Funtap/iStock via Getty Images

Market Review

Frontier Emerging Markets (‘FEM’) fell 1.9% in the second quarter, trimming the year-to-date benchmark return to 3.7%. The losses were mainly clustered in Asia, hurt by the effects of weak real-estate markets in index heavyweights Vietnam and the Philippines, as all other regions rose during the quarter.

In Vietnam, Vingroup, the country’s largest conglomerate, and property developers affiliated with it were hit especially hard. Vinhomes, the largest residential developer in Vietnam, which is controlled by Vingroup, saw a sharp drop in revenue and profit in the first quarter on the back of slower property deliveries to buyers. Vingroup’s decision to push out by 18 months repayments of half of its dollar-denominated US$625 million maturing debt unnerved investors, raising questions about its financial strength.

MSCI FEM Index Performance (USD %)

|

Sector |

2Q 2024 |

Trailing 12 Months |

|

Communication Services |

0.1 |

3.1 |

|

Consumer Discretionary |

-3.5 |

6.9 |

|

Consumer Staples |

-2.4 |

-12.5 |

|

Energy |

7.8 |

48.0 |

|

Financials |

-0.9 |

16.7 |

|

Health Care |

1.5 |

13.1 |

|

Industrials |

-7.0 |

0.1 |

|

Information Technology |

-2.4 |

2.6 |

|

Materials |

3.6 |

40.5 |

|

Real Estate |

-13.4 |

-12.8 |

|

Utilities |

2.3 |

17.8 |

|

Geography |

2Q 2024 |

Trailing 12 Months |

|

Philippines |

-10.6 |

-2.2 |

|

Vietnam |

-9.4 |

-4.7 |

|

Peru |

2.0 |

40.0 |

|

Romania |

11.7 |

52.6 |

|

Morocco |

3.3 |

14.8 |

|

Kazakhstan |

5.5 |

68.2 |

|

Iceland |

-2.8 |

-1.9 |

|

Colombia |

-4.1 |

29.3 |

|

Slovenia |

9.8 |

37.5 |

|

Egypt |

-4.1 |

-4.7 |

|

MSCI FEM Index |

-1.9 |

11.3 |

|

Source: FactSet, MSCI Inc. Data as of June 30, 2024. Selected countries are the 10 largest by weight, representing 85% of the MSCI Frontier Emerging Markets index, listed in order of their weighting. Companies held in the portfolio at the end of the quarter appear in bold type; only the first reference to a particular holding appears in bold. The portfolio is actively managed therefore holdings shown may not be current. Portfolio holdings should not be considered recommendations to buy or sell any security. It should not be assumed that investment in the security identified has been or will be profitable. To request a complete list of holdings for the past year, please contact Harding Loevner. A list of our ten largest holdings at June 30, 2024 is available on page 6 of this report. |

New regulations shook up real-estate developers in the Philippines. The Real Property Valuation and Assessment Reform Act, signed into law in June, aims to ensure a unified valuation methodology and more frequent updates of property values and to boost tax collection. Another issue was the decision by the country’s central bank to start interest-rate cuts as early as August, ahead of the US Federal Reserve, which contributed to the Philippine peso’s continued depreciation against the dollar.

Latin America eked out a small gain as a modest rise in Peru offset weakness in the much smaller market of Colombia. Peru was helped by copper miners, whose shares advanced on higher prices, expected growth in production, and progress toward new mining projects. Colombia was hurt by renewed concerns about its fiscal health. Facing weaker-than-expected tax revenues, the Colombian Congress approved a US$17.6 billion increase in the debt ceiling to fund spending and meet debt obligations. This prompted credit-rating agency Moody’s to cut Colombia’s outlook to negative from stable. The country retains its Baa2 investment grade rating from Moody’s.

Europe was the best-performing region, with most countries in positive territory, led by Romania. Inflation there is easing gradually, with moderating food and energy prices, which should support a recovery in consumer spending. Shares of Banca Transilvania, the largest constituent of the MSCI Romania Index, advanced on the back of strong first-quarter results that showed robust loan growth, contained provisioning costs, and gains on the acquisition of BCR Chisinau bank completed earlier in the year.

Viewed by sector, Energy was the best-performing sector this quarter, boosted by rising oil prices. Oil rose after the OPEC+ cartel pledged in June to curb oil production by more than 3 million barrels a day until the end of next year. Real Estate, given the weakness of Philippine and Vietnamese real-estate developers, performed the worst.

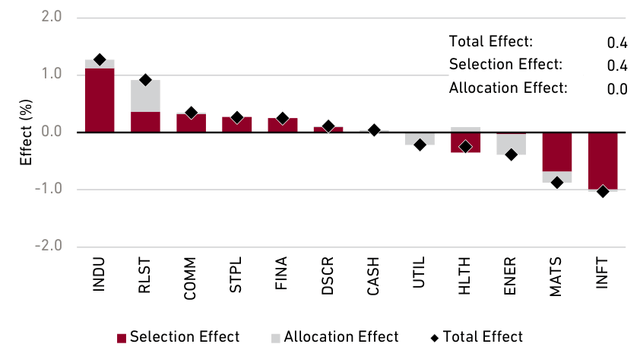

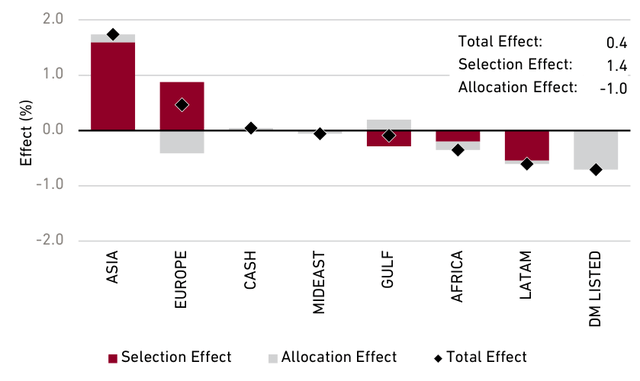

Performance and Attribution

In the second quarter, the Frontier Emerging Markets Equity composite fell 1.4% gross of fees while its benchmark, the MSCI Frontier Emerging Market Index, fell 1.9%.

By sector, Industrials provided the biggest boost to relative performance, especially port terminal operator Marsa Maroc of Morocco. The company experienced strong growth in the volume of gateway containers in Casablanca and transshipment containers in the Tanger Med port terminal. Its dry-bulk cargo volumes also rose. Our underweight to the poor-performing Real Estate sector also helped performance.

Poor stocks in Information Technology hurt performance the most, especially two US-listed IT services holdings: Argentina-based Globant (GLOB) and eastern-European EPAM (EPAM). Both companies experienced a slowdown in growth as some of their clients reduced their IT budgets while expectations of a ramp up in artificial intelligence-related spending have so far proved premature.

By region, the portfolio outperformed through strong stock picking in Asia, especially in the Philippines and Vietnam. In the latter, air-cargo terminal operator Saigon Cargo Service Corp. benefited from an export rebound and a new partnership with Qatar Airways.

Second Quarter 2024 Performance Attribution

Sector: Frontier Emerging Markets Equity Composite vs. MSCI FEM Index

Geography: Frontier Emerging Markets Equity Composite vs. MSCI FEM Index

|

“DM LISTED”: Includes companies in frontier markets or emerging markets listed in developed markets. Source: Harding Loevner Frontier Emerging Markets Equity composite, FactSet, MSCI Inc. Data as of June 30, 2024. The total effect shown here may differ from the variance of the composite performance and benchmark performance shown on the first page of this report due to the way in which FactSet calculates performance attribution. This information is supplemental to the composite GIPS Presentation. |

Beer-maker Sabeco also performed well as it gained market share with consumers trading down from premium to mainstream beer, where Sabeco is the leader. Latin America detracted from performance, especially cement-maker Cementos Argos (OTCPK:CMTOY), which saw its Colombian cement volumes slump on slowing construction activity.

Perspective and Outlook

Over the past decade, Vietnam has been one of the fastest growing economies in the world, a “development success story” in the words of the World Bank. The country has attracted sizable foreign direct investment (FDI) given its skilled and wage-competitive labor force, integration into global trade through participation in multiple free trade agreements, and predictable, business-friendly government policies. Its manufacturing sector, which has historically garnered the majority of FDI flows, has been instrumental in increasing exports, which almost tripled from US$132 billion in 2013 to US$355 billion in 2023. This, along with rising consumption, has propelled Vietnam’s economy.

Growth slowed in 2023, as the country’s GDP expanded by just 5%, the lowest rate in a decade outside of a pandemic-induced slowdown in 2020 and 2021. Rising interest rates in the first half of the year pushed up borrowing costs for consumers and businesses, leading them to pull back on spending. Contraction in demand for Vietnamese goods from key trading partners the US and the EU depressed exports, which hurt export-oriented manufacturing firms and lowered incomes for workers in the trade hubs of Hanoi, Ho Chi Minh City, and surrounding provinces.

Perhaps the most profound impediment to growth was the government’s crackdown on abuses in the property sector, which culminated in the fall of 2022 with the arrest of the chairwoman of Van Thinh Phat, one of the country’s leading real-estate companies. This crackdown disrupted activity throughout the real-estate market. Sales of land were placed on hold or even cancelled by government officials, themselves fearful of anti-corruption investigations. The property market froze and construction projects plummeted. From January to June 2023 builders suspended more than 1,200 real-estate projects worth US$34 billion because they were unable to secure funding; during the whole year some 1,300 real-estate companies were forced into insolvency. The fallout from the property-market slump rippled through the entire Vietnamese economy, sparing virtually no sector or industry.

As the largest steelmaker in Vietnam, Hoa Phat Group was hit hard by the downturn in the property market. Hoa Phat’s overall steel volumes declined 7% in 2023 while construction-steel volumes fell 11%. This weakness, coupled with falling global prices, pressured the price of steel on the domestic market. To make matters worse, high prices for iron ore and coking coal— essential inputs in the blast furnace process for steelmaking that the company uses—exacerbated the pressure on profitability. After earnings rose 16-fold between 2013 and 2021, Hoa Phat’s profits fell 74% in 2022 and a further 23% in 2023.

That cyclical weakness, severe as it was, should not obscure Hoa Phat’s formidable competitive position. With production capacity of 8.5 million tons of steel per year, the company is the largest steelmaker in Southeast Asia. Hoa Phat’s scale allows it to procure iron ore at prices similar to the world’s largest steel mills, giving it a significant cost advantage over its smaller competitors.

These cost advantages helped Hoa Phat gain 16 percentage points of market share over the past decade. Today it towers above the sector with 35% market share in construction steel and 28% in steel pipe in Vietnam—more than next three competitors in each segment combined.

Hoa Phat’s already strong competitive position should be further solidified with the launch of the new Dung Quat 2 steel plant in early 2025. This plant will be able to produce 5.6 million tons per year, increasing Hoa Phat’s current capacity by 65%. The plant will produce mostly hot rolled coil (HRC) steel, helping the company capture domestic HRC demand, a significant portion of which is now met by imports. The property sector should rebound as new regulations, which aim to alleviate project bottlenecks, become fully effective later this year, which should be good news for construction-steel volumes and Hoa Phat.

The real-estate market’s downturn wasn’t just a problem for companies. Falling housing prices and sluggish income growth left many Vietnamese feeling poorer. That resulted in consumers cutting their spending for myriad products, including beer.

Vietnamese beer volumes fell 26% in 2023, after growing an average of about 9% a year from 2014 to 2022. Our portfolio holding Sabeco was not spared; its volumes dropped by 13%, half the wider market.

Sabeco owes its relative resiliency to several factors. First, its flagship Bia Saigon brand (bia is Vietnamese for beer), which comprises most of its sales, skews toward the mainstream segment and is more affordable than premium beers offered by competitors such as Heineken. As such, Sabeco benefits as consumers switch to cheaper alternatives in tougher economic conditions.

Second is Sabeco’s strength in the “off trade” channel (i.e., at-home consumption), which stems from its superior distribution. The company operates a nationwide network of 26 breweries spread across the country while its main competitors Heineken and Habeco operate six and two breweries, respectively. This allows Sabeco to ensure timely delivery of its beer to its more than 200,000 retail outlets, located in every province and city in Vietnam. The company also benefited from tougher enforcement of drunk-driving laws, which pushed more consumers to drink at home rather than in bars and restaurants, inadvertently helping Sabeco relative to the overall sector.

Vietnam is the third-largest beer market in Asia, behind China and Japan, and Vietnamese have traditionally preferred beer to wine and spirits. At more than US$10 billion annually, beer is by far the biggest beverage category in Vietnam, comprising more than 90% of the value of all alcohol consumed. Vietnam’s youthful population (the median age is just 33) forms a substantial part of the country’s beer drinkers. These attractive demographics, rising incomes, and Vietnamese cultural affinity for beer bode well for Sabeco’s long-term growth prospects, notwithstanding short-term challenges.

Last year’s turbulence interrupted the country’s robust growth trajectory but did not derail it; Vietnam remains one of the fastest-growing economies in the region with GDP growth projected at about 6.5% annually for the next several years, according to the International Monetary Fund.

Industries such as steel making and beer have been and will remain important to Vietnam’s economy. But the country’s growth is increasingly being powered by technology-centric industries, including telecommunications, software development and testing, and semiconductors.

In recent years the country emerged as a winner from the reconfiguration of global supply chains and should to continue to benefit from the so-called “China +1” strategy. In that regard, Vietnam enjoys several advantages. First is its geographic location: the manufacturing hubs of Hanoi and Ho Chi Minh City are close to Shenzhen, the industrial and high-tech center of China. Second is the availability of a skilled and cost-competitive workforce: manufacturing wages in Vietnam are half of those in China. Third is a favorable regulatory and policy backdrop, which aims to promote investment, particularly in manufacturing and technology sectors through tax breaks and other incentives. Recently the government adopted a strategy with an objective to train at least 50,000 engineers for the semiconductor industry by 2030. Global tech giants, including Intel (INTC), Hana Micron, Synopsys (SNPS), Qualcomm (QCOM), and Nvidia have invested or pledged hundreds of millions of dollars to expand their operations in the country.

As Vietnamese companies become more entrenched in global supply chains, they will continue to climb up the value curve, boosting worker wages, enlarging the country’s middle class, creating new demand, and driving investment and consumption higher. These favorable tailwinds should power Vietnam’s economy and sustain growth for our companies for years to come.

Portfolio Highlights

As Hoa Phat and Sabeco illustrate, even companies with a long growth runway are not immune to cyclical headwinds. But these turbulent periods can otter the most compelling investment opportunities. Mobile World, a new addition to our portfolio this quarter, is one such example.

Mobile World, founded in 2004, is the largest multi-format retailer in Vietnam. The company initially focused on selling phones and accessories through its The Gioi Di Dong stores. It launched a consumer-electronics chain called Dien May Xanh in 2010 and these segments still account for about 70% of the company’s total revenue. Its grocery chain Bach Hoa Xanh, launched in 2016, makes up the bulk of the remaining 30%.

Mobile World stores are differentiated from those of its competitors by having a broad selection of smartphones and consumer electronics as well as trained salespeople to give advice, a transparent refund and exchange policy, and reliable after-sales service and support. High-end phones and appliances can cost hundreds and even thousands of dollars—a steep price tag for a country where GDP per capita is just $4,200. Such purchases would be out of reach for most Vietnamese without access to financing. Through its financing partners, Mobile World otters a wide array of payment and credit options to its customers.

For online sales, which comprise roughly 16% of total electronics sales, Mobile World offers nationwide delivery, using its stores as distribution points, resulting in faster delivery times compared with other platforms.

Virtually no sector escaped the economic downturn of 2023 unscathed, but consumer electronics was hit particularly hard. Faced with excessive inventory build-up as consumer spending slowed, Mobile World and other retailers began discounting across the board, unleashing intense price competition that hurt the entire industry’s revenues and profits.

Competitive intensity has moderated since late last year as excess inventory was cleared out and consumer purchasing power should gradually recover as the economy improves. Yet given the relatively high modern retail penetration of nearly 50%, we expect Mobile World’s grocery business to grow faster relative to its electronics business over the medium term.

The rationale for an electronics retailer to expand into grocery is simple: at US$52 billion, the addressable market is roughly five times larger, while formal penetration, at just 11%, is among the lowest in the world. There are just 71 modern grocery stores per one million people in Vietnam, compared to 156 in Indonesia and 296 in Thailand.

Today, Bach Hoa Xanh has about 1,700 minimart grocery stores, located in high-traffic areas close to where consumers live and work. The typical store ranges between 200 and 300 square meters and carries roughly 3,000 essential grocery and packaged-goods items. This small footprint makes it easier to locate stores in residential neighborhoods, in contrast to larger hypermarkets and supermarkets, typically located at the outskirts of the cities. These locations align well with the shopping habits of Vietnamese consumers used to parking their motorbikes in front of a store and then driving off with their purchases.

Besides convenience, a large selection of fresh foods is another differentiator. The Vietnamese diet is fresh-food-based, so fresh produce as well as meat and fish are important to attract customers. More than a third of Bach Hoa Xanh’s product mix are fresh foods—the highest proportion among grocery chains in Vietnam. A final competitive advantage is Bach Hoa Xanh’s scale: with US$1.3 billion in sales in 2023, it is one of the largest grocery chains in Vietnam. This scale allows the company to get volume discounts from suppliers and pass some of the savings on to customers.

Over the last few years, management revamped Bach Hoa Xanh operations by shutting down underperforming stores and renovating remaining ones, streamlining product assortment, and implementing targeted discounts, especially on fresh food and other selected items. Now that a sustained level of profitability has been achieved, the company plans to roll out hundreds of Bach Hoa Xanh stores across Vietnam to further entrench its scale and cost leadership.

Elsewhere in Asia, we sold our position in Prodia, the Indonesian lab-testing business, due to intensifying competition from hospitals that led to significantly diminished pricing power and a deteriorating growth outlook. We added to our position in Sabeco, discussed earlier, as well as Philippine home-improvement chain Wilcon Depot, as we believe the current valuation does not fully reflect the operational recovery the company has made since the COVID-19 pandemic.

|

Note on BlackRock Frontier ETF Liquidation and MSCI Index Changes At Harding Loevner, we focus on building portfolios from the bottom up, guided by our quality-growth philosophy, and rarely comment on actions of other investors or index providers. We only do so to highlight meaningful developments affecting the FEM asset class. In June, asset manager BlackRock announced its intention to liquidate its Frontier & Select EM ETF, which once had assets exceeding US$400 million. At the time of this writing, more than 96% of the ETF’s holdings were cash and cash equivalents, indicating that most positions have already been sold. The BlackRock ETF’s overlap with our portfolio holdings was not substantial and, given trading liquidity in the shares of BlackRock’s largest positions, this liquidation did not have a material impact on our portfolio holdings’ share prices. BlackRock cited persistent liquidity challenges in several smaller frontier markets as the main reason for its decision. Markets like Egypt and Nigeria have indeed faced liquidity challenges, caused by unsustainable currency pegs that both countries abandoned earlier this year. Egypt has since attracted US$35 billion from a consortium led by Abu Dhabi’s ADQ investment company and additional US$5 billon from the IMF, helping substantially ease liquidity pressure. Nigeria was eliminated from the benchmark by index provider MSCI in February. We also note that BlackRock made its decision at a time when the FEM index actually became more balanced, after MSCI added about 125 stocks to the MSCI FEM Index during 2023 and the first half of 2024, resulting in lower country concentration for the benchmark. The Philippines, once the largest market with more than 30% weight, is now 20%. In fact, the MSCI FEM Index is now more diversified than the MSCI EM Index. The five largest markets in FEM—the Philippines, Vietnam, Peru, Romania, and Morocco—account for less than two-thirds of the index weight while the five largest markets in EM—China, India, Taiwan, South Korea, and Brazil—account for more than three-quarters of the index weight. This also demonstrates that investors in FEM get meaningfully different exposure compared with EM. BlackRock’s decision only underscores our long-held belief that the idiosyncratic nature of frontier and small emerging markets, as well as their volatility and liquidity characteristics, make them much better suited for an active rather than passive investment strategy. We continue to find many outstanding companies in FEMs and are as excited about their potential as we were when we launched this strategy in 2008. |