Portra/DigitalVision via Getty Images

Dear readers/followers,

At times, companies I invest in and hold see market moves that I considered at the time to be unrealistic. One of those things is what the GEA Group (OTCPK:GEAGF) did not that long ago. If you’ve followed my work, you know that I’ve invested in the GEA Group a few times over the past 5 years I’ve written on SA. I’ve both bought, held, and sold the company. I currently own stock in the company. That stock and that position are currently up over 24% inclusive of FX and dividends compared to only 15% for the index, so a positive RoR.

However, in my last article which you can find here, I also went neutral and “Hold” on the stock – which means that anyone following my ratings here did not purchase prior to the significant jump we saw in the company’s price.

So in this article, I’ll look over this failure of forecast, and see what caused it to see how to prevent it in the future. Also, if there’s a reason to raise the PT here because if there isn’t, it might be time to actually sell off my position in the company in favor of something cheaper.

So, let’s see what we have going for us here.

GEA Group – 2Q24 outperformance – but why?

This is an industrial player with plenty of operational leverage and upside. I’ve never made any secret of the fact that I “like” this company – but it’s also required some very careful valuation considerations to deliver market outperformance. It’s also a fairly cyclical business, which influences how I “view” the company.

However, when you understand the basics of what it does, you’ll usually understand why I’m so positively inclined for the company.

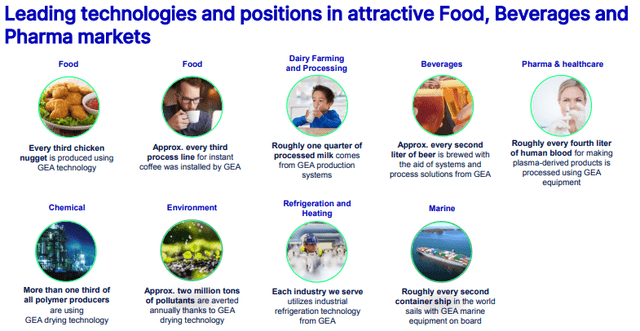

Supplying the industrial sector with must-have systems and products is a good business idea – and this company does this in a variety of markets. We’re talking about things like pharma, food, beverages, dairy, and other things. This company plans, researches, manufactures, and sells your company the machines and industrial assets it needs to “drive” its factories – and it’s also one of the more market-leading businesses in this entire sector.

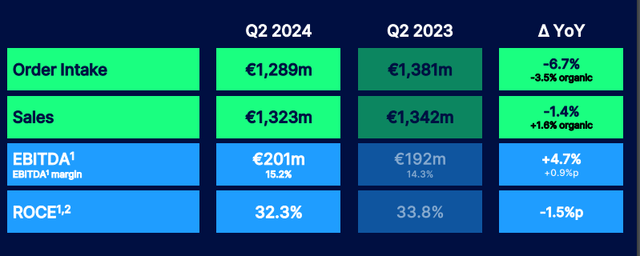

But first, let’s look at the results that have the market in a bit of a craze for GEA here, given the bounce we saw. With an order intake that’s actually “down” 3.5%, it’s initially hard to see what the market is so excited about here. Company revenue is up around 1.6%, but down 1.4% reported, and EBITDA is only slightly up (and that before company restructuring expenses). ROCE is also down, and net working capital is up.

The positives here that the market is focusing on are two. First off, the company got raised ratings by both Moody’s and Fitch, confirming the company’s current moves to increase its stability and fundamentals. Secondly, the company did, despite declining order intake and revenues, raise its overall profitability and as a result of this, raise the expectations for the full year. This is why things are seemingly so positive for GEA.

It’s no secret that these are difficult times for a player like GEA, but also for most industrial players. So for a company to actually increase its overall results here, despite the ongoing macro, that’s a positive. EBITDA increase of almost 5%, and due to a higher amount of gross profit, with margins improving to over 15% means the company is now at one of the better margins in the entire sector here.

In a way, the company is doing what construction and infrastructure businesses in Northern Europe have been doing for a few years now – improving its overall trends and margins by being more selective with contracts. GEA is doing the same here.

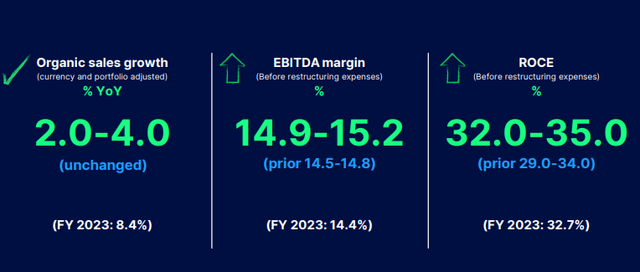

FY Guidance is now raised.

The rating increases put the company firmly into the IG rating spectrum, with positive outlooks for its BBB and Baa1 ratings. GEA recently completed a share buyback of around €400M, during which it bought back nearly 3% of SO. These individual measures and results are the reason why the share price a bounced to the degree that it did, as larger players loaded up on GEA shares.

Unlike other companies in these segments, the company still maintains a fairly large segment organization. GEA’s operations are split into SFT (Separation & Flow tech), LPT (Liquid & Powder tech), FHT (Food & Healthcare tech), HRT (Heating & Refrigeration tech), and FT (Farm Tech). All of these various segments with the exception of LPT saw EBITDA contribution positivity for the 1H24 period, and the company’s cash generation was at a strong level, with a 62% cash conversion ratio.

The remainder of 2024 looks like a positive period. We’ve 3Q in 2 months, at which point we’ll see if there are any “worries” here for the full year, but the margin improvement we saw here coupled with the other positives are explanations for why the company is up this much in as short a time as we’re seeing.

The fundamentals are the reason why you should consider GEA Group to be an interesting play. I’ve spoken to some of these reasons before, and here is an example of them again.

The company has a continued track record of profitable growth, good cash generation, an attractive risk profile provided you buy the company cheaply and is well-positioned into several of the leading industries affected by demographic and macro indicators for growth – such as population, urbanization, and the like.

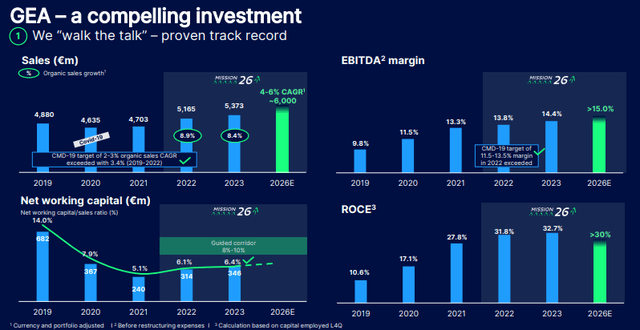

Obviously, no company is completely without risks, and we’ll get into these risks later in the article, but I want to be clear in the fact that I do expect GEA to continue to grow. Its exposure to new technologies is non-trivial. We’re talking about things like new food segments, decarbonization tech, carbon capture, lithium and chemical processing, manure enriching, and the like. Its current plan, called “Mission 2026”, tracks the company’s sales, EBITDA margins, and ROCE, which are all set to improve over the next 2 years. And some of these, like EBITDA margin, are already “there”.

On a divisional level, there are also KPIs that are tracked, and most of them are meeting the organic growth and performance targets. FHT is a bit low, but it’s the company’s lowest-margin segment, with SFT (separation and flow tech), leading the margin charge at over 26% EBITDA margin. The lowest segment is 7.6%, which is still “good” in terms of generating profit.

The main problem for the company here is valuation-related – so let’s get into that.

GEA Group – The ADR move doesn’t represent in full the native, and the valuation is so-so.

The first thing to understand here is that the ADR move, as quick as it was, for GEAGF did not really represent the native movements. The native ticker G1A as moved up much more slowly. It’s also wrong to say that this level of valuation is unheard of or unexpected because it’s not. A €40/share price is actually fairly average for what the company has been doing for the past 5 or so years.

The issue with GEA is that it has moved from a premiumized position of around 20x P/E to more than 15-17x P/E. And the thing is, I don’t see much reason why the company should be meaningfully above this level either – not with only a 2.5% yield (that’s well-covered), BBB rating, and a growth rate, that outside of 2026E is expected to average no more than 2-4%.

It’s a good company – but it doesn’t mean you should say it’s worth 20-25x P/E.

I would say the company at this time can return something along the line of an 8-10% annualized RoR at 15-16x p/E. This is not good enough for me, and you should really consider if it’s good enough for you. The current analyst expectation is for the company to generate EPS growth on an adjusted basis of 1-9% yearly between 2024-2026E, and for this growth to be heavy on the tail-end, 2026. (Source: F.A.S.T Graphs paywalled Link)

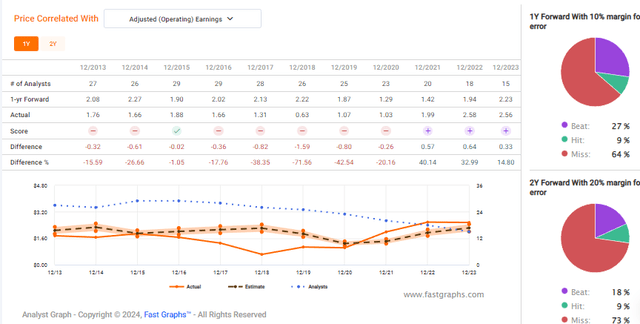

And here is the reason why I consider any forecasts above the average to be somewhat suspect for this company.

GEA Group Earnings Forecast Accuracy (GEA Group Earnings Forecast Accuracy)

I believe it’s fair to say that the GEA group came out of a very negative trend that lasted over 10 years and has been outperforming for 3 years. But this does not take away from the fact that the company is a volatile and uncertain investment, no matter how “positive” some indicators here are.

You could make an argument here that the company’s 20-year average is closer to 21x P/E, and that such a valuation would imply a share price of €65/share and an upside of 25% per year. I would then point out that this would require the company to go up around 66% while only growing 4-5% at current estimates for the next 2-3 years per year.

The ADR GEAGF is a 1:1 SHARE, meaning that 1 equals 1 of the native. The yield is also fairly accurate. My PT for GEA would continue to be along the level of €37 native, coming to around $39 for the ADR, which means the company is slightly overvalued here. I’m raising my own PT a bit to reflect the outperformance and upside potential. I am not selling my shares, but I’m also not adding more to my position here.

Risks for GEA are as follows.

Risks for GEA

Mainly valuation-related. The company is foundationally safe and has operational leverage and good management. The one crux is that you’re currently paying in excess of what I consider the company to be worth. Because I don’t invest in overvalued companies, and I’m careful about what I pay, this is not a time for me to invest more. I’m keeping my position and keeping an eye on GEA Group.

If you’re interested in buying here, you should either believe in significant outperformance potential and premiumization, or you should be prepared for some time of what I consider to be sub-par returns.

Otherwise, there are better options out there.

Thesis

- GEA Group is a market-leading name in the food processing and other processing systems industry. The company is a market leader with excellent tradition and overall safety. It has no net debt, and it’s a net beneficiary of overall macro trends, including demographics, urbanization, and food consumption. This is the sort of company I like buying.

- I want a 15% annualized RoR for this company. At this valuation and these prospective growth rates, that is not an easy estimate to find on a realistic overall basis. Because of that, I am changing my rating on the company to a “HOLD” from a “BUY”.

- That is the background for my change in my stance here – but I’m keeping what I have in GEA.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansions/reversions.

The company no longer fulfills my criteria – at least not more than 3 of them, which is why I am more careful here and consider the company a “Hold”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.