Ralf Hahn/iStock via Getty Images

Federal Home Loan Mortgage Corporation aka Freddie Mac (OTCQB:FMCC) and Federal National Mortgage Association aka Fannie Mae (OTCQB:FNMA) should be viewed as speculative investments. The reason for this is because major decisions by the government could be positive or negative for these GSEs (government sponsored enterprises). This presents a high risk, high reward situation for investors. As a result, investors should only put an amount of money towards the GSEs that they are willing to lose.

Potential Catalyst: Privatization of Freddie Mac And Fannie Mae

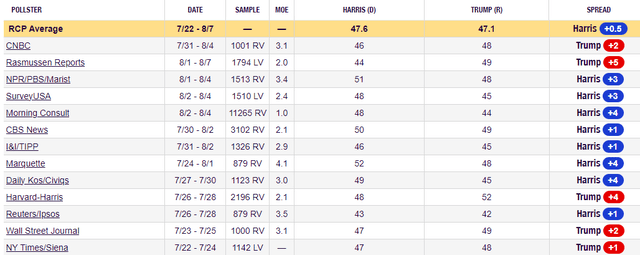

The big potential catalyst for Freddie Mac and Fannie Mae is the possibility of privatizing these enterprises. Former President Donald Trump stated that he is in favor of privatizing these GSEs. He laid out a plan for privatization back in 2019 during his Presidential term. However, privatization did not occur during his term. The possibility of Trump winning the 2024 Presidential election could rekindle a chance of privatization during Trump’s potential second term. Current polls are mixed as to who is in the lead to win the 2024 Presidential election. This list of 13 different polls shows Kamala Harris in the lead with a +0.5% lead over Trump. Harris shows an average of 47.6% support, while Trump has 47.1% support.

2024 Presidential Election Polls (RealClearPolling.com)

With such a narrow overall lead, the final result could swing either way by election day. The upcoming debates and any economic news or other significant news/events could lead either candidate to pull away with a wider margin lead.

The bottom line is that if Trump does win the 2024 election, it could catalyze the stocks of FMCC and FNMA on optimism that these GSEs could become privatized. If privatization does take place, it could allow the GSEs to raise about $240 billion to be on a level playing ground with other financial institutions.

As GSEs Freddie Mac and Fannie Mae have the advantage of borrowing from the U.S. Treasury at rates that are lower than those available to banks. However, Fannie and Freddie also hold less capital than the banks. Therefore, privatization could significantly boost the amount of capital that FMCC and FNMA hold. That could help the GSEs grow at a faster pace.

Privatization could also diversify the types of products that FMCC and FNMA offer. Currently, the GSEs only offer mortgages, making them highly levered to the real estate market. Privatization could open up new lines of business for them, lessening the risk and possibly driving stronger future growth.

The main criticism of privatizing the GSEs is that they currently provide affordable mortgage loans to middle-income borrowers. They also currently support underserved communities, protect taxpayers, and ensure that the housing and mortgage markets are less cyclical. Privatizing the GSEs could change this dynamic which could have a significant negative effect during another financial crisis. The possible negative effects of privatization could lessen the likelihood that the government would change the current GSE situation.

There is also the possibility to privatize the GSEs while simultaneously implementing reforms so that they could still offer the same or similar benefits to homebuyers.

The GSE’s as Investments Without Privatization

Let’s take a look at the GSEs as investments, assuming that they never get privatized. Both Freddie Mac and Fannie Mae increased interest and dividend income by double-digit annual paces since 2022. However, the stock remained under $1 per share in 2022 and 2023. The stock didn’t move above $1 until 2024. So, it is not clear how the stock will respond with continued growth of interest and dividend income. FMCC’s stock is up 28% year-to-date, while FNMA is up 7.5% year-to-date. So, it is possible that investors are finally warming up to the GSEs as speculative investments.

One theory is that this means there is more upside for the stock, since the price still needs to catch up with the growth in interest and dividend income. I think that the price/sales ratio is the most appropriate valuation metric for the GSEs. The reason I say that is because the U.S. government receives most of their earnings. So, revenue growth would be more important for shareholders.

FMCC is trading with a low price/sales ratio of 0.15. FNMA is also trading with a low price/sales of 0.21. Price/sales ratios below one show an attractive low valuation. For context, the Mortgage Finance industry trades with a higher price/sales ratio of 1.21. Therefore, the GSE’s have plenty of upside potential. They just need a positive catalyst to get the stocks moving higher.

The health of the real estate market could be a positive catalyst for the GSEs. With the interest rate cycle about to shift back to cutting rates as early as the September 17, 18 Federal Reserve meeting, the real estate market could pick up. Lower mortgage rates would likely reduce the total cost of homeownership. Of course, we would need a soft landing for the economy to avoid a possible significant downturn in the real estate market.

The possible fundamental catalyst for the GSEs could be continued revenue growth. Analysts’ estimates show that FMCC is expected to increase revenue by 6.6% in 2024 to $19.78 billion, while FNMA is expected to increase revenue by 2.8% to $29.6 billion.

If the GSEs meet or exceed these consensus estimates, it could spark the stocks to rally from the low valuation level. FMCC may have the advantage with higher expected growth. FMCC also had an upward revision to its expected revenue, while FNMA had a downward revision to expected revenue for 2024. FMCC’s revenue estimate went from $19.17 billion back in May 2024 to the current estimate of $19.8 billion. FNMA’s revenue estimate was decreased from $30.91 billion at the start of 2024 to the current estimate of $29.6 billion. FMCC’s upward revision could show that the covering analysts are confident that the GSE will at least meet these higher revenue expectations for 2024. This could be positive for the stock.

Technical Perspective

Federal Home Loan Mortgage Corporation (FMCC) Stock Chart with RSI & MACD (TradingView)

FMCC’s daily chart above shows a bullish divergence between the stock price having a lower low while the RSI made a higher low. This could be a double-bottom formation. The MACD at the bottom of the chart is showing a decrease in downward pressure (histogram moving from red to pink). Investors should watch to see if the blue MACD line crosses above the red signal line. Also look for the RSI to move above 50. The RSI is currently at about 40. This would indicate a change in trend back to positive for the stock.

The Bottom Line for Freddie Mac and Fannie Mae

The stocks of the GSEs are trading at attractive valuation levels. They just need a positive catalyst to drive the stocks significantly higher. The biggest catalyst in my opinion would be privatizing them, which would allow them to hold significantly more capital. Meeting or exceeding revenue growth expectations could be another positive catalyst.

Both of the GSEs should be considered speculative, as there is no guarantee that privatization will occur or if it will drive the stocks significantly higher. There is also no guarantee that the GSE stocks will increase on revenue growth. We’ve seen the stocks lag even as revenue increased in recent years.

The biggest risk for the GSEs is the high amount of debt that they carry. FMCC has over $3 trillion in net debt. FNMA has over $4.1 trillion in net debt. Another significant financial crisis could seriously hurt the GSEs ability to pay off this debt. As a result, the stocks could suffer significantly. The financial crisis of 2008 caused these stocks to plunge from the $60s down to below $1. I believe another financial crisis could drive these stocks close to zero.

I would guess that the privatization of the GSEs would create enough excitement for the stocks to make a significant run higher. We just don’t know if that will happen any time soon, or if it will ever occur.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.