Digital Vision./DigitalVision via Getty Images

The Calamos Strategic Total Return Fund (NASDAQ:CSQ) is a closed-end fund that income-focused investors can employ as a means for accomplishing their goals of providing themselves with a high level of income from the assets that they already own. This is something that could prove to be very attractive in today’s inflationary environment, as the rapidly rising cost of living has led all of us to search for additional sources of income to maintain the lifestyles to which we are accustomed. The fund manages to do reasonably well at this task, as it currently boasts a 7.92% yield. Here is how that compares to some of the fund’s peers:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

Calamos Strategic Total Return Fund |

Hybrid-U.S. Allocation |

7.92% |

|

Bexil Investment Trust (OTCPK:BXSY) |

Hybrid-U.S. Allocation |

8.26% |

|

Gabelli Convertible & Income Securities Fund (GCV) |

Hybrid-U.S. Allocation |

13.60% |

|

RiverNorth Opportunities Fund (RIV) |

Hybrid-U.S. Allocation |

12.93% |

|

Tri-Continental Corp. (TY) |

Hybrid-U.S. Allocation |

3.47% |

|

Virtus Diversified Income & Convertible Fund (ACV) |

Hybrid-U.S. Allocation |

9.76% |

|

Virtus Equity & Convertible Income Fund (NIE) |

Hybrid-U.S. Allocation |

9.21% |

We can immediately see that the Calamos Strategic Total Return Fund is far from the highest-yielding fund on this list. However, it still does much better than the 1.34% trailing twelve-month yield of the S&P 500 Index (SP500). When we consider that the Calamos Strategic Total Return Fund does not require potential investors to sacrifice the upside that can be obtained by investing in common equities, this is a very reasonable yield. In addition, the fact that the Calamos Strategic Total Return Fund has a lower yield than many of its peers could be a sign that the market is more confident in its ability to sustain its distributions than it is of comparable funds. That is also something that may be attractive to investors who are primarily seeking a source of income.

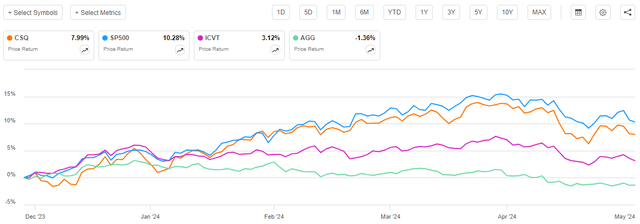

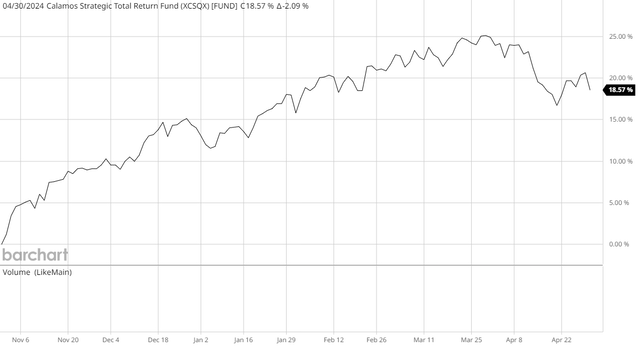

As regular readers may recall, we previously discussed the Calamos Strategic Total Return Fund in late November 2023. At the time, we were in the midst of a very energetic market for both stocks and bonds that has since cooled off. As such, we might expect that this fund has delivered a generally positive return since the publication date of the previous article. This is certainly true, as shares of the Calamos Strategic Total Return Fund are up 7.99% since that date:

We can see that the fund has underperformed large-cap stocks over the period, but it has outperformed both convertible securities (ICVT) and investment-grade bonds (AGG) over the same time span. This is exactly what we would expect from a hybrid fund that invests in a combination of all three types of securities.

However, as I pointed out in a recent article:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund actually did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

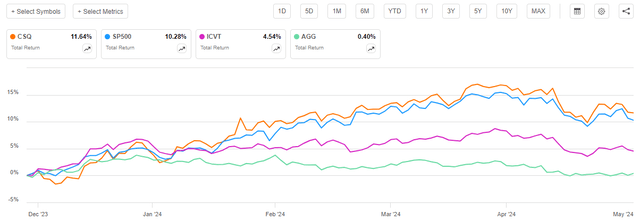

The bond and convertible securities indices also tend to deliver a significant portion of their investment returns in the form of direct payments to the shareholders. As such, we should consider the distributions paid out by the index funds tracking these securities. When we consider all the distributions that investors would have received over the course of the roughly five-month period, we get this chart:

As we can see here, investors in the Calamos Strategic Total Return Fund actually managed to beat the S&P 500 Index over the period. This is probably because the performance of common stocks has fallen off a bit so far in 2024, and this fund has a substantially higher yield than the index. In any case, this is something that will almost certainly appeal to any investor, not just those who are seeking income.

A few things have changed with the Calamos Strategic Total Return Fund since the last time that we discussed it. The most important of these things is that the fund released an updated financial report that covers the fund’s entire 2023 fiscal year. As this is a much newer report than the one that we had available to us the last time that we discussed it, we will make sure to pay special attention to its contents.

About The Fund

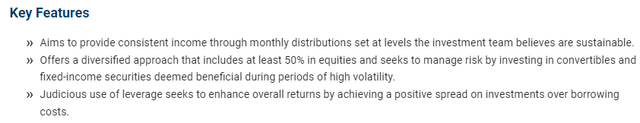

According to the fund’s website, the Calamos Strategic Total Return Fund has the primary objective of providing its investors with a high level of capital appreciation and current income. The website describes the fund’s strategy simply:

The Fund seeks total return through a combination of capital appreciation and current income by investing in a diversified portfolio of equities, convertible securities and high-yield corporate bonds.

The website goes on to state that the fund will always be at least 50% invested in common equities:

This is pretty much what we would expect from a hybrid closed-end fund. It invests in a combination of equities, convertibles, and junk bonds but maintains a specific focus on common equities. This supports the statement that I made in the introduction to this article that this fund should deliver a performance that is between equities and bonds. In most cases, that means that it will underperform equities and outperform bonds. This is exactly what we saw in its price performance over the past five months, although the distributions increased it beyond any of these assets.

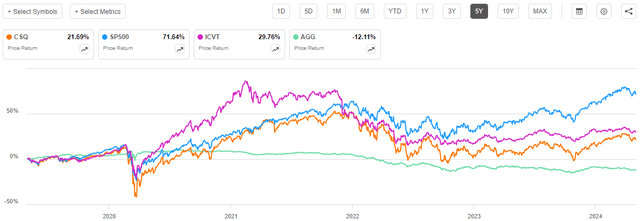

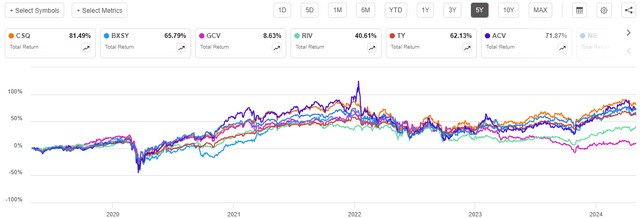

This is not exactly what we have seen over the past five years. In terms of share price performance, the Calamos Strategic Total Return Fund underperformed both common stocks and convertible bonds:

The fund did outperform investment-grade bonds over the period, but those have generally been a pretty poor instrument for buy-and-hold investors for most of the past twenty years due to interest rates being at the zero-bound and the lack of any significant yield. When we include the impact of the distributions paid by these funds, though, the Calamos Strategic Total Return Fund comes out as the top performer:

This arguably speaks well to the management of the fund, although it is not as appealing if we only look at the share price performance. Then again, nobody purchases a closed-end fund solely for its share price performance.

The fund’s most recent annual report corresponds to the full-year period that ended on October 31, 2023. It gives the following asset allocation:

|

Asset Type |

% of Total Assets |

|

Asset-Backed Securities |

0.0% |

|

Corporate Bonds |

18.1% |

|

Convertible Bonds |

23.0% |

|

Bank Loans |

6.2% |

|

U.S. Government and Agency Securities |

3.1% |

|

Convertible Preferred Stocks |

2.3% |

|

Common Stocks |

96.0% |

|

Warrants |

0.0% |

|

Exchange-Traded Fund |

0.0% |

|

Preferred Stocks |

0.3% |

|

Rights |

0.0% |

|

Purchased Options |

0.1% |

As is always the case when we see a 0% weighting on a fund’s schedule of investments, this does not mean that the fund has none of those securities in its portfolio. It means that the fund has at least one instance of that security type, but its value accounts for less than 0.5% of the fund’s total.

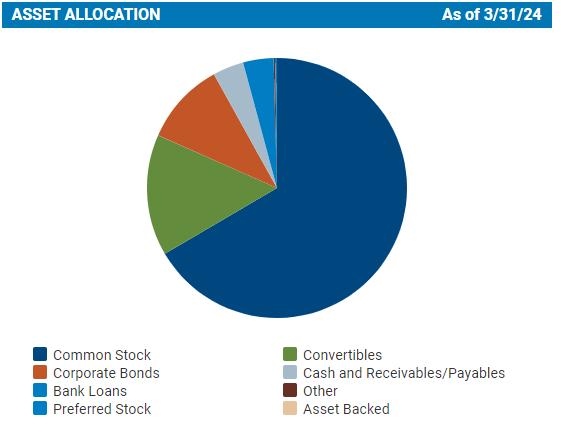

The asset allocation provided above is as of October 31, 2023, so it is naturally several months out of date at this point, despite it being directly from the fund’s most recent financial report. The website provides an updated asset allocation:

Calamos Investments

In table form:

|

Asset Type |

% of Portfolio |

|

Common Stock |

66.57% |

|

Convertibles |

15.08% |

|

Corporate Bonds |

10.30% |

|

Cash and Receivables |

3.83% |

|

Bank Loans |

3.81% |

|

Preferred Stock |

0.18% |

|

Other |

0.21% |

We can immediately see that the fund is fulfilling its stated mandate of having at least 50% of its assets invested in common stocks. This is something that is very nice to see, considering that common stocks can act as an inflation hedge. This comes from the very simple fact that a company’s earnings should increase with the price level. After all, its revenues should increase as the price of its products rises due to inflation. If it manages to keep its margins stable, then earnings should rise. That should cause the stock price to rise. As I pointed out in a few recent articles (such as this one), it is likely that the U.S. dollar will decline in value over the long term, so inflation will probably be a problem going forward. The fact that this fund has a sizable percentage of its assets invested in common stocks, but still manages to provide a high yield, could thus be appealing to income-focused investors who wish to have some protection against inflation.

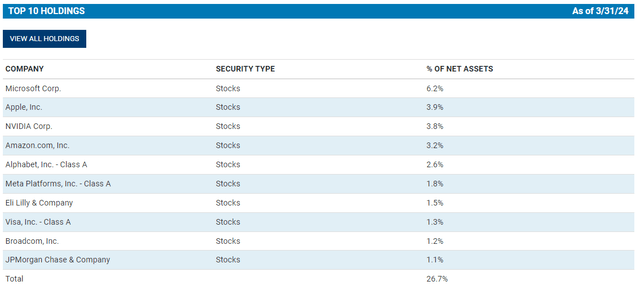

Here are the largest positions in the Calamos Strategic Total Return Fund as of March 31, 2024:

As was the case the last time that we looked at this fund, we see significant exposure to the “Magnificent 7” technology stocks. In fact, all six of the fund’s largest positions are in this group. In a few cases, though, the fund’s weighting to these companies is less than their weighting in the S&P 500 Index:

|

Company |

Weighting in Fund |

Weighting in S&P 500 |

|

Microsoft (MSFT) |

6.2% |

6.97% |

|

Apple (AAPL) |

3.9% |

5.84% |

|

NVIDIA Corp. (NVDA) |

3.8% |

4.87% |

|

Amazon.com (AMZN) |

3.2% |

3.89% |

|

Alphabet (GOOGL) |

2.6% |

4.23%* |

|

Meta Platforms (META) |

1.8% |

2.30% |

* Total weighting of Alphabet’s A and C-class shares.

As I pointed out in the previous article:

This is something that could be concerning, particularly for anyone who is attempting to construct a diversified portfolio. After all, these companies are all technology companies, and the fact that they currently account for a substantial portion of just about any broad market index or mutual fund means that an investor in multiple funds will have a great deal of exposure to only a few assets. As a result, the concentration risk faced by any investor who holds positions in multiple companies is extremely high right now.

Interestingly, the index weighting of Microsoft and Apple is quite a bit lower than it was the last time that we discussed this fund. This is probably because of the remarkably strong performance that we continue to see from NVIDIA that has resulted in its weighting climbing from 3.09% of the S&P 500 Index in late November to 4.87% today. The weighting of the Calamos Strategic Return Fund to NVIDIA has nearly doubled over the past five months or so, as it was 2.0% of the fund’s total assets the last time that we looked at this fund. Today, we can see that it has risen to 3.8% of the fund.

NVIDIA was far from the only weighting change that we see here from the previous discussion:

|

Company |

Current Weighting in Fund |

Weighting on October 31, 2023 |

|

Microsoft |

6.2% |

5.9% |

|

Apple |

3.9% |

5.4% |

|

Amazon.com |

3.2% |

2.8% |

|

Alphabet |

2.6% |

2.5% |

|

NVIDIA |

3.8% |

2.0% |

|

Meta Platforms |

1.8% |

1.3% |

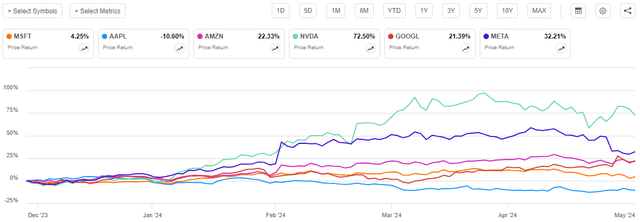

The only company that has seen a decrease in its weightings since our last discussion was Apple, which is not surprising as it has been by far the worst performer out of this group since the previous article was published:

The best performer here was unsurprisingly NVIDIA, which completely dominated the rest of the Magnificent 7 and nearly every other stock in the market, due mostly to the incredibly high optimism surrounding generative artificial intelligence. As such, the fact that this stock’s weighting in the fund increased significantly compared to the other major technology companies in the fund’s largest holdings is unsurprising. However, there are some risks here, considering that generative artificial intelligence is receiving a lot of pushback from various sources and may not live up to the hype that the market is currently assigning it.

Fortunately, at this point, the only stock that currently accounts for 5% of the fund’s portfolio is Microsoft, so investors in the Calamos Strategic Total Return Fund should be reasonably well protected against single-company risks.

Other than the weighting changes that we just discussed, there have been relatively few changes to the fund’s largest positions. There were only two companies – UnitedHealth Group (UNH) and Exxon Mobil (XOM) – that were removed from the list. Naturally, there were two additions to the list – Broadcom (AVGO) and JPMorgan Chase (JPM). Broadcom is a company that we have started to see among the largest positions of many equity closed-end funds, so its presence here appears to further reduce the fund’s potential to reduce an investor’s overall concentration risk.

It is not really surprising that the fund’s portfolio did not experience significant changes over the period. It only had a 29% portfolio turnover for the most recent year, which is very low for a fund that has such a high allocation to equities.

Leverage

As is the case with most closed-end funds, the Calamos Strategic Total Return Fund employs leverage as a method of boosting its effective returns. I explained how this works in my last article on the fund:

In short, the fund is borrowing money and using that borrowed money to purchase stocks and bonds. As long as the purchased assets produce a higher return than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective return of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to an excessive amount of risk. I typically like to see a fund’s leverage under a third as a percentage of its assets for this reason.

As of the time of writing, the Calamos Strategic Total Return Fund has leveraged assets comprising 30.56% of its assets. This is obviously under the one-third cutoff that we would prefer to see, and it is less than the 32.43% leverage that the fund had the last time that we discussed it.

Here is how the fund’s leverage ratio compares to that of its peers:

|

Fund Name |

Leverage Ratio |

|

Calamos Strategic Total Return Fund |

30.46% |

|

Bexil Investment Trust (OTCPK:BXSY) |

10.00% |

|

Gabelli Convertible & Income Securities Fund (GCV) |

8.00% |

|

RiverNorth Opportunities Fund (RIV) |

31.99% |

|

Tri-Continental (TY) |

2.00% |

|

Virtus Diversified Income & Convertible Fund (ACV) |

31.56% |

|

Virtus Equity & Convertible Income Fund (NIE) |

0.00% |

(All figures from CEF Data).

The Calamos Strategic Total Return Fund certainly uses more leverage than many of its peer funds. While we might be able to justify this away if the fund had a higher yield, as we saw in the introduction, this is not the case. The Calamos Strategic Total Return Fund has managed to deliver a higher total return than any of the funds on this list over the past five years, however:

As the basic point of using leverage is to boost a fund’s performance, it appears that it is accomplishing its goals pretty well.

Overall, we should not need to worry too much about the fund’s leverage, but it is important to keep in mind that the fund may suffer more than some of the other companies shown here in the event of a market downturn. This is due to the leverage amplifying downside movements. The fund’s high exposure to the “Magnificent 7” stocks could be a risk here, as these stocks are somewhat more interest-rate sensitive than stocks in other market sectors. Another potential risk comes from a major government imposing some kind of regulation around generative artificial intelligence that the market deems negative. As such, the balance between the risks and rewards with respect to the fund’s leverage is probably okay, but investors should not ignore the risks here.

Distribution Analysis

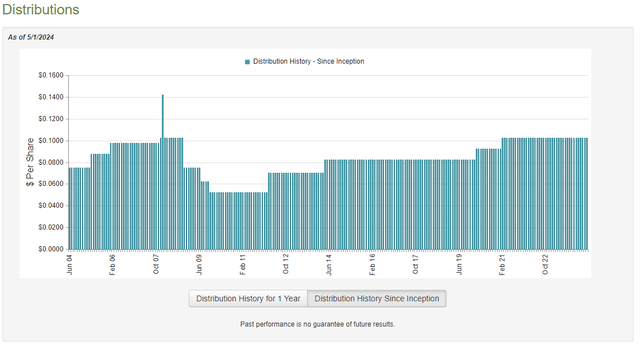

As mentioned in the introduction, the Calamos Strategic Total Return Fund boasts a 7.92% yield at the current price. This is currently being paid in monthly installments of $0.1025 per share, which works out to $1.23 per share annually. The fund has been remarkably consistent with its distribution in recent years:

As I stated in the previous article:

This is a much better history than that possessed by most closed-end funds, as we have seen quite a few funds that have had variable distributions over the past decade. There are very few funds that have actually managed to boost their distributions over the trailing ten-year period, so the fact that this one has accomplished that feat is something that any income-focused investor should appreciate. The fact that the fund has consistently increased its distribution over time is very nice to see in today’s inflationary environment, as inflation has caused the purchasing power of the distribution paid by a fund that keeps its payout static to decline. The fact that this fund has managed to boost its distribution with the passage of time helps to offset this problem and ensures that those investors who are living off of the distributions can keep their purchasing power relatively stable over time.

Naturally, we want to ensure that the fund can afford its distribution. Let us have a look at the fund’s most recent financial report, which was linked to earlier in this article. As already mentioned, this is a newer report than we had available at the time of our last discussion, so it should provide us with a better idea of how well the fund is doing.

For the full-year period that ended on October 31, 2023, the Calamos Strategic Total Return Fund received $46,478,954 in interest and $41,706,635 in dividends from the assets in its portfolio. A significant percentage of the interest that the fund reported was considered amortization of principal, so it is not considered to be investment income. The fund thus reported a total investment income of $77,966,357 for the period. This was not sufficient to cover its expenses, and the fund ended up reporting a net investment loss of $13,950,035 for the period. Obviously, the fund is not paying its distributions out of net investment income.

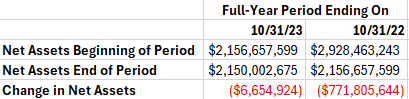

However, the fund did manage to post some realized capital gains during the period. It had net realized gains of $196,397,180 for the full-year period. The net realized gains were partially offset by $12,807,341 net unrealized losses. Ultimately, the fund failed to cover the $196,582,807 that it paid out in distributions and its net assets declined by $6,654,924 after accounting for all inflows and outflows for the full-year period.

This was the second full-year period for which this fund failed to cover its distribution, although it did much better than it did during the full-year period that ended on October 31, 2022:

Power Hedge

This suggests that the Calamos Strategic Total Return Fund is over-distributing and may not be able to sustain its payout going forward. After all, no fund can pay out more than it earns in investment profits forever.

Fortunately, we may see some improvements here when the fund releases its semi-annual report for the first half of the 2024 fiscal year in a few weeks. This chart shows the fund’s net asset value per share over the October 31, 2023, to April 30, 2024, period:

This is the period of time that will be covered by the semi-annual report when it is released (probably around the end of June). As we can see, the fund’s net asset value per share increased by 18.57% over the period. This tells us that the fund fully covered all the distributions that it paid out over the six-month period, with a substantial amount of money left over. This is a good sign, and it suggests that the fund should be able to maintain its current distribution as long as the market does not decline substantially from its current level. While we may certainly see market weakness, I doubt that we will see a decline sufficient to erase all the gains that this fund has experienced over the past six months, so the distribution will probably be safe for the remainder of the 2024 fiscal year.

Valuation

The Calamos Strategic Total Return Fund trades at a 1.0% discount to net asset value at the current price. This is a bit worse than the 2.44% discount that the shares have averaged over the past month. As long as the fund’s share price remains at a discount, the entry point should be fine for buying in.

Conclusion

In conclusion, the Calamos Strategic Total Return Fund appears to be a pretty decent way for equity investors to obtain a high level of income from their portfolios. The biggest problem here is the fund’s substantial exposure to the “Magnificent 7” technology stocks, so it does not work that well as a diversification for most investors. The fact that the fund appears to be increasing its exposure to these companies enhances that problem. However, investors who are able to obtain reasonable diversification through investments in other funds might find a lot to like here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.