dem10

Maybe you are thinking: ‘Ugh… All right, another analyst talking about how great Bitcoin is and how it will revolutionize the financial market.’ Yes, here I am, but this time, I will share with you an interesting and particular parallelism that really blew me away. In my opinion, there are many reasons to remain bullish on Bitcoin; a curious combination of Halving, fiscal and monetary policy, global instability, and the emergence of new investment channels in crypto (ETFs) could really lead to a significant explosion in the price of Grayscale Bitcoin Trust ETF (NYSEARCA:GBTC).

A strange parallelism between halving and market cycles

Hasn’t anyone noticed a strange parallel between the advent of the halving and the end (or the beginning, depending on the perspective) of a short-term economic cycle, in the style of Ray Dalio? Let me explain better.

First of all, everyone knows how halving works; in simple terms, the BTC halving is a scheduled event that occurs approximately every four years, during which the reward for mining new blocks is halved. Essentially, it is a mechanism designed to control inflation and incentivize the long-term value of Bitcoin. Focus on that: ‘designed to control inflation.’ In my honest opinion, this slogan behind the Bitcoin ecosystem sounds really good, especially in periods like this. Bitcoin was born in 2008, after the great subprime mortgage crisis, as if it were the answer to a malfunctioning ecosystem, ruled by inefficient mechanisms.

I would like to focus your attention on this: every 4 years (on average), the reward for mining new blocks is halved. Do you know Ray Dalio’s economic cycle theory? It divides market cycles into two main categories based on the time frame: the one we are interested in is the short-term cycle. This cycle typically lasts from 5 to 10 years and is based on the normal ups and downs of the economy, driven by expansions and contractions of credit. These cycles are characterized by periods of economic growth followed by recessions, primarily influenced by the monetary policies of central banks.

If we consider the last 15 years, starting from 2008, we could say that this ‘mini cycle’ happened with a 4-year frequency: 2008, 2012, 2018, 2022 (and to be truthful, also in 2020). The Bitcoin halvings have occurred in 2012, 2016, and 2020. It almost seems as though Bitcoin is mocking the traditional economy. When the value of fiat currency decreases due to politics and monetary policy, the value of Bitcoin rises, sustained by mathematics, not policymakers.

Why am I bullish on GBTC?

Now, I’m really confident about the rise of GBTC. For several reasons, all of which are oriented around the same concept: ‘BTC price is destined to go up as long as the traditional ecosystem continues to function like it has in the last decade.’

What will likely happen:

It is very likely that rates will be lowered in September

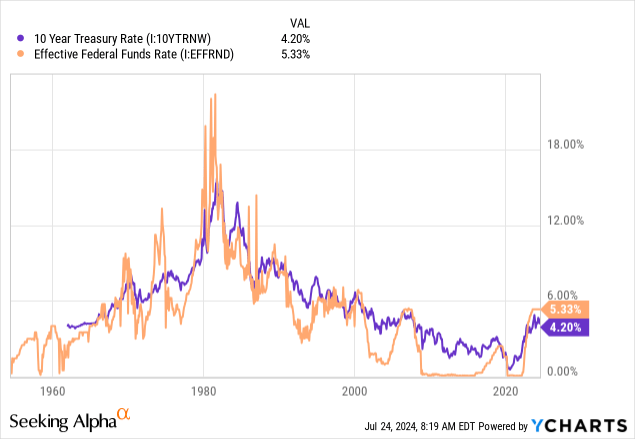

Everyone is talking about the September interest rate cut. According to the Fed Watch Tool of CME, the probability of this event is 100%; practically, the market is assuming with certainty a rate cut in 2024, as Powell mentioned in the last FOMC meeting. So, traders are trying to price the market considering this event, and naturally, it’s causing a downtrend in Treasury yields and a fall in the most speculative markets, like high-tech (Nasdaq 100).

Currently, the yield on 10-year Treasuries is around 4.26%, while the price of Fed funds futures for September 2024 is 94.775, which implies an expected interest rate of approximately 5.225%. At present, the Federal Funds rate in the United States is between 5.25% and 5.50%, so the market is currently certain that the Federal Reserve will begin cutting rates in the upcoming meetings.

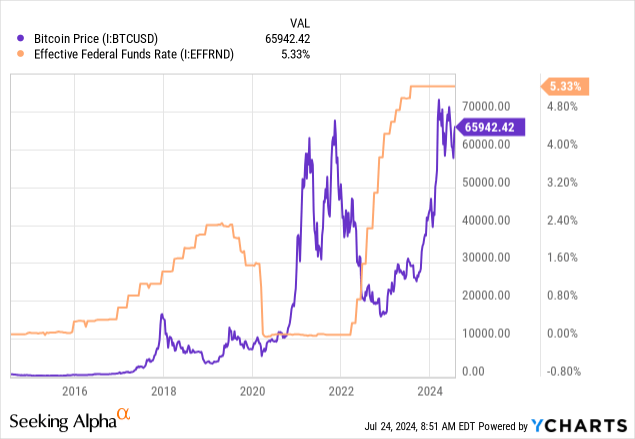

I’m starting by saying that, historically, cutting interest rates has been associated with a rise in the BTCUSD price. Now, I would like to add another technical consideration before moving on to another point of view: when the market starts to anticipate a Fed rate cut, the BTCUSD price begins to rise. Naturally, Bitcoin has a short data history, but this happened in 2018. To be more specific, when the effective federal funds rate reached its peak, the BTC price started to go up, and the same happened in 2023. After the initial surge, the market began to take profits, and sentiment in the decentralized world declined along with market capitalization.

What happens then? A very curious thing occurs: when interest rates start to go down and sentiment returns to a state of fear (as measured by the Fear & Greed Index, which we will look at later), the BTCUSD price surges, reaching new unexpected highs.

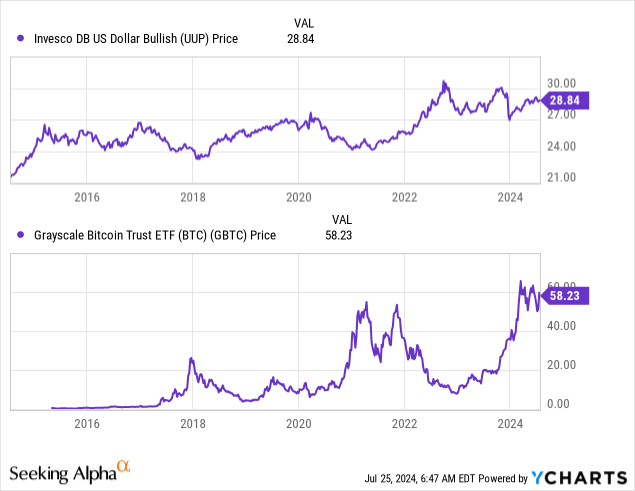

The dollar could likely go down

I have already explained in this content why I really think that this is not a great moment to be exposed to the dollar. Historically, there’s an inverse correlation between the Bitcoin price and the dollar. I believe that when the dollar value, measured by the DXY index or the UUP ETF in this case, starts to go down, the value of assets priced in dollars becomes more attractive to buy. It’s an easy commercial mechanism, but in the end, it also regulates the stock market. For example, in this situation, the price of commodities and stocks in emerging markets starts to go up.

Even though it’s a bit old, I think this article explains the correlations regarding Bitcoin well.

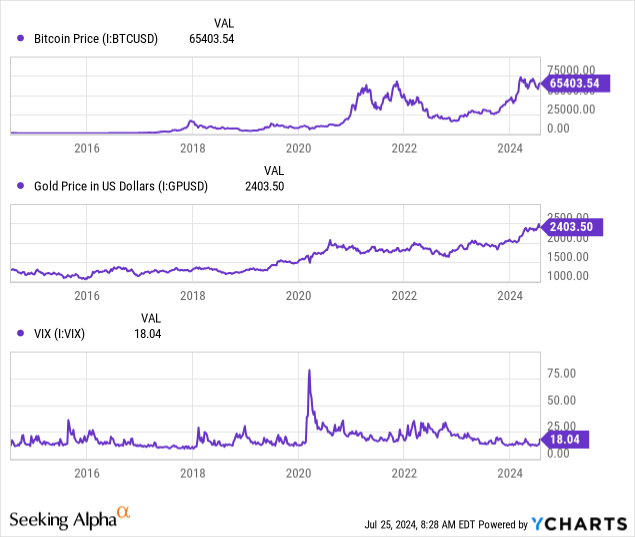

Fear is rising, and global economic and political instability is growing

Greed is up, both in the traditional market and in the decentralized market as well. The Fear and Greed index by CNN shows market sentiment very well: the indicator has reached 41 points, the FEAR zone. At the same time, the Fear & Greed Index by CMC is a little better, at 59 points, indicating a neutral zone. This expresses a better sentiment in the cryptocurrency market compared to the stock market, where there is a lot of pessimism now. The reason? In my opinion, it’s the great sense of loss among investors. At this moment, political and economic uncertainty reigns supreme. The CME volatility index, VIX, is near its minimum, and after touching the lowest point in the last five years, it suddenly started to rise rapidly.

In particular, Bitcoin seems to thrive on political instability, which ‘strangely’ appears every four years during the US presidential election. Indeed, there is a great correlation between VIX and BTC, but there is a strong positive correlation between BTC and Gold. Gold reacts very well to economic predictions, and Bitcoin, in my opinion, follows with a little latency and much more volatility.

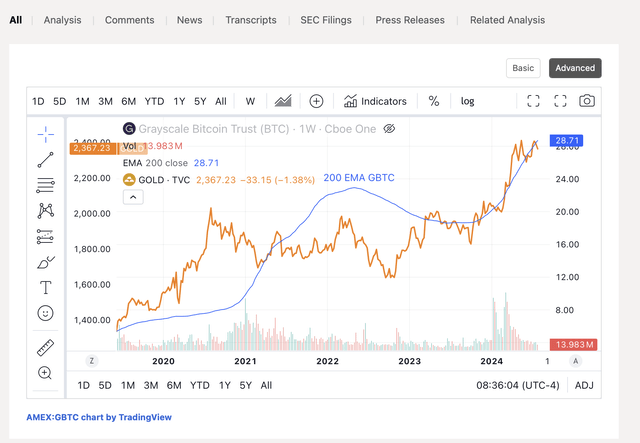

This lack of confidence is like fuel for the crypto market. While many people criticize Bitcoin, affirming that it is not a safe haven like gold, I suggest trying to stop analyzing BTC on a normalized chart and start looking at it on an exponential chart or with its 200-moving average. Trust me, suddenly everything will become clearer

GBTC EMA 200, GOLD (SEEKING ALPHA ADVACED CHART)

Why GBTC?

In this article, I don’t want to spend a lot of words explaining why I chose GBTC to invest in Bitcoin; I think you can find a great explanation here.

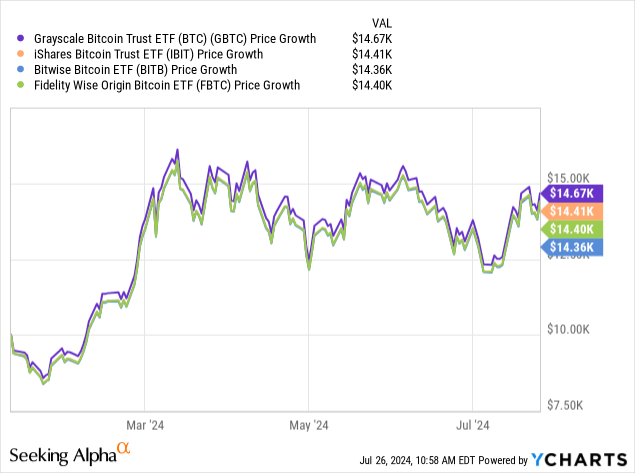

I would like to focus on one thing that is usually undervalued: the weight of an expense ratio. As you may already know, the expense ratio for GBTC is 1.50%, which is higher than its competitors, since the time it was a closed-end fund. There are alternative ETFs on the market with lower costs; one that I also like is iShares Bitcoin Trust ETF ((IBIT)) by BlackRock.

At the same time, if we consider the performance chart since the launch of the other ETFs, investing 10K in GBTC has yielded more compared to its peers. Maybe tomorrow, the cost of this ETF will eat into its performance, but for now, GBTC remains the most profitable alternative on the market.

What could go wrong?

Even though the market is confident, or rather certain, that rates will drop in September, the Federal Reserve has not officially commented on this and will not do so until September. I think that, for several reasons, the Fed will eventually be forced to cut the interest rate. However, if there’s something I hate about the markets, it’s when they discount something with certainty. From the moment this certainty becomes uncertain again (for whatever reason), panic ensues in the market. If the Fed were to postpone the first rate cut in September once again, I think this would not bode well for Bitcoin. In my opinion, it wouldn’t invalidate my thesis, but it would most likely delay the appreciation of the cryptocurrency.

Conclusion

I think that at this moment, GBTC is one of the best opportunities in the market. I’m bullish on the crypto market, especially on Bitcoin. I’m really confident that this fund could grow in the long term, but at the moment, there are also macroeconomic and mathematical data that support my thesis, and for this reason, I see an alpha to benefit from.