David Trood/DigitalVision via Getty Images

Clarus (NASDAQ:CLAR) has performed badly since we last covered it. Good news is that the sale of the precision sports business, the ammo business, got them into net cash: no net debt issue anymore. The issue is that the end markets are weak and that the business needs operating leverage. There is some incremental cost cutting coming in and the company is pointing to new product launches towards the end of the year, and the hope is that a strong Q4 summer season in their large Australia/New Zealand markets may at least make their guidance of the year for EBITDA profitability, meaning a very significant profitability turnaround from the current run-rate negative levels at least for that season. With the Clarus levels severely traded down from weakened guidance and general concerns around run-rate profitability compounded by weak demand in the industry’s end markets, the situation is rocky. The whole apparel industry is getting dumpstered currently, including Canada Goose (GOOS) and V.F. Corporation (VFC) just to name some of the more related players. It would be aggressive to actually buy, but we are leaning towards there being more upside than downside at this point and think that the lack of debt really saves it from deserving these levels.

Latest Earnings

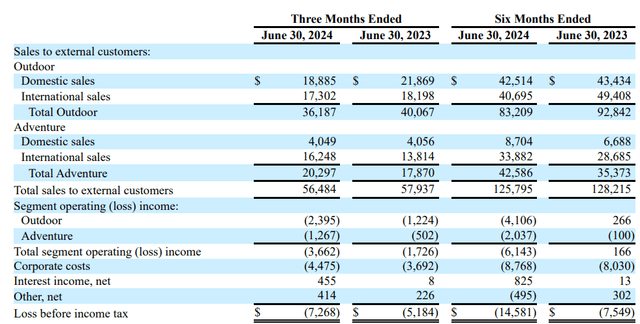

Let’s start with the latest earnings. The main thing on the call was the worsened guidance on EBITDA, not on sales.

We have reaffirmed our topline guidance and continue to expect sales to range between $270 million and $280 million for the full-year 2024. Adjusted EBITDA from continuing operations is now expected to be approximately $11 million to $14 million or an adjusted EBITDA margin of 4.5% at the midpoint of revenue and adjusted EBITDA.

As a reminder, they have two major segments (they had three before they sold the precision sports ammo business), the outdoor segment which is dominated by the great brand, Black Diamond, who made my dad’s Telemark skis and make climbing shoes which is a growing market, and then the adventure business which is dominated by products like traction pads and racks and mounts for cars.

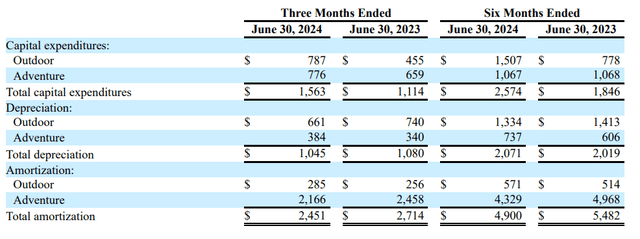

Outdoor has been suffering in terms of sales, while adventure has actually done alright but the issue is that mix effects hit venture and general issues in the retailers of their products not wanting new inventory is causing reversed operating leverage close to breakevens which has shot them into negative territory. Then there were other issues related to the PFAS allowance, as some of their inventory is associated with some PFAS environmental risks. The allowance was around $700k so about 20% of the net operating losses this quarter. They also had more marketing than expected and some new hires that are being utilised in the upcoming launches.

There is an incremental cost-cutting measure to the effect of $700k also expected to help hit results that will help things out, and there has been a slowdown in negative momentum in lowered buying from retailers and the inventory situation at Clarus as well. So things are stabilising.

Considerations

It’s already remarkable that they even have EBITDA profitability slated by the end of the year which means a major uptick is being expected in profitability. The Q2 was supposed to be a strong quarter but wasn’t. The Q4 is also expected to be a strong because the large Southern Hemisphere businesses are coming into summer soon. They are planning product launches in that season which is one of the reasons there’s the expectation that profitability will meaningfully pick up.

If they perform to expectations that could be a boost for the stock. The other thing to think about is that while there are some valid economic concerns in Western markets, rate cuts are coming and most importantly they are coming in the context of a relatively unrelated decline in oil, mostly spurred by unrelated macroeconomic factors and also simply supply side expansion. We wouldn’t count on it too much but it’s a potentially useful thought.

We also believe that Black Diamond has some growth areas. Climbing in particular is a growing pass time. They have significant share (around 50%) in carabiners, helmets, harnesses and other equipment, and have O.K share in the climbing shoes business as well.

Bottom Line

After the sale of the precision business, the company is net cash positive. It doesn’t really deserve such a precipitous decline. If you take a comp like VFC and apply their EBITDA margins to Clarus’ guided topline, it gives you an indicative forward multiple of something like 3.3x EV/EBITDA. It’s quite cheap. While it needs to flush out COVID-19 hangover and lap comps, we do think there are some growth engines within Black Diamond which protects downside. Of course from current prices with the end markets being what they are, and us being some quarters away from Q4 when things are expected to seriously inflect upwards, there could be some more imminent downside. Also, we don’t know if these new product launches will do much to offset weaker spending in end markets. But prices are really depressed at this point as well, so maybe it’s time to move if you want to be aggressive.