mr.suphachai praserdumrongchai/iStock via Getty Images

When we last looked at mid-cap medical device Globus Medical, Inc. (NYSE:GMED) in November of last year, the stock had fallen by a third due to concerns about the benefits of the large acquisition of Nuvasive it was digesting. I noted at the time that this story was worth watching, and it is now time to circle back to this device maker focused on musculoskeletal disorders. An updated analysis follows below.

Globus Medical, Inc. is headquartered in Pennsylvania. The company is primarily focused on providing a wide variety of devices used in spinal surgeries. It also offers products for knee and hip procedures, as well as robotic and imaging systems. The stock currently trades at around $72.00 a share and sports an approximate market capitalization of $9.8 billion.

September 2023 Company Presentation

The acquisition of Nuvasive last summer was an all-stock merger where Nuvasive shareholders got 28% of the company and Globus Medical shareholders keeping the remaining 72%. The company had complementary product portfolios in the spinal and orthopedic arenas. Management also believes the combination will accelerate the merged company’s global growth prospects and provide other benefits.

Recent Results:

Globus Medical posted its Q2 numbers on August 6th. The company delivered non-GAAP earnings of 75 cents a share, seven cents a share ahead of expectations. This was an increase of 20% from the same period a year ago. On a GAAP basis, the company had a net income of $31.8 million for the quarter. This was driven down by 45% from 2Q2023, primarily by the amortization costs of purchase-accounting-related fair-value step-ups and restructuring costs. GAAP gross profit shrank to 58.7% in the second quarter of 2024, compared to 73.8% in the prior year quarter, due to these factors.

Due mainly to the integration of Nuvasive, revenues rose nearly 116% on a year-over-year to just $630 million, topping the consensus by some $14 million. Musculoskeletal revenue in the second quarter came in at $592.9 million, a better than 130% increase. However, taking out the contributions from the integration of Nuvasive, revenue growth would have been slightly less than four percent on a year-over-year basis. U.S. sales came in just under $500 million, up just over 103% from the same period a year. International growth benefits even more from the pickup of Nuvasive with growth of 182% to $130.2 million. On a pro forma basis, international sales were up only 4.4%.

Management also raised its FY2024 guidance slightly to a range of $2.47 to $2.49 billion. On a pro forma basis, guidance implies three to four percent year-over-year growth sans Nuvasive. Leadership also now projects non-GAAP earnings per share in the range of $2.80 to $2.90.

Analyst Commentary & Balance Sheet:

Despite the Q2 “beat,” the current analyst firm view around Globus Medical. Since second quarter results hit the wires, a half dozen analyst firms, including Oppenheimer and Truist Financial, have reissued/assigned Hold/Sell ratings on the stock. Eight analyst firms, including Wells Fargo and Barclays, see things differently and have maintained/assigned Buy ratings on the stock. Price targets proffered among these optimists range $75 to $100 a share, with most price targets in the mid-$70s to mid-$80s range.

Approximately four percent of the outstanding float in the shares is currently held short. Several insiders sold approximately $6.5 million worth of shares from early March to mid-May collectively, at considerably lower prices than the current trading level of the stock. It was the first insider activity in the stock since May 2023.

Globus Medical ended the first half of 2024 with just over $490 million worth of cash and marketable securities on its balance sheet, according to the 10-Q the company filed for Q2. Globus Medical also listed senior convertible notes of just over $430 million, which are due in March 2025. The company delivered $26.5 million worth of free cash flow in the second quarter.

Conclusion:

Globus Medical posted earnings of $2.32 a share (non-GAAP) on $1.57 billion in revenues. The current analyst firm consensus sees profits rising to $2.85 a share in FY2024 on $2.48 billion in revenues. They project profits of $3.33 a share in FY2025 on sales growth of seven percent.

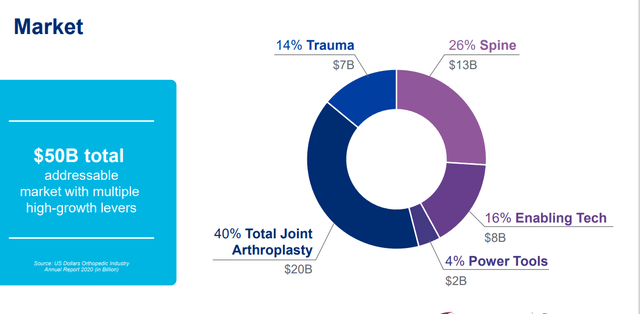

September 2023 Company Presentation

The now merged company is targeting large markets, as can be seen above. Management appears to have a solid job integrating the two companies. Whether to invest in GMED comes down to valuation. Revenue growth will slow to the mid-to-high single digits in FY2025 on more of an apple-to-apple comparison now that the companies are merged.

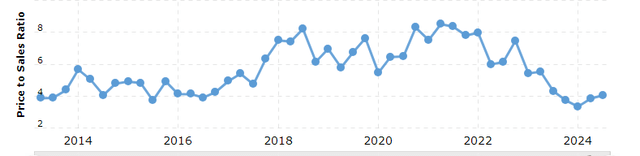

On a price-to-sales ratio, the stock has been in the lower end of its range over the past decade. However, the stock is bumping up against the lower end of its price target range from the bullish analyst firms on the equity. It also has several detractors at this valuation after the stock has risen by over 40% since its recent lows of early May.

Globus Medical, Inc. stock trades north of 25 times forward earnings, a premium over the 22 times the S&P 500 is currently trading at. I think both valuations are overly bullish. Based on the second quarter run rate, the stock has just over a one percent free cash flow yield as well. Hardly compelling. If the stock retraces some of its recent gains and falls back to the mid to high $50s, they would be more attractive at that time.