sankai

Introduction

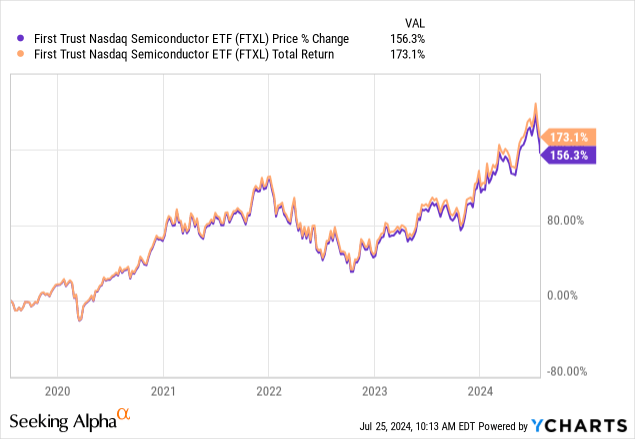

We last covered First Trust Nasdaq Semiconductor ETF (NASDAQ:FTXL) back in September 2023. At that time, we noted its high valuation relative to the historical average. It has been nearly a year since we last covered FTXL. It is time for us to analyze the fund again and provide our insights and analysis.

ETF Overview

First Trust Nasdaq Semiconductor ETF has a portfolio of 32 large-cap U.S. semiconductor stocks. FTXL has outperformed the broader market and has done very well thanks to the recent AI hype. The market is currently very optimistic about the industry’s outlook through 2026. However, its valuation is expensive right now. Since the industry typically goes through an inventory correction cycle every 3 to 4 years, and that in an inventory correction, valuation can contract significantly, investors need to be prepared for this volatility. Given its expensive valuation right now, we think a higher margin of safety is desired.

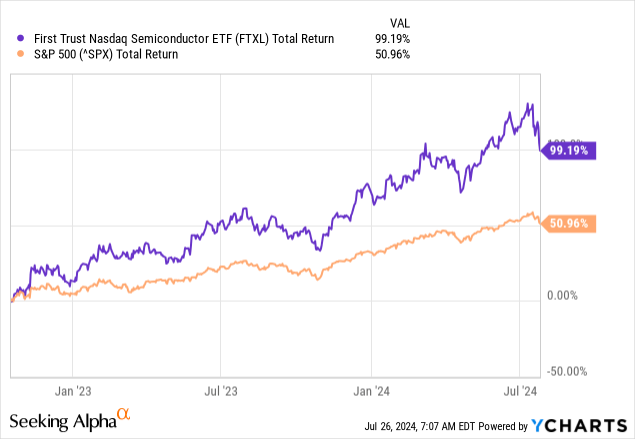

YCharts

Fund Analysis

Strong performance in 2023 and 2024

The semiconductor sector has performed very well since the cyclical low reached in October 2022. In fact, FTXL has delivered a total return of 99.2% even if we include the recent correction in July. This performance is nearly double the 51.0% performance of the S&P 500 index.

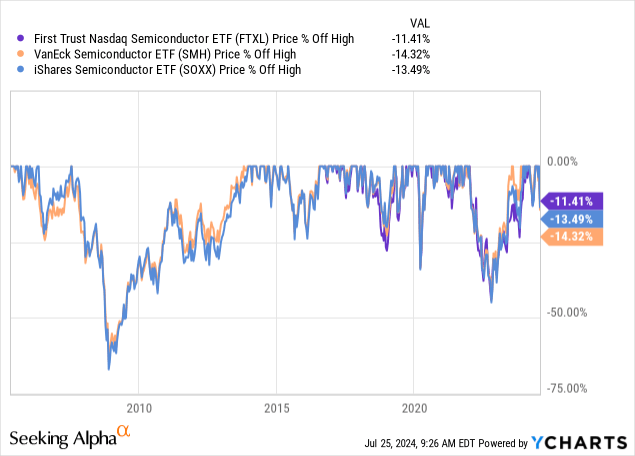

YCharts

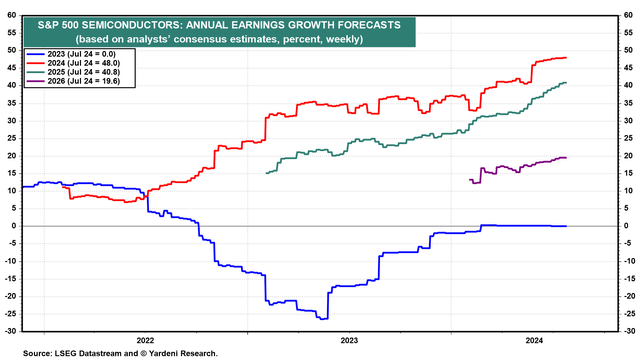

Outlook favorable through 2026

Many have wondered whether this strong performance will continue especially that the market has become quite volatile with FTXL declining by 13.5% from the peak reached in early July. Let us first look at the growth forecast of the entire semiconductor industry in the next few years. Below is a chart that shows the annual earnings growth forecasts for semiconductor stocks in the S&P 500 index. Since FTXL’s portfolio of stocks are mostly large-cap stocks and has significant overlap to the semiconductor sector in the S&P 500 index, the chart can also help us understand the growth outlook of stocks in the FTXL’s portfolio. As can be seen from the chart, following a period of negative earnings revision in 2022 and 2023 (see blue line), consensus earnings growth rates between 2024 and 2026 are on a positive earnings revision trend. In fact, consensus earnings growth rates are expected to reach 48.0% and 40.8% in 2024 and 2025 respectively. The annual earnings growth rate is expected to decelerate to 19.6% in 2026. These impressive growth rate estimations are primarily driven by the AI hype that started in the spring of 2023.

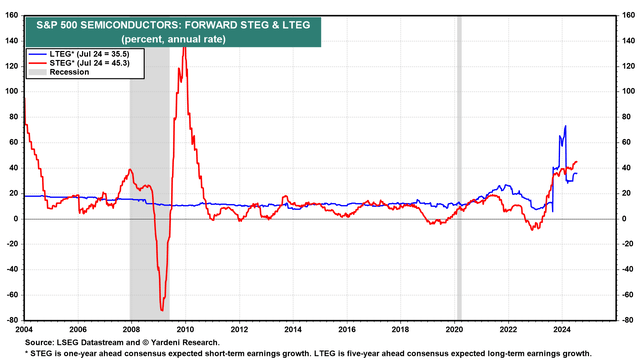

Semiconductor industry typically goes through inventory correction every 3~4 years

Although the semiconductor industry’s growth outlook appears to be very good through 2026 thanks to AI hype, the industry typically goes through inventory correction every 3~4 years. This is because it usually takes about 2~3 years to build new fabs and semiconductor companies often over-invest when the demand is robust, and under-invest when the demand is weak. This is reflected in the dip in the short-term earnings growth (STEG) rate in the chart below. As can be seen, the industry’s STEG rate dipped in 2009, 2012, 2016, 2019, and 2023. Therefore, investors should not be fooled by sheer optimism. If demand diminishes, the industry will need to go through inventory correction and earnings growth may be revised downward.

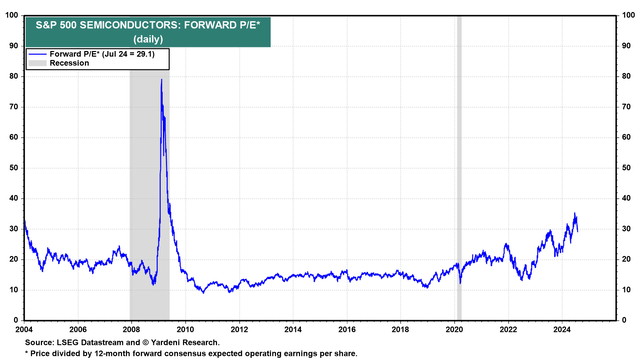

Very expensive valuation means downside risk is high

Semiconductor industry has clearly walked out of the low reached in late 2022 and has delivered impressive returns in this bull market. As a result, its valuation has also been inflated considerably. As can be seen from the chart below, the sector’s consensus forward P/E ratio has expanded to 29.1x. This is significantly higher than last year’s 25x and much higher than the trough of about 15x in late 2022. Except during the Great Recession in 2008/2009, the current valuation is the most expensive since the Internet-Dot-Com bubble. This high valuation suggests that the market may have baked in the industry’s strong growth outlook in 2025 already.

Significant downside risk in an inventory correction

As we have discussed earlier, the semiconductor sector typically goes through inventory corrections every 3 to 4 years. As can be seen from the chart below, FTXL has declined by more than 25% during the correction in 2019 and declined by about 45% in 2022. Since FTXL’s inception date was in September 2016, we do not have any data before 2016. However, other semiconductor funds such as VanEck Semiconductor ETF (SMH) and iShares Semiconductor ETF (SOXX) both experienced pullbacks of nearly 25% in 2016 and more than 30% in 2012/2013. Therefore, if another inventory correction occurs, FTXL may experience significant declines.

YCharts

Investor Takeaway

Although FTXL has a strong growth outlook through 2026, we think its valuation is expensive. While we do not know when the inventory correction will occur, investors should keep in mind that sooner or late, this correction will happen. Hence, we think a higher margin of safety is necessary.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.