Jonathan Knowles

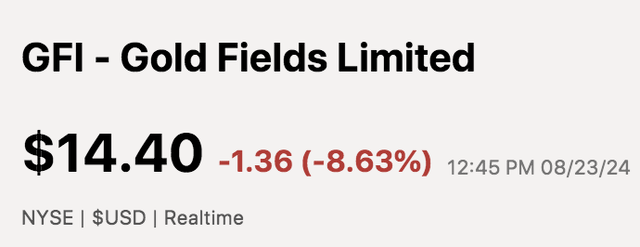

Gold Fields Limited (NYSE:GFI) reported its first-half results on Friday, revealing disappointing figures and a downgrade in its full-year guidance. Investors didn’t like the news as Gold Fields’ stock slipped by nearly 10% after the event.

GFI Stock Price (Seeking Alpha)

We last covered Gold Fields’ stock in June, echoing our neutral outlook about its prospects. However, considering Gold Fields’ topsy-turvy quarter and the market’s subsequent reaction, I decided to update our thesis by commenting on its first-half results.

Herewith is my opinion about Gold Fields’ stock.

A Reminder Of Gold Fields

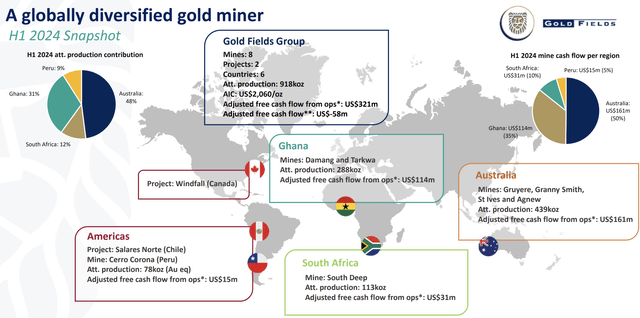

For those unaware, Gold Fields is a South African gold mining company with operations in South Africa, Western Africa, Australia, Canada, and Peru.

The following diagram conveys Gold Fields’ cash flow and production mix.

Operational Framework (Gold Fields)

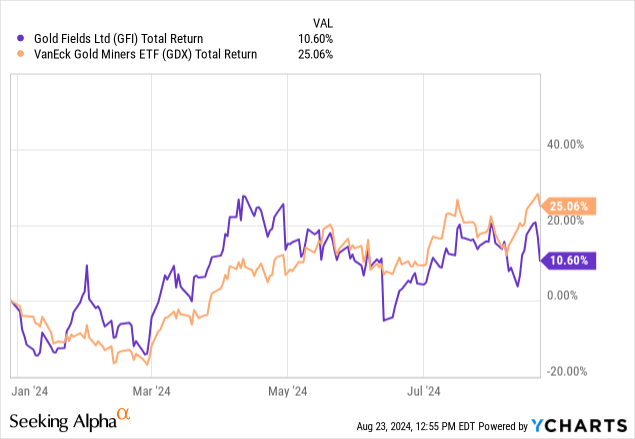

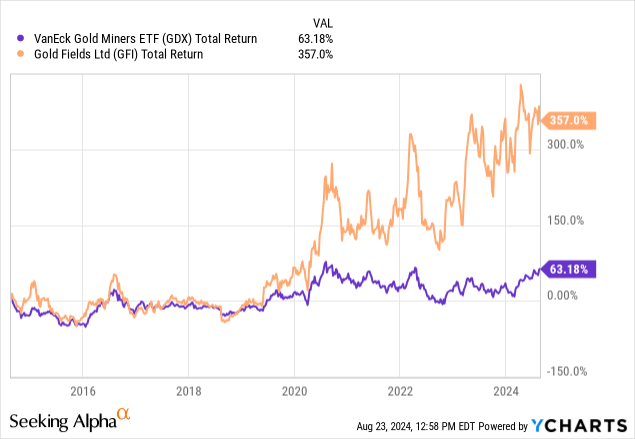

Although it has exhibited positive returns since the turn of the year, Gold Fields has underperformed the VanEck Gold Minders ETF (GDX), suggesting it has noteworthy idiosyncratic influencing variables.

I embedded a longer-term return below to allow a time-series vantage point. As the graph illustrates, Gold Fields has beaten its peer group in the past ten years.

Earnings Review

Headline

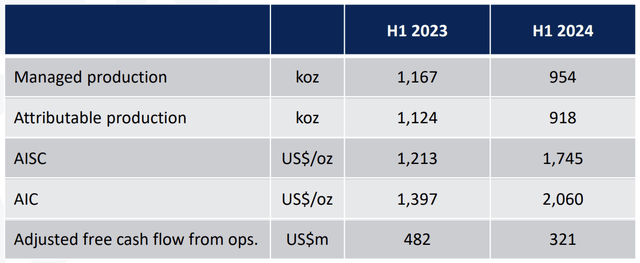

Gold Fields’ first-half managed production crashed by about 22.3% year-over-year to 954,000 ounces. Likewise, the firm’s attributable production slid by about 22.4% to 918,000 ounces, while all-in-sustaining costs increased by 43.86% to $1,745 per ounce.

The company’s amalgamated operating performance ultimately led to a $161 million year-over-year decrease in adjusted free cash flow from operations, conveying a receding trajectory.

Production and Financial Headlines (Gold Fields)

I think it’s safe to say that some might find Gold Fields’ first-half results disappointing. However, what were the primary causes behind Gold Fields’ light performance? What does the future hold?

Let’s look at and address some of its inflection points.

Lower Output From Gruyere and St. Ives In Australia

Gruyere’s production slumped by 20% year-over-year to 127,000 ounces. The root cause was a severe weather event that restricted mining. However, mining resumed in April, meaning production will likely ramp up in the back end of 2024.

Furthermore, St. Ives‘ production slipped by 25% year-over-year to 139,000 ounces. According to Gold Fields, the lower production is attributable to lower grades from underground operations and stockpiles. Despite the mine’s headwinds, Gold Fields anticipates St. Ives’ volumes to rebound by 49% half-over-half.

I have little to add about St. Ives. However, I believe Gruyere’s slump was a non-core event, which can likely be backed out of Gold Fields’ core earnings.

Lower Delivery From South Africa’s South Deep

The South Deep mine’s production fell by 25% year-over-year to 117,000 ounces, mainly due to a fatality incident in January and “reduced stope access due to increased backfill rehandling and slow drilling through crushed ground.”

I can’t speak to the technicalities. However, Gold Fields anticipates volume to increase by 14% half-over-half, which I find believable, given that South Africa’s electricity load-shedding is abating. Nevertheless, regional summer is emerging, which might bring rainfall into the equation.

Lower At Peru’s Cerro Corona

Cerro Corona’s production fell by 42% to 79,000 ounces. The primary reason for the drawdown was the weather and knock-on effects.

Although I think the events can be considered non-core, mining is set to conclude at Cerro Corona as the mine nears its projected 2025/2026 maturity date. Gold Fields will mine stockpiles afterward, but revenue replacement might be an issue as it would likely require an acquisition.

Aside: The production results released within the main section are what I consider material. Gold Fields has other mines—visit this link for a full breakdown.

A Few Positives

Gold Fields’ operating performance led to a downward revision of its guidance. The company anticipates between 2 million and 2.15 million ounces for the entire year, down from its previous forecast of 2.2-2.3M ounces.

Despite its operational headwinds, I see a few positives.

Normalization and Gold Prices

As mentioned throughout the previous section, normalization of operations might occur as many of Gold Fields’ misfortunes were due to non-core events such as weather and below-par grade.

Furthermore, gold prices are on a roll, and this will likely continue into late 2024. Why? A U.S. interest rate pivot seems likely, and economic indicators such as business confidence, annualized GDP growth, and unemployment indicate that systematic risk is heightened. As such, I foresee many traders using gold to hedge against USD tail risk.

XAUUSD Spot (Seeking Alpha)

Additional Links:

- U.S. Economic Indicators.

- Gold To Hedge USD

- USD Vs. U.S. Interest Rates

- Gold To Hedge Economic Tail Risk

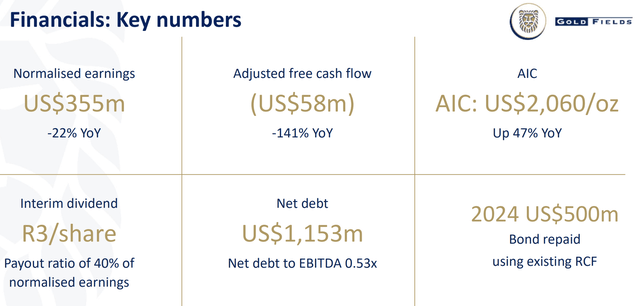

Lucrative Dividends

Another feature that I find compelling is Gold Fields’ dividend policy of 40% of its normalized earnings. The stock has a four-year average yield of 2.89% (recorded before its earnings release). We will likely see Gold Fields’ forward and normalized dividend drop slightly after its latest release. However, I still deem its dividend lucrative and sustainable, especially given the company’s impressive debt coverage.

Aside: Gold Fields has a Net Debt/EBITDA ratio of 0.53, illustrating its debt coverage.

Gold Fields

Buy The Dip?

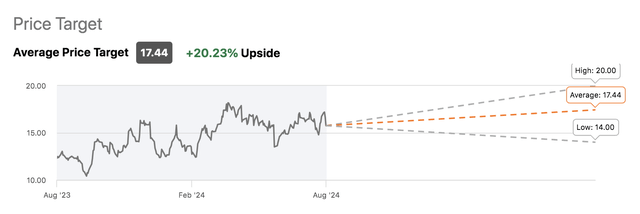

Seeking Alpha samples Wall Street analysts’ price targets. The tool suggests that the average sell-side analyst price target is $17.44, presenting nearly 20% upside potential.

GFI Stock Price Target (Seeking Alpha)

Furthermore, Gold Fields’ post-earnings slump dragged its stock’s relative strength index to the 30 handle, which indicates that the stock might be oversold (30 is considered an “oversold” boundary). Although merely a technical indicator, the RSI is used by many to discover entry points.

Relative Strength Index (Seeking Alpha)

Concluding Thoughts

I deem Gold Fields’ stock an equal-weight asset.

Gold Fields’ post-earnings slump might present an entrance point to some, especially considering the potential normalization of the firm’s mining operations, Gold Fields’ financial market-based indicators, and the momentum exhibited by gold prices.

However, despite its positives, Gold Field’s catalysts probably don’t provide enough to justify an overweight position.