conclusion

Despite going up a fair bit over the last eight months, HPE remains an excellent value in an important industry, and while it isn’t the screaming buy it was in January, I’m still going to view it a buy because there is just no way to get a profitable venture in an AI-centered enterprise computing company for such a bargain.

I would keep a close eye on the company, especially in light of the planned acquisition of Juniper Networks and the impact that might have on the cash position, but HPE is definitely a winner, with plenty of reason for optimism going forward.

With a single-digit forward P/E and trading at well better than sector median by seemingly every metric, HPE just plain looks cheap at current prices.