Entravision Communications (EVC) Colorblind Images LLC

In recent years, legacy media conglomerates have been pivoting towards digitalization of their businesses. However, in the case of Entravision Communications Corporation (NYSE:EVC), a partial “de-digitalization” is happening. Those with a vague familiarity with the company may know of it as a leading owner/operator of Spanish-language television and radio stations in the United States, yet for the past few years, Entravision has primarily been a digital advertising company.

But as Seeking Alpha’s Kingdom Capital discussed in prior coverage of EVC, a major customer loss has resulted in EVC moving to divest and wind down the lion’s share of its digital advertising operations. This has driven a partial rebound for EVC, following its sharp drop in the customer loss news.

A steep gap between EVC’s trading price and underlying value remains, but it may take time to close it. Based on the latest developments, management does not appear in a hurry to sell digital media assets not affected by the customer loss. There may be a factor limiting Entravision’s ability to pursue strategic alternatives. Nevertheless, for patient investors buying in at today’s prices, an investment in EVC could ultimately pay off. Here’s how.

Recent Earnings, and Management’s Current Game Plan

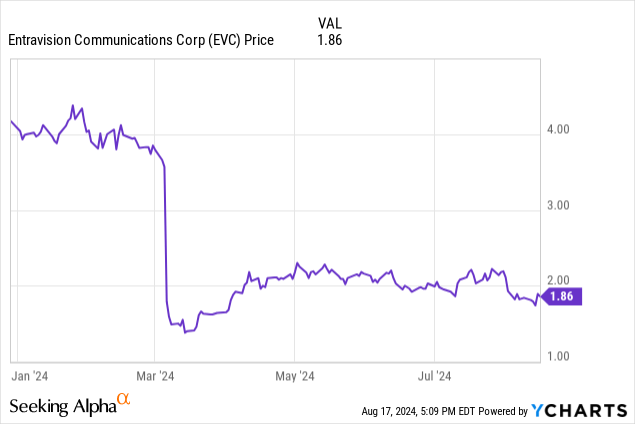

Back on March 5, Meta Platforms, Inc. (META) announced plans to shut down its authorized sales partner program by July. Given the tremendous impact this would have on EVC’s digital ad business, shares experienced a massive slide in price, falling from just over $3.50 per share to as low as $1.33 per share.

Since then, however, the stock has partially recovered, as management quickly responded to this material change to its business. Entravision has sold off several of its main international digital advertising assets, including its digital platform representation business.

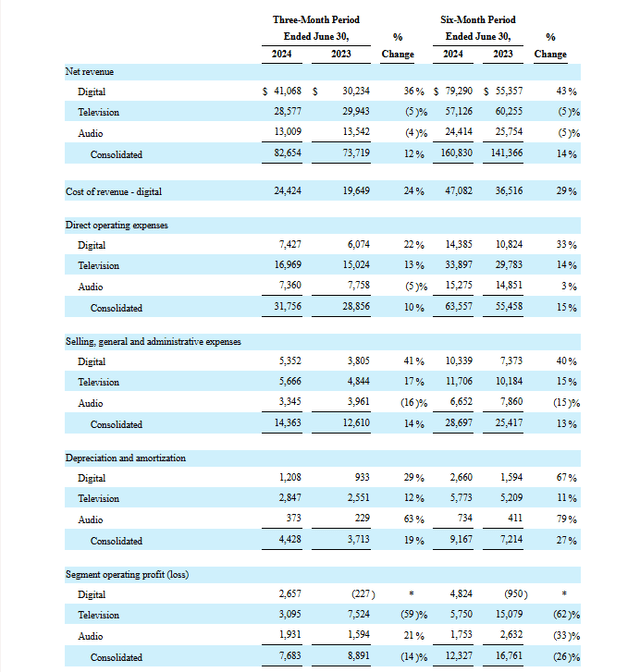

As seen in EVC’s latest quarterly results (released on Aug. 8), the company is taking big one-time losses from the sale/wind-down of its international digital ad segment. Although overall revenue was up 12% year-over-year, thanks to election year ad spending, Entravision reported a net loss of $31.68 million for the quarter ending June 30, 2024, a big jump from around $2 million in net losses reported in the prior year’s quarter.

The results, largely expected, have had little impact on the price of EVC stock. EVC’s rangebound performance since earnings also makes sense, given management’s latest updates on the company.

On the post-earnings conference call, EVC CEO Michael Christenson discussed the company’s plans to maximize political revenue from its TV and radio businesses, mainly through the expansion of news coverage by the TV stations.

Christenson also discussed how the company plans to invest further in the growth of its Smadex programmatic advertising and Adwake mobile advertising subsidiaries.

Well, not a bad plan in and of itself, it’s questionable whether these efforts will significantly improve EVC’s financial performance or stock price in the immediate future. Maximizing political revenue will boost results this year, but what about after the end of the 2024 election cycle?

Even if Smadex and Adwake continue to grow, could it go unnoticed, as investors continue to consider EVC a broadcasting stock? For shares to make a big move, more aggressive moves may be necessary, such as asset sales.

Class U Shares May Limit Takeover Appeal

As Kingdom Capital also discussed in its EVC stock write-up earlier this year, the passing of Walter Ulloa, the company’s founder, marked the end of Entravision being a controlled company.

Yet while there’s no longer a controlling shareholder, Entravision may not necessarily be a top takeover target among broadcasting companies. EVC’s Class U common shares would likely complicate a full-on sale of the company or of its main broadcasting assets. The Class U shares, all owned by TelevisaUnivision, which owns the Spanish-language TV networks most of Entravision’s TV stations are affiliated with, carry limited voting rights.

They represent only 10% of EVC’s total equity. If TelevisaUnivision sells or transfers the shares, they automatically convert into Class A shares. However, as long as they are outstanding, Entravision cannot sell itself or enter into a merger, nor can it sell off any of its Univision and UniMás affiliates, without TelevisaUnivision’s consent.

While in theory, EVC could afford to repurchase and retire the shares, which are worth about $17.4 million at current prices, given how these shares perhaps serve as a “trump card” TelevisaUnivision holds over what is its largest affiliate group, it’s questionable whether they would be willing to sell, even at a premium.

How EVC Could Still Ultimately Pay Off

Strategic and/or financial buyers may not soon be coming along to take over Entravision, but don’t assume this means EVC stock continues to be a value trap. Selling the TV stations may prove difficult, but Entravision could still sell other assets.

Just because EVC’s C-suite is for now looking to build rather than sell what remains of its digital advertising business, doesn’t mean a possible sale is completely off the table.

In fact, taking time to further build and sell the business could prove to be a wiser move. Over the next year, if the much-desired “soft landing” forecast for the economy plays out, digital advertising demand trends could stay favorable. In turn, acquisition interest from strategic buyers could grow as well.

Even now, this business is quite valuable. Last quarter, what remains of Entravision’s digital business generated around $41.1 million in revenue. CFO Mark Boelke noted on the conference call that this segment now sports positive operating margins, and further revenue growth is expected this quarter.

What remains of EVC’s digital business is still growing, and operating margins are rising (Entravision Communications Q2 2024 Form 10-Q)

Backing out COGS, as well as direct operating and SG&A expenses, EBITDA for the segment came in at around $3.86 million. Annualized, this suggests EBITDA in the $15 million range. Even at an EBITDA multiple in line with peers at the lower end of the valuation range, like Criteo S.A. (CRTO), which trades at an EV/EBITDA ratio of around 10.9, Entravision’s digital businesses could be worth around $163.5 million to a strategic buyer.

A Possible Second Windfall

If Entravision’s digital segment keeps growing, a possible deal price could exceed this amount. The proceeds from a sale could provide EVC with a windfall on par with the windfall from the company’s 2017 sale of some of its broadcast spectrum assets.

Relative to EVC’s current valuation of $167.4 million, the impact of a future nine-figure windfall could be more significant than the past windfall. Instead of using the cash to fund an M&A spree (as happened last time, with mixed results), EVC’s management could find more shareholder-friendly ways to put this cash to work.

For example, Entravision could use it to pare down its $237.7 million in outstanding debt. The company could use it to finance a special dividend or to resume making large share repurchases. Although EVC has been aggressive in buying back stock in recent years, buyback activity has slowed down more recently.

Other Catalysts and Risks

The above-mentioned possible future catalyst for EVC comes atop other existing catalysts that could serve to send this very undervalued stock back to higher prices.

In particular, the possibility of Entravision being able to sell more of its spectrum assets. This catalyst may still be many years away from (possibly) coming to fruition, but it’s still worthy of a mention.

Alongside catalysts, of course, there are still many risks at hand with an EVC stock investment. The digital ad businesses may still be growing at a fast pace now, but what if a much-desired economic “soft landing” fails to finish playing out? Growth could screech to a halt.

In turn, potential interest in acquiring Smadex and/or Adwake could evaporate. A downturn would also bode badly for the broadcasting segment. Besides macro risks, another potential downside risk is that Entravision decides to cut or eliminate its 5 cents per share quarterly dividend. At current prices, this gives the stock a juicy double-digit annual dividend yield of 10.75%.

Even as the stock is priced as though the dividend could be cut or eliminated in the future, chances are the elimination of it would at the very least apply near-term downward pressure on shares.

Bottom Line

The fallout from the Meta Platforms revenue loss may now be behind it, but a lack of major news may lead to continual middling price performance for Entravision Communications shares

However, while it may take some time, the ultimate payoff could prove worth it. In a few year’s time, Entravision may monetize the still-thriving portions of its digital ad business, unlocking value for investors in the process.

Such a “payoff moment” could arrive even soon if shareholder activism emerges in this stock. While the Class U shares may complicate interest from a strategic buyer, this may not have much impact on an activist’s efforts.

An activist fund could take a position, gain influence and/or seats on the board, and push to prioritize efforts besides management’s current plans. Still, irrespective of whether EVC stock becomes an activist target or not, if you are a value investor with a long-time horizon, shares are worthy of consideration at current prices.