BlackJack3D

Gossamer Bio (NASDAQ:GOSS) is a clinical-stage biopharmaceutical company with a pipeline of one drug: Seralutinib. Seralutinib is focused on treating pulmonary arterial hypertension (“PAH”) and pulmonary hypertension with interstitial lung disease (“PH-ILD”). The company has a history of disappointing investors, typical in biotech, as 90% of drugs fail clinical trials. This is what Gossamer’s pipeline looked like in 2020:

Gossamer Bio Pipeline in 2020 (company website)

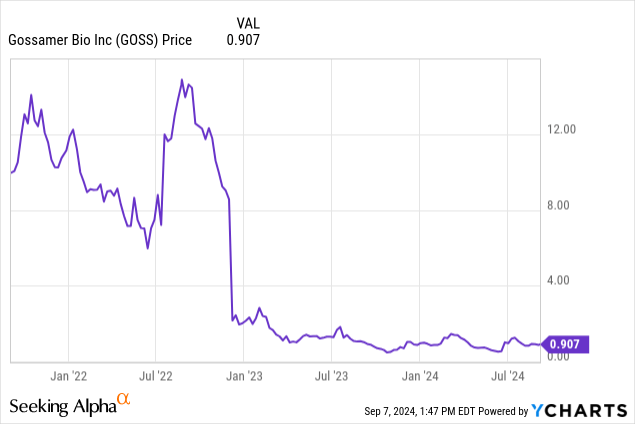

The most recent disappointment was the Phase II Torrey clinical study results, despite Seralutinib meeting its primary endpoint of reducing pulmonary vascular resistance (“PVR”). The results disappointed investors, as the Torrey results were not as good as those achieved by Merck’s (MRK) Sotatercept drug during its Phase II study in not only the primary endpoint but also in demonstrating an improvement in the 6-minute walk distance (“6MWD”), the secondary endpoint. GOSS stock price declined almost 60%. Sotatercept was approved by the FDA earlier this year.

GOSS CHART (SEEKING ALPHA)

Investment Thesis

Although the Seralutinib Phase II Torrey study data has been perceived negatively, the clinical data also demonstrated that the patient group selection was flawed and that Seralutinib has several advantages over the Sotatercept drug.

Gossamer is currently enrolling patients for a phase III Prosera clinical trial, with improvement in 6MWD as the primary endpoint. Gossamer has partnered with a large pharmaceutical company and beefed up its leadership team to accelerate the completion of the regulatory process and the expected commercial rollout.

The stock price should rebound on a positive Phase III outcome. Top-line results are expected in Q4 2025. Smaller potential catalysts, such as Seralutinib introduction to the medical community and analysts’ revision of estimates, also exist.

Phase II Torrey

The Torrey trial was conducted during the COVID-19 pandemic. Enrolling patients with severe PAH disease levels who were staying home for safety reasons was challenging, so the majority, two-thirds, of patients enrolled had mild PAH conditions. Only 14 of the 44 enrolled patients were the more severe class III.

Seralutinib improved PVR by 14% during the Torrey clinical trial. The result met endpoint requirements, but investors expected at least a 20% improvement. The lower-than-expected score for both PVR and the 6MWD endpoints is attributed to most patients having mild PAH conditions. The Torrey data demonstrated that Seralutinib dramatically improved in patients with more severe PAH.

The most encouraging Torrey data came from the open-label extension. 93% of the enrolled Torrey patients continued into the extension, where Seralutinib improved 100% of patients’ conditions at 72 weeks. No other study has demonstrated the efficacy of PAH drugs for such a long period.

Comparing Seralutinib with Sotatercept

While there is no cure for PAH, available treatments for PAH other than Sotatercept treat the symptoms, not the disease. Seralutinib, when and if cleared by the FDA, will compete directly with Sotatercept in slowing down the disease, but both drugs can be used in conjunction as they attack from different pathways.

The Sotatercept phase II Spectra data indicated that the drug peaked in performance during the initial 26-week period. In the extended period of its phase II trial, Seralutinib showed reduced PVR in 100% of its enrolled patients.

The patient administers Seralutinib via a dry powder inhaler, while Sotatercept is delivered via an injection every three weeks. Seralutinib patients tend to suffer from headaches and coughing, which are common side effects associated with the use of an inhaler. Side effects related to Sotatercept are more severe and include spider veins on the skin, diarrhea, and dizziness. Sotatercept requires frequent monitoring for hemoglobin increases, thrombocytopenia, and gastrointestinal bleeding.

Sotatercept costs around $300K per patient per year. Seralutinib pricing has not been established yet, but it should be in the same range. Seralutinib, with its longer efficacy, has the potential to bring in higher revenue than Sotatercept.

Partnership

Gossamer Bio announced a collaboration with Chiesi, a multi-billion dollar private Italian biotech company, in May. Under the agreement, Gossamer receives $160 million in development reimbursement and $326 million as regulatory and sales milestones are met. Chiesi will fund all expenses other than the Phase III trial. Gossamer will conduct U.S. sales, while Chiesi will manage sales outside the U.S. The partners will split U.S. commercial profits 50/50, and Gossamer will receive royalties on sales outside the U.S.

The partnership is symbiotic. Only about 100 medical centers in the U.S. treat PAH. Gossamer can service these centers with around 20 salespersons, five centers per salesperson. Chiesi is a global company with a footprint in over 30 countries, making it well-suited to market Seralutinib internationally.

Total funding from Chiesi allows Gossamer to accelerate its plan to obtain FDA clearance for PH-ILD treatment and initiate clinical trials in early 2025. The cash infusion extends its runway.

PAH and PH-ILD Industry Outlook

PAH affects about 1% of the population, predominantly middle-aged Hispanic and African-descent women. It is a progressive disease that worsens over time. There is no cure, and the cause is unknown. PAH patients experience a tightening of the blood arteries that causes the heart to pump harder, resulting in shortness of breath, difficulty breathing, and often fainting.

PAH treatment is highly competitive, with 16 FDA-cleared options, but the opportunity is significant. The TAM for PAH treatment is forecast to grow at a CAGR of 5% over the next ten years to almost $8B. There are about 25 million PAH patients in the U.S. and Europe.

PH-ILD is also a progressive disease caused by high blood pressure in the lungs. Only one drug, Tyvaso DPI (Treprostinil) from United Therapeutics (UTHR), was FDA-approved for treating PH-ILD. UTHR reported almost $400 million in revenues from Tyvaso in 2024 Q2. Liquidia (LQDA) has its own Treprostinil version, Yutrepia, which the FDA just cleared.

Seralutinib’s more prolonged efficacy can potentially generate a higher revenue than Tyvaso. Targeting over a billion dollars in annual revenue is very reasonable.

Leadership Team

Faheem Hasnain and Sheila Gujrathi were executives at Receptos when Celgene acquired it in 2015. They began acquiring the rights to drugs that were potential therapies and founded Gossamer Bio in 2018. Both have extensive backgrounds in the biotech industry. Mr. Hasnain now serves as CEO and Chairman of the Board. Dr. Gujrathi serves as a consultant.

The Phase II data suggests that Gossamer has a drug candidate that falls into the 10% that succeeds. Gossamer has been making moves to improve its chances by bulking up its core management team with previous mutual working experience with new leadership members. The complete management and board of directors roster is available on the company website.

Chief Medical Officer Richard Aranda, Chief Financial Officer, and Chief Operating Officer Bryan Giraudo were also executives at Celgene. Dr. Aranda was the Vice President of Clinical Development at Celgene. Mr. Giraudo has been Gossamer’s CFO since 2018 and added on COO duties in 2021. He has an extensive background in biotech financing.

Chief Commercial Officer Bob Smith was hired in December 2023. Mr. Smith’s previous employment was with Merck as the National Sales Lead for the launch of Sotatercept. Mr. Smith has over 30 years of pharmaceutical experience, including leading the launches of Opsumit and Uptravi, two PAH drugs.

Dr. Stephen Nathan and Skye Drynan were added to the Board of Directors earlier this year. Dr. Nathan is recognized as an expert in pulmonary diseases and will be instrumental in guiding the company’s PH-ILD clinical trials. Ms. Drynan is a businesswoman and fashion designer. She was a Partner and Senior BioPharma Analyst at Capital Group, involved in biopharma investing with over $2 trillion in assets.

Financials

There are 226 million shares. Insiders own about 11% of the shares and have been active buyers over the past 12 months. Institutions own about 81% of the shares.

The company’s market cap is $206 million. As of 6/30/24, it had $354 million in cash and $200 million in debt. The debt is a convertible note at 5% interest, payable semi-annually, and matures in July 2027. The burn rate is about $50 million annually, which gives the company sufficient funding to complete the phase III Prosera clinical trial.

Merck acquired Acceleron (XLEN) in 2021 when it began a Phase III clinical trial for Sotatercept for $11.5 billion. I want to use that as a basis for setting a price on GOSS, but it compares apples to oranges. XLEN had other drugs in its pipeline and sold for close to its market cap.

The stock is selling at less than cash and deserves a higher multiple based on the potential to exceed a billion dollars in annual revenue.

Piper Sandler’s price target is $16/share, Oppenheimer’s is $9, Leering Partners’ is $6, and H.C. Wainwright’s is $10.

Risks

The obvious risk is that the Phase III results do not support FDA approval. Competing PAH drugs are also emerging. Keros Therapeutics (KROS) recently began stage II clinical trials for its PAH drug. Janssen Pharmaceutical, a division of Johnson & Johnson (JNJ), recently received FDA clearance for the first daily pill for PHA patients. Interestingly, Janssen’s pill had inferior 6MWD results than Sotatercept, but it is offered in a much easier-to-administer format. Mochida Pharmaceuticals launched its PAH drug in Japan last year.

Conclusion

The stock has had a roller coaster ride, trading at lows and below cash value. The company has beefed up its management team and board of directors. It has formed a symbiotic partnership with a large global pharmaceutical company as data from its Phase II study points to FDA approval for its lead drug candidate. Due to the large cash balance, there’s a low chance of further dilution before the anticipated FDA approval. The shares are supported by strong institutional investment, and insider buying.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.