Pgiam/iStock via Getty Images

Investment summary

Highly commoditized industries – such as the automotive parts + equipment industry – are largely undifferentiated in any consumer-important way, such as product, price, or functionality. Successful businesses in these domains have either 1) production/pricing advantages, or 2) consumer advantages through differentiation of offerings. Both can be attractive plays given the right economics [high ROICs, economic profit above a 12% threshold, extensive reinvestment runway, and so forth].

This thinking brought me to analyze the investment prospects of Garrett Motion Inc. (NASDAQ:GTX).

Investment thesis

Located in Switzerland, Garrett Motion specializes in solutions for emission reduction and energy efficiency, predominantly for the automotive industry. The company designs, manufactures, and sells highly engineered turbocharging, air and fluid compression, and high-speed electric motor technologies to original equipment manufacturers (“OEMs”) and distributors within these domains. Garrett’s expertise spans internal combustion engines (“ICE”) – these are your conventional motors using gasoline, diesel, natural gas, and so forth – as well as zero-emission technologies that use hydrogen fuel cell systems.

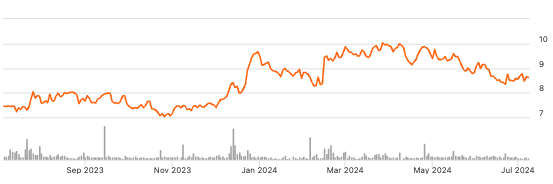

Figure 1. GTX 12-month price evolution

Seeking Alpha

I am buy on GTX given 1) high-quality business fundamentals [25% trailing ROICs that are +500bps since FY’21, capital turnover ~2.6x], 2) economic value on these investments is >12% with management creating ~$17 in EP/share in FY’21 alone, 3) highly compressed multiples at ~9x NOPAT and 2.3x capital despite large multiples expansion over FY’21-’24. I see the valuation calculus as skewed to our favour with the margin of error dampened in paying <10x trailing NOPAT for a quality business with firm leadership. With (a) the productivity of GTX’s operating capital and (b) the spread of ROIC over our 12% hurdle rate on this alone, the stock is worth ~$12/share in my view, ~40% upside potential on today’s price. Net-net, rate buy.

Note: All per share amounts in this note are on a diluted weighted average basis, reflecting all stock held in treasury, and all preferred outstanding prior to conversion.

Why GTX is a great business

GTX has hard-to-replicate business advantages that show up in its abnormally high returns on capital required to operate the business. Its offering has obvious pricing + consumer advantages that are reflected above industry pre-tax margins [12.8% EBIT margin vs. industry, 4th on the list behind (GNTX), (DORM) + (XPEL), respectively] and capital turnover >2.5x on below-average gross margins of ~19% [indicating it prices offerings <industry averages].

The key reason behind this competitive advantage is its leading market position – GTX is the no. 1 maker of turbochargers for ICEs. Holding this place evidences quality, as the sector is characterized by predictable business dynamics and design wins mapped out years in advance.

Additional factors of quality include:

- Starting with the value drivers – returns on capital are +500bps since FY’21 as management has stripped capital and assets from the business. GTX has ~$1.5Bn of net capital directly employed in it and invested into operating assets vs. ~$1.9Bn in FY’21. Sales are ~$130mm cumulatively higher since FY’21 (TTM basis) but the investment required to produce $1 of sales has reduced drastically. Management has shed capital through (i) asset divestitures and (ii) buybacks [it still has ~$150mm remaining under its buyback program in FY’24, having completed ~$150mm]. Capital turns are now >2.5x on ~10% NOPAT margin, producing ~13% economic profit (“EP”) spread over our 12% hurdle rate. This is attractive – anything where $1 capital produced >$2.50 sales is exceptional.

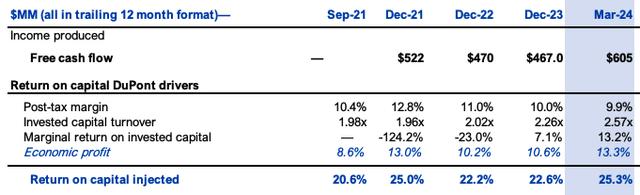

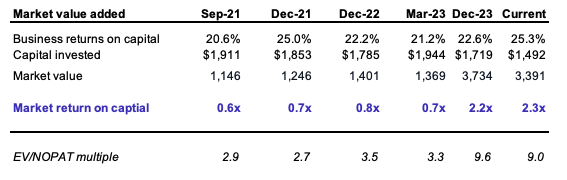

Figure 2.

- These returns are highly durable and suggest an extensive duration of excess spread above the 12% hurdle rate – With management’s capital allocation decisions, ROICs are +300bps since FY’22. Then I assume the competitive advantage period (“CAP”) was ~11 years and this has >4 years to ~15 years. Whether the 15 years is correctly implied or not isn’t the point – what is, is the increase in ROIC and what it means for GTX’s competitive advantage. In my view, it has 1) strengthened, and 2) lengthened its runway.

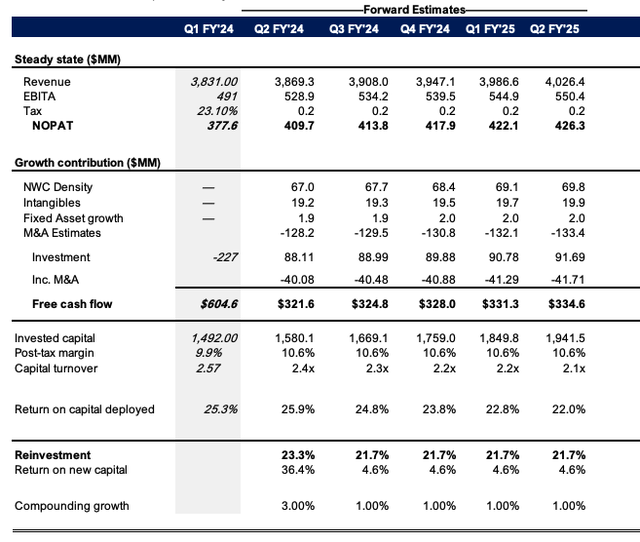

Figure 3.

Company filings

- These figures imply ~$3.9Bn in FY’24 sales stretching to >$4Bn in FY’25, calling for ~1-3% YoY growth respectively [see: Appendix 1]. I assume no further divestitures and capital reinvestment of ~20-23% of NOPAT. This suggests GTX could throw off ~$300-$330mm in FCF each 12 months, ~17% of current market cap. I include the fade rate of ~6% as in Figure 3, compressing ROIC to 22% by FY’25, and capital turns back to ~2x.

Attractive valuation

I believe GTX is undervalued given the company’s current market position and future growth prospects. The likely FCF + EPs over the next five years is roughly double the current stock price, and management has created at least ~$17/share in EP since FY’21 in my view.

My view is GTX is worth ~$12-$13/share today and this value gap could be filled by FY’26E. At starting valuations of ~9x NOPAT, there is low risk of permanent loss of capital in my view.

Valuation insights

- Prior to Q1 FY’23 the stock traded at a discount to book capital before investors expanded this to ~2.3x as I write. It is an expansion as 1) book capital was only -$500mm since FY’21, but the market cap jumped from ~$1.3Bn to >$3.7Bn as the company converted its series A preferred into commons in June last year. Hence, the company is now “worth” 2.3x invested capital, but on a pro-rated basis the share price is up from the ~$5s to the $8.60s where is trades now.

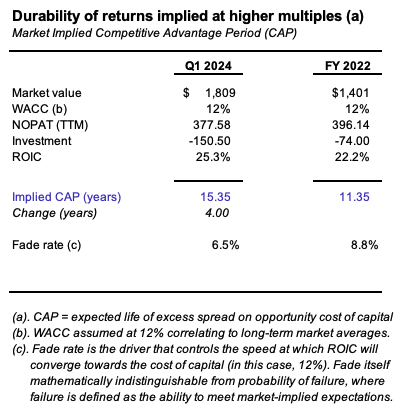

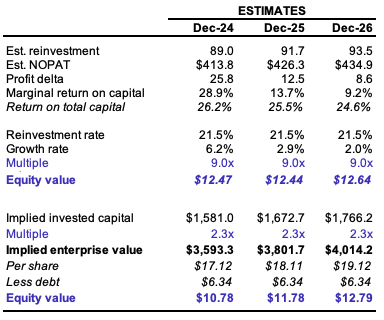

Figure 4.

Author’s estimates

- The valuation was stable prior to the conversion and presuming it stays relatively stable ahead then I get to ~$12.50-$13/share in implied value today – this is supported by 1) the +500bps ROIC growth since ’21, 2) the higher capital productivity as a result, and 3) the flywheel built from its ability to reinvest at these rates going forward. My presumption is for 26% ROIC in FY’24 fading at 6% p.a. to the long-term mean. This equals ~9x P/NOPAT (or ~4.8x EV/NOPAT inc. ~$6/share debt).

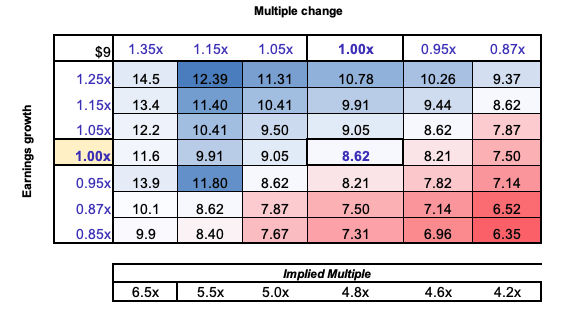

- The margin for error is low at the statistically low multiple and my numbers have +6% growth this year and GTX could still trade flat with a compression to 4.6x EV/NOPAT (Figure 6). On the upside, the +6% growth with a move to 5.5x gets us to ~$10.40/share. The valuation calculus is skewed to the upside.

Figure 5.

Author’s estimates

Figure 6.

Author’s estimates

Potential catalysts for price change

There are several LT catalysts I have identified that could propel the business forward over our three- to five-year investment horizon, namely:

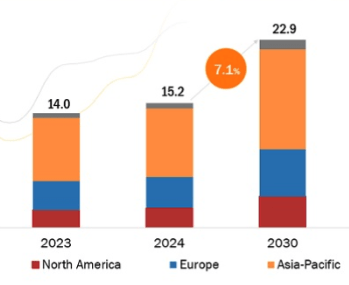

- Increased penetration of turbochargers: The ongoing adoption of turbochargers in ICE vehicles continues to drive growth, despite the rise of electric vehicles (EVs). The fact is that 1) engine sizes are shrinking 2) these require greater boost from forced induction, 3) turbochargers enhance output by recycling exhaust gases such that 4) CO2 emissions are reduced. The market for turbochargers in vehicles is projected to grow CAGR 7.1% to 2030 with severe under-penetration in Europe and APAC. Regulatory factors could be a risk factor to this in my view, a fact I am aware of.

Figure 7.

Markets and Markets

- FY’24 guidance maintained with confidence, suggesting +200bps sales growth at the upper end and ~100bps reduction in light vehicle production sales. Management sees ~15% battery electric vehicle penetration by FY’24 with ~4.5% R&D reinvestment vs. sales, the bulk of which to be put into zero-emissions development. It looks to throw off ~$620mm in FCF in this. These are stable with prior outlook and support my case to ~$3.9–$4Bn sales these next 2 years on ~$410–$430mm in post-tax earnings [see: Appendix 1].

Risks to thesis

Downside risks to the thesis include 1) EV penetration rates: at reasonable EV penetration rates, GTX’s revenue growth may flip from positive to negative due to competition, 2) management misallocating FCF on EV-related acquisitions remains, and 3) the broader set of macroeconomic risks that must be factored into all equity appraisals, including the rates/inflation axis and potential geopolitical risk spillover.

In short

Starting valuations at ~9x NOPAT support a buy for GTX on the basis that 1) the business produces >20% returns on its operating capital, 2) management is unlocking value via reinvestment + buybacks, 3) the preferreds conversion headwind is settled, meaning after all this 4) the margin for error is low in my view. On the upside, the stock is worth ~$12/share in my view, on the downside it looks worth about what we pay for it today. Net-net, rate buy.

Appendix 1.