Oat_Phawat

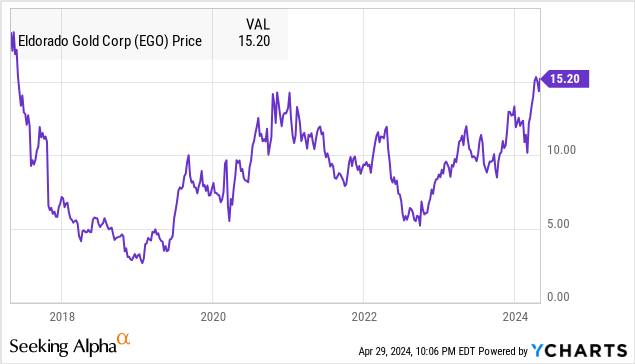

Eldorado Gold Corp (NYSE:EGO) has quietly rallied to its highest level since 2017, gaining momentum in recent months alongside the record price of gold. Indeed, the company reported its latest quarterly results highlighted by solid growth with management guiding for an even stronger second half of the year.

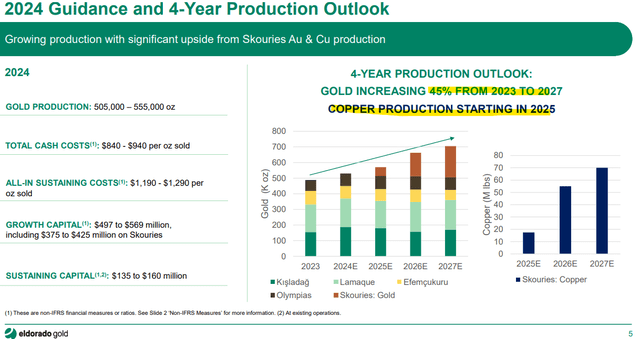

The market is also looking ahead to the company’s game-changing high-grade “Skouries” project in Northern Greece, expected to be commissioned by 2025. At full production, the facility is expected to drive a 45% increase in total gold production while also transforming the company into one of the largest copper producers in the European Union.

Overall, there’s a lot to like about EGO as a good option for exposure to trends in gold and copper. We are bullish on the stock and see room for more upside going forward.

EGO Earnings Recap

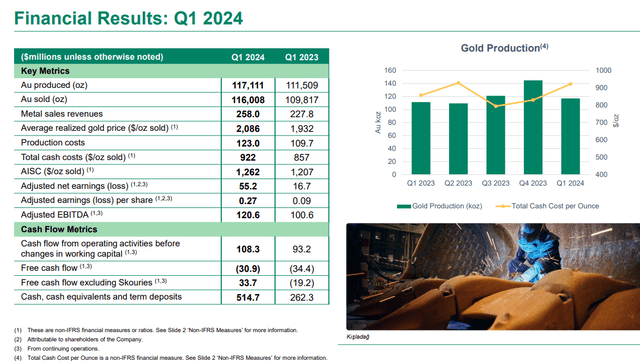

EGO Q1 EPS at $0.27 marked a ramp-up compared to $0.09 in the period last year. The more normalized adjusted EBITDA reached $120 million, representing a 20% increase from $100 million in the period last year.

Revenue of $258 million was up 13% year-over-year, capturing a 5% increase in gold ounces sold coupled with an 8% higher average realized price from Q1 2023. The all-in-sustaining cost (AISC) at $1,262/oz was modestly 4.6% higher y/y including some higher capex spending.

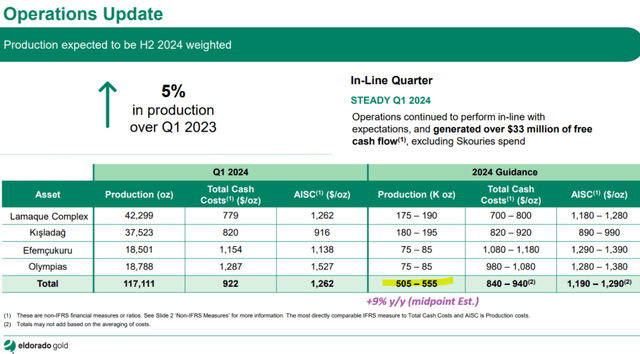

Eldorado produced 117k ounces of gold in Q1 compared to 112k in the period last year.

This was achieved primarily through a 14% increase from the “Olympias” project and 12% growth from the “Lamaque” mine, balancing a weaker quarter at the “Efemcukuru” due to lower planned grades processed. “Kisladag” output was nearly flat on a year-over-year basis.

For the full year, management projected optimism during the earnings conference call.

The guidance is for total gold production between 505k and 555k, around 9% higher than 2023 at the midpoint. This is expected to be achieved through further development of the higher grade “flat zone” in the Olympias project into the second half of the year.

The target for AISC between $1,190 and $1,290, would be up from $1,089 in 2023 compensated by the sharply higher gold price.

Skouries Update

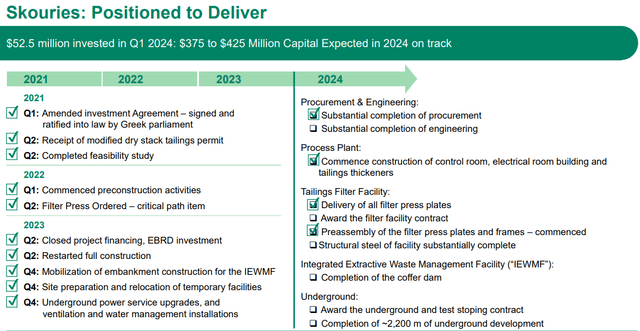

We mentioned the attention on the Skouries project. In February, Eldorado made some headlines by pushing back the timetable for the first production to Q3 2025 from the prior guidance of mid-2025.

Eldorado invested $53 million in Q1 with a total planned expenditure this year of around $400 million this year. While cost overruns have been a theme for the project going back several years, the good news now is that there is some confidence the project will ultimately be completed.

The latest update is progress on the completion of procurement as well as the start of plant construction for the main control room, electrical building, and tailings thickness. Overall project completion is reported at 73% with the next major milestone being completion of engineering work.

Compared to this year’s gold production target of around 530k ounces, Skouries is expected to take that figure toward 700k by 2027. That incremental output could translate to upwards of $400 million in annual revenue based on current market pricing for gold.

The other dynamic here is the copper side of the project which will also be started by 2025. Eldorado expects to generate 70 million pounds of copper production by 2027. With the current price of copper hovering above $4.65/lbs, the implied production value is around $325 million.

What’s Next For EGO?

If there was any doubt about the economic attractiveness of the Skouries project in recent years, the latest rally in the price of copper and gold reaffirmed Eldorado’s as well-positioned to capitalize on these trends.

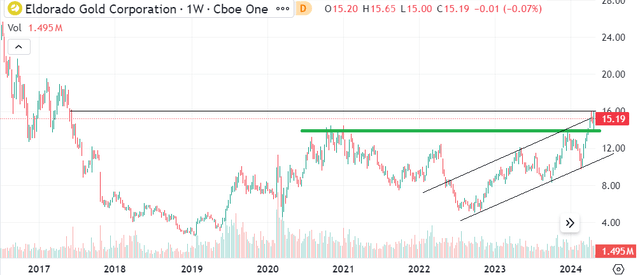

From the stock price chart, EGO has climbed above $15.00 per share, surpassing its 2021 high, in what we would describe as a technical breakout.

As long as the project remains on track and the company can reach its production targets, we believe the stock can outperform the commodity price.

The key here is that regardless of how much more upside gold or copper delivers during this market, EGO is on track to deliver significant profitability and climbing cash flows that should accelerate looking out through 2025 and beyond as the operation expands.

We can also mention the separate “Perama Hill” development as the next major asset on the pipeline supporting a positive long-term outlook.

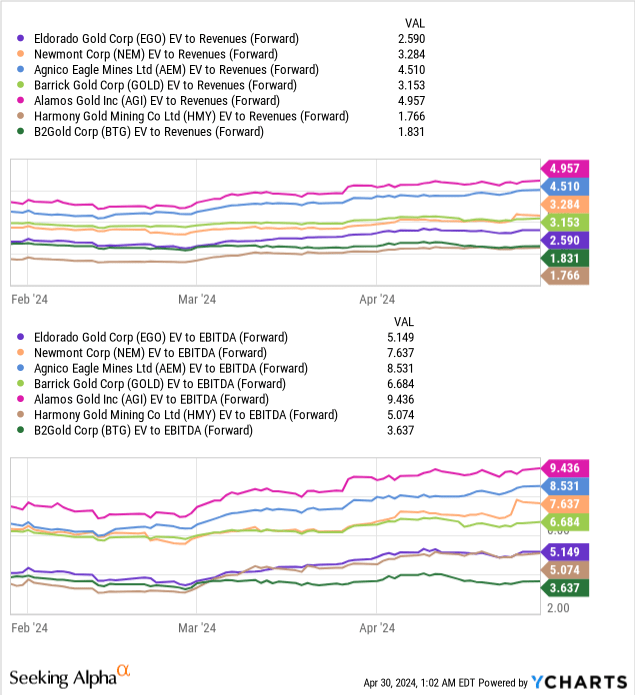

In terms of valuation, EGO’s $3 billion market cap or $3.1 billion enterprise value considering just $100 million in net debt implies the stock is trading at under 3x sales or around 7x on an EV to EBITDA basis.

The path is for both of those metrics to narrow significantly through 2027 and beyond, thinking about the operating leverage and expected decline in AISC over the period.

EGO stacks up well against its mining peer universe considering larger names like Newmont Corp (NEM) or Barrick Gold Corp (GOLD) trade at wider premiums. There is a case to be made that Eldorado’s future diversification into copper adds a layer of quality that can justify an expansion of its valuation spreads going forward.

Final Thoughts

Eldorado Gold is a high-quality miner with overall solid fundamentals. The company delivered a strong start to 2024 with several moving parts supporting a positive outlook.

The main risk to consider would be an extended selloff in the price of gold and copper, forcing a reassessment of the earnings trajectory. A setback in the timetable for the completion of the Skouries project could also open the door for a deeper selloff.

Monitoring points for the rest of the year include quarterly production level updates as well as the trends in cash flow and costs.