Tero Vesalainen/iStock via Getty Images

Investment Thesis

Electronic Arts (NASDAQ:EA) is scheduled to announce their full-year FY24 earnings report next week on Tuesday, May 7th, after market hours.

The Redwood City, CA-headquartered game publisher of some of the biggest games of all time has been cycling through a few key updates since management announced their Q3 FY24 earnings earlier this year.

The video game publishing giant enjoyed the success of its rechristened soccer game, EA Sports FC, after walking away from its partnership with FIFA. Other EA Sports franchise hits, such as Madden NFL, as well as games outside of the EA Sports franchise, such as The Sims, continue to find deep relevance with gamers, per my observation.

However, I believe Electronic Arts is still in need of that elusive blockbuster hit that can ramp up the compounding growth missing from its slate of games today. In the absence of new IP and blockbusters, the company has demonstrated increased operational leverage so far in terms of a lower expense profile.

Given my tempered outlook on the company’s game pipeline and the fact that I expect no significant changes as EA heads into its final quarter of FY24, I continue to hold a neutral view on Electronic Arts stock.

Summarizing Electronic Arts’ Q3 Performance and Key Management Commentary

In my previous coverage of Electronic Arts, I explained why I expect the company to grow its free cash by 5% over the next decade, implying the stock was trading within a fair value range. But I had also mentioned the following:

I fear that if the company does not pull more levers to grow its business or widen its margins, it will continue to trade sideways, at best, as it has over the past 3 and a half years, as seen below.

Since then, the company’s stock has been range-bound for the most part, as I implied in my previous research note, but I have also observed moderate volatility in the stock for the past two months. Following my previous coverage, the company released its Q3 FY24 earnings results, which I will briefly summarize in this section.

Electronic Arts versus the markets on a trailing twelve-month basis (sa)

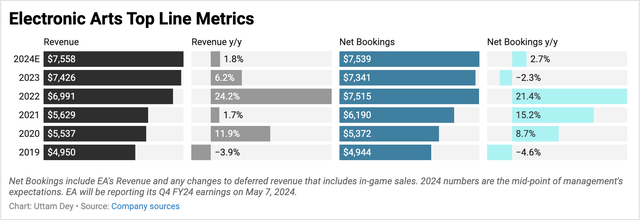

Per the company’s Q3 FY23 report, Electronic Arts reported revenues worth $1.95 billion, 3.4% higher than the previous year. Revenue from Live Services, the gaming-as-a-service delivery format for its video games, continued to become an even more important part of Electronic Arts’ business model, accounting for ~70% of total revenues in Q3 and growing 5.4% y/y to $1.33 billion. Management expects low single-digit growth at the midpoint of its guidance range, as shown below.

Quarterly trends for top line metrics, Electronic Arts (Q3 FY24 Investor Presentation, Electronic Arts)

Net bookings, the company’s revenue plus any changes in deferred revenue that usually comprise the sale of goods or subscriptions in the live games, grew 1% to ~$2.37 billion. Yet again, Live Services continued to be the anchor here as well, where net bookings in Live Services grew by 3%. Per my observation, the company’s EA Sports franchise continued to be the growth flywheel for its bookings. For example, I noticed that EA Sports FC 24 delivered 7% growth in net bookings, while Madden NFL net bookings grew 5%. Outside of the EA Sports franchise, Sims and Battlefield continued to also hold strong relevance among gamers, while Apex Legends “did not meet our expectations,” per comments from management. Management expects low single-digit growth in net bookings as well in FY24.

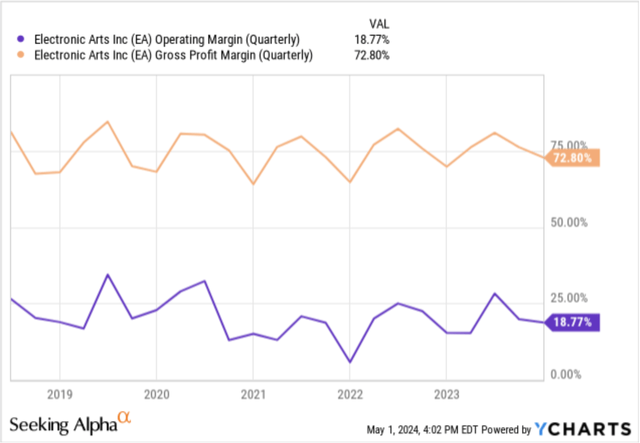

In terms of its operating leverage, I see that operating income grew 17.4% y/y to $365 million as margins expanded by 224 basis points to 18.8%. While gross margins remain tightly controlled within a range, operating margins have fallen from ~25% before the pandemic to ~20% after, as seen below. Its Q3 GAAP EPS was $1.07 versus 73 cents in the prior year, same quarter.

Gross margins and operating margins for Electronic Arts (yCharts)

Updates from the Q3 FY24 that may impact Electronic Arts’ Q4 results

One of the most important updates in the past three months was an announcement from management about downsizing its staff by about 5%. In a filing, the company said it expects about ~$125M-$165M in charges related to the layoffs due to charges such as office space reductions, employee severance costs, and license cancellation fees. At least ~85% of these charges and expenses are expected to be borne by the company by the end of this calendar year itself. This news was also timed with the start of the company’s relative underperformance to the markets, as seen in the first chart of this research note.

Then, a leading video game market research firm reported last month that Electronic Arts plans to raise the price of its EA Play subscription service by ~20% across its tiers.

At the same time, the company has not had a major blockbuster release of new intellectual property (IP) over many years. Per my observation, most of the company’s video games have been re-launched or re-purposed to spread across different formats, while also increasing the modes of play for its hit games.

For example, its EA Sports FC games also include the Ultimate Team mode, and similar game modalities are also being launched for other hit games. The next highly anticipated game to be launched by Electronic Arts seems to be EA Sports College Football, which also includes a Dynasty mode, scheduled for launch in the summer of this year. To me, these actions continue to point in a direction where the company is unable to produce blockbuster games, and in lieu of those hit games that can provide a nice bump to its growth story, management is resorting to pulling operational levers such as prices and expenses.

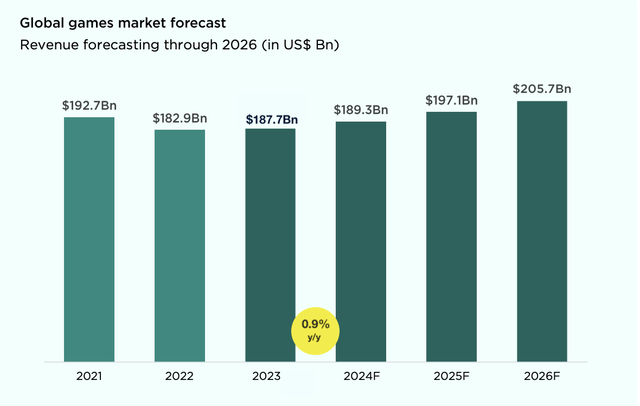

I will be curious to understand from management their outlook and guidance for FY25 in the backdrop of, what I believe are, two operational levers that have been pulled to manage its cost structure. The company’s games have not been performing as per expectations, like Apex, which I noted earlier. Moreover, research suggests growth is coming back to gaming markets this year, as shown below.

Gaming markets will see some modest ~low single digit gains this year. (Newzoo)

Electronic Arts stock is priced in ahead of earnings

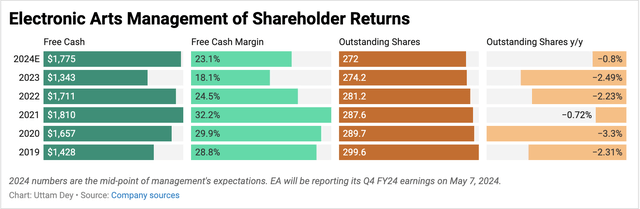

In the Q3 earnings report, management mentioned that cash flow from operations is expected to grow to ~$2.03 billion at the midpoint of its guidance range, up from 30.6% last year. To arrive at my estimate for expected free cash, I will use their guidance on the full-year FY24 capex of ~$250 million, which gets me to expected free cash worth ~$1.78 billion, as seen below.

Electronic Arts free cash and shares outstanding (Company sources)

The above chart suggests that Electronic Arts free cash is expected to grow ~4.5% CAGR since 2019. Over the past ten years, free cash has grown at a compounded growth rate of ~11%. I don’t expect the company to return to double-digit free cash growth unless it can deliver some blockbuster games. Without that, I see the company delivering ~mid single-digit free cash growth, as I had assumed in my previous coverage of Electronic Arts.

If I use a reverse discounted cash flow model, I see that the market is expecting the company to deliver free cash at a ~4.6% compounded growth rate, as seen below.

Electronic Arts stock looks fully priced heading into earnings (Author)

I believe this is a fair assumption. In fact, if I assume my previous assumption of 5% CAGR in free cash, I expect a marginal 3-5% growth in the company’s stock at best, assuming a discount rate of ~9%. Operational levers such as price increases and lower expenses can boost the free cash flow marginally, per my assumption.

Given this outlook, I do not see any material improvement from my prior analysis of Electronic Arts.

5 Key Factors to look for in Electronic Arts’ Q4 FY24 earnings report

I wanted to emphasize a few things that I think are important to look for in Electronic Arts’ earnings report next week:

-

Q4 and full-year FY24 expectations: The company is expected to report $1.52 earnings per share on revenue of $1.77 billion in Q4 FY24. With the past three quarters reported, this would mean the company would be expected to report $7.13 earnings per share on revenue of $7.55 billion, in line with management’s projections.

-

Bookings and long-term outlook: Management expects low single-digit growth in net bookings in FY25, with scope for acceleration down the road. This looks to be in line with the gaming market forecasts I highlighted earlier.

-

New games and IP: Management commentary on new games in the development pipeline will be key, in my opinion. To turn bullish on this company, I would love to see more movement in IP and new games being released.

-

Current strengths update: The robustness of their EA Sports franchise holds the key to supporting the company’s long-term success. There is unofficial chatter in video game forums about FIFA looking to partner with Electronic Arts rivals for a new FIFA-branded soccer game.

-

I am also looking for rationale around the price increases, which, at 20%, look excessive to me. What is their outlook on sustained demand given the price hikes? Plus, any updates on more layoffs planned or M&As.

Takeaway

Electronic Arts continues to be a company that is caught in between cross currents. The company appears to have reached peak growth for now but continues to demonstrate operational efficiency to optimize costs, which is keeping the stock buoyant for now. With no major growth catalysts on the horizon, there is nothing exciting to turn me bullish.

For now, I continue to rate Electronic Arts as a Hold ahead of its earnings.