Joe Hendrickson

Duluth Holdings’ (NASDAQ:DLTH) 2Q24 was not very surprising from a results perspective, but the markets liked the quarter, with the stock reaping almost 30% in the few days after the release. This seems normal for a company with significant operational leverage, in which small tweaks to sales and margins make a big difference in profitability.

From an operational standpoint, I still do not see improvement in what, I believe, are Duluth’s key operational problems: assortment and inventory management. If anything, I see the problems worsening with more clearance, more inventories, and more SKUs.

Looking forward, the company’s 3Q24 will be challenging from a seasonal perspective, but above all, from a cash perspective, with significant cash requirements and some upcoming non-recurring severance payments.

Looking at the valuation, between its dip and further resurgence, the stock has not meaningfully moved from my 1Q24 article, at which I considered the stock not an opportunity. The model I proposed back then is still valid, with management reaffirming yearly guidance. For that reason, I still believe Duluth is a Hold at these prices.

2Q24 results in line

Sales up but comps down: The company posted sales growth of 1.8% YoY, which is salutary as Duluth had been posting relatively bad numbers (down high single digits) in previous quarters.

Looking under the hood, the company grew in women at 6% and was flattish in men at 1%. Men make up the majority of sales, and women is a smaller category, with growth easier to achieve. Regarding comps, digital was up 5.6%, whereas stores were down 4.4% (albeit stores improving sequentially from down 7% in Q1). Store comps are an important factor in determining overall margins because they help greatly with leverage, whereas ecomm growth has higher variable components (shipping and advertising mostly).

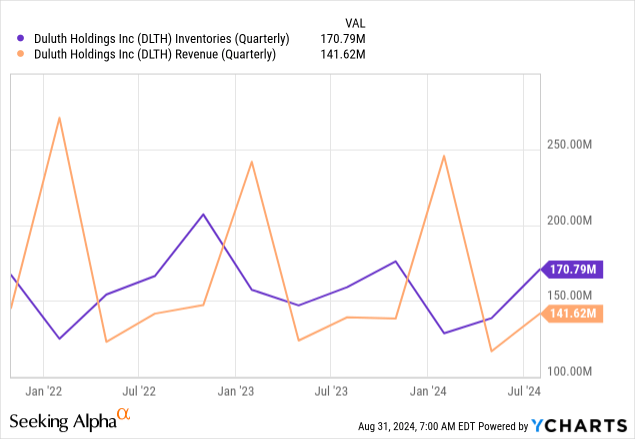

Assortment is not improving much: Since I’ve been writing about Duluth, my main criticism is its inventory and assortment management. The company has too many SKUs, which leads to high sourcing costs, and a lot of clearance activity. Unfortunately, the company has not improved in this area too much.

On the positive side, they have reduced sourcing costs by going directly to factories, albeit I fear that this might come at the expense of higher SG&A and higher volume commitment. The problem is that the improvement from sourcing was lost in higher clearance activity. Still, gross margins improved 90bps YoY.

However, we should not look at those margins in isolation because the company also carried a lot of inventory from Q2 into Q3 that will need to be cleared. Clearance inventory grew to 11% from 7%, and inventories grew by almost $30 million YoY when, seasonally, they do not tend to. Management commented that this inventory will be cleared in Q3, putting pressure on margins in this quarter.

More strategically, the company continues with the expansion of SKUs. This quarter, they commented on the launch of not one but two new footwear collections. This puts pressure on volumes and overhead to source cheaper inventory and puts pressure on them to clear that inventory. Also, strategically and more positively, the company announced the incorporation of a new Chief Merchandising Officer, coming from Academy Sports and Outdoors (ASO), a retailer operating in a similar market with sales of $7 billion. This should be a good addition and may improve the merchandising situation.

SG&A improving ex nonrecurring: If we look at SG&A, the YoY comparison is not great, increasing 4.6% and deleveraging. However, out of the $4 million increase, $1.5 million corresponds to the impairments from the abandonment of a DC center (commented on the Q1 article), and another $2.4 million comes from a tax accrual. This means that ex these non-recurring expenses, SG&A was flat in dollars and leveraged a little. In addition, if we remove these non-recurring expenses, the company posted breakeven EBIT.

Prepare for a challenging Q3: The next quarter will probably be challenging from a results perspective. There are four reasons for this. First, the quarter is seasonally low (similar to Q2 and Q1), which generally puts pressure on the fixed cost overhead margins. Second, the company will need to clear the obsolete Q2 excess inventories (probably mostly related to summer activities that will not be easy to sell during fall and early winter). This will pressure gross margins. Third, the company will recognize another $5.8 million in DC impairments, part of which will be cash-based (potentially as much as $4.5 million). Finally, the company will need to build the key season 4Q inventories. All of this will imply operational losses (at least in accrual terms) and a deterioration of the cash position of the company (which currently has $10 million in cash and no debt).

Valuation not modified

After the Q1 results (and when I valued the company for the last time), it went down almost 20%, from $3.8 to about $3.2. But then, the rally post-Q2 results recouped all of that and then more. Today, the stock is 7% above where it was one quarter ago.

This implies that the company’s valuation has not changed meaningfully. I do not believe its fundamentals have changed much, either. It is true that sales growth is positive, but I would point to previous retractions in incipient turnarounds in this figure. On the critical merchandising side, I see no improvement and could even consider further worsening of the situation. The company has also maintained its yearly guidance. Therefore, the model I posted in Q1 is still valid.

At that point, I commend that the valuation was consistent with low single-digit growth, gross margin improvement of 200bps, and fixed SG&A. That was necessary for the bare minimum returns justifiable for holding Duluth.

I still believe that the scenario above is relatively optimistic and is only the basis for justifying a fair price for Duluth, not considering it an opportunity. In addition, I fear the volatility leading into the challenging Q3. I would also like to see merchandising improvements before considering Duluth.

For these reasons, I continue to believe the stock is a Hold at these prices.