Joe Hendrickson

Intro

Duluth Holdings (NASDAQ:DLTH) 1Q24 results were not great, with comparable sales down and margins decreasing, contrary to many apparel retailers posting margin improvements. Merchandising problems were also notable, with some styles being out of stock. During the earnings call, the management team discussed a strategic review process, considering closing stores and fulfillment centers. SG&A and marketing expenses continue to grow despite the falling sales.

Despite the low valuation, the company’s consistent negative top-line results, lack of strategic change or SG&A efficiency, and low cash reserves make it a risky proposition. Therefore, I maintain the Hold rating I posted in my first article on the company in March 2024.

Bad 1Q24 evidences strategic problems

In my original article on Duluth, I considered the company to suffer from a series of strategic problems: excessive and inefficient marketing investments, excessive promotional activity, problems in merchandising, and a lack of urgency to turn the company around. I believe the 1Q24 results validate this view.

The company’s sales were down more than 5% YoY. Unlike most apparel retailers, the company did not post comparable figures, but retail and DTC levels were down 7% and 10%, respectively. The company’s sales were benefitted by a large order from Costco, representing about 300 basis points of uplift, in preparation for Father’s Day. Without this order (which is not necessarily recurrent), sales would have been down 8%. As covered by many small-cap apparel retailers, Duluth is not alone in mid- to high-single-digit yearly revenue declines, though.

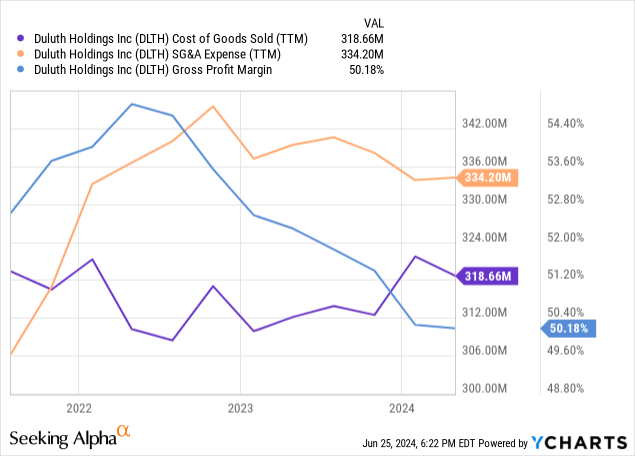

The margin performance was worse, particularly in comparison to other retailers. The company’s gross margins were flat, contrary to many retailers posting gross margin improvements despite falling sales. Just to name a few of Duluth’s approximate size, we have Tilly’s (TLYS), Zumiez (ZUMZ), Torrid (CURV), and Destination XL (DXLG).

Management commented that the uplift in gross margins is taking longer than expected because higher-cost older inventories are moving slowly. Despite having slow-moving inventories, management commented that the company had lost sales in the digital channel and in some product lines because of being out of stock. This evidences my claim that the company is having trouble with the merchandising function.

On the SG&A front, absolute and revenue-wise expenses grew, fueled by higher marketing expenses and investments in personnel and systems. This also evidences my claim that Duluth’s management does not seem worried about protecting the company’s SG&A efficiency to protect operating profits and operating cash flows given the challenging macroeconomic context.

The result has been that the company’s operating losses almost doubled YoY to about $9 million from $4.5 million one year ago.

Unfortunately, and contrary to common practice among apparel retailers, the company does not disclose the origin of the leverage or deleveraging of costs across gross or SG&A categories. This would help separate the effect of higher promotions versus higher product costs, or higher marketing investments versus higher performance bonuses.

Timid improvements

Some aspects are improving.

For example, the company’s management now recognizes the need to make strategic changes. During the call, the company’s new CFO (who started in January 2024) talked about revising the company’s store fleet for potential closings, as well as its large distribution base (four fulfillment centers) and benchmarking other activities like working capital use.

I believe these are steps in the right direction. In my previous article, I criticized the company’s store base (with comparatively large stores), excessive distribution capacity, and merchandising problems.

The company also seems to be reducing proportionality. Its website does not show as many promotions on its home page (visitors were previously welcomed with large clearance banners). Traffic also seems to be improving, according to Semrush.

Valuation does not compensate for risk

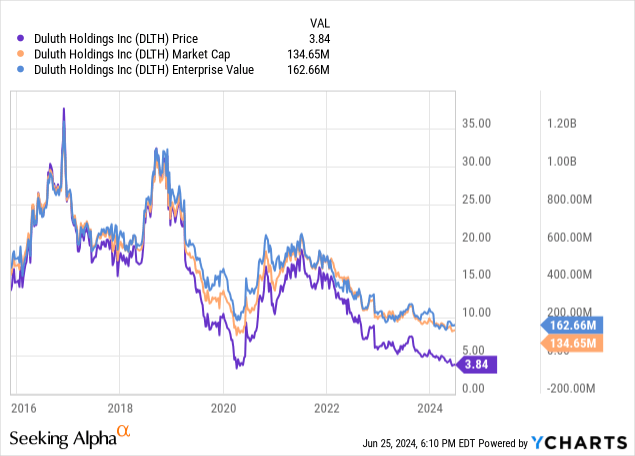

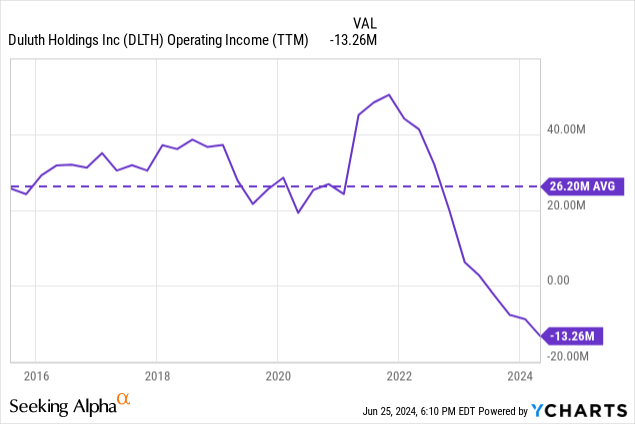

Currently, the company is trading at a decade’s low. I believe the bullish thesis on Duluth is the upside potential if the company can recover some of its pre-pandemic profitability. As shown in the second chart below, the pre-pandemic average operating income (even accommodating for the recent bad performance) is sufficient to justify the company’s current market cap or EV.

However, I disagree with the bullish view for two reasons.

The first is that Duluth’s problems are not only caused by a more challenging macroeconomic context. Part of the company’s problems are caused by internal reasons, some of which I mentioned above. Until there is an indication that the company is improving in these categories, I do not see evidence to justify a turnaround in the company’s profitability.

The second factor is that Duluth does not have cash reserves that are important for any retailer to survive a prolonged economic downturn.

Small model exercise

Even if the company’s problems were caused by the macro, there is currently no indication that the macro is turning positive in the short term. However, Duluth does not have the benefit of time. The company’s cash reserves were invested in a new distribution facility and in sustaining large marketing expenses. Today, the company has $10 million in cash and securities, $25 million in long-term debt, and has drawn $11 million from its credit facility. If losses continue, the company may need to continue drawing from its credit facility. A financially leveraged retailer is much more risky than a retailer undergoing challenges but financially strong.

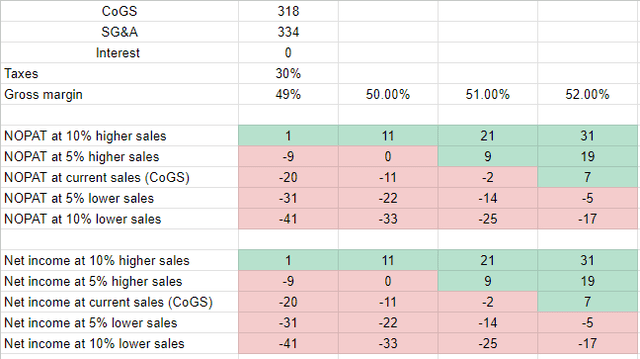

We can also use a very simple model to project what Duluth’s current valuation requires to provide a sufficient earnings yield. The company’s CoGS can be considered more variable, whereas SG&A is more fixed, given it includes rent and labor. The model is in the table below.

Duluth simple profit model (Author)

As we can see, at current gross margins, the company would need to grow sales significantly, about mid-single digits, to generate operational profits. However, Duluth’s management expects gross margins to improve by 200 basis points or reach about 52% for fiscal 2024. Under this scenario, the company would need to grow sales by low single digits to generate net income of about $13 to $15 million, barely enough to justify its current market cap.

I believe, although possible, that the above assumption is aggressive. Duluth’s sales are currently falling at comparable rates that are close to negative high single digits. A turnaround is yet far away.

For the above reasons, I believe Duluth is not an opportunity at these prices and continue to think the stock is a Hold.