MoreISO/iStock Editorial via Getty Images

Gannett investment thesis

For decades, newspaper companies like Gannett Co., Inc. (NYSE:GCI) have had to adapt to the new technologies that gave us the Internet, digitization, and more.

The company behind USA Today is getting closer to what it calls an inflection point, where new digital revenue that will offset and eventually surpass its print losses. The latest quarterly report indicates it is headed in the right direction.

But it is still displaying red ink and investors need to be patient. This is a company with promise, but we await proof it can make a profit and use those profits to drive new growth.

About Gannett

This now more than a century-old media company is also a creature of the digital age. In its 10-K for 2023, it calls itself a “diversified media company with expansive reach at the national and local level dedicated to empowering and enriching communities.” It operates through four major brands:

- USA TODAY NETWORK, which comprises its national publication USA TODAY, as well as local media organizations in the U.S.

- Newsquest: A wholly-owned subsidiary operating in the United Kingdom.

- LocaliQ: A digital marketing solutions provider serving the small and medium-sized business sector.

- USA TODAY NETWORK Ventures: This is its events division, which “creates impactful consumer engagements, promotions, and races.”

Reporting is done through three segments:

- Domestic Gannett Media

- Newsquest

- Corporate and other: Includes functions such as legal, finance, and marketing.

Newsquest just emerged as a separate segment in the fourth quarter of 2023.

The company expanded significantly in 2019, when it merged with New Media Investment Group Inc. At the time, New Media was one of the country’s largest publishers of locally based print and online media. Its 152 daily papers and other assets bulked up Gannett’s presence domestically.

At the close of trading on June 28, its share price was $4.61 and its market cap was $641.21 million.

Digital and print competition

Gannett competes with thousands of other newspapers, online news sites, and more. Because Internet access is now cheap and easy, there are few barriers to entry in the news and digital information sphere.

Still, the firm has plenty of reach. It claims in the 10-K that is reaches half of U.S. adults through USA TODAY and local media brands. It also has the fourth largest digital audience in the News and Information category. Further, it points out, “our content reaches more people digitally than Fox News Media, CNN Network, CBS News, New York Times Digital, or WashingtonPost.com,”

Overall, its websites attract 187 million monthly unique visitors, which is almost 55% of the United States’ 2024 population of 342 million.

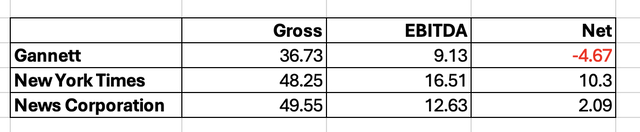

So, Gannett has at least scale as one of its competitive advantages, particularly over smaller and less integrated media firms. However, its margins are weak when compared with two other publishing giants, The New York Times Company (NYT) and News Corporation (NWSA):

GCI comparative margins table (author)

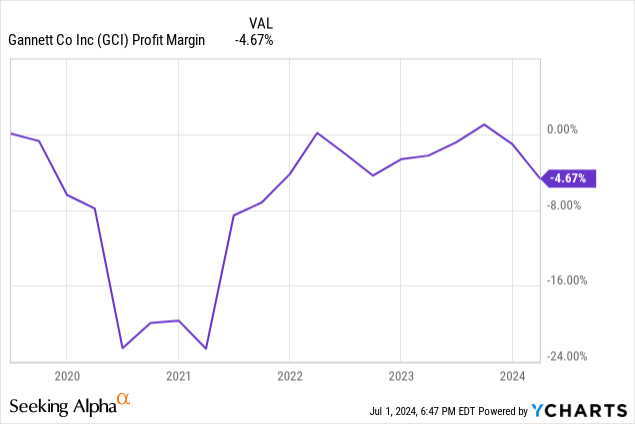

The net margin has been an Achilles Heel for Gannett over the past five years, stubbornly remaining negative:

The negative net margins suggest Gannett has a narrow moat, if it has one at all.

Management and strategy

CEO Mike Reed has been with the company since 2006. Originally, he had been the CEO of GateHouse Media, a subsidiary of New Media, which merged with Gannett in 2019. Previously, he had been President and CEO of Community Newspaper Holdings, and for multimedia company Park Communications.

CFO Doug Horne joined Gannett in 2020, and has more than a quarter century of experience in the entertainment, media, and technology industries. Previously, he held senior financial positions at The We Company and Warner Media.

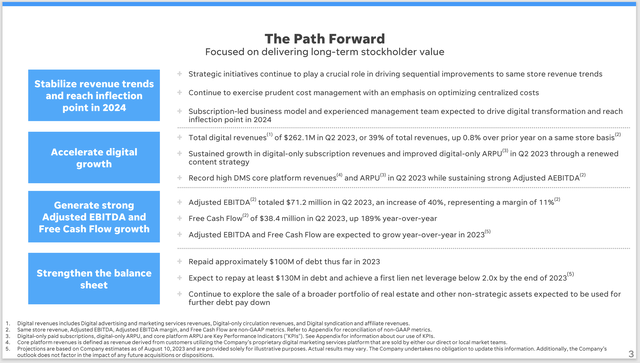

Gannett’s strategy is to deliver long-term strategic value; in its presentation to the Citi Global Technology Conference in September 2023, it saw four tactics that would take it toward that goal:

GCI strategy and tactics slide (Citi investor presentation)

Within those four tactics, digital growth is the one that gets the most attention. As its print revenues fade, digital is the primary means by which it intends to grow profitably.

Stabilizing revenue trends means it is working to reach what it calls an inflection point, where the growth in digital revenues outpaces the loss of traditional revenues.

Adjusted EBITDA and free cash flow refer not only to profitability, but also making cash available for growth, whether organic or acquisitions. The firm does not pay a dividend.

Strengthening the balance sheet refers to repayment of debt taken on during the New Media-Gannett merger in 2019. Gannett is making good progress, reducing its outstanding principle from $1.76 billion in 2019 to $1.1 billion in Q1-2024.

Comments: senior managers appear to have the experience and expertise to continue leading the company toward that long-term shareholder value. On the individual tactics of the strategy, the firm has been making progress across the board. Most importantly, digital revenues are growing, and the company should hit its target of reaching the inflection point this year.

Financial reporting

Gannett released its first-quarter 2024 results on May 2, and the key points were:

- Total revenue was $635.8 million, down 5% from the same period last year. It’s also better than the 8.4% decline in Q4-2023. Total digital revenues were up 8%, while its ‘same store’ revenues were down 5.1%.

- It had a net loss of $84.8 million, including an impairment charge of $46 million due to exiting its leased facilities in McLean, Virginia.

- Adjusted EBITDA fell 8.4% compared to Q1-2023.

- Cash from operations hit $22.5 million, $15.7 million higher than the same period last year.

- Free cash flow expanded to $9.5 million, an $11.5 million improvement on the same quarter last year.

- At the close on March 31, it had cash and cash equivalents of $93.3 million.

- Its total debt outstanding dropped to $1.114 billion after a repayment of $16.3 million.

In the Q1 earnings call, management sounded optimistic. As CEO Mike Reed put it, “As you will hear throughout the call this morning, our momentum continues to build, and we believe our first quarter results have set the tone for a promising 2024.”

He added, “Year-over-year revenue trends were a bright spot in the quarter, reflecting the most pronounced sequential trend improvement in nearly 3 years.”

Much of that optimism is based on digital revenues increasing; in Q1, digital provided 42% of total revenue, moving it closer to its 50% target. Management also was bullish on its print and commercial business, which is being optimized, “As a result of our efforts, our overall print trends saw sequential improvement in Q1, and we expect to continue this momentum moving forward.”

Growth

Management wrote in the 10-K, “Our strategy prioritizes maximizing the monetization of our audience through the growth of increasingly diverse and highly recurring digital businesses. We expect the execution of this strategy to enable us to continue our evolution to a predominantly digital media company.”

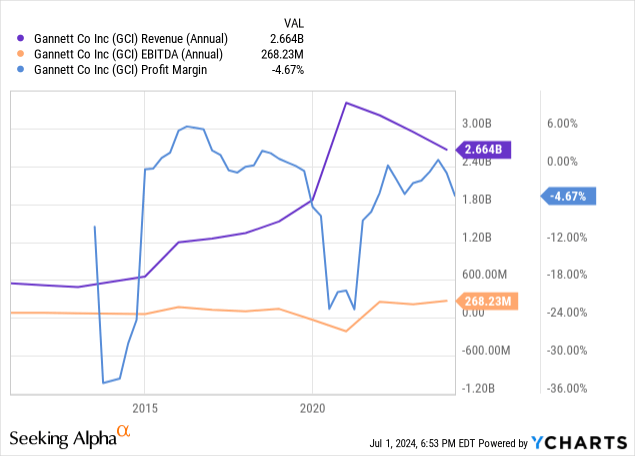

This 10-year chart shows the company slowly growing its EBITDA and net income, while its total revenues erode:

In its Q1-2024 investor presentation, it provided guidance for the rest of this year, 2025, and beyond. The outlook includes:

- Revenue: for the full year, it expects total revenue growth to be nearly flat, while total digital revenues increase by 10%. In 2025 and subsequent years, it expects over 10% per year from digital.

- Net income/loss: for this year, it is expected to improve, but will be negative because of a charge related to the closure of some of its offices. In 2025 and beyond, net income should be positive.

- Adjusted EBITDA: continuing growth this year and in subsequent years.

- Free cash flow: should be positive this year; for 2025 and beyond, it expects compounded annual growth of 40% per year.

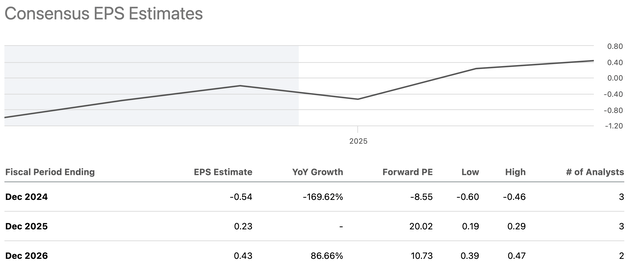

The Wall Street analysts who have published estimates see profits coming in 2025:

GCI EPS estimates – Wall Street analysts (SeekingAlpha )

Comments: the estimates of the analysts are more cautious than those of the company. Both assume more momentum on the digital side of the business, and reduced costs from lower interest expenses. In addition, Gannett is enacting other cost controls that should help the bottom line.

And, the company has the trend to digitization as a tailwind, along with growing cash resources as EBITDA and free cash flow expand.

Valuation

Remarkably, for a company that hasn’t yet turned the corner to profitability, its share price has had quite a run over the past year:

GCI price chart (SeekingAlpha )

However, the charts are less attractive over five and ten years. A decade ago, shares were trading in the mid $20s.

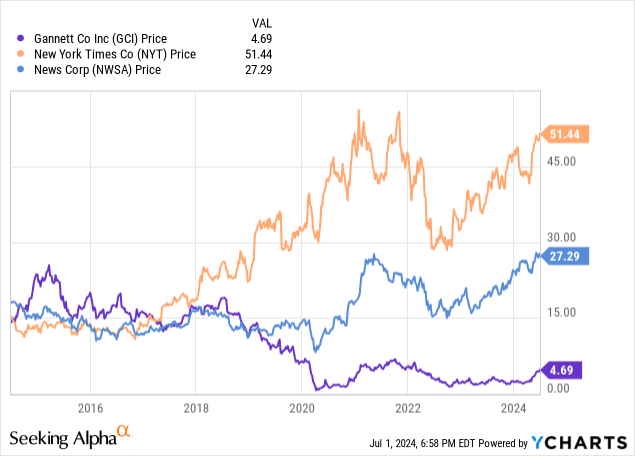

The New York Times and News Corporation also have seen hard times over the past decade, but they recovered more quickly than Gannett:

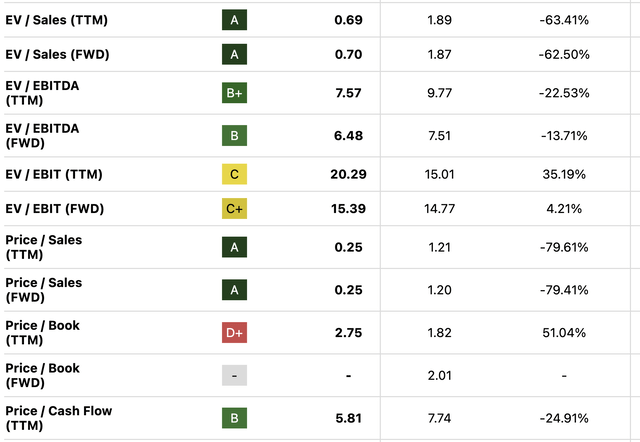

Overall, the valuation metrics for Gannett are positive. Since its earnings are currently negative, the conventional P/E and PEG ratios are unavailable. But others are positive, as this excerpt from its Valuation page at Seeking Alpha shows (the second column shows the Gannett ratios, the third shows medians for the Communication Services sector, and the fourth shows the percentage differences between Gannett and the sector):

GCI valuations table (SeekingAlpha)

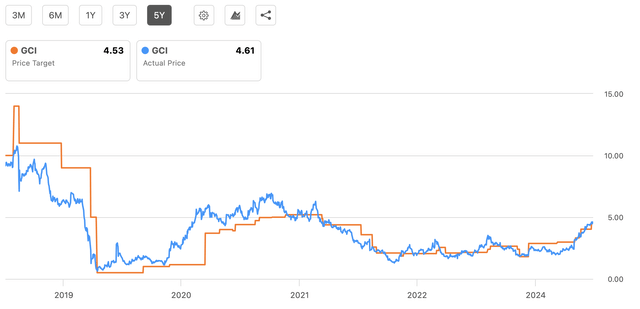

The Wall Street analysts have an average one-year price target of $4.53 (below the June 28 closing price of $4.69), a low estimate of $2.50 and a high estimate of $6.00. In the past, these analysts have been quite accurate in their forecasts:

GCI price target vs actual prices chart (SeekingAlpha)

The average target seems well grounded, and not simply because of the analysts’ record, especially over the past three years. In a year’s time, earnings should improve but may not have reached the inflection point or profitability. Gannett has indicated that could happen in 2024, but is not specific about which quarter.

Digital revenues are expected to be up 10% this year, but digital will still be less than half of the company’s total revenues. Until net income and earnings per share become positive, investors aren’t likely to join in this parade.

I agree with the analysts that $4.53 is a suitable target price for June 30, 2025, despite the runup in the share price in the past year. Therefore, I rate Gannett a Hold. The Quant system gives it a Hold as well, while Wall Street analysts give it Strong Buy, Hold, and Strong Sell ratings. There are no other Seeking Alpha ratings.

Despite my Hold, I expect the company to keep improving its top and bottom lines and become profitable. Once it does, I believe the share price will pick up as well.

Risk factors

Notwithstanding my long-term optimism, Gannett operates in highly competitive markets, especially in digital markets where technological advances can disrupt the status quo. Now, with a major expansion into the United Kingdom, management has to monitor international and domestic markets.

It points out in the 10-K that its business is highly sensitive to the markets in which it operates; advertising sales follow local economic conditions. In addition, demographics may change in those local markets, and it may not be able to respond appropriately.

Like most other companies, recruiting and keeping employees with the right skill sets is becoming increasingly difficult as the Baby Boomers retire. Also, from a human resources perspective, some of its employees are unionized, putting upward pressure on wages and exposing it to work stoppages.

Its 2027 debt notes include a conversion clause, and there is a possibility that shareholdings could be diluted if note holders decide to convert their notes into equity.

Artificial intelligence is upending many areas of the news industry, and may affect both its print and digital operations.

Conclusion

Gannett appears to be on the right track, as it grows its digital revenue to offset print losses. As it does so, it gets closer to producing black ink, rather than red, on the bottom line.

Prudent investors will want to see that inflection point and know the company is making good on its strategy and tactics. Until then, I rate it a Hold, with the promise of growth and profitability in the next year to two years.