Suphanat Khumsap

More than three years ago, New Fortress Energy (NFE) acquired Golar LNG Partners in a $1.9 billion transaction that likely saved the debt-laden partnership from a potential bankruptcy filing.

Shortly after closing, the partnership decided to delist its 8.75% Series A Cumulative Redeemable Preferred Units (OTC:GMLPF) from Nasdaq.

With the preferred units now trading on the OTC Expert Market, the majority of investors is precluded from trading in the securities except for closing existing positions.

In recent years, Golar LNG Partners has liquidated virtually all of its assets and distributed the proceeds to cash-hungry parent New Fortress Energy.

Earlier this year, the partnership sold its stake in the LNG carrier joint venture Energos Infrastructure to funds affiliated with joint venture partner Apollo Global Management for $136.4 million. In addition, Golar LNG Partners sold its last remaining vessel Mazo for total consideration of $22.4 million.

During Q1/2024, the partnership paid an aggregate $157.0 million in cash distributions with New Fortress Energy pocketing $146.3 million.

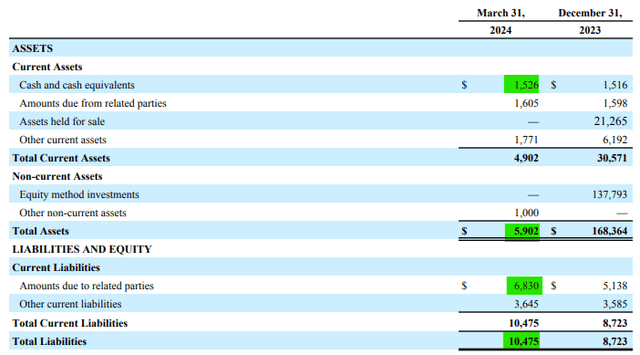

Golar LNG Partners finished the quarter with $1.5 million in cash and $5.9 million in total assets as well as $10.5 million in total liabilities:

Golar LNG Partners Q1/2024 Results

Despite the apparent lack of funds, the partnership managed to pay the regular quarterly cash distribution of $0.546875 per Series A Preferred Unit on May 15 and August 15, likely due to an “irrevocable letter of support” provided by New Fortress Energy as disclosed in Golar LNG Partners’ 2023 financial statements on page F-10.

The ability of the Partnership to continue as a going concern is dependent upon the continued financial support from the ultimate parent undertaking, NFE.

As of April 29, 2024, the issuance date of these consolidated financial statements, the Partnership concluded that it is probable that its continued funding from NFE will be sufficient to fund dividends on the preferred stock, operating expenses, financial commitments, and other cash requirements for at least one year after the issuance date of these financial statements. NFE also provided an irrevocable letter of support whereby NFE has committed to fund such commitments.

While preferred unitholders might find some comfort in the parent’s stated commitment, I wouldn’t bet on the parent’s ability to help an empty shell dealing with $12 million in annual dividend obligations for much longer as New Fortress Energy has been struggling with the refinancing of near-term debt maturities as of late.

As a result, the price of the company’s 2026 Senior Secured Notes has plunged from the mid-90% to the low-80% in recent months:

While New Fortress Energy has secured an up to $875 million backstop commitment for the refinancing of its 2025 Senior Secured Notes, the company’s ability to deal with the $1.5 billion 2026 debt maturity remains in limbo.

Investors looking for more color on New Fortress Energy’s operational and financial issues should read fellow contributor Michael Boyd’s excellent article.

But even when assuming New Fortress Energy getting a handle on its debt issues, the fate of Golar LNG Partners’ preferred unitholders remains unclear. At least in my opinion, the parent is not likely to support the distribution in perpetuity, particularly not under a potential debt restructuring scenario.

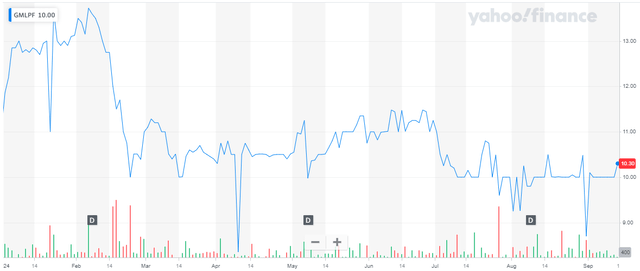

The preferred unit price clearly reflects the above-discussed issues:

While a 22% distribution yield might look enticing, a debt restructuring at the parent level might very well result in distributions being cancelled indefinitely which in turn would likely cause the unit price to drop into the low single digits.

However, should New Fortress Energy regain its financial footing and honor its stated commitments, the preferred unit price might recover some of the recent losses.

For my part, I do not feel comfortable with owning preferred shares of an empty shell dependent on financial support from a struggling parent company.

Consequently, I am rating Golar LNG Partners’ 8.75% Series A Cumulative Redeemable Preferred Units a “Sell“.

Risks

As stated above, New Fortress Energy might very well honor its commitment thus providing preferred unitholders with juicy distributions for many years to come.

Even better, the parent might come up with a tender offer at some point going forward in order to capture some of the current discount to the unit’s $25 liquidation preference.

Bottom Line

Golar LNG Partners’ preferred unitholders require nerves of steel as their juicy distributions are fully dependent on cash-strapped parent New Fortress Energy honoring its support commitment.

At least in my opinion, the potential reward is not worth the elevated risk here. Consequently, I am rating Golar LNG Partners’ 8.75% Series A Cumulative Redeemable Preferred Units a “Sell“

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.