phototechno

The strategy of actively managing Fidelity® Fundamental Large Cap Core ETF’s (BATS:FFLC) portfolio of value and growth stocks with a bottom-up fundamental analysis approach makes it a solid investment option in the wake of increasing uncertainty. The ETF’s price performance in the past three years indicates that the management’s investment approach is working both in the up and downtrends. Moving forward, it appears that creating a new stake or holding an existing position could help investors earn market-beating returns. Therefore, I maintain my buy rating on FFLC.

FFLC Is Poised to Shine despite Uncertainty

As the US stock market bull run halted in the past month due to tech-driven selloff, the sector-focused and high-growth ETFs posted significant losses with the risk of selloff intensifying in the coming quarters. The tech stocks lofty valuations and the Fed’s strategy of holding rates higher for a longer time could be the biggest drivers of the selloff.

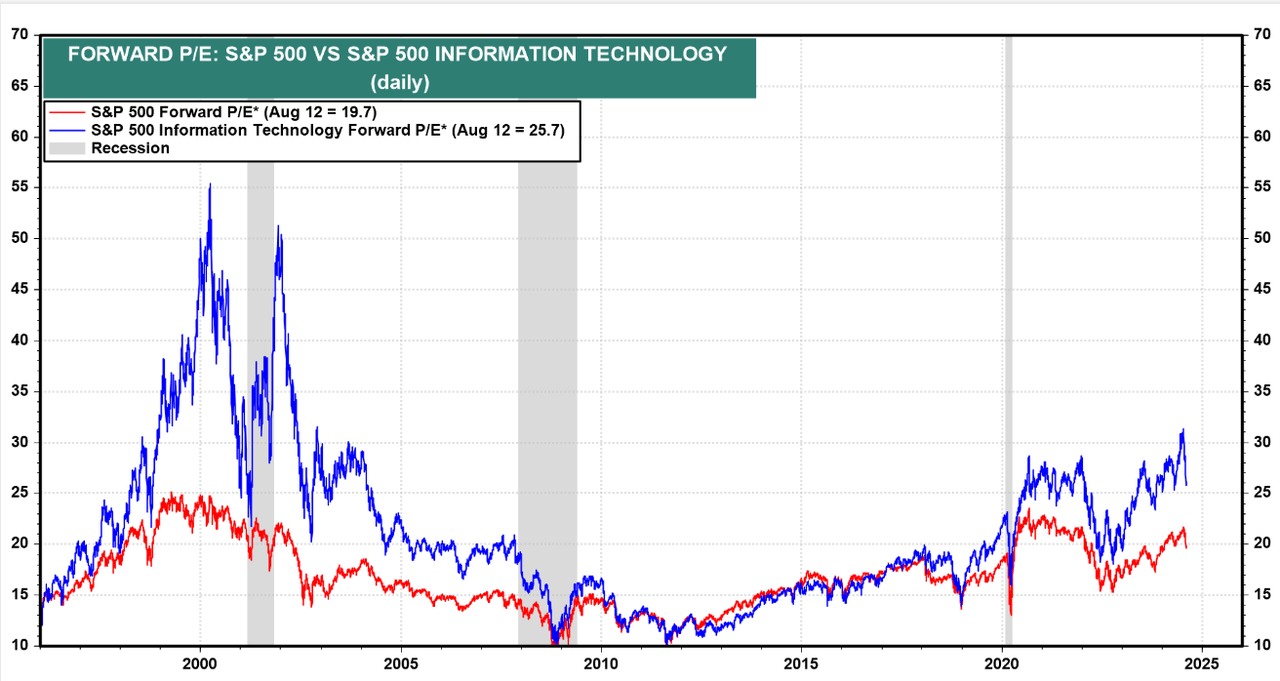

Tech sector forward PE (Yardeni)

Despite the fact that the recent selloff lowered tech sector’s forward PE to 25.7x and mega-8 at 27x, the forward valuations are still above their 5 and 10-year average. In addition, fading AI mania could also negatively impact tech stocks prices. This is because mega and large-cap tech companies so far remained unsuccessful in generating notable revenues from their billions of dollars investment in AI. It appears that tech companies’ investments in the emerging technology are likely to take a longer time to create a significant impact on their financial numbers.

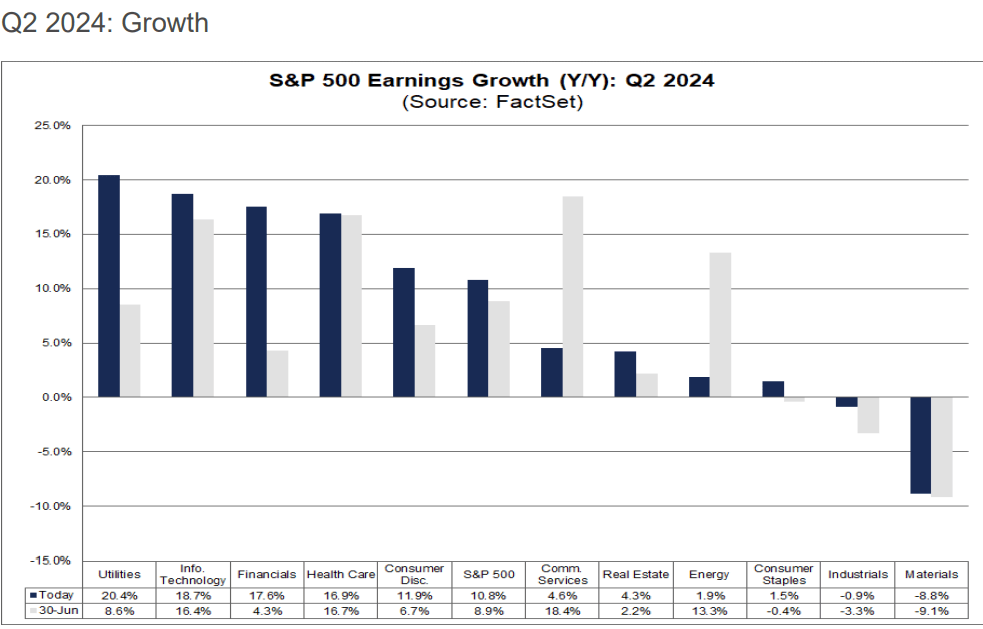

Q2 earnings growth (FactSet)

Nevertheless, it’s also difficult to rule out the potential rebound because forecasts for two consecutive years of double-digit earnings growth. In the June quarter, the S&P 500 reported a whopping 10.8% year-over-year increase in earnings, marking the largest quarterly increase since the final quarter of 2021. Growth heavy categories, such as information technology, consumer cyclical, communication services, were the biggest drivers of the earnings growth. Value-heavy categories, such as healthcare, financials, and utilities also reported solid earnings growth. FactSet data indicates 10.8% and 15% earnings growth for fiscal 2024 and 2025.

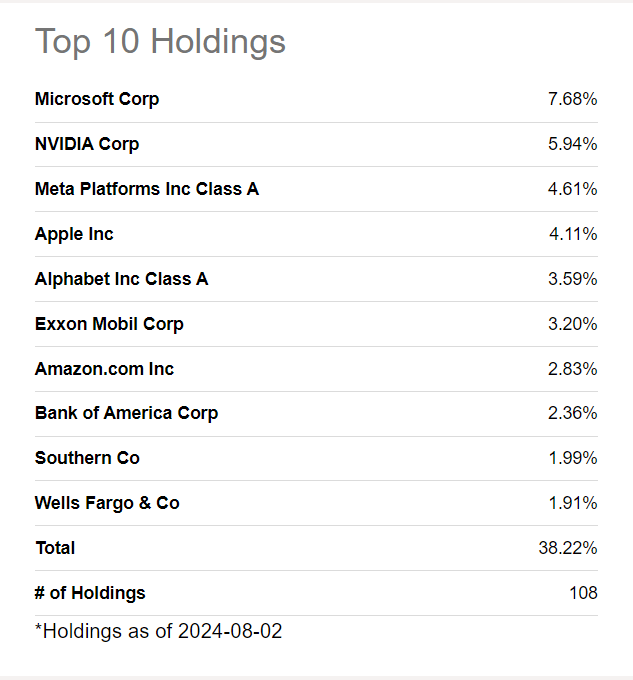

As the market is standing at a crossroads, Fidelity® Fundamental Large Cap Core ETF appears to be a solid investment vehicle to face uncertainty. This is because of the fund’s active portfolio management strategy of investing in fundamentally sound growth and value stocks according to market conditions. The diversification factor is also key for FFLC’s ability to lower the downside risk and capitalize on the broader stock market performance. FFLC’s top 10 holdings made up 38% of its overall portfolio. Whereas, the tech sector-focused and growth-focused ETFs have significant concentration in their top 10 holdings. For example, The Technology Select Sector SPDR® Fund ETF (XLK) and Vanguard Growth Index Fund ETF Shares (VUG) have nearly 60% of portfolio concentration in their top 10 holdings.

FFLC top 10 holdings (Seeking Alpha)

Its top 10 holdings are comprised of top-performing stocks from various sectors and categories. For instance, its top 10 holdings are composed of 6 stocks from the mega-8 group. All these stocks belong to the growth-heavy information technology, communications, and consumer cyclical sectors. These three sectors represent 47% of its portfolio. In the case of an uptrend, FFLC’s stake in growth stocks will enable it to capitalize on the uptrend. Its top 10 holdings also include well-established stocks from the energy, utilities and financials sectors.

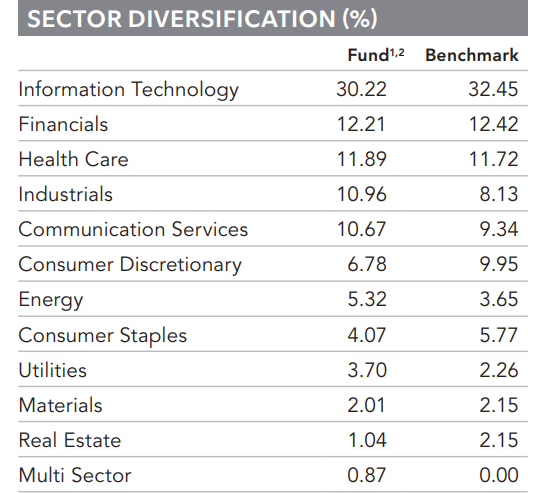

FFLC sector diversification (Fidelity Institutional)

Large-cap stocks from the financials, healthcare and industrial sectors hold more than 34% of weight in FFLC’s portfolio. These sectors performed exceptionally so far in 2024, thanks to their robust earnings growth. In the second quarter, the financials sector reported 17% and healthcare generated 15% earnings growth, while large-caps from industrials also impressed investors with a sustainable growth.

Its stock holdings from the financials sector, include Bank of America (BAC), Wells Fargo (WFC), JPMorgan Chase (JPM), Visa (V), Mastercard (MA), Moody’s Corporation (MCO), Apollo Global Management (APO) and a few others. All these stocks have been performing strongly in terms of financial growth. Consequently, their shares are soaring at a healthy pace. For instance, Apollo Global generated a 26% price return along with a hefty 1.77% dividend yield. Similarly, shares of Moody’s soared 35% while Bank of America, Wells Fargo, and JPMorgan’s share price rallied 23%, 19% and 33%, respectively, in the past twelve months.

Industrial stocks in the FFLC portfolio, such as GE Aerospace (GE), General Dynamics (GD), Eaton Corp. (ETN), are also considered fundamentally strong companies. They have delivered solid second quarter results and returned a significant amount to shareholders in the form of dividends and share price gains. For example, GE Aerospace topped June quarter revenue and earnings estimate by $0.55 billion and $0.20 per share. The company also lifted its full-year profit and free cash flow guidance. GE recently increased its dividend from $0.08 per share to $0.28 per share, while its shares rallied at a stunning pace of 80% in the past twelve months.

FFLC’s Potential Performance

FFLC price performance since 2022 (Seeking Alpha)

FFLC appears to be one of the best ETFs for investors seeking to earn high risk-adjusted returns. The fund’s portfolio structure and management’s strategy of picking fundamentally sound stocks based on future market conditions strengthens its ability to limit the downside while beating the S&P 500 in the uptrends. The ETF’s stock price performance in the last bear and bull markets vindicates its market-beating potential. For example, during the 2022 bear market, its shares plunged only 2.6% compared to the S&P 500’s 20% selloff. Meanwhile, its share price outperformed the broader market index in the current bull run. Since the beginning of 2023, its shares soared 53% compared to the S&P 500 gain of 40%. Its average three-year beta of around 0.90% reflects that the fund has the potential to offer downside protection while outperforming in the bull market.

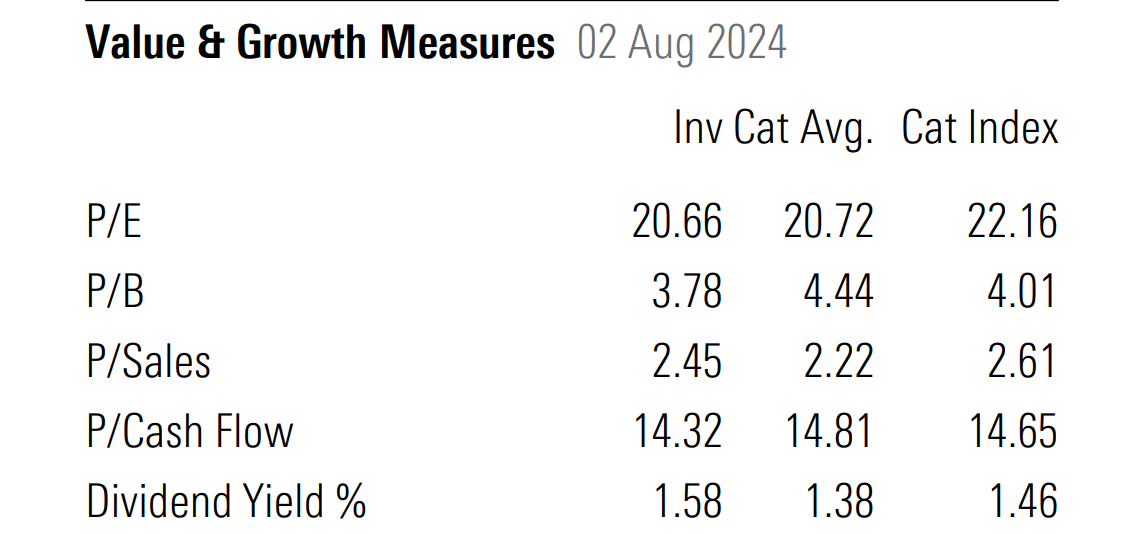

FFLC valuation (Morningstar)

The ETF also looks undervalued considering its valuation. Its shares are trading around 20.66x earnings, compared to the category average of 22.16x and S&P 500’s 27x. Its price to book and price to sales ratios of 3.78 and 2.45 are also well below the category average of 4.01 and 2.61, respectively. Low valuation also makes it a solid alternative for investors seeking to rotate out of overvalued tech and growth ETFs. Given its valuation, recent price performance and investment strategy, FFLC has a potential to generate market-beating returns in the coming quarters.

FFLC: Buy Rating

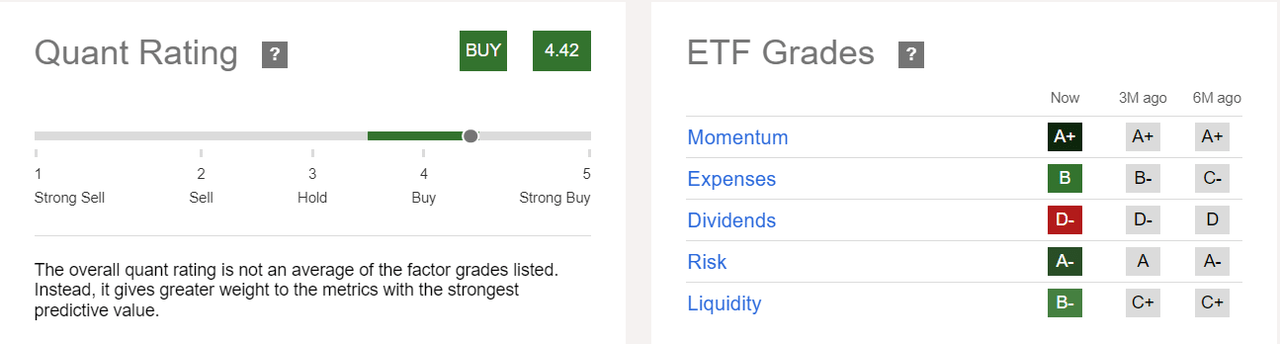

FFLC quant rating (Seeking Alpha)

According to Seeking Alpha quant rating, Fidelity® Fundamental Large Cap Core ETF received a buy rating with a quant score of 4.42. Its high quant rating is attributed to an A-plus grade on the momentum factor. Technically, stocks with high momentum are generally deemed to extend the uptrend. It earned a B grade on the expense factor because its expense ratio of 0.38% is below the of median of all ETFs. Quant rating also highlights that the risk factor with FFLC is low. A low-risk factor is attributed to multiple elements, such as a higher diversification and a low short interest ratio.

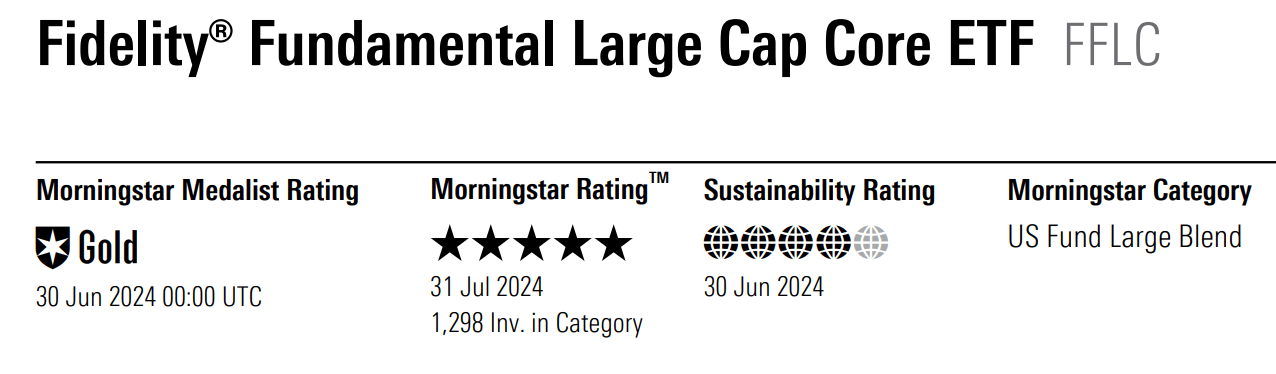

FFLC rating (Morningstar)

FFLC is a Gold Medalist with a 5-star rating based on the Morningstar analysis. The firm attributed a gold rating to the fund’s sound investment process and strong management team. According to FactSet analysis, FFLC received A grade because of high scores on the efficiency and tradability factors.

In Conclusion

As the US stock market can swing either way in the coming months, it might be a prudent strategy to consider investment vehicles with a potential to outperform in both up and downtrends. FFLC is one of the best ETFs with a potential to generate market-beating returns, thanks to its active portfolio management strategy and holding stakes in fundamentally sound value and growth stocks. It could also be a solid investment option for investors seeking to rotate out of tech-focused ETFs.