Kovshutin Denis/iStock via Getty Images

I have recently written an article on the Invesco Variable Rate Investment Grade ETF (VRIG) where I detailed why I believe the Janus Henderson AAA CLO ETF (JAAA) may be a better alternative for conservative investors who want a premium yield. Compared to the JAAA ETF, how does the BlackRock AAA CLO ETF (NASDAQ:CLOA) look?

In my opinion, the CLOA ETF is a viable alternative to JAAA, as the two funds have very similar mandates and historical performance. The one downside to CLOA is it is a much smaller fund with lower liquidity. Otherwise, choosing between the two should come down to personal preference.

With the economy slowing down and investors’ focus shifting to the labor market, I believe investors should take the opportunity to high-grade their portfolios and reduce credit risks. The CLOA ETF can provide premium yield with AAA-rated securities that have historically performed well through multiple economic cycles. I rate CLOA a buy.

Fund Overview

Similar to the JAAA ETF, the BlackRock AAA CLO ETF seeks to provide capital preservation and high current income by investing mainly in a portfolio of U.S. dollar-denominated AAA-rated Collateralized Loan Obligations (“CLOs”).

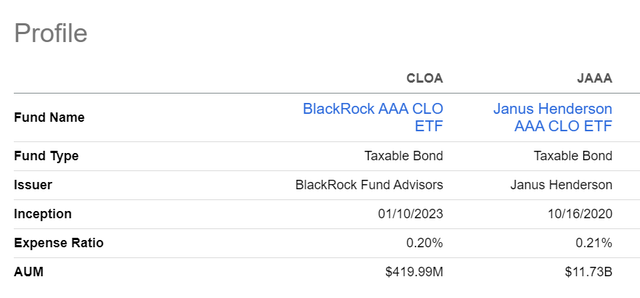

CLOA is a much smaller fund than, with only $420 million in AUM (Figure 1). However, it is slightly cheaper at 0.20% expense ratio compared to JAAA’s 0.21%.

Figure 1 – CLOA vs. JAAA overview (Seeking Alpha)

CLO Refresher

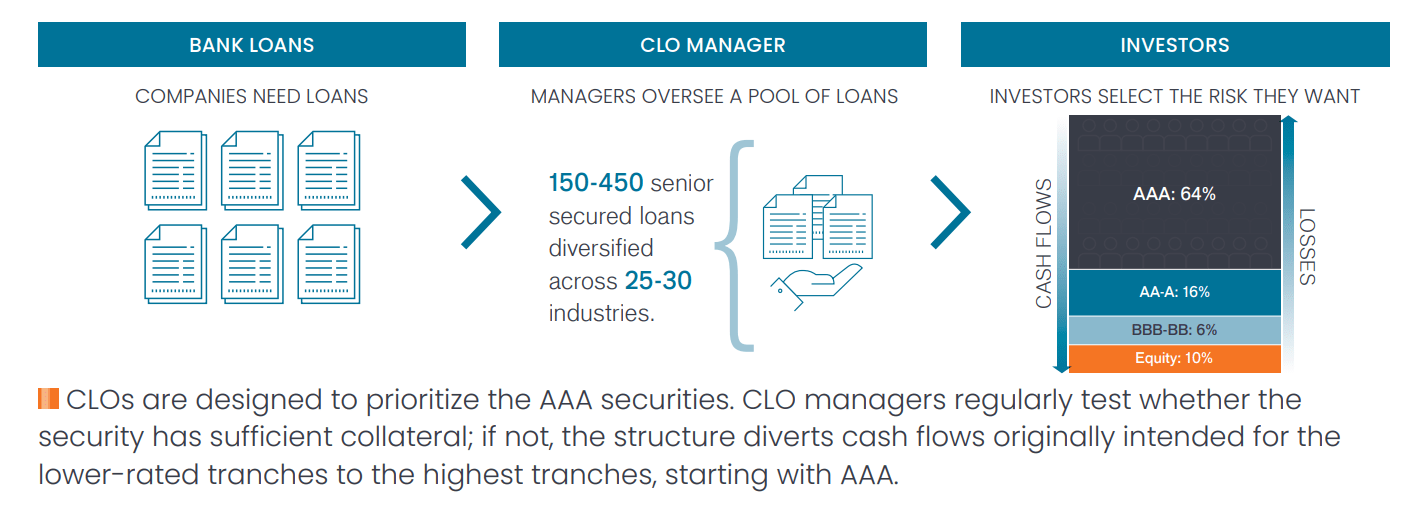

For those not familiar with CLOs, Collateralized Loan Obligations are floating-rate structured investment securities that package together dozens of senior-secured loans from a diversified portfolio of companies across the economy (Figure 2).

Figure 2 – CLO structure overview (Janus Henderson Investors)

The securitization process allows AAA-rated securities to be synthetically created from underlying loans that may not be AAA-rated themselves.

Investment-grade CLO debt tranches (AAA to BB in Figure 2 above) are protected from losses by structural enhancements such as over-collateralization and interest diversion.

Over-collateralization means that the CLO may pool together $120 million of loans to create $100 million of debt securities plus $20 million of ‘equity’ securities. When defaults occur in this portfolio, the more senior debt tranches of the security (i.e., AAA) are protected from default by the junior tranches which absorb the defaults in reverse order of their seniority (i.e., the ‘equity’ tranches take the first loss, followed by CCC, B, BB, etc.).

Interest diversion means that cashflows collected from the pool of loans are used to pay interest to the most senior tranches (i.e., AAA) first, followed by the more junior tranches.

So from the perspective of the CLO structure, the CLOA ETF invests in the highest-quality tranches, with commensurately lower yields.

Are AAA CLOs A Free Lunch?

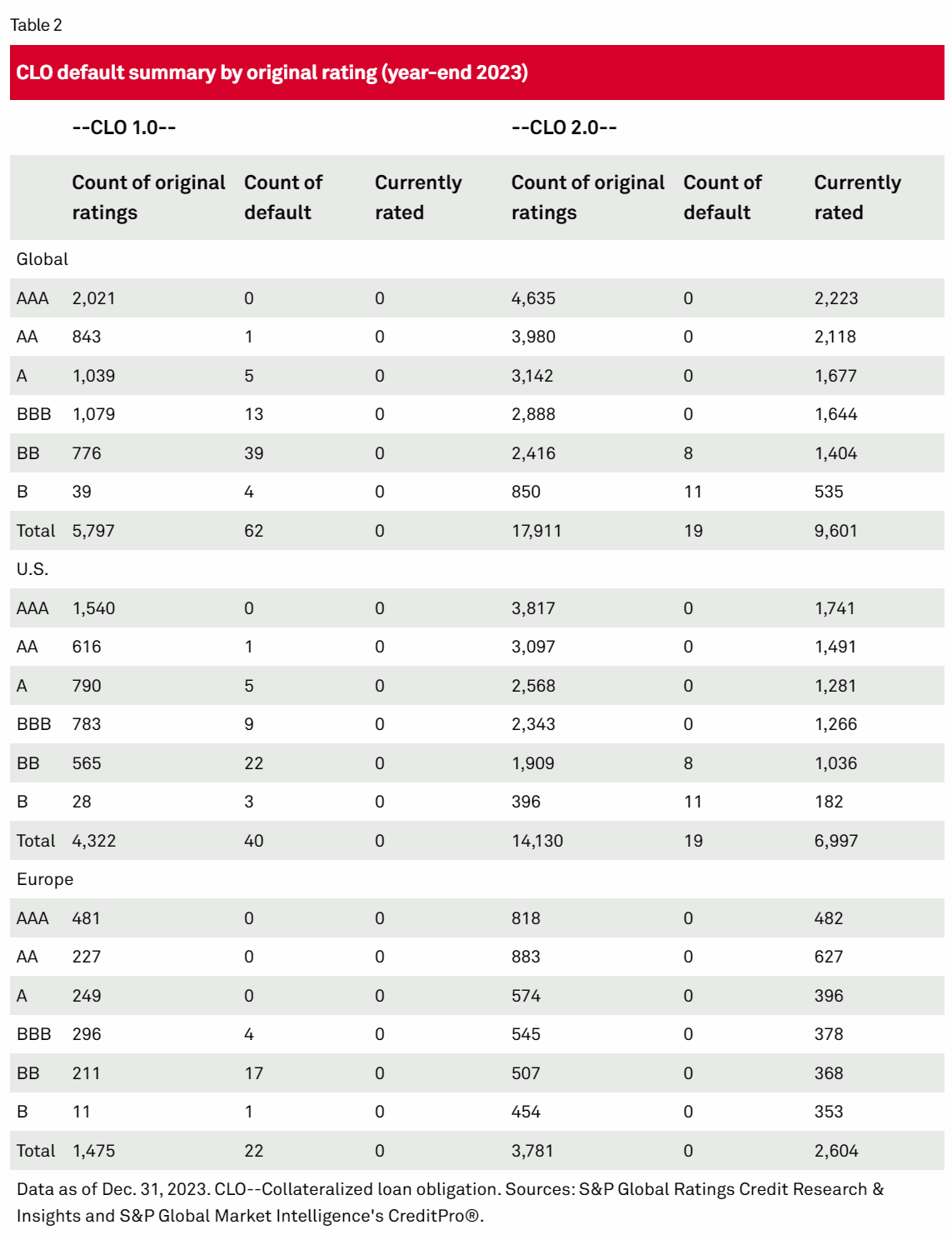

Historically, highly rated CLO debt tranches have performed very well. Since the inception of the investment structure more than 30 years ago, AAA-rated tranches have not seen any cumulative defaults (Figure 3).

Figure 3 – CLO defaults by original credit rating (S&P Global)

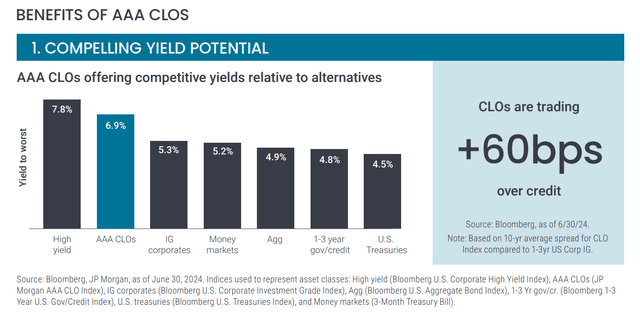

At the same time, CLOs tend to yield higher than similarly rated loans and treasuries (Figure 4).

Figure 4 – CLOs tend to yield more than similar-rated loans (Janus Henderson Investors)

Does that mean CLOs have created the proverbial ‘free lunch’?

Before investors rush out to snap up the JAAA and CLOA ETFs, they need to understand there is no free lunch in financial markets and there are some risks they should consider. First, the CLO 2.0 default (those issued after the Great Financial Crisis) experience shown in Figure 3 above may have been artificially boosted by central banks’ liquidity largesse and ZIRP policies, which have kept many zombie companies afloat.

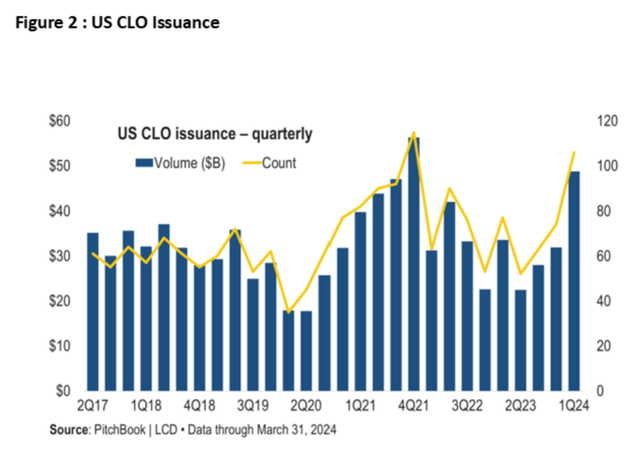

Furthermore, with credit markets re-opening in the last few quarters, new-issue CLOs have been booming, with CLO issuance volumes in Q1/2024 approaching Q4/2021 peaks (Figure 5). I worry that in a rush to get deals done, credit covenants on these CLOs may be relaxed, and lower-quality companies may be slipping through the cracks into CLO deals.

Figure 5 – CLO issuance by quarter (Pitchbook via Livewire Markets)

If/when a recession finally occurs, the default experience from these recent vintages could be worse than in prior years.

Finally, another risk to consider is that the CLOA ETF is an ETF with daily creations and redemptions and not a closed-end fund (“CEF”). This key difference may come into play in a recession scenario when investors panic sell their security holdings. Being an ETF, the CLOA ETF may be forced by redemptions to sell into a ‘no bid’ market, whereas a closed-end fund does not face this redemption risk. Remember, CLO tranches are relatively illiquid securities that may be hard to dispose of in a crash.

Portfolio Holdings

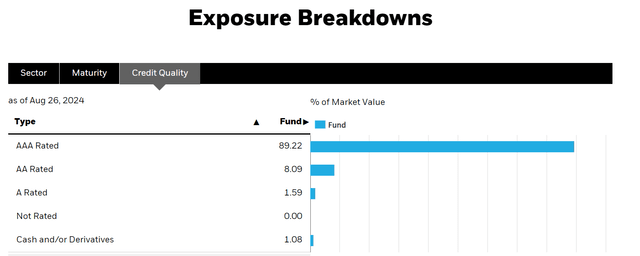

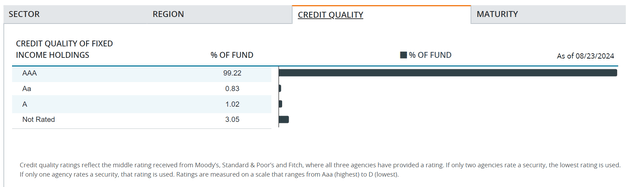

As per its mandate, the CLOA ETF primarily holds AAA-rated CLOs, with 89.2% of its portfolio AAA-rated and 8.1% AA-rated (Figure 6).

Figure 6 – CLOA credit quality allocation (BlackRock)

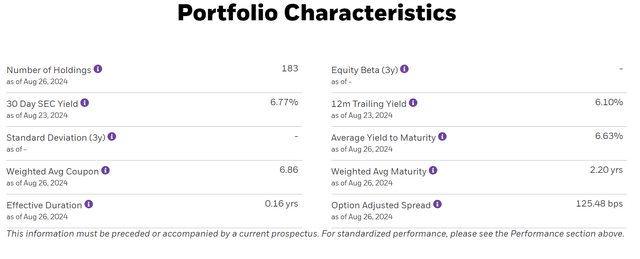

CLOA’s portfolio holds 183 securities with a portfolio 30-Day SEC yield of 6.8% (Figure 7).

Figure 7 – CLOA portfolio characteristics (BlackRock)

Portfolio Returns

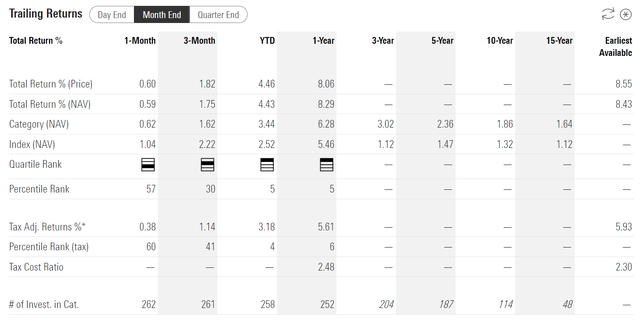

Since its inception, the CLOA ETF has delivered an 8.4% annualized return to July 31, 2024 (Figure 8).

Figure 8 – CLOA historical returns (Morningstar)

CLOA vs. JAAA

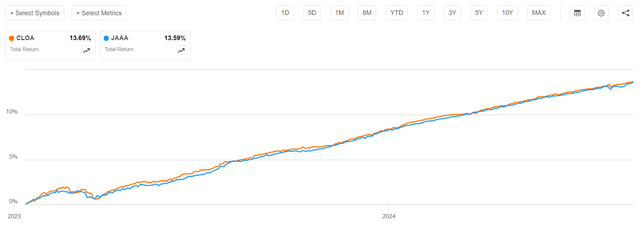

The main question in my mind is whether CLOA outperforms the JAAA ETF that I hold in my portfolio. Since its inception, CLOA’s returns have been virtually identical to that of the JAAA ETF (Figure 9).

Figure 9 – CLOA vs. JAAA returns (Seeking Alpha)

This result is expected, as both JAAA (managed by Janus Henderson, a fixed-income specialist asset manager) and CLOA (managed by BlackRock) have very similar mandates. The 0.1% total return difference between the two could be due to CLOA’s slightly higher allocation of AA-rated securities, which may have delivered a higher yield (Figure 10).

Figure 10 – JAAA credit allocation (Janus Henderson Investors)

Otherwise, the choice between JAAA and CLOA comes down to personal preference and the amount of assets one decides to allocate to the CLO asset class.

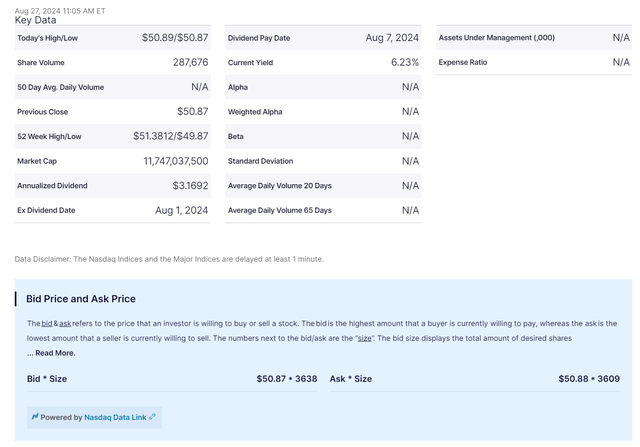

With over $11 billion in AUM, the JAAA ETF trades hundreds of thousands of shares per day and has a tight bid/ask spread that should be sufficient for most retail investors (Figure 11).

Figure 11 – JAAA is highly liquid (Nasdaq)

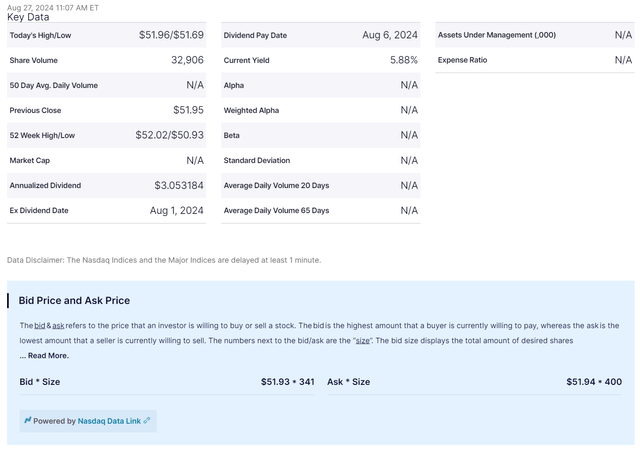

In contrast, the CLOA ETF trades about 1/10th the volume of JAAA and the bid/ask size is also about 1/10th of JAAA. This means CLOA has much lower liquidity for larger investors (Figure 12).

Figure 12 – CLOA is relatively illiquid compared to JAAA (Nasdaq)

Beware What You Wish For

My biggest takeaway from the Federal Reserve Chairman’s speech at last week’s Jackson Hole Symposium is that the Fed will start lowering policy interest rates at next month’s FOMC meeting: (Author highlighted important sentences from Jerome Powell’s speech)

The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.

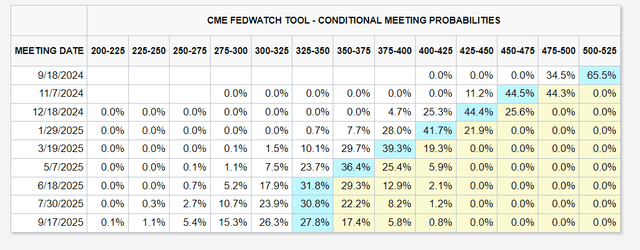

While the pace of rate cuts is still uncertain, investors have priced in 100bps of rate cuts into the end of 2024 (Figure 13).

Figure 13 – Investors have priced in 4 rate cuts into year-end (CME)

However, before investors rejoice, readers are reminded that policy rate cuts may not be something to celebrate. The main concern for the Fed appears to have shifted from inflation to the labor market:

Overall, the economy continues to grow at a solid pace. But the inflation and labor market data show an evolving situation. The upside risks to inflation have diminished. And the downside risks to employment have increased. As we highlighted in our last FOMC statement, we are attentive to the risks to both sides of our dual mandate.

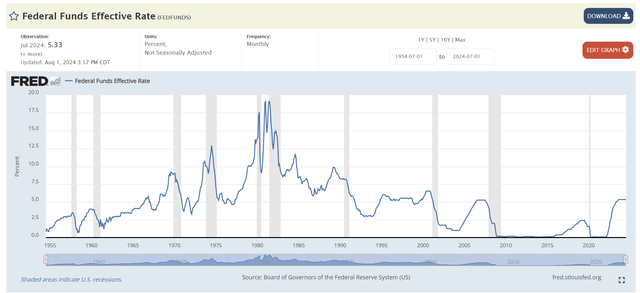

Historically, the Fed cuts policy rates just before, or during recessions, and this time may be no different (Figure 14).

Figure 14 – Historic fed funds effective rate (St. Louis Fed)

AAA CLOs May Be A Safe Place To Park Capital

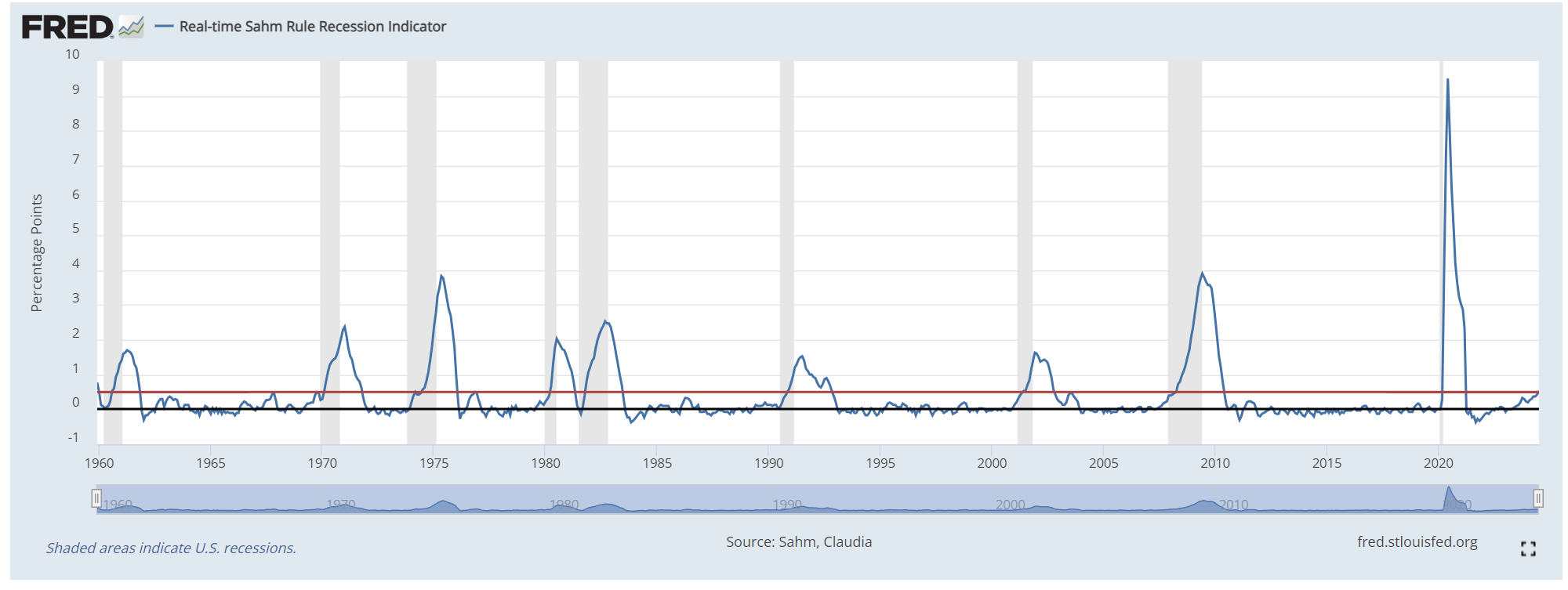

In fact, as I have written in previous articles, a rapidly deteriorating labor market suggests an economic slowdown is already upon us as the July Employment report triggered the infamous ‘Sahm Rule recession indicator (the Sahm Rule indicator says that a recession has started when the three-month moving average of the unemployment rate rises by half a percentage point from the cycle low).

Figure 15 – Real time Sahm Rule indicator triggered in July (St. Louis Fed)

While a recession will only look apparent after the fact, I recommend investors heed the warning from the Sahm Rule and look for ways to high-grade their investment portfolios with AAA-rated CLOs while we wait for better equity valuations and credit investment opportunities.

Conclusion

The BlackRock AAA CLO ETF gives investors exposure to floating-rate AAA-rated CLO securities. Historically, AAA-rated CLOs have experienced very strong credit performance through multiple economic cycles.

With the Fed ready to start cutting policy interest rates in order to protect the labor market, I believe investors should be attentive to the rising slowdown risks. With the Sahm Rule recently triggered, an economic slowdown is happening and investors should look to high-grade their portfolios.

The CLOA ETF is a viable alternative to the JAAA ETF that I have recommended in the past. However, the only caveat is that CLOA’s relatively small size means it may be less liquid. I rate CLOA a buy.