kontrast-fotodesign

Dear readers/followers,

In this article, I’ll update my thesis on Fresenius (OTCPK:FSNUF) (OTCPK:FSNUY). I’m not prepared as of yet to call this one a very solid investment. However, I am prepared to say that we’ve seen some of the initial recovery I have been forecasting for quite some time.

Fresenius has been an unimpressively lengthy investment, by which I mean that it’s taken a much longer time than I initially expected to see the company through, and then to really start recovering. I ascribe this fact to my overstatement of management capabilities. The main flaw here, I believe, is that I overestimated what the board and management would be able to do and in what time frame. The company has been unsuccessful in this but has now started to slowly turn things around (even if signs have been visible for some time). It goes to show you that German companies, when doing turnarounds, may take even longer than non-German companies – especially when the ownership of those companies is structured like Fresenius.

Also, the healthcare sector isn’t the easiest or least volatile to make money in – as we’ve seen with this company taking a government sort of “bailout” that required it to reduce the dividend, where it currently for the last year period does not pay one.

But since I held my last article, the company has outperformed – by quite a margin.

Seeking Alpha Fresenius RoR (Seeking Alpha Fresenius RoR)

It’s definitely too early to take any sort of credit here. I believe we’re at the beginning of a development here. You can find my last article on Fresenius here.

And what I will do in this article is to provide an update to see the upside that we have, and the likely (as I see it) time to materialization of said upside.

Fresenius – We’re starting to see the light in the tunnel

Fresenius represents a non-trivial investment stake for me, meaning more than 0.25% of my portfolio. Despite the dividend suspension, I’ve never been worried about the company’s fundamentals or ability to deliver longer-term returns. However, the longer time it takes to get back up, the less annualized RoR we’re getting. And that 15% annualized I expected years ago, might turn out to be only 6-7% annualized if this takes “too long”. In that scenario, I would argue that this investment could become (at least theoretically) a failure.

It highlights the importance of knowing the investments you buy very well, and what you expect out of them – or following someone who knows this well.

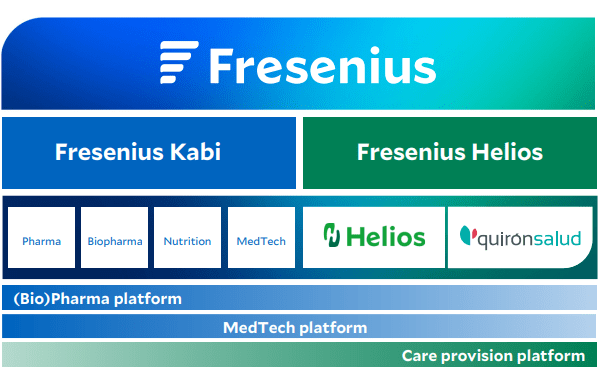

Fresenius has worked its “FutureFresenius” program for some time now. And it’s moved into a very different structure than the one we invested in many years ago. Medical Care is divested, and what we have remaining in the group is as follows.

Fresenius IR (Fresenius IR)

So what you’re investing in today is the Kabi segment, which owns products for the therapy and care of the chronically ill, including biopharma and nutrition, MedTech products, IV products, and IV fluids. Helios meanwhile is Europe’s largest private healthcare provider with assets around Europe in Germany and Spain – also some LATAM assets.

That is what remains. The company here has a rev split of 39% to 60% for Kabi and Helios respectively (corporate being the rest), and a quarterly revenue of €5.4, coming to roughly a run rate of €21B per year. Over 70% of this is from Europe.

The company manages an EBIT margin of 12.2% on that revenue as of 2Q24, an improvement, and an RoE of 8.5%, as well as an ROIC of 6%. Over 175,000 employees work for the company, and this is a reduction of almost 20,000 people since 2023 due to divestments and efficiencies. The new company’s leverage has fallen below 3.5x for the first time in a very long time.

This is the reason why the share is up, and why I am up as well.

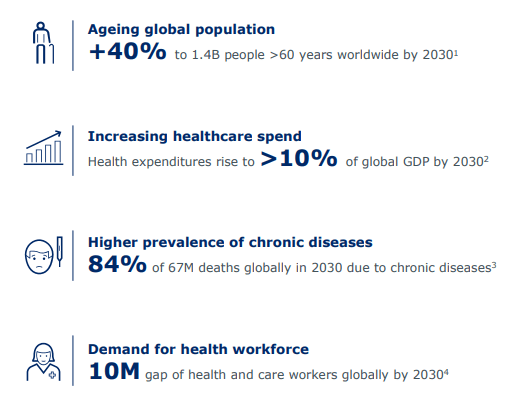

This company points to more or less the same trends that all healthcare companies point to.

Fresenius IR (Fresenius IR)

I don’t argue with these, but I tend not to be as exuberant due to the question of financing the spending and other moving parts in this equation. The new group structure is one I like, though, and the simplification of operations has worked in its favor. While both the German and Spanish hospital segments are somewhat volatile and in need of improvements, it acts as an excellent base of revenues and profit, with an average EBIT margin of 10-11% between the two, Spain being higher.

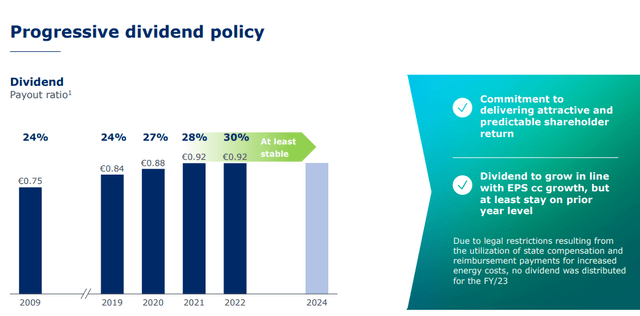

The company has all but confirmed that a dividend will be paid for the coming year.

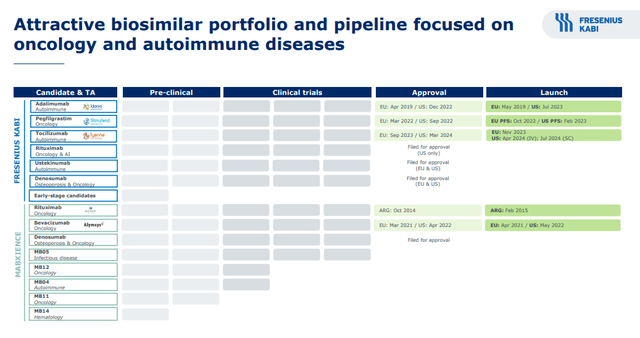

And the therapy focus we’re looking at here is something I can get behind. The positive I can confirm here is that the company has actually delivered on its ambitions as of this time. Vamed has moved away, FMC is deconsolidated, and the company is back to significant profitability. The absence of a dividend has turbocharged the company’s delevering efforts to where we’re already below 3.5x, which will improve costs and efficiencies further, and what remains in the company is simpler for Fresenius to focus on. All of the company’s segments and sub-segments are delivering solid growth on the top line, between 4-8% mainly, but Biopharma has recovered at a 57% growth rate – impressive here.

Kabi also has a very attractive pipeline with a good focus, with plenty of products coming in the coming few years.

For Helios, the plan after the successful 2Q24 is to move forward with its growth ambitions. Between subsegments, the company is looking for no less than 4-6% revenue growth per year, as well as 4-6% earnings growth, coming from the expansion of its medical clusters, further improving outpatient care, emergency care, leveraging digital, physicians and being more careful with operational expansions to ensure profitability. The use of AI is a given here, but if you follow my work, you can likely tell that when it comes to AI, I hold more of a stance that I want to see proof of improvements before I’m willing to allow some valuation increases there.

That’s the reason I don’t hold a single AI-oriented stock in my portfolio, even if I hold many investments that utilize the technology. While I don’t claim to be any sort of expert in AI, I have conversed with people that I believe know what they are talking about. What they report from the ground is that AI technology, at its current iteration, becomes increasingly useless and problematic when talking about so-called tail events – and because healthcare providers by their nature are companies that work with tail events, the usage here will be (in my opinion) less than some people believe. While I don’t believe in the bearish view that AI is essentially becoming an ouroboros (Source), I do believe the implementation of the technology deserves our skepticism more than our exuberance.

Hence, I’m careful attributing growth or efficiency from it here.

Let’s look instead at some fairly standard and traditional valuation models – because that’s where my heart and expertise lie.

Fresenius – Where is the upside at this time?

The recovery has begun here. We also need to take into consideration that the divestments of Vamed and FMS are going to impact the bottom line as well as the costs – in short, profits for the company will be worse, no doubt about it.

Still, the company is BBB rated, has a solid expectation of double-digit growth this year that I happen to fully agree with, and goes on to generate double-digit EPS growth for 2 years beyond this. Again, something I agree with.

And while recovering from 8x normalized, we’re at 11.4x P/E for a company that’s expecting double-digit growth as well as a 3% yield. Not the best, but certainly not bad.

From the forecast perspective, even at today’s valuations, this gives us an annualized upside of at the very least 17.1% per year based on an 11.35x P/E for the 2026E period. This is the 5-year company average valuation, and it’s derived in part from data collected when the company was troughing. As such, it represents a time of valuation when the company was generating negative EPS growth. That’s why it’s conservative and the “lowest” I consider valid here.

For the 20-year basis, the company’s average P/E is around 17x. That would imply an annualized upside of at least 38% per year, or triple-digit returns in reversal to a PT of €67/share, and 112% RoR until the tail-end of 2026E.

I don’t consider this one likely either, saying it’s too exuberant. The truth is likely somewhere in the middle. Consequently, however, the company’s upside is in my opinion at the very least 17% per year, and likely upwards of 22-25% per year, with a total RoR in 3 years of at the very least 60-70% here.

And that is why I remain positive about Fresenius.

It’s not the greatest time to “Buy” it here. I’m not cutting my PT here – it’s at €35/share, and the company is very close to that. €35/share also represents, (that’s why I have it) – the highest Price where a 15% annualized to the conservative 11.2x P/E is still possible.

If you buy above this, your return could be, in my estimate, below 15%, and I would no longer be interested.

FSNUY is the ADR of choice here. It’s an ADR ORD .25x, meaning 1 native share is 4 ADR shares. That makes my FSNUY PT based on €35/share for the native around $9.7/share, which still makes this company a “Buy” as of this time.

And that is my update for September of 2024. The company has reversed, but there is plenty left, which is why I am keeping my shares, and why this likely could be one of the last chances to invest profitably according to my targets here.

Thesis

- Fresenius is a significantly undervalued German healthcare market leader with appealing vectors and segments available for investors today. I believe the company has massive appeal from a very fundamental point of view, and that long-term investors can look forward to nearly triple-digit rates of return going forward.

- The company is in the midst of a turnaround, but with many of the parts of the turnaround delivered, I now consider the company poised to deliver the next ones as well, starting with a vastly improved and modernized operating structure.

- Conservatively, I expect a 60% RoR in the next 3 years, and I put my price target for Fresenius for 2024-2026 at least at €35/share – and I don’t believe this to even be close to what the company could be capable of if we see a full reversal. This is my updated thesis for September of 2024.

- I view this latest period as a beginning confirmation of what I forecasted.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company fulfills every investment criteria I put forth except being cheap, which makes this business a “BUY” for me at an attractive price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.