Andrii Yalanskyi

By Katherine Nuss, CFA

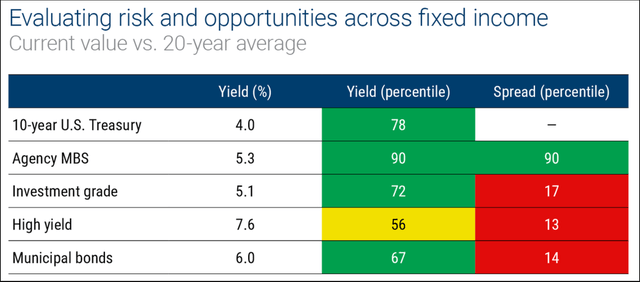

Our proprietary Fixed-Income Monitor compares yields and credit spreads over 20 years of history and across fixed income. It’s designed to help investors identify opportunities and risks in the asset class.

Key takeaways for August 2024

- Treasury yields declined on softer economic data that paves the way for a September rate cut by the Fed. After core CPI inflation cooled to its slowest monthly pace since January 2021, the market repriced expectations from two rate cuts to three by year-end.

- Demand for credit remained robust as investors anticipate stronger returns with a potential Fed move toward easing. High yield (CCC-rated) bonds outperformed higher quality bonds, suggesting a healthy appetite for risk-taking.

- While municipal bonds lagged U.S. Treasuries, returns were strong enough to flip year-to-date performance positive. There was unusually heavy supply in July as issuance was pulled forward ahead of the November presidential election.

Source: Columbia Threadneedle Investments as of July 31, 2024. Yield is represented by yield to worst, which is the minimum return received on a callable bond, apart from the yield if the issuer were to default. For municipal bonds, yield is represented by taxable equivalent yield, which is based on the top federal bracket (37%) and net investment income tax (3.8%). Other taxes are possible. Yield percentile and spread percentile are represented by the range of daily yields and daily spreads, respectively, and both are for the last 20 years, with the current percentile position indicated. Past performance is not a guarantee of future results.

Interpreting yields and spreads

One way to identify opportunities in fixed income is to look at bond yields. That’s because yield, which is based on a bond’s price and coupon payments, reflects total return potential. Yields can change over time and across bond sectors. Spread, which refers to the difference between a bond’s yield and the yield of a risk-free issue with the same duration (e.g., U.S. Treasuries),1 indicates how much investors are being compensated for taking on additional credit (default) risk. If spreads are above their long-term average (sometimes called “wide” or “cheap”), investors are being paid more to take on credit risk; if they’re below their long-term average (called “narrow” or “tight”), investors are being paid less.

Disclosures

1 There’s no credit spread on U.S. Treasuries, which are considered risk-free government securities, since payments are guaranteed by the U.S. government.

Agency MBS is represented by the Morgan Stanley 30-Year Conventional Current Coupon ZV Indicator, which represents the zero volatility spread for the hypothetical $100-priced 30-year conventional mortgage over time. Investment grade is represented by the Bloomberg U.S. Corporate Investment Grade Index. High yield is represented by the Bloomberg U.S. High Yield Corporate Bond Index. Municipal bonds are represented by the Bloomberg Municipal Bond Index. It is not possible to invest directly in an index. Index descriptions are available here.

Past performance is not a guarantee of future results. There are risks associated with fixed-income investments, including credit risk, interest rate risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer-term securities. A rise in interest rates may result in a price decline of fixed-income instruments. Falling rates may result in a fund investing in lower yielding debt instruments, lowering income and yield. These risks may be heightened for longer maturity and duration securities. Mortgage- and asset-backed securities are affected by interest rates, financial health of issuers/originators, creditworthiness of entities providing credit enhancements and the value of underlying assets. Income from tax-exempt municipal bonds or municipal bond funds may be subject to state and local taxes, and a portion of income may be subject to the federal and/or state alternative minimum tax for certain investors. Federal and state income tax rules will apply to any capital gains.

Additional Disclosures

© 2016-2024 Columbia Management Investment Advisers, LLC. All rights reserved.

Use of products, materials and services available through Columbia Threadneedle Investments may be subject to approval by your home office.

With respect to mutual funds, ETFs and Tri-Continental Corporation, investors should consider the investment objectives, risks, charges and expenses of a fund carefully before investing. To learn more about this and other important information about each fund, download a free prospectus. The prospectus should be read carefully before investing. Investors should consider the investment objectives, risks, charges, and expenses of Columbia Seligman Premium Technology Growth Fund carefully before investing. To obtain the Fund’s most recent periodic reports and other regulatory filings, contact your financial advisor or download reports here. These reports and other filings can also be found on the Securities and Exchange Commission’s EDGAR Database. You should read these reports and other filings carefully before investing.

The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be appropriate for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that any forecasts are accurate.

Columbia Funds and Columbia Acorn Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA. Columbia Funds are managed by Columbia Management Investment Advisers, LLC and Columbia Acorn Funds are managed by Columbia Wanger Asset Management, LLC, a subsidiary of Columbia Management Investment Advisers, LLC. ETFs are distributed by ALPS Distributors, Inc., member FINRA, an unaffiliated entity.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.