filo

EPR Properties (NYSE:EPR) is a well-managed entertainment-focused real estate investment trust with a unique portfolio of experiential properties across the United States.

EPR Properties easily covered its monthly dividend of $0.285 per share with funds from operations as adjusted in the second quarter and the trust reaffirmed its FFO forecast for 2024 FFO.

I think that as long as the U.S. economy remains in good shape, EPR Properties is a compelling investment for passive income investors. The 7.3% dividend yield has a high margin of safety and I am doubling down on the trust’s stock as I think the divided will be prove to be sustainable.

My Rating History

My last stock classification for EPR Properties was Buy. My stock classification prior to this was ‘Hold’ primarily because the real estate investment trust had considerable exposure to troubled theater chain AMC Entertainment Inc. (AMC).

In my view, EPR Properties has considerable excess dividend coverage and could sustain its present pay-out even in the event of a recession. The dividend pay-out ratio of 70% leaves room for error and the stock is selling for a moderate FFO multiple.

Portfolio Review, Diversification And Growth Potential

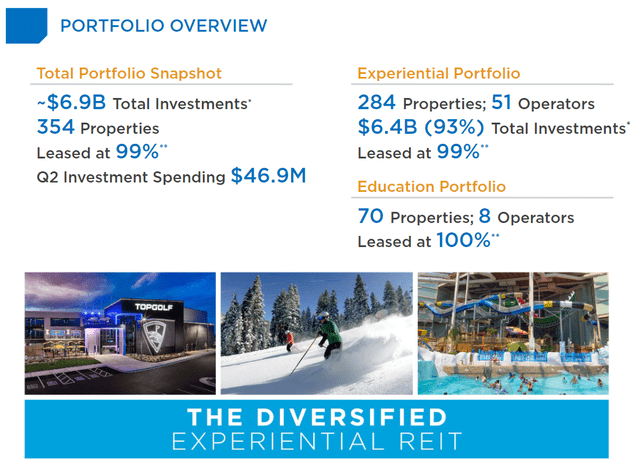

EPR Properties is an experiential real estate investment trust and in this regard quite uniquely positioned. The trust owned a collection of assets in the leisure and entertainment industries including theatres, eat-and-play mixed-use facilities, lodging, wellness, education and attraction facilities in the United States.

In total, EPR Properties owned $6.9 billion in investments spread out over 354 properties. Of those assets, 161 properties related to cinemas which management has said it wants to reduce its exposure to in the long-term. The majority of EPR Properties’ assets (99%) are leased to operators and therefore fully utilized.

Portfolio Overview (EPR Properties)

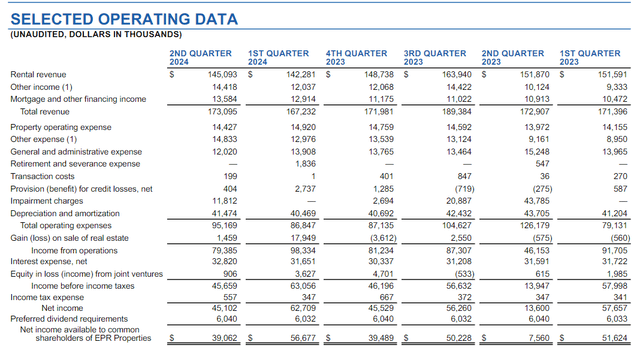

EPR Properties produces rental income from its properties that translate to a substantial inflow of cash on a recurring basis. In the second quarter, EPR Properties’ widely diversified real estate portfolio produced $173.1 million in sales which was about flat YoY. Nonetheless, EPR Properties has been consistently profitable in the last year, on both a net profit and FFO basis.

Selected Operating Data (EPR Properties)

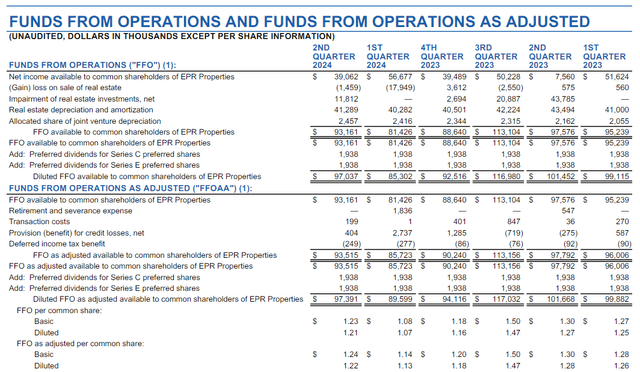

In terms of funds from operations, a metric often used by REIT investors to quantify pay-out metrics and dividend coverage, was not as impressive, EPR Properties didn’t have any problems covering its dividend with funds from operations as adjusted. The reconciliation between FFO and FFO adjusted considers irregular expenses such as costs occurred in the context of transactions and credit losses.

In the second quarter, EPR Properties earned $93.5 million in funds from operations as adjusted, reflecting a YoY decline of 4% due to asset sales.

Funds From Operations (EPR Properties)

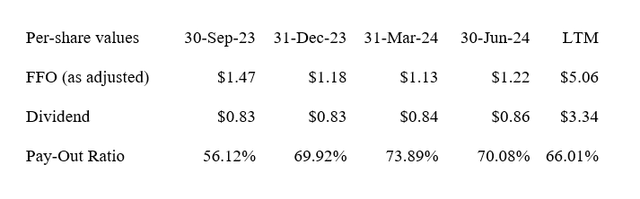

Dividend Pay-Out Metrics

EPR Properties earned $1.22 per share in funds from operations as adjusted in the second quarter compared to $1.28 per share last year. The dividend pay-out ratio fell 4 percentage points QoQ to 70% in 2Q24. The raised its monthly dividend in the first quarter from $0.275 per share to $0.285 per share per month and I predict that passive income investor are going to get another hike next year.

The dividend is very well-covered by funds from operations which gives EPR Properties at lot of optionality: it could decide to further growth its dividend and invest more cash into the repayment of debt or into new income-producing properties.

Dividend (Author Created Table Using Trust Information)

FFO Guidance And Multiple

EPR Properties reaffirmed its forecast of $4.76 to $4.96 in funds from operations as adjusted for 2024. The forecast includes between $200 million and $300 million in investment spending as well as disposition proceeds of $60 million to 75 million.

Based on a stock price of $46.94, EPR Properties is selling for a 9.7x funds from operations multiple. I previously asserted that I thought EPR Properties could rerate to a 10.0X funds from operations multiple (the same multiple EPR sold for at the start of the year), so my stock price target has almost been reached.

I don’t think the investment thesis has much changed because of EPR Properties higher stock price, as I think the stock is primarily attractive for passive income investors for its recurring monthly income.

Risks with EPR Properties

EPR Properties is a pro-cyclical real estate investment trust whose funds from operations and profits are correlated to a healthy economy and strength in consumer spending.

A recession would probably hurt EPR Properties particularly hard compared to other real estate investment trusts that are operating in less cyclical industries of the economy. In addition, the trust continues to exhibit concentration to the movie theater business which is challenged by the prevalence of stream-at-home services.

Be that as it may, the risks to the dividend, as far as I am concerned, appear relatively small considering that EPR Properties paid out just 66% of its funds from operations ad adjusted in the last twelve months.

My Conclusion

EPR Properties provides passive income investors with a well-covered dividend and a 7% yield that could be sustainable even in the event of a recession. The reason for this is that the real estate investment trust has a low FFO-based dividend pay-out ratio which equates to a high margin of safety for passive income investors.

The trust also reaffirmed its FFO forecast for 2024 and could potentially profit from a strategic shift away from movie theaters in the long-term which would further help de-risk the trust’s cash flows.

I think that the value proposition for EPR Properties is overall compelling, particularly for long-term passive income investors. Buy.