peeterv/E+ via Getty Images

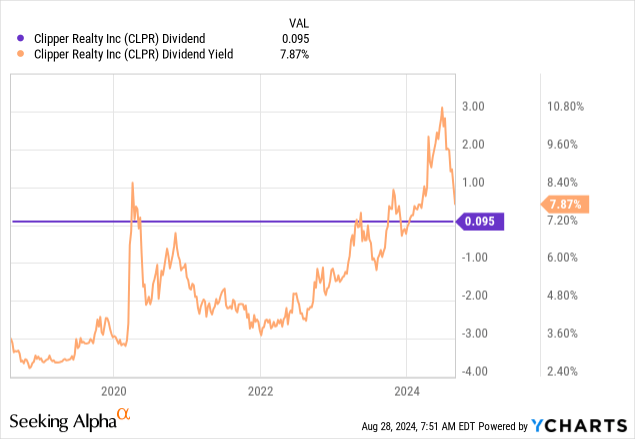

New York-focused multifamily REIT Clipper Realty (NYSE:CLPR) is a strong buy as rate cuts come into focus and with the common shares trading hands at 7.1x times annualized fiscal 2024 second quarter FFO. The REIT last declared a quarterly cash dividend of $0.095 per share, unchanged from its prior distribution, and $0.38 per share annualized for an 8% dividend yield. CLPR has kept its dividend stable since its onset with the dividend 179% covered by second-quarter FFO of $0.17 per share. This beat consensus by 3 cents per share and was up from its year-ago quarter. Critically, CLPR is trading far lower than its significantly larger apartment REIT peers even as pending Fed rate cuts look set to deliver relief to its balance sheet and further entrench the safety of the current high dividend yield. I believe this low valuation reflects transient factors and CLPR stands to drive significant total returns for its shareholders. CLPR generated second-quarter revenue of $37.3 million, up 8.1% over its year-ago comp.

The first reason for the discount is that CLPR is not a 100% multifamily REIT with two office properties at 141 Livingston and 250 Livingston. These are 216,000 square feet and 370,000 square feet of gross leasable area (“GLA”) respectively. The REIT owned nine properties spread across roughly a 3.5 million GLA in Manhattan and Brooklyn at the end of its second quarter. CLPR’s problems are also compounded by material lease expirations at both the Livingston properties. The REIT had the City of New York (“CNY”) as a tenant at both properties, this drove roughly 21% of total revenue for the second quarter. CNY has informed CLPR it intends to fully vacate its lease for 342,496 square feet of office space at 250 Livingston Street from August 23, 2025. This is 93% of the tenancy of the property and could form a hit to CLPR’s total revenues if there isn’t a near-term salvo. Further, the REIT has entered into negotiations with CNY for its existing lease at 141 Livingston with an ambition to extend the current lease of 206,084 square feet by an additional five years. This lease is set to expire in December of 2025. I believe the market has been far too harsh in discounting CLPR against this event.

Income, FFO Growth, And Balance Sheet Health

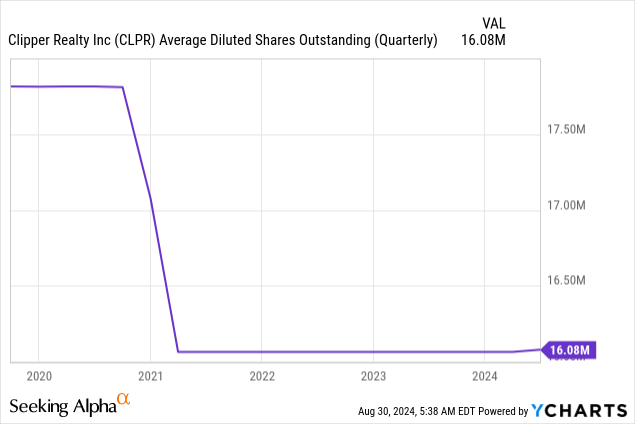

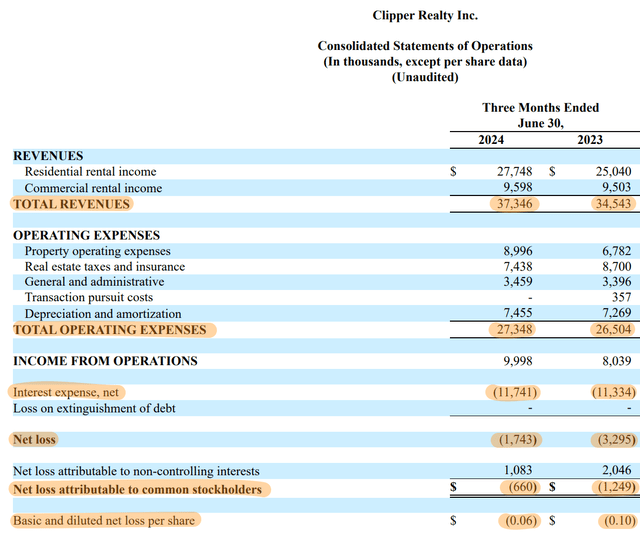

Net income was negative at 6 cents per share for the second quarter, but an improvement of roughly 4 cents per share from CLPR’s year-ago comp. CLPR has been extremely clinical in keeping its weighted average shares outstanding healthy and flat. This was 16,077,290 at the end of the second quarter, little moved from 16,063,228 in CLPR’s year-ago comp. Negative net income was due to depreciation and amortization costs of $7.45 million aggregated with interest expense of $11.74 million during the quarter.

Clipper Realty Fiscal 2024 Second Quarter Form 10-Q

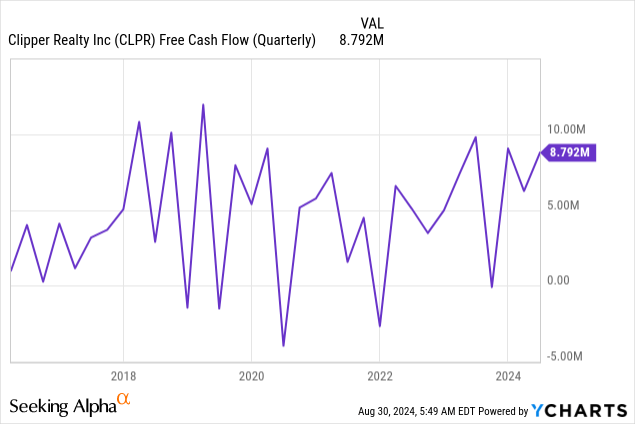

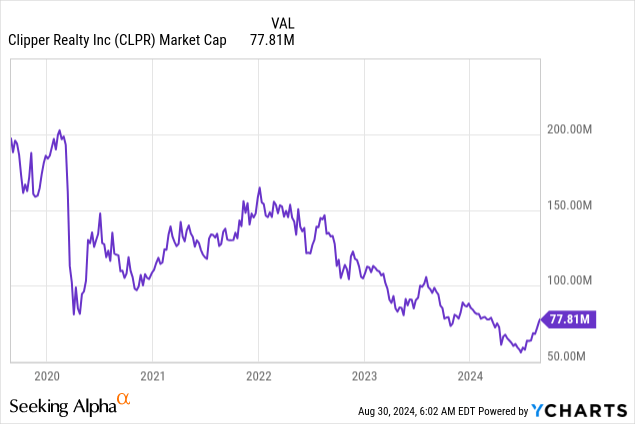

Non-cash expenses meant FFO was positive at $0.17 per share with CLPR generating free cash flow of $8.8 million, up sequentially from $6.3 million in the first quarter. This figure has remained broadly in line with the CLPR’s pre-pandemic averages. Trailing 12-month free cash flow at $24 million is set against a REIT whose market cap sits at $77.8 million with its commons trading at $4.84 per share.

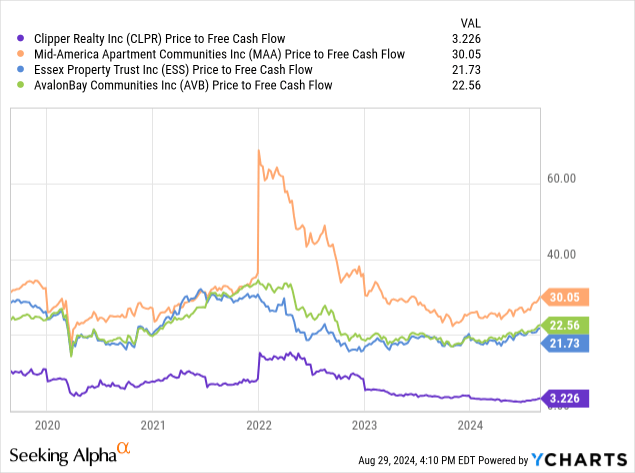

To be clear, CLPR is trading at 3.24x its free cash flow even with a healthy portfolio in the most dynamic and richest city in the US. New York is also supply-constrained with extremely strong market demand which supports high rents. CLPR saw new residential leasing spread during the second quarter exceed prior rents by over 7%. Rent levels were $81 to $84 per square foot, up from $63 per square foot at the end of CLPR’s fiscal 2021. The selloff of the REIT’s common shares became defined during the pandemic and was compounded at the start of 2022 when the Fed started aggressively raising interest rates to combat inflation. CLPR has unfortunately faced the perfect consecutive backdrop of headwinds.

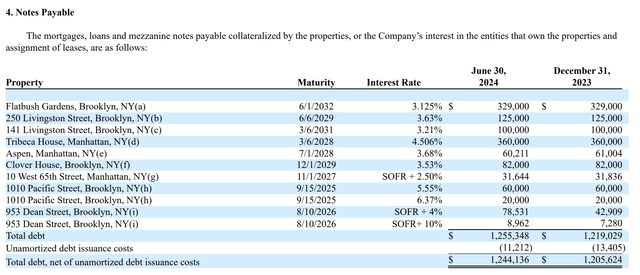

This is changing with the Fed set to push through its first rate reduction since 2020 at its September 18th FOMC meeting. The CME FedWatch Tool has placed the probability of this at 100%. CLPR is already generating strong free cash flows quarter-on-quarter providing depth on the coverage of the quarterly dividend payouts, with interest rate cuts to lighten the burden of the REIT’s $1.24 billion in total notes payable at the end of the second quarter.

Clipper Realty Fiscal 2024 Second Quarter Form 10-Q

CLPR’s nearest term maturity is the 15th of September 2025 with the maturity of two construction loans on 1010 Pacific Street in Brooklyn, a 9-story residential building with roughly 119,000 square feet of GLA. The total due at $80 million should be able to be refinanced to a cheaper-rate mortgage loan. The firm’s latest completed ground-up development has been fully stabilized, is contributing materially to cash flow, and is 100% leased and yielding the projected 7% cap rate.

CLPR does not face any material debt maturities until 2028 at the earliest, with SOFR-linked debt set for a reduction in quarterly interest expenses in direct response to Fed interest rate reductions. I quickly took a full position in the New York-focused multifamily REIT owner whose cheap valuation is underpinned by its office exposure and high total debt burden against a Fed funds rate at a 23-year high. An extension of the current lease at 141 Livingston at a positive leasing rate will remove a material overhang on the stock with rate cuts set to form the more potent near-term catalyst.