Delta Air Lines Airbus A350-900 (N512DN) passenger plane. viper-zero

Delta Air Lines (NYSE:DAL) has been one of the worst-performing large cap stocks of the last five years. Having gone from $62 in 2019 to $19 by the COVID-era lows, it fell a whopping 70% from top to bottom. And, the stock still hasn’t recovered to its 2019 high, being currently down 18.8% from that level!

As a result of the beating it has taken, DAL has very low valuation multiples. At today’s prices, it trades at 7.3 times adjusted earnings, six times GAAP earnings, 0.51 times sales and 4.5 times cash flow. In today’s hot market, where the S&P 500 index trades at 24 times earnings, that kind of valuation really stands out.

You might think, looking at those rock bottom multiples, that Delta Air Lines is a “growthless wonder,” but think again! DAL scores a respectable B- on growth in Seeking Alpha Quant, with revenue up 9.3% and earnings up 162% in the trailing 12-month period. Even in the trailing five-year period, the middle of which saw widespread COVID-19 lockdowns, the compounded annual (“CAGR”) earnings growth rate was 5.3%. Finally, the company’s TTM earnings are up from 2019, the last full year before the COVID-19 pandemic hit.

Now, if you’re wondering why I’m belaboring the “COVID” point so much when America hasn’t seen a lockdown in years, it’s because that topic explains how Delta Air Lines got to where it is in the first place.

Public health officials handled the COVID-19 pandemic, initially, by lockdowns and travel restrictions. Before the Pfizer (PFE) vaccine came out, nobody had an effective treatment for existing infections, so the “treatment” was to attempt to keep the virus from spreading. That entailed keeping people at home. COVID spread primarily by air, so if people stayed inside, that would help to slow the spread. Keeping people “at home” partially meant keeping them in the city they were residing in: many foreign trips were banned outright, and travel within the U.S. at times required a 14-day quarantine period in a hotel room or home by one’s self.

All of this naturally had a major effect on Delta Air Lines. For the full year 2020, it delivered:

-

$17 billion in revenue, down 61%.

-

A $-12.4 billion operating loss, down from a $5.2 billion profit.

-

A $-12.3 billion net loss, down from a $3.3 billion profit.

-

A $-3.7 billion net cash outflow from operations, down from a $7 billion net inflow.

As you can see, the pandemic absolutely devastated DAL financially. With Americans having to avoid international travel and in some cases quarantine for two weeks upon entering a different state, the demand for travel tanked. DAL stock declined 67% in February and March 2020. Since then, the stock has risen 148%. However, it is not even close to re-taking its 2019 highs.

That’s interesting because, at this point, Delta Air Lines as a business has almost fully recovered from the COVID-19 damage it took in 2020. Its revenue and earnings are both ahead of 2019 levels. Operating income and free cash flows remain down from 2019, but are appreciably above the levels seen in 2020. Despite this, DAL today trades at about the same price it traded at on February 26, 2020 ($46). In this article. I will make the case that this price is likely undervaluing DAL shares, while the company itself delivers high growth and decent margins.

Recent Earnings

To start off our analysis of Delta Air Lines, we can look at the company’s most recent earnings release. In the first quarter, the company delivered:

-

$13.7 billion in operating revenue, up 7% year over year (y/y).

-

$614 million in operating profit, up from a $277 million loss.

-

$0.06 in earnings per share, up from a loss.

-

$0.45 in adjusted earnings per share, up 80%.

-

Guidance for $2.20 to $2.50 in second quarter earnings per share.

-

Guidance for $6 to $7 in full year earnings per share.

-

Guidance for $3 billion to $4 billion in free cash flow.

Revenue beat estimates by a wide margin, adjusted earnings also beat expectations, while GAAP earnings missed expectations. Overall, it was a good showing. Slightly less encouraging was the forward guidance. The company said that it expected $7 in earnings per share for fiscal 2024, which is lower than the TTM amount of $7.78. Nevertheless, DAL stock is cheap enough that it does not require much growth in order to be worth the investment. If we treat next year’s $7 in estimated EPS as a cash flow, and discount it at 10% with no assumption of growth, we get a $70 price target, which is 52% upside to today’s prices. In other words, the stock is so cheap it can afford to have its earnings go down 10% and still be worth the investment.

Rapid Debt Reduction

One very encouraging trend in Delta Air Lines’ earnings is its reduction in debt. In 2020, DAL tripled its debt load to $26 billion in order to make it through the pandemic with diminished revenue. Part of the debt came from government rescue financing at 1% interest, which was a relatively low price to pay. Still, the increase in debt resulted in a big increase in interest expenses. However, once the lockdowns ended, DAL started paying off its debt. By the end of 2021, debt was already down to $23 billion. Today it sits at $15.5 billion.

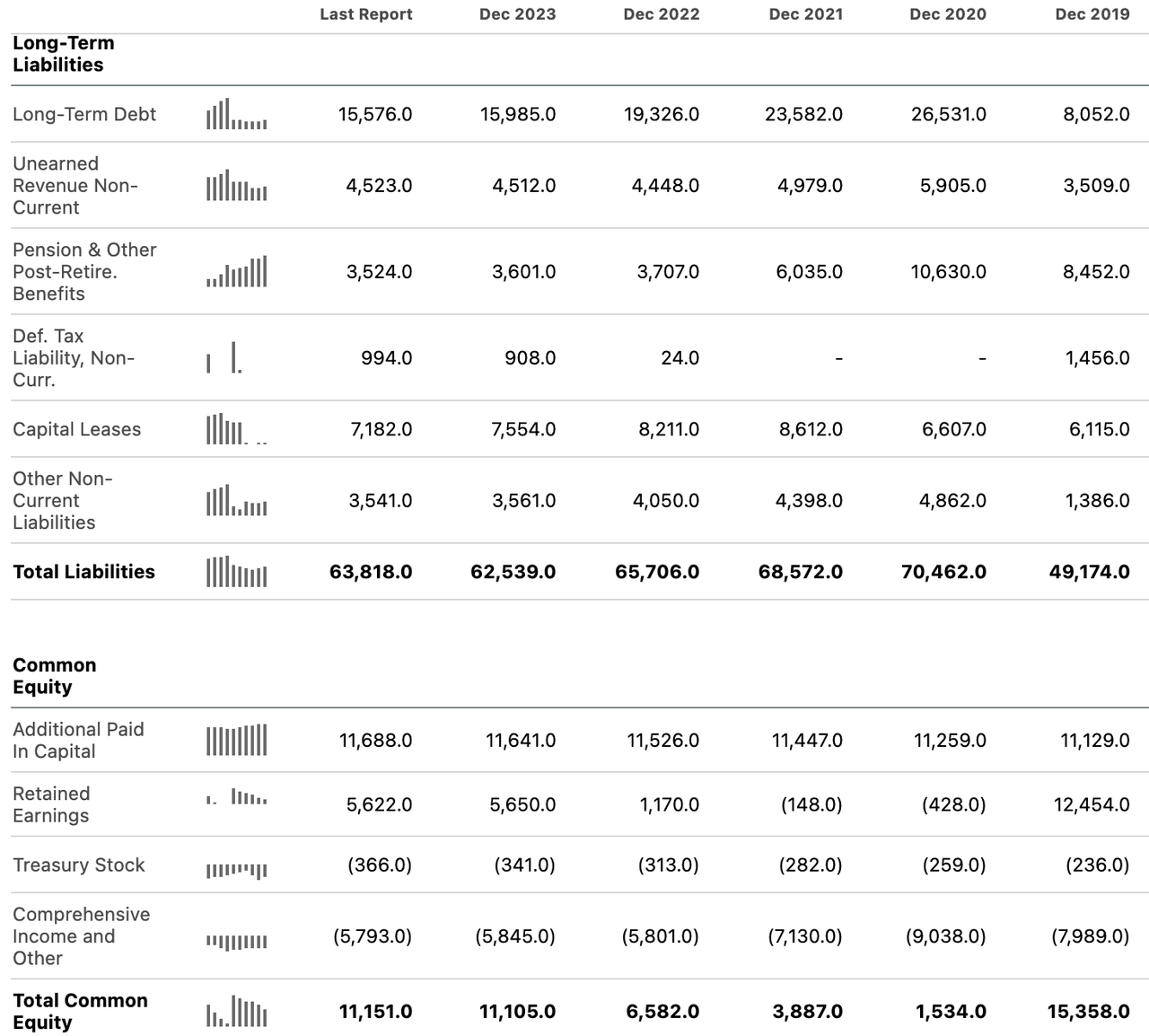

Delta’s debt to equity (“DE”) ratio is heading in the right direction. In the screenshot below, you can see that DAL had $26.5 billion in long-term debt (“LT” debt) to $1.5 billion in equity at the end of 2020. You can also see that it had $15.5 billion in debt to $11.5 billion in equity at the end of 2023. So, the debt to equity ratio shrank from 17.7 to 1.34 in the span of four short years. That’s incredible progress.

Delta Air Lines balance sheet (Seeking Alpha Quant)

Now, you can also see in the image that the debt to equity ratio in 2019–the final full year before the pandemic began–was much lower than in the trailing 12-month period. With $8 billion in debt to $15 billion in equity, it stood at a mere 0.53! This shows that Delta Air Lines has not fully recovered from the damage it took during the pandemic. However, it has made progress. Debt has been cut by nearly a half. If it is cut by the same percentage over the next four years, then DAL will be back to having a 0.5 debt/equity ratio–among the best in its sector.

Tea Leaves From Air Canada’s Latest Release

Another factor we can look at in building our estimate of Delta’s future performance is a competitor’s most recent quarter:

Air Canada (AC:CA).

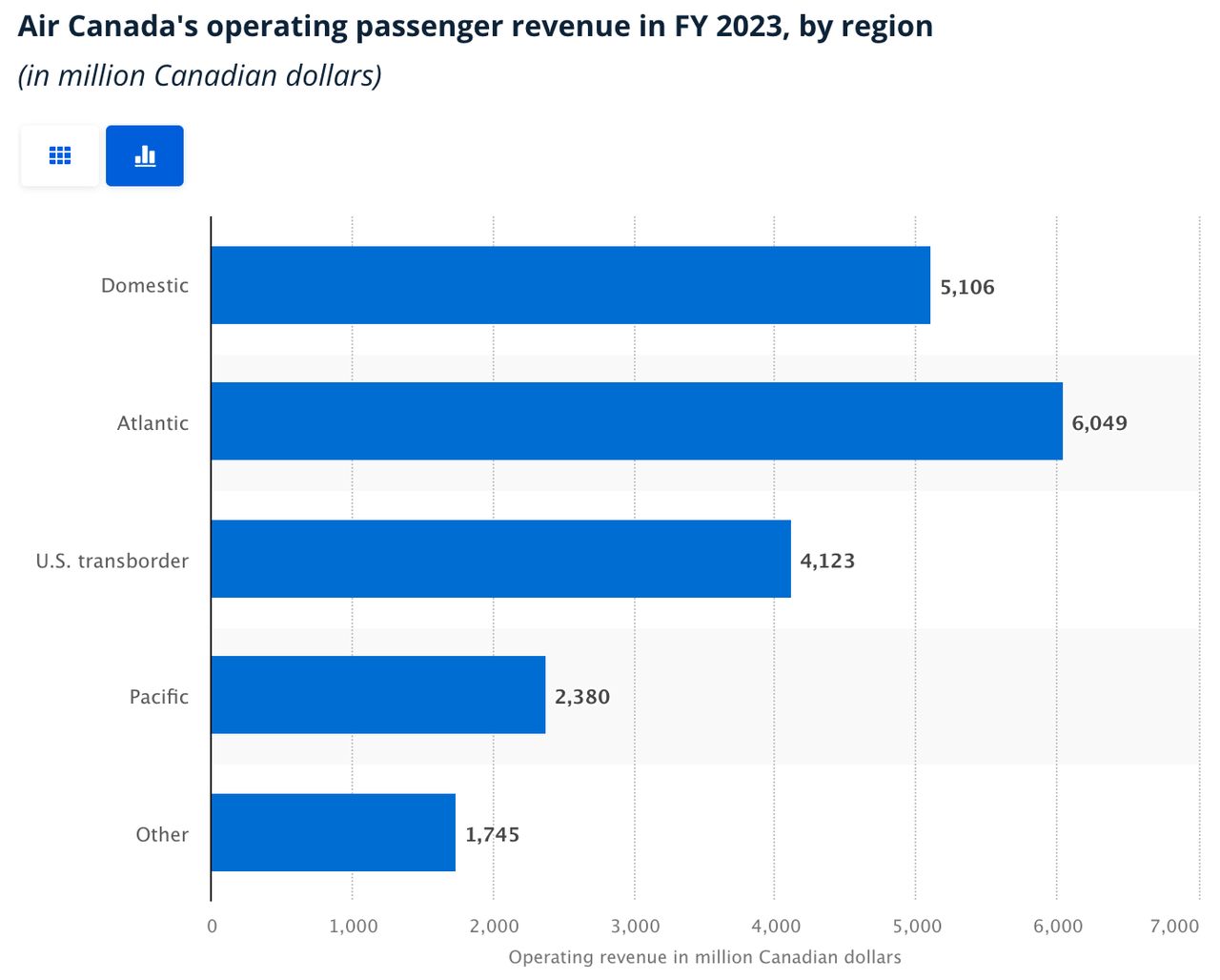

Air Canada is a North American airline that operates in many of the same U.S. markets that Delta operates in. As you can see in the chart below, approximately 26% of Air Canada’s revenue comes from “U.S. transborder” traffic. That means flights from Canada to the U.S. and vice versa. Canada’s border regions are economically similar to the U.S., and have similar travel patterns. So, Air Canada’s earnings may tell us a little bit about DAL’s upcoming earnings.

In its most recent quarter, Air Canada delivered:

-

$5.2 billion in revenue, up 7.2%.

-

$453 million in EBITDA, up 10.2%.

-

Guidance for $3.7 to $4.2 billion in EBITDA, which will be growth between 8.8% and 23% if it is achieved.

These figures are fairly similar to the ones that DAL delivered in its most recent quarter. The forecasted EBITDA growth was a little ahead of what DAL guided for (a slight decline in earnings). Based on Air Canada’s earnings and guidance combined with Delta’s, we can safely say that there is a trend toward positive revenue growth at North American airlines, as well as the possibility of earnings growth in the year ahead.

Delta Air Lines: Preliminary Forecast

Based on Delta’s own guidance as well as that of its peer Air Canada, we can surmise the following about how the company’s 2024 fiscal year is likely to turn out:

-

Revenue growth will be positive and in the high single digits.

-

Earnings will likely either be in line or overshoot the target slightly.

-

Free cash flow will also probably be in line with expectations.

-

The $3 to $4 billion FCF target leaves room for several billion dollars worth of debt repayment.

So, DAL’s financial picture is likely to improve in the year ahead. There are certain risk factors that could result in the reality being different from my forecast. For example, rising oil prices. These increase the cost of Jet Fuel, DAL’s single biggest expense category. However, I showed in an earlier paragraph that even if DAL’s earnings decline 10%, the company still has a fair value 52% higher than the current share price. So, there is a considerable margin of safety here. On the whole, I would be comfortable holding Delta Air Lines stock today.