andresr

It’s been a heck of a nice value rotation in recent weeks.

Charlie Bilello

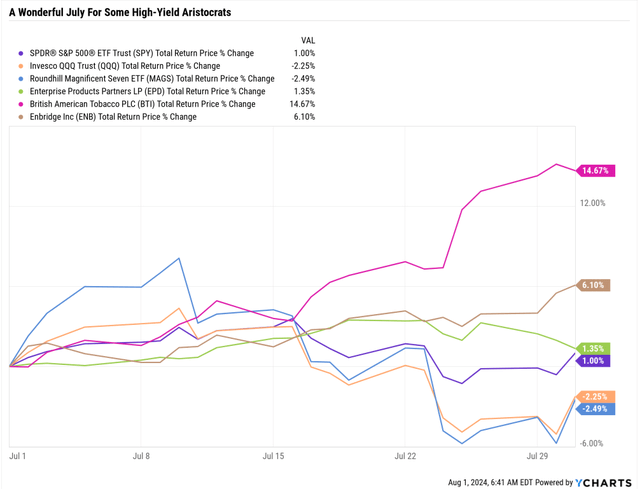

It was a fantastic July for my favorite high-yield aristocrats, Enbridge (ENB) and British American (BTI).

Ycharts

But with the market still near record highs, there are wonderful high-yield blue-chip bargains.

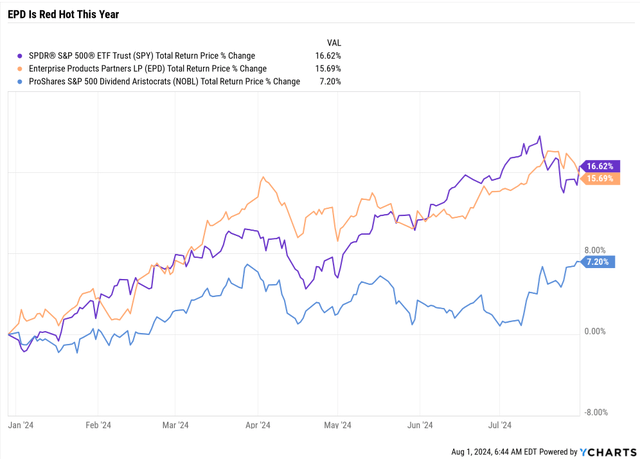

So today, I wanted to update Enterprise Products Partners (NYSE:EPD), a 7.3% yielding dividend aristocrat still 16% undervalued which has become one of Wall Street’s hottest value stocks.

Ycharts

EPD is one of the few value stocks keeping up with the Nvidia (NVDA)- powered market this year. It still offers incredible opportunities, making it ideal for retirees seeking generous and dependable income.

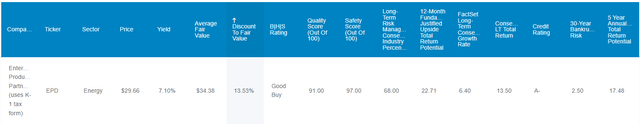

Bottom Line Up Front: 7.3% Yielding Dividend Aristocrat With Room To Run

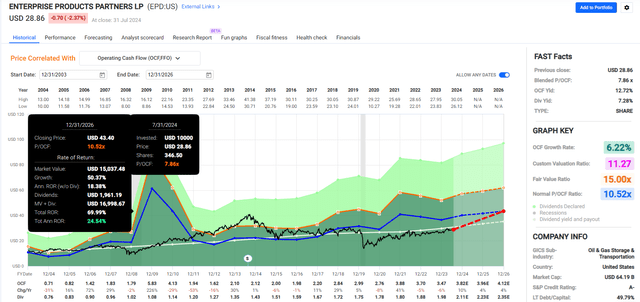

Dividend Kings Zen Research Terminal

Enterprise is one of the highest quality aristocrats.

The only A-credit rating in the industry’s history is that of a dividend aristocrat (champion, technically) with a 25-year distribution growth streak.

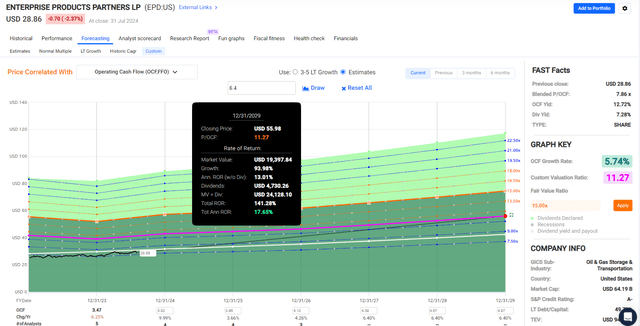

5-Year Consensus Return Potential: 141% = 18% Annually vs 84% S&P = 13% annually

FAST Graphs, FactSet

3-Year Consensus Return Potential: 70% = 25% Annually vs 35% S&P = 13% annually

FAST Graphs, FactSet

1-Year Consensus Return Potential: 23% vs 12% S&P

What about long-term returns?

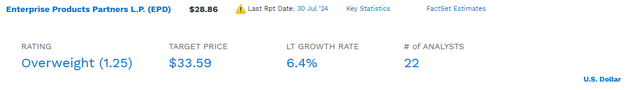

FactSet Research Terminal

7.3% yield and 6.4% long-term growth are 13.7% long-term return potential.

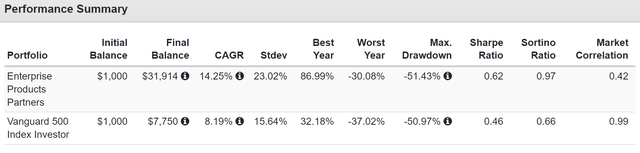

Historical Return Since 1998

Portfolio Visualizer

That’s consistent with returns since 1998.

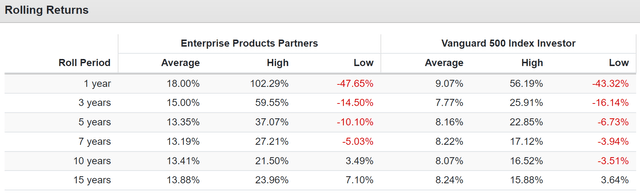

Portfolio Visualizer

EPD’s average rolling 15-year return is 14% per year, and analysts expect that.

Why?

Why Enterprise Is A Rich Retirement Dream Stock

First, here’s a summary of EPD’s earnings.

Earnings Summary

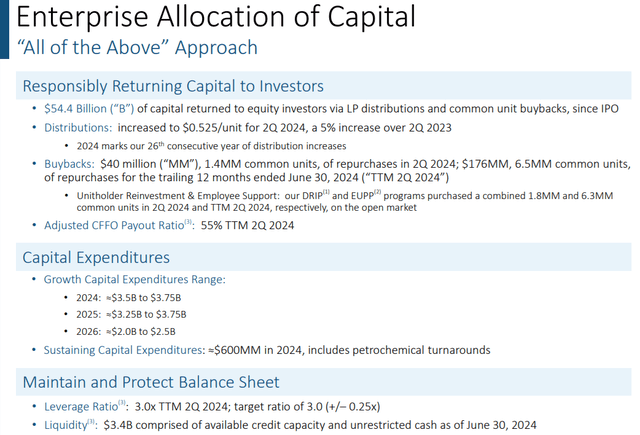

- Distributable Cash Flow: EPD generated $1.8 billion in distributable cash flow for the quarter, up from $1.7 billion in the same quarter last year.

- Coverage Ratio: The quarter’s coverage ratio was 1.6 times, indicating a strong ability to cover distributions.

- Distribution: EPD declared a distribution of $0.525 per common unit for the second quarter of 2024, a 5% increase over the distribution declared for the same quarter last year. This distribution will be paid on August 14, 2024, to common unitholders of record as of July 31, 2024.

- Distribution Retention: The company retained $661 million of its distributable cash flow in the second quarter, contributing to a year-to-date retention of $1.5 billion.

- Unit Buybacks: In the second quarter, EPD repurchased approximately 1.4 million common units for $40 million. The total buybacks over the past 12 months amounted to $176 million, or approximately 6.5 million common units.

Financial Performance

- Adjusted EBITDA: The company reported an adjusted EBITDA of $2.4 billion, up from $2.2 billion in the same quarter last year.

- Net Income: Net income attributable to common unitholders was $1.4 billion, or $0.64 per unit, representing a 12% increase over the second quarter of 2023.

- Adjusted Cash Flow from Operations: Adjusted cash flow from operations increased by 11% to $2.1 billion compared to $1.9 billion in the same quarter last year.

Capital Investments and Debt

- Capital Expenditures: Total capital investments for the second quarter were $1.3 billion, including $1 billion for growth capital projects and $245 million for sustaining capital expenditures.

- Debt: As of June 30, 2024, the total outstanding debt principal was approximately $30.6 billion, with a weighted average cost of debt of 4.7% and consolidated liquidity of approximately $3.4 billion.

Outlook

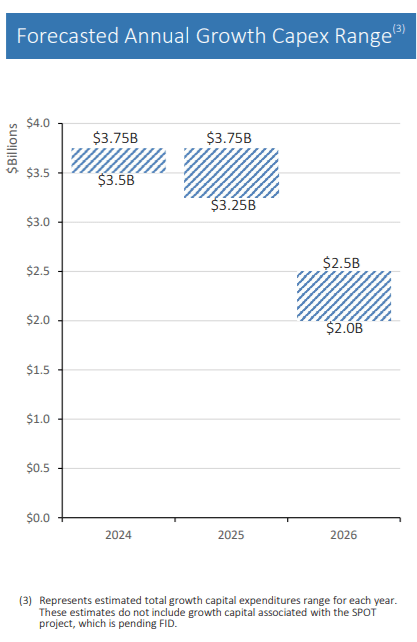

- Growth Capital Expenditures: For full-year 2024, EPD expects growth capital expenditures to be between $3.5 billion and $3.75 billion. In 2025, the expected range will remain between $3.25 billion and $3.75 billion.

- Sustaining Capital Expenditures: Due to planned turnarounds, sustaining capital expenditures for 2024 are estimated at approximately $600 million, up from $550 million.

Bottom Line

EPD’s strong distributable cash flow, robust coverage ratio, and consistent distribution growth make it an attractive option for dividend investors. The company’s strategic investments and disciplined capital management further enhance its financial stability and growth potential.

EPD’s results were solid, confirming the long-term investment thesis.

earnings presentation

EPD is delivering on its historical promise of dependable income, including through a free cash flow self-funded business model, which is the platinum standard of safety in this industry.

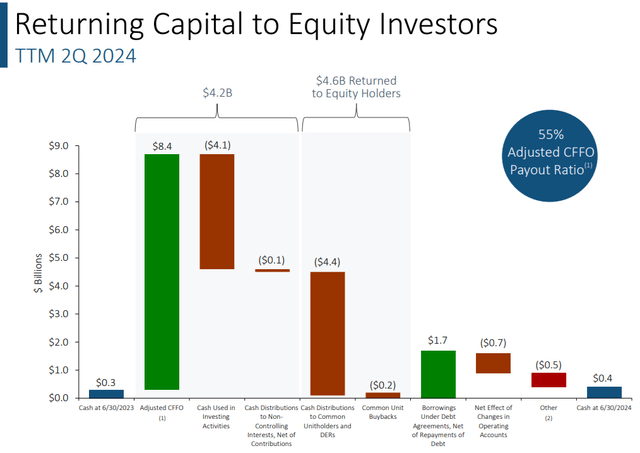

That means that EPD, after running the business, generates $4 billion per year in excess distributable cash flow above its distribution.

Even with increased growth spending, its free cash flow covers its distribution by 100%, which is unheard of for any midstream before 2020.

Earnings presentation

EPD has returned $4.6 billion to investors in the last year, a record, and it’s the most sustainable capital return in the industry.

Earnings presentation

Management expects to cut spending by $1 billion in 2026, which will translate directly into new free cash flow that can be spent on acquisitions, buybacks, or higher distributions.

Earnings presentation

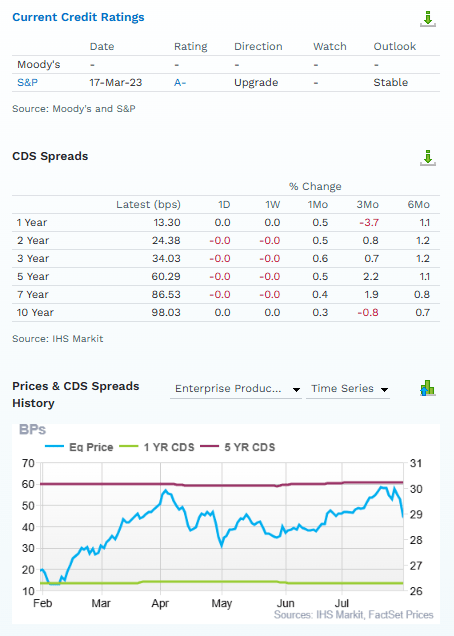

Credit ratings and credit default swaps tell us the probability of EPD investors losing 100% of their investments through bankruptcy over various periods.

According to S&P, the probability is 2.5% over the next 30 years, and according to bond investors, it is 2.9409%.

These estimates change daily, so if news breaks, we can tell within 24 hours whether the “smart money” on Wall Street thinks it’s a risk to the investment thesis.

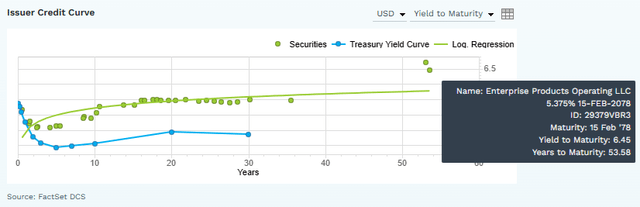

FactSet

Long-term bond investors are so confident in EPD’s energy transition plan that they are willing to buy bonds that mature in 2078, almost 54 years from now.

That’s not just the second-longest duration bonds in the midstream industry but also some of the longest bond durations of any company in an industry.

That’s a strong vote of confidence for EPD, from the “smart money” on Wall Street, that this is a “buy and hold forever” aristocrat.

Which is extra relevant given EPD’s beneficial but complex tax profile.

Risks To Consider: Let’s Talk About Taxes

EPD is an MLP, meaning it has a K1 tax form with pros and cons.

On the plus side, EPD has tax-advantaged income, meaning it’s ideally owned in a taxable account.

Specifically, the IRS treats distributions (not dividends) as “return of capital.”

That’s not the same ROC as some ETFs or CEFs. It destroys net asset value, effectively gives investors back their money, and calls it a dividend.

When EPD pays you a distribution, it doesn’t get taxed; it reduces your cost basis.

After 13.7 years at current yields, you will have received 100% of your initial investment via distributions, and your cost basis will be zero.

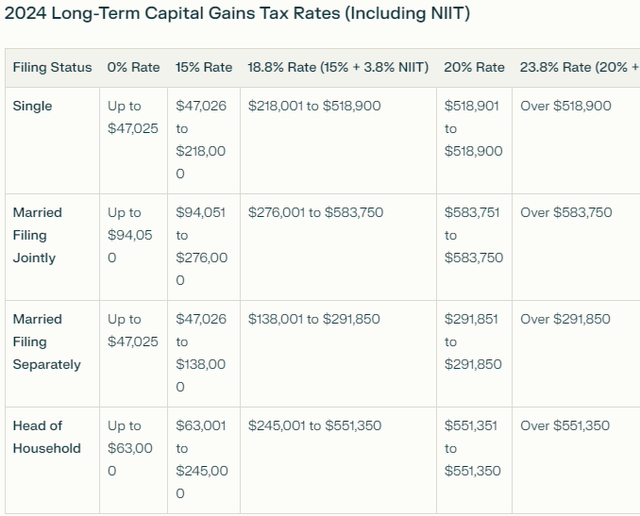

At that point, EPD’s distributions are taxed as long-term capital gains equal to the qualified dividend rate.

Perplexity, Nerd Wallet

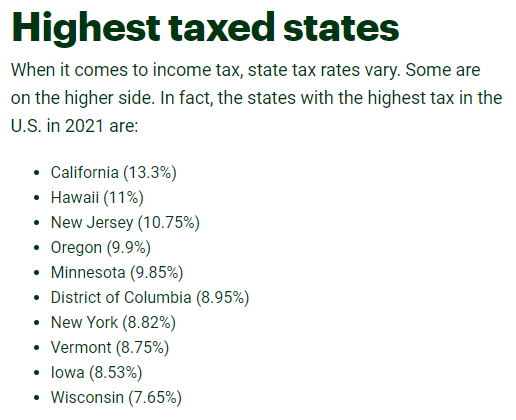

Remember that most states tax qualified dividends and long-term cap gains as ordinary income.

H&R Block

Some local governments also tax capital gains and dividends.

Perplexity

Remember that to get the tax benefits of MLPs, you need to own them in taxable accounts.

If you live in Portland and are in the top tax bracket, then your tax rate once the cost basis hits zero is 23.8% Federal + NIIT + 9.9% state income tax + 4% city/county tax.

- 37.7% peak tax rate for some investors.

When the MLP units are eventually sold, the investor must account for the recapture of depreciation and other deductions, taxed as ordinary income. The remaining gain, which is the appreciation in the value of the units, is taxed as a capital gain.

The tax headaches are based on the need to account for depreciation, meaning that EPD is a wonderful “buy and hold forever” ultra-yield aristocrat.

If you never sell, you never have to worry about depreciation recapture.

Moreover, you can obtain permanent tax deferments for yourself and your family.

Permanent Tax Deferment

If you never sell EPD, then your original cost basis worth of distributions (14 years of payouts at today’s yield) are tax free.

When your heirs inherit your units, the cost increases to the price on the day of your death.

That means they can sell 100% of the position with zero taxes.

Or they can continue to own them and receive 100% of the new cost basis in distributions, tax-free.

Every generation can continue to pass on EPD, and each time the cost basis steps up, it can lock in exponentially more tax-deferred income.

It’s similar to the 1031 exchange in real estate, which allows you to roll over proceeds from a property sale to buy a new property without paying capital gains taxes.

This approach can defer hundreds of thousands or even millions of dollars in safe and dependable income over several generations.

The downside? Why isn’t everyone in love with MLPs thanks to this incredible tax-deferred status?

The Downside of MLP Tax Treatment

Many MLPs operate in multiple states, which can subject investors to state income tax filings in each state where the MLP operates. This can add significant complexity and potentially increase the investor’s state tax liability.

Technically, the pass-through nature of MLPs means that you should file state income tax returns with every state an MLP operates in. Most states require a tax filing if your net income from any source is $1. Does that mean MLP investors have to do that?

According to Bob Meighan, a CPA and vice president of TurboTax publisher Intuit, “It’s not worth the aggravation, whether you do the returns yourself or hire a CPA. Fortunately, states follow a reasonableness standard.”

According to tax professionals and experts, while the technical requirement exists, the practical enforcement varies. Bob Meighan, a CPA and vice president of TurboTax publisher Intuit, suggests that it may not be worth the aggravation to file returns for minimal amounts, and states often follow a “reasonableness standard.” This implies that states may not aggressively pursue tax filings from individual investors for small amounts of income.

The “reasonableness standard” means that states may not enforce the filing requirement for trivial amounts of income, recognizing the administrative burden it places on taxpayers. This is especially true for individual investors with minimal income from the MLP in those states.

However, some investors will not feel comfortable with this reasonable standard for individual states since, technically, it’s at each state’s discretion.

The individual state tax authorities decide whether to require an investor to file a tax return. These authorities establish the rules and income thresholds that require a tax return filing.

Tax Withholdings for Foreign Investors in MLPs

Foreign investors in Master Limited Partnerships (MLPs) are subject to specific tax withholding rules due to the nature of the income and the U.S. tax regulations.

Here are the key points regarding the tax withholdings for foreign investors in MLPs:

Withholding Rates

Effectively Connected Income (ECI):

For non-corporate foreign partners, the withholding tax rate on effectively connected income (ECI) is 37%.

For corporate foreign partners, the withholding tax rate is 21%.

Publicly Traded Partnerships (PTPs):

Under IRC Section 1446, distributions and dispositions from publicly traded partnerships (PTPs) held by non-U.S. persons are subject to U.S. withholding tax. This includes MLPs, which are a type of PTP.

Additional Withholding:

Some sources indicate that the withholding tax rate for distributions to non-resident, non-U.S. citizens can be as high as 39.6%.

Filing Requirements

Tax Identification Number (TIN):

Foreign investors must obtain a U.S. Taxpayer Identification Number (TIN) and submit it to the MLP’s transfer agent using Form W-8BEN to get credit for the withholding taxes.

Federal Tax Returns:

Foreign investors must file federal tax returns to report their share of the MLP’s income, gain, loss, or deduction and pay federal income tax at regular rates on their share of net income or gain.

State Tax Returns:

Foreign investors might also need to file state tax returns, depending on the states in which the MLP operates.

Complications and Considerations

Excess Withholding:

The U.S. withholding tax may exceed the foreign investor’s actual tax liability. The only way to reclaim the excess tax is to file a U.S. tax return.

Tax Treaties:

Tax treaties between the U.S. and the investor’s home country may affect the withholding rates and filing requirements. Investors should consult with tax professionals to understand the implications based on their specific situation.

Investment Accounts:

The withholding tax applies to all accounts, including registered and non-registered accounts. For example, Canadian investors face a 39.6% withholding tax on MLP distributions in both registered and non-registered accounts.

As you can see, the tax complexities for foreign investors are much higher, with as much as 40% withholdings, which significantly reduces the total return potential of owning EPD.

Retaining those withholdings can require filing a federal tax return, which isn’t worth the hassle for small investors. For larger investors, it might be remembered that you’ll have to pay a CPA to do it (unless you want to spend several hours each year doing US taxes).

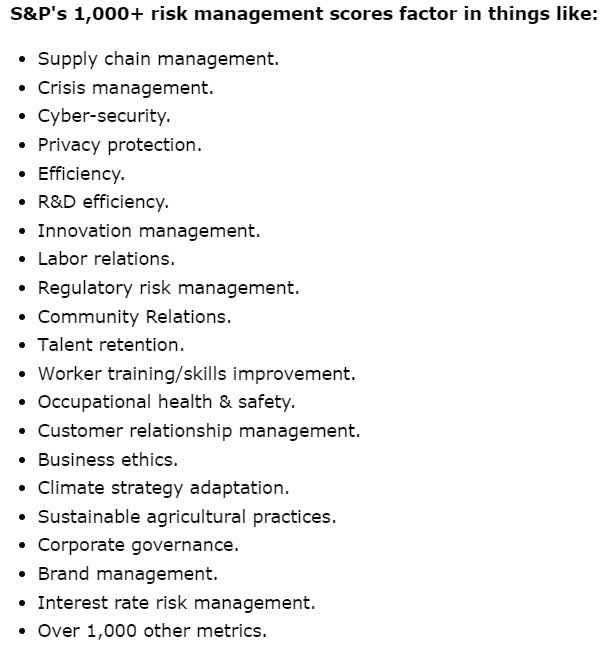

S&P

| S&P LT Risk Management Score | Rating |

| 0% to 9% | Very Poor |

| 10% to 19% | Poor |

| 20% to 29% | Suboptimal |

| 30% to 59% | Acceptable |

| 60% to 69% | Good |

| 70% to 79% | Very Good |

| 80+% | Exceptional |

| EPD Optimality | 74.38% |

| Global Percentile | 99% |

(Source: S&P)

EPD has the long-term risk management chops to be an authentic “buy and hold forever” stock, and its stable business model, including plans for a post-fossil fuel transition, makes it one of the few MLPs that can safely be owned with a perpetual time frame.

However, it’s important to remember that any business can fail. So, anyone buying EPD to generate passive income indefinitely will have to bear the single company risk that comes with all individual stocks.

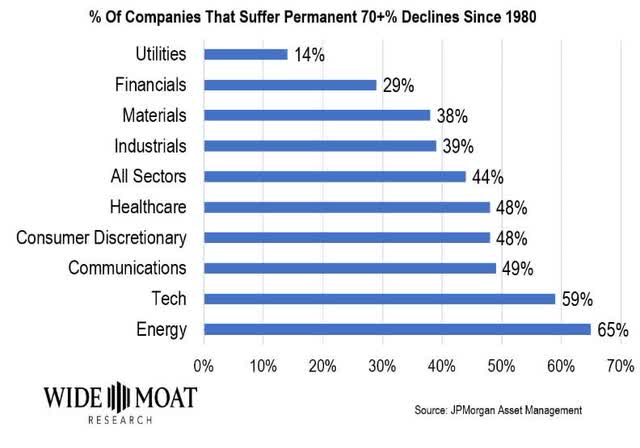

Wide Moat Research

65% of energy stocks since 1980 have fallen 70%-plus and never recovered.

I’m 80% confident (Marks/Templeton certainty limit) that EPD will never suffer such a permanent catastrophic decline.

However, the future is always uncertain, so there are no 100% probabilities on Wall Street.