LewisTsePuiLung

Defining a luxury is a daunting task.

Consumers perceive luxury in different ways, for some, it’s all about the sky-high price tag, high quality, and unique craftsmanship. For others, luxury is exclusivity, rarity, and a work of art.

Luxury brands generally share a few attributes:

- A Rich Heritage.

- Craftsmanship & Quality.

- Exclusivity.

- Symbolic Value.

- Superior Customer Service.

Yet, luxury goods are often mistaken for premium ones, where the status and prestige do not matter as much, instead the focus is on superior quality, offering high-end products to a larger market.

Hermès International Société en commandite par actions (OTCPK:HESAY) is one of the few truly luxury brands, money can buy on the stock market, led by the sixth generation of the Hermes family, valued at $237 billion.

The company has done extraordinarily well, rewarding shareholders with a 605% total return, in the span of the last 10 years thanks to its unique $30B brand positioning, supported by the mismatch of supply and demand for its iconic Birkin bags starting at $10,000.

Hermes, and other luxury brands per se, leverage their iconic products that define the brand’s identity and reputation to sell a wider portfolio of goods.

Take for instance the Birkin bag, if you walk into a Hermes store, there is almost a zero chance the sales representative will sell you the bag as long as you have not established a relationship previously. Instead, the representative will offer you a variety of other goods, which you never wanted to buy in the first place, to build a purchase history and demonstrate loyalty to the brand.

This sales strategy helps to maintain the exclusivity and desirability of the Birkin bag, ensuring it is accessible only to a select few. Once you spend let’s say $60,000 on the other items from Hermes, the sales representative will eventually offer you the Birkin bag.

That’s how luxury brands manipulate and build artificial demand based on the flagship items, helping them to thrive since the 19th century.

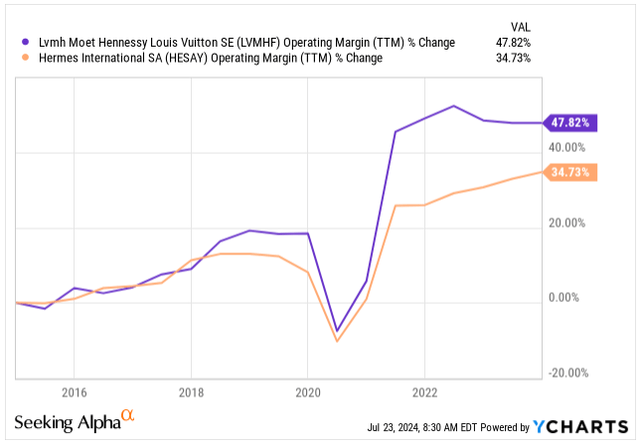

Helped by a secular growth of the luxury market thanks to globalization and economic prosperity, Hermes has tripled its sales since 2014 and delivered a staggering 16.2% annual EPS growth, partially aided by a major Operating Margin expansion, yet still trailing behind the efficiency and scale of LVMH Moët Hennessy – Louis Vuitton, Société Européenne (OTCPK:LVMHF).

Operating Margin (Seeking Alpha)

Business Overview

Hermes is a wide-moat business with its niche in the luxury goods industry, thanks to its exposure to super-wealthy clients, making the business more resilient to economic swings and demand cyclicality.

Take for instance LVMH, whose target customers are individuals with an income of $75,000+, the potential addressable market is larger, yet less resilient to economic downturn.

The slowdown in the sales of luxury and premium goods is one of the key fears in the industry right now. After a strong recovery from the COVID-19 pandemic, with investors getting accustomed to double-digit revenue growth, many brands are under pressure as almost all key regions show signs of a slowdown with customers shifting their preferences towards more accessible goods.

Yet, Hermes demonstrated a strong Q1, with revenue barely decelerating sequentially to 17% at constant currency thanks to its exposure to affluent customers and unique portfolio with upscale items and smaller goods alike, catering to a wider audience, helping to offset the cyclicality.

To put it into perspective, the industry leader, LVMH, has reported only 2% organic growth in Q1 with sales falling on an FX-adjusted basis, as proof of a less resilient portfolio and customers.

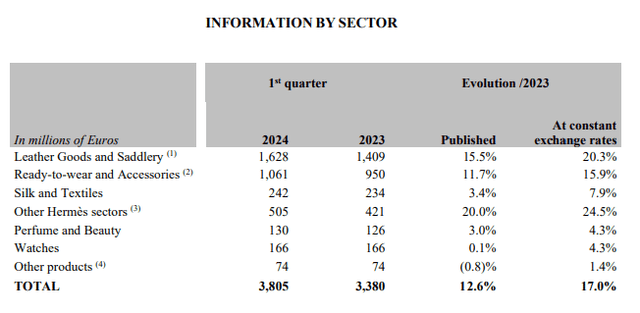

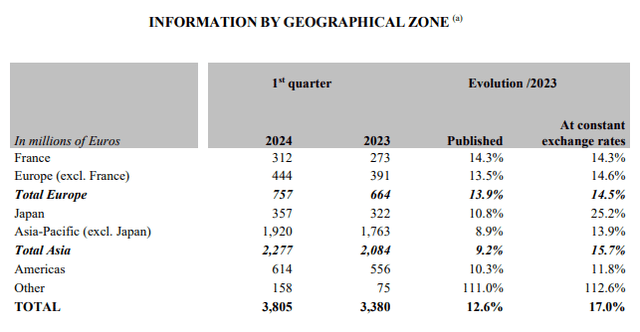

Going too much into the details of Q1 earnings does not make much sense at this point as Hermes is scheduled to release Q2 earnings this week, but let’s look at key figures from the last report.

HESAY Category Breakdown (HESAY IR)

Hermes is well-known for its strong pricing power, which is a key to their sales growth. In Q1 the revenue growth was significantly helped by continuous price increases, in the high single digits, particularly in the leather goods segment which accounts for 43% of total sales.

The leather goods segment revenue has also increased 20.3% on an organic basis, partially helped by the increased spending during the New Lunar Year in China, however, management expects a deceleration towards 15% growth for the remainder of the year.

The smaller segments, exposed more towards the aspirational buyers (customers who aim to buy luxury goods, but are not quite in the same financial position) have shown weaker growth with silk and textiles at 7.9% and perfumes and beauty at 4.3%, a trend I am expecting to see in the Q2 earnings report as well.

Similar to other luxury brands, Hermes’ key geographical area (50% of sales) is Asia-Pacific (excl. Japan) where the sales are showing continuous strength, despite the Chinese economy being plagued by problems.

Even as I would like to see more balanced market exposure, fearing the potential escalation of trade wars and military conflicts between Western economies and China, the region appears to be ripe for more growth thanks to an untamed appetite for luxury goods with second-generation middle-class likely to be the growth driver.

HESAY Geographical Breakdown (HESAY IR)

Thanks to Hermes’ vertical integration of its supply chain, from leather tanning to controlled distribution channels and internally operated store network, management has unlocked major growth with a 5Y average ROE of 28.3% and ROI of 23.5%.

Having a fully integrated supply chain is a key to success with any luxury goods company, controlling the supply of the goods flowing into the market and destroying any extra inventory, to avoid discount racks and protect the brand equity the company has built for six generations.

Even though the short-term industry headwinds may exert near-term pressure on sales, the luxury industry is well-positioned to thrive with Hermes leading the way.

Valuation

Hermes’ valuation remains a challenge for many investors with conventional thinking.

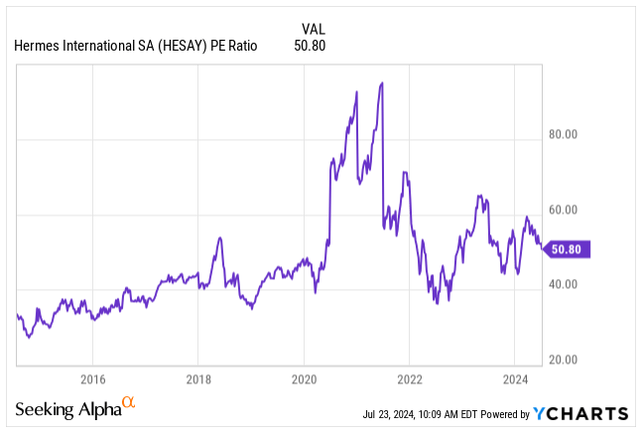

The company is priced at a significant premium to its peers at a P/E of 50x. That’s more than twice as expensive as LVMH which is trading at a P/E of 23x.

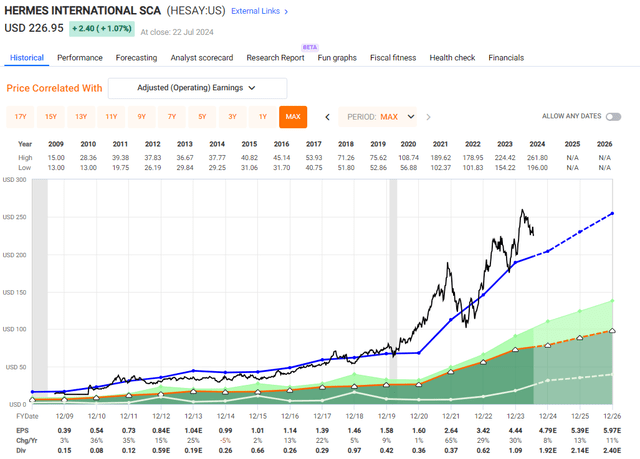

Yet, the company has been demonstrating much more resilient growth compared to peers with EPS growing at an annual rate of 16.5% since 2009.

On top of that, the business is well-positioned to keep benefiting from its industry-leading pricing power and vertical integration, potentially expanding its Operating margin well into 40% (from today’s 36%) territory.

As the world population gets richer with more people entering the middle class and the number of high-net-worth individuals grows, this should create a higher demand for Hermes as long as the company retains its exclusivity.

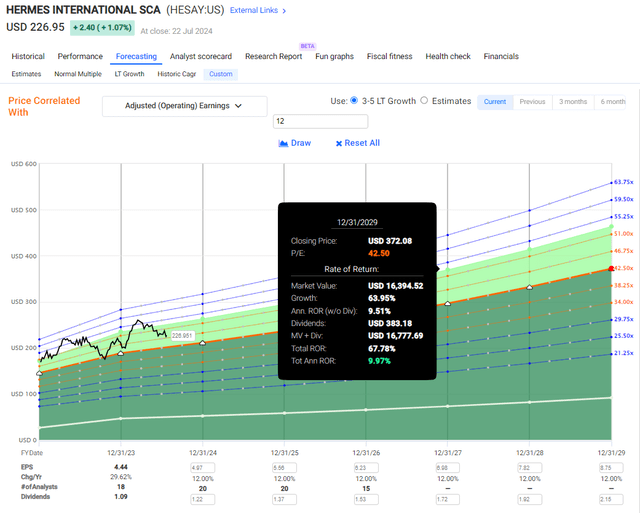

Expecting a 10% sales growth is entirely feasible over the next decade, helped by the expanding profit margins, 12-13% EPS growth is a baseline scenario of mine.

Based on the data from FactSet, analysts’ EPS growth expectations closely align with mine:

- Expected EPS of $4.79, YoY growth of 8%.

- Expected EPS of $5.39, YoY growth of 13%.

- Expected EPS of $5.97, YoY growth of 11%.

If the bottom-line growth materializes, the forward valuation looks like the following:

- FY24 Forward P/E of 46.9x.

- FY25 Forward P/E of 41.7x.

- FY26 Forward P/E of 37.7x.

Even if the valuation contracts towards its 42.5x P/E average since 2009, with 12% annual EPS growth, investors are set for 10% annual returns including the 0.55% dividend yield Hermes pays.

HESAY Potential Return (FAST Graphs)

Risks

Speaking of risks that would force me to revise my bullish investment thesis, further deceleration of the demand for luxury goods is the primary one.

If the purchasing power of consumers further decelerates as a result of the continuously elevated inflation and decade-high interest rates, particularly in Europe and the US, the already weakened consumer may show signs of further cracks, jeopardizing consumer sentiment.

In turn, this would hurt Hermes’ growth on both the top and bottom lines, where justifying a P/E of 50x its FY24 earnings would prove to be difficult.

The recent surprise French election has thrown the country into political turmoil with three opposing blocks, each with different objectives and agendas, having to form a coalition to lead the country.

Even as politics does not directly impact Hermes’ demand abroad, Hermes’ native shares are domiciled on the Paris Stock Exchange. The politics and equity valuations have been historically intertwined in France with the potential to shave off 10-20% of the domestically listed companies.

Takeaway

All in all, Hermes is perhaps the single greatest luxury brand an investor can buy on the stock market.

The company’s current 50x P/E valuation is difficult to justify by conventional thinking, yet the business enjoys remarkable stability thanks to its exposure to high-net-worth individuals, being more resilient to economic cycles.

The unique strategy of Hermes, leveraging sales of Birkin bags to drive demand for other goods, positions it well for continued success as the world economies get richer, the middle class grows and the number of wealthy individuals increases.

Hermes delivered 16.5% annual EPS growth since 2009 and even as I expect a slowdown towards 12% growth for the remainder of the decade, the business is well positioned to keep rewarding shareholders with the 6th generation of the Hermes family in charge.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.