RoschetzkyIstockPhoto/iStock Editorial via Getty Images

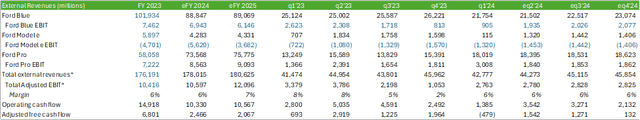

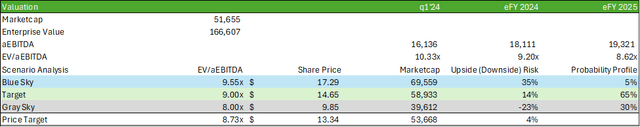

Ford (NYSE:F) is facing certain headwinds as we turn the page for q2’24 at the end of July going into the second half of the fiscal year. Management faces the challenge of lower volumes in ICE, a -2% pricing decline in ICE vehicles, and further pressure on Model e. One area of resilience that may offset some of the declines is Ford Pro, which provides roadside services to contractors and other labor-intensive professionals; Ford Pro may navigate the shift to electric fleets through its fleet management software, charging stations at depots, and other features that provide catered services to vehicles on the road. Given the pricing and volume headwinds going into e2h24, I provide F shares a HOLD rating with a price target of $13.34/share at 8.73x eFY25 EV/aEBITDA.

Be sure to read my initial report covering Ford here:

Ford’s New Hybrid Strategy Will Bolster Margins

Ford Operations

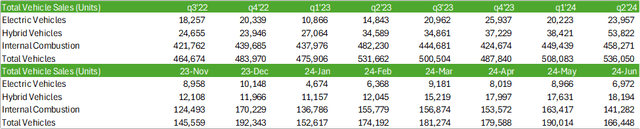

Ford released their latest q2’24 sales figures with hybrids and EVs growing 56% and 61%, respectively, and total truck sales up 5% year-over-year, outpacing both GM and Ram by 71k and 173k trucks, respectively. This comes in line with management’s expectations for the quarter as the firm faced some delays in the release of the latest F-150 series truck as the firm ran the truck through quality assurance before its release. The delay to the Ok2Buy resulted in avoiding 12 recalls. The firm also launched their latest Super Duty and is expanding its production capacity as the truck was oversubscribed 2:1 as of q1’24.

It’s clear that management’s repositioning of production to focus more heavily on hybrids is paying off, as discussed in my previous report covering Ford. With the newly remodeled Maverick and the hybrid F-150, hybrid sales were up 56% year-over-year, with total hybrid sales for q2’24 reaching 53,822 units. 1h24 sales for the Maverick and F-150 were 40,420 and 33,674 units, respectively, a major driver for the growth in truck sales for Ford.

On the EV front, electric vehicle sales increased by 61% year-over-year to 23,957 units sold, driven by the Mustang Mach-E and F-150 Lightning. Despite the growth in unit sales, I believe much of the growth is driven in part by the substantial markdown in selling price as the EV segment remains under competitive pressure. Management mentioned in their q1’24 earnings call that their EVs have been marked down by -20% with the Mach-E being reduced by -17%. EVs aren’t alone in terms of pricing headwinds. The broader vehicle market is expecting a -2% decline in retail prices for eFY24, suggesting that the supply/demand dispersion has normalized in accordance with financing and insurance costs. I anticipate worsening margins for EVs in the run-up to lower-cost EVs, and slightly lower margins for Ford Blue.

Though the first generation of EVs was somewhat of a flop for Ford in terms of profitability and interest by the general populus, management is laser-focused on reentering the EV space with a meaningful impact. Management reiterated the delay of the launch of their 3-row CUV by two years in order to refocus their attention on affordability and profitability. The goal for the launch of each model is to reach profitability within the first year. Management is also targeting a more consumer-focused price range for their second generation of electric vehicles at $25,000-30,000. This price range is to make purchasing EVs more competitive with ICE or hybrid vehicles in terms of affordability. Assuming battery technology improves and becomes more cost effective, this strategy may work out. Companies like QuantumScape (QS) are developing solid-state battery technology that is said to hold a stronger charge, have faster charging rates, and may allow for more affordable vehicles. The technology is currently being tested with manufacturing targeted to scale in eFY25. Despite the drive to improve battery technology, I remain skeptical of QuantumScape in their ability to scale operations to cater to the level of demand by the automotive industry.

Looking at consumer preferences, it is clear traditional ICE vehicles remain market-dominant for Ford. It is worth noting that hybrids have been creeping up as a percentage of total units sold, sitting at 10% in q2’24. Hybrids have grown sequentially since q1’23 and should be expected to continue this trajectory going forward as consumers prefer the reliability of gasoline while being able to leverage the battery technology for their daily commutes. Associated costs and commute time as it pertains to BEVs is something I thoroughly discuss in my report covering EVgo (EVGO). Though Ford has made it clear that their EVs have gained significant interest by consumers, I do not believe the economics align as the costs to manufacture an EV remains significantly higher than the declining selling price.

Management discussed some commercial fleets turning to all-electric vehicles in the coming years, as Ford Pro allows for greater flexibility and better fleet management. Revenue from Ford Pro grew by 36% on a year-to-year basis to $18b in q1’24 and has grown sequentially over the years as more fleets turn to Pro services to cater to all roadside needs. I believe Ford Pro will be the driving factor for EV fleet adoption, given the data tracking capabilities and roadside services offered through the subscription-based service. This includes most schematics for EVs, including fleet charging networks for depots, charging software, fleet management software with GPS and telematics capabilities, and other data services. Ford Pro is highly accretive and held a 27% aEBIT margin in q1’24 and accounted for 42% of total revenue. Looking to guidance, management anticipates relatively flat margins for the duration of eFY24 for Ford Pro.

Pro has a large opportunity ahead of itself as infrastructure projects are anticipated to pick up pace. As discerned in my coverage of Crown Castle (CCI), telco companies have set year-to-year increases for capital investments as 5G density is being built out. Though I do not anticipate this area to be a major needle-mover in terms of broader growth, I believe it should help drive incremental growth for the Pro segment. In addition to 5G build-outs, electrification of the grid should benefit Ford Pro. One example of the need for electrification is the stress charging stations have on the grid and the necessity to accommodate for higher baseloads. Intermittent power supply will also drive the necessity for grid modernization. Projects like these will likely help drive growth in the Pro segment.

Macroeconomic Landscape

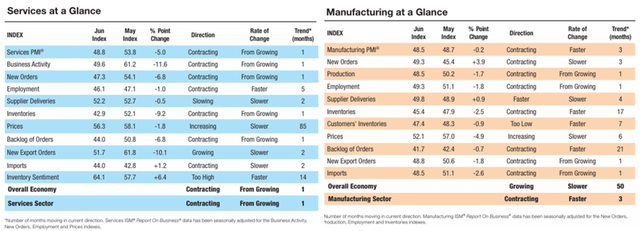

On the macro front, there are some growth concerns in the broader economy as the business outlook begins to sour. The June ISM-PMI Services reading came in sharply lower from the previous month at 48.8% driven by business activity, new orders, and lower backlogs. Though this is a singular data point in time, it may be a continuation of a declining trend towards deeper contractionary territory.

The ISM-PMI Manufacturing figures reported for June were also in contractionary territory at 48.5%; however, this isn’t necessarily a unique occurrence as seen in PMI-Services. Though it is too early to suggest that the economy is taking a massive turn for the worse, it should be understood that the US economy may be losing steam and may add some headwinds beyond -2% to Ford Blue or the -20% in Model e.

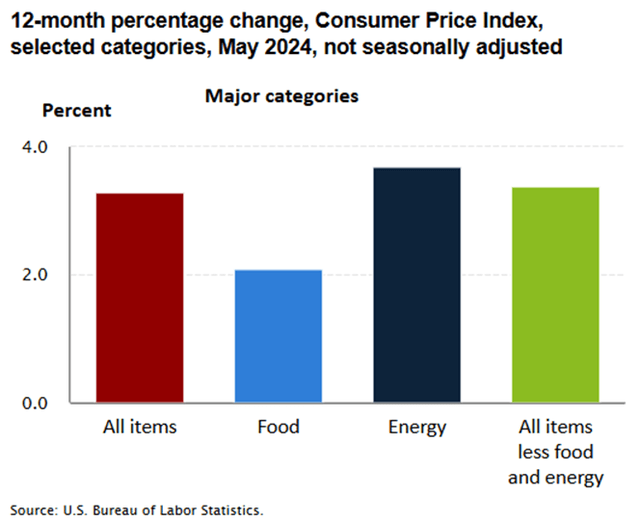

Forecasting financials, I anticipate some headwinds to growth for Ford Blue and Model e as prices normalize down for ICE with more severe price cuts for EVs. Volumes for ICE appear to be challenged given the -5% year-to-year decline for q2’24 and may result in a sharper price decline when considering management’s -2% pricing guidance. I expect vehicle sales to remain flat-to-slightly-down for eFY24 as consumers remain pressured by elevated inflationary rates. Though inflation has somewhat moderated in certain areas, overall cost of living remains elevated for food, shelter, and energy.

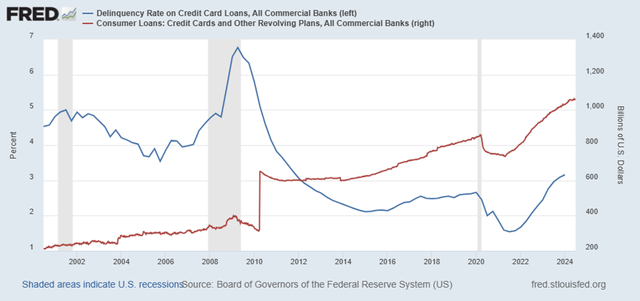

Additionally, consumer credit appears to be becoming more challenged. According to data provided by FRED, the credit card delinquency rate is back above pre-C19 levels. Though management at Ford has not voiced concerns about higher delinquencies, there could be other underlying challenges unrelated to Ford Credit. This could result in fewer consumers upgrading their vehicles or make it more challenging for consumers to receive financing for vehicles.

Valuation & Shareholder Value

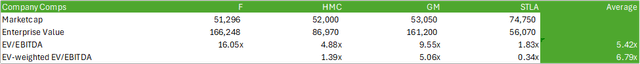

F shares currently trade at 10.30x EV/aEBITDA and, in unadjusted terms, a premium to competitors.

Considering the growth headwinds to come in eFY24, I’d be cautious in buying F shares, despite management’s 50-60% of adjusted free cash flow being returned to shareholders. Contrary to my previous coverage of Ford, I anticipate a more challenging market for eFY24 for the firm that may result in less appealing returns to shareholders. Forecasting Ford’s financials and weighing to the lower pricing premium, I rate F shares with a HOLD recommendation with a price target of $13.34/share at 8,73x eFY25 EV/aEBITDA.

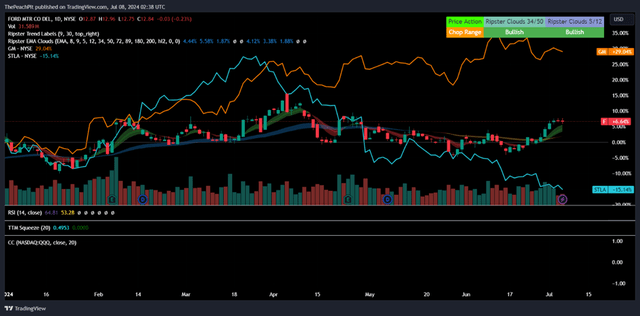

Despite the potential headwinds to come, F shares have held up YTD, though have significantly trailed General Motors (GM). I believe F shares are appropriately priced for growth over the next two years. To the upside, Ford Pro come to be resilient and realize continued heightened adoption. I believe Ford Pro could potentially offset some of the pricing headwinds in Ford Blue; however, management will need to remain focused on making Model e profitable before we can expect any substantial margin growth.