LIVINUS

Deutsche Börse AG (DBOEF, OTCPK:DBOEY) has reported a positive operating performance over the past few quarters and its valuation is attractive, remaining a good growth pick in the European financial sector.

As I’ve covered in previous articles, I see Deutsche Boerse has an interesting growth play in the European financial sector over the long term, as the company is well exposed to several structural growth drivers.

In this article, I update its most recent financial performance and investment case, to see if it still offers value for long-term investors.

Deutsche Boerse’s Recent Earnings

Since my last article on Deutsche Boerse, the company has reported results for the full year 2023 and the first quarter of 2024, maintaining a positive operating momentum, supported by higher activity in the capital markets.

Indeed, interest rate volatility has been higher than usual as long-term rates have reacted to hikes from the central bank and the inflationary environment, while expectations of future rate cuts have also been a key theme for above-average volatility in rates.

Given that Deutsche Boerse is significantly exposed to futures trading in German government bonds, this background has been positive for revenues in its derivatives trading segment. This was an important support for revenue growth related to cyclical factors, plus its exposure to structural growth trends and acquisitions were also important factors leading to higher revenues in recent quarters.

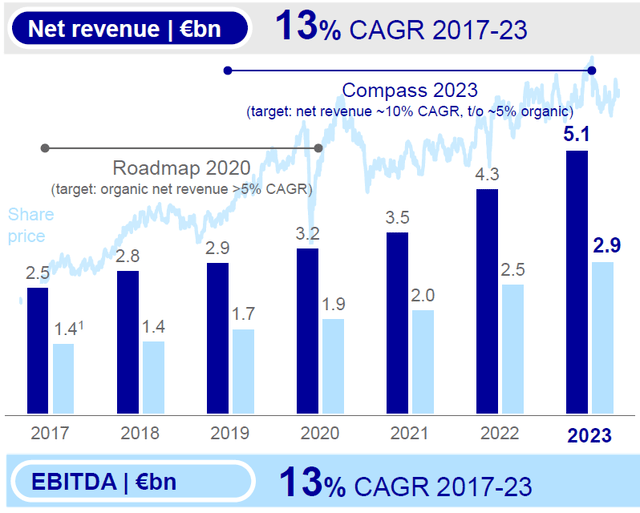

Indeed, the company recorded another record year in 2023, with revenues increasing by 17% YoY to €5.1 billion, doubling compared to 2017 and growing at a compounded annual growth rate of 13% from 2017-23, which is a strong achievement.

Revenue growth (Deutsche Boerse)

During the last year, its revenue growth was mainly organic, representing revenue growth of 12% compared to the previous year, while the consolidation of SimCorp boosted revenues by 5%. An important driver of revenue growth was higher interest rates, which led to strong growth in net interest income and a treasury result of €961 million in 2023, an increase of 81% YoY.

Regarding its costs, despite the inflationary environment and pressure on wage growth, Deutsche Boerse was able to report strong organic cost control with operating expenses up by 5% YoY in 2023, which is way below its revenue growth and shows that the company’s operating leverage is quite positive.

Due to higher revenues and strong cost control, its EBITDA also increased to a record at €2.9 billion in the last year, up by 17% YoY. Its EBITDA margin was close to 57%, which is a good level and shows that Deutsche Boerse’s profitability is quite high. Its net income was €427 million, up by 13% YoY, and its earnings per share (EPS) amounted to €2.20.

During the first quarter of 2024, Deutsche Boerse reported a strong operating performance and is progressing well in its growth strategy, plus the integration of SimCorp is also an important driver of higher revenue and earnings.

In Q1 2024, its revenues amounted to €1.4 billion (+16% YoY), of which SimCorp boosted revenue by 10%, and organic growth was 6%. This performance was above expectations and mainly driven by structural factors, as lower equity and rates derivatives had a slightly negative contribution for revenue growth in the last quarter.

Regarding costs, its organic cost growth was only 4% in the quarter, leading to EBITDA of €875 million (+13% YoY) and a margin of 61%, representing an increase of about four percentage points compared to 2023.

For the full year, Deutsche Boerse confirmed its guidance of reaching revenues of at least €5.6 billion (+10% YoY) and EBITDA above €3.2 billion (also +10% YoY), supported by its organic growth initiatives and synergies from the SimCorp integration.

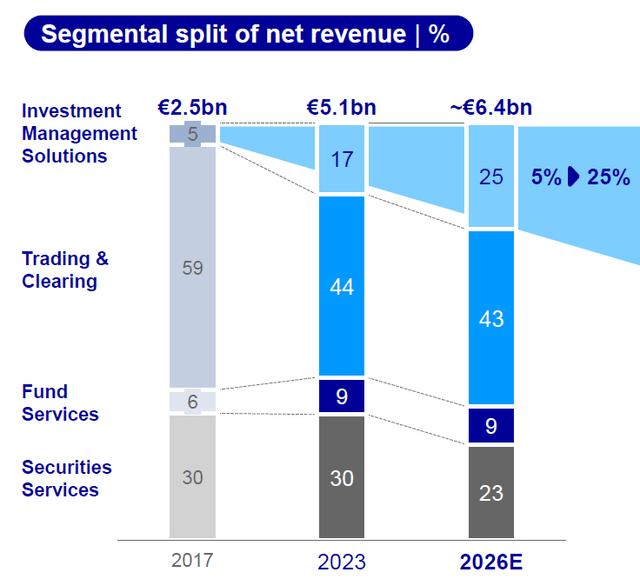

Its growth strategy remains focused on diversifying its revenue and earnings stream, particularly in businesses not related to trading. Indeed, Deutsche Boerse’s goal is to increase the weight of revenues coming from its Investment Management Solutions segment to about 25% by 2026, compared to 17% in 2023, being its major growth driver in the coming years.

This growth should be mainly organic, especially considering that it’s still integrating the SimCorp acquisition in this segment, even though Deutsche Boerse is always open to new acquisitions if they fit well into its business profile and make sense from a financial perspective.

Regarding its balance sheet, its net debt amounted to more than €6 billion at the end of 2023, and its leverage, measured by the net debt-to-EBITDA ratio, was 2.2x at the end of last year. This increased significantly from a leverage ratio of 1.2x in 2022 due to SimCorp’s acquisition, and the company’s goal is to deleverage in the coming years, to a level that is more consistent with its strong credit ratio of AA by S&P.

This means much of its cash flow generated in 2024 and, potentially, in 2025 will be used to reduce balance sheet leverage, to protect its credit rating. While Deutsche Boerse’s EBITDA is also expected to increase over the next couple of years, it will not be enough to reduce its leverage ratio to a range between 1-1.5x, thus Deutsche Boerse is likely to use free cash flow generated to increase its cash position and reduce leverage in this way.

Taking this background into account, it’s not surprising that Deutsche Boerse has reduced its dividend payout ratio range to a level between 30-40% in the future, a level that is quite conservative and lower than its historical range. This clearly shows that Deutsche Boerse’s focus in the short to medium term is investing in its business growth and deleverage its balancer sheet, while returning capital to shareholders seems to be a secondary goal.

Nevertheless, the company raised its dividend related to 2023 earnings to €3.80 per share, up by 6% YoY, and intends to maintain a growing path in the next few years. However, its annual dividend related to 2023 earnings was way below street expectations of about €4.20, showing that its new dividend policy was not expected by the market.

At its current share price, Deutsche Boerse offers a dividend yield of about 2%, which is not particularly attractive compared to other stocks in the European financial sector, or other alternatives in the fixed-income asset class, thus its income appeal remains relatively low. On top of dividends, the company also wants to use some excess liquidity to perform share buybacks, having completed a €300 million share repurchase program in 2024, a strategy that is expected to be maintained in the near future.

Regarding its valuation, Deutsche Boerse is currently trading at about 18.3x forward earnings, a similar valuation compared to when I last covered Deutsche Boerse, being a discount to its historical average of more than 20x forward earnings over the past five years. Compared to its closest peer, London Stock Exchange Group (OTCPK:LNSTY), this valuation also seems to be attractive given that LSEG is trading at 25x forward earnings, which is a premium to Deutsche Boerse and also compared to its own historical average of around 23x over the past five years.

This means Deutsche Boerse seems to be a better play right now in the European exchange sector, due to an attractive combination of growth and value.

Conclusion

Deutsche Boerse has delivered a very positive financial performance in recent quarters and its growth prospects are good, remaining one of the best growth plays in the European financial sector. Moreover, its valuation seems attractive considering its business fundamentals and relative to its closest peer, thus my recommendation remains “Buy” on its shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.