onurdongel/E+ via Getty Images

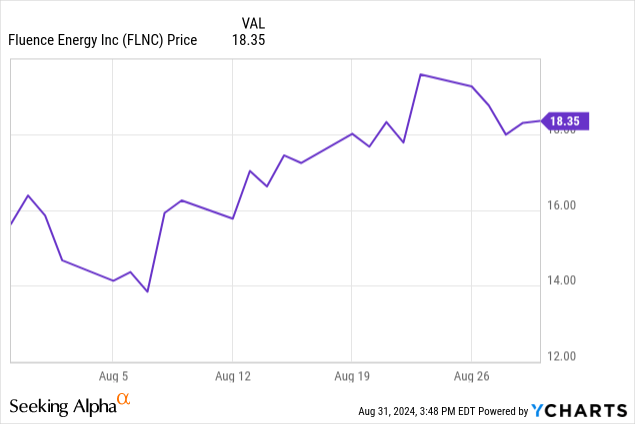

Fluence (NASDAQ:FLNC) has experienced a plethora of good news as of late, from strong quarterly results to likely interest rate cuts. As a result, Fluence has seen its share prices skyrocket over the past month. While the company’s short-term prospects look bright, the company’s long-term prospects are even stronger. The convergence of cheap intermittent renewables and generative AI will set in motion unprecedented demand growth for large-scale energy storage technologies.

Fluence has seen its shares skyrocket in recent weeks.

Strong Q3 Results

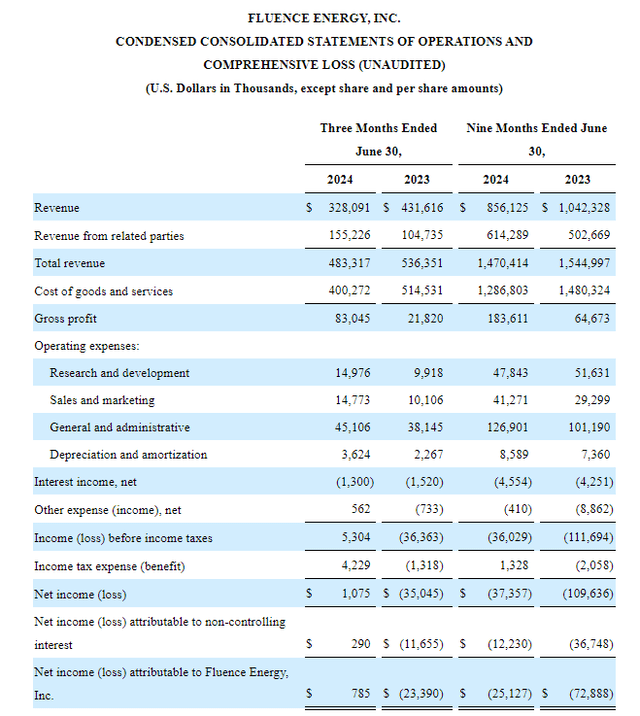

Fluence reported strong Q3 results, beating even the most optimistic expectations. The company reported revenue of $483.3M, which beat expectations by $20.52M. This translated to a positive GAAP EPS of $0.01, which beat expectations by an impressive $0.13. As a result, Fluence’s Q3 marked one of the few quarters where the company managed to post a profit. While the company’s overall revenue declined nearly 10% Y/Y, this decline could be attributed to seasonality.

Fluence also added $1.3B of new contracts, which set a quarterly record and brought the company’s backlog to $4.5B. What’s more, the company is also starting to see its services and digital business gain steam as these divisions contributed $80M in annual recurring revenues during the quarter. Demand for Fluence’s BESS (battery energy storage system) products and services is clearly starting to take off despite the increasingly competitive landscape.

Fluence has improved its financials in Q3.

Fluence

Neutral Player

While Fluence has some of the industry’s leading BESS technology, the company’s main advantage is arguably its positioning as a neutral player. In an industry filled with Chinese competitors and conflicted domestic players, Fluence is unique in its ability to stay neutral. Chinese competitors pose obvious risks for BESS customers on the geopolitical front. It is highly unlikely that large U.S. corporations will entrust Chinese companies to play such an integral role in the buildout of billions of dollars worth of critical energy infrastructure for obvious reasons.

On the other hand, Fluence’s main domestic competitor, Tesla (TSLA), may face an even harder time attracting large domestic customers. After all, many of the largest BESS customers are big tech companies that are involved in businesses in which Tesla also competes. For instance, Tesla’s efforts to build out frontier AI models directly threaten major data center players like Alphabet (GOOGL) or Microsoft (MSFT). Moreover, Elon Musk has insulted or belittled nearly every big tech company, and often the executives at these companies themselves. This only adds further reason as to why these companies will be incredibly hesitant to work with Tesla.

Fluence has none of these issues as a neutral player in the BESS space. In fact, it can be argued that Fluence has been incredibly adept at attracting business from large players like Alphabet. This will give Fluence a key advantage as energy usage is increasingly being consolidated among the largest companies, especially with the rise of cloud computing and incredibly capable frontier AI models.

Interest Rates

The renewable industry is particularly sensitive to interest rates, as entire project economics vary dramatically based on interest rates. With the Fed indicating that interest rate cuts will likely come sooner rather than later, Fluence could see demand for its BESS products and solutions skyrocket. Given that energy storage is becoming an increasingly vital component for intermittent renewable technologies like solar and wind, Fluence is in a great position to benefit from interest rate cuts.

AI could also act as a deflationary force given its ability to raise productivity across a wide variety of sectors. This could put even more pressure on the Fed to lower interest rates at an even greater rate, which could further catalyze BESS demand. As frontier models become increasingly capable, their ability to increase productivity will likely be a key demand driver for Fluence.

Risks

The BESS industry is starting to attract higher caliber competitors as a result of its growth potential. In fact, BESS was a major focal point in Tesla’s recent conference call as a result of its outperformance in the last quarter. Tesla is also planning to dramatically ramp up its BESS production with its $10B Shanghai Megapack factory. Such large investments into the BESS space by competitors like Tesla will have a negative impact on Fluence’s demand.

Fluence is also a relatively small player compared to other companies in the space. This means that the company will not be able to invest in R&D or expand capacity at the same rate as its larger competitors. Despite this, the BESS market will likely have more than enough room for Fluence and several big competitors. Moreover, Fluence already has a head start in this industry and has cultivated a good reputation in this space.

Conclusion

Fluence is one of the most promising energy and AI plays in the market. Fluence currently has a P/S ratio of 1.13 at its current market capitalization of $3.34B, which is low given Fluence’s leadership position in an incredibly high-growth industry. While fears surrounding Fluence’s profitability likely play into its depressed valuation, the company’s positive net income in Q3 should help assuage these concerns. Fluence is in a prime position to ride the renewable and AI waves as a technological and market leader in the BESS space.